Given the economic wound that has been inflicted on India by the pandemic, a robust and visionary economic revival strategy is needed to revive the growth of economy which is in its nascent stage of growth. Three decades after the 1991 reforms, India’s growth can be best described as lagging, slow and contracting. The growth that India had envisioned during the early years of 1991-1992 have been stifled by various series of ill-omened steps that were taken by various governments to implement change at various levels in the economy. Be its Modi’s demonetization programme or GST implementation, Indian economy had been witnessing contraction even before the detestable pandemic had struck the economy.

Therefore an imperative question to be asked here is that where will the envisioned growth come from? One way to answer this question sagaciously is through consumption and private investment that will help ramp up the nascent economy. It is no news that consumer and producers demand drive the economy. Consumption, as we know, is the flagbearer of growth that drives the economy towards employment and growth. This argument can be supported by various consensus and analysis, that last decade was run by consumers demand in the economy and how many startups, to tend to the such demands have sprung up, on an increasing level, in the economy.

India lost its fastest growing economy tag long before Covid had entered its borders. Given how Covid has mercilessly massacred economy and public governance, it is a pressing question to ask that how will India get back on its successful trajectory of growth. To answer the same, one needs to certainly analyze India’s growth dynamics for this decade.

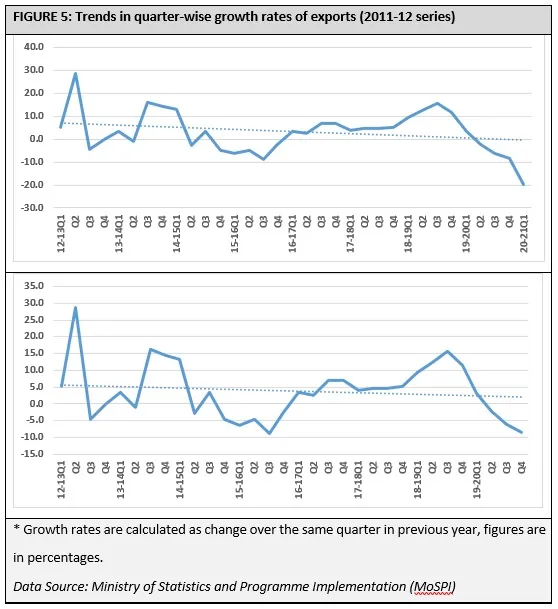

According to reports, the growth had been highly powered by the Siamese twins of investment and exports when the economy had implemented the LPG reforms. But by 2012, quite detestably, the exports had begun to slow. Complementary to that implementation bottlenecks and investment overcapacity had played an aversive role in the contraction of growth. This had led to an another quite detestable problem, that corporates were left with unsustainable debt and the banking sector was experiencing burgeoning NPA crisis.

The odious economic setbacks

Given the economy or particularly the banks were experiencing NPA or bad loan crisis, banks started licking their wounds. This led bankers to turn their attention to one segment of the economy that had been untouched and under-saturated- households. It is to be noted that after the discovery of the untapped sector, retail credit boomed in the economy, which lead to rapid proliferation of Non-Bank Financial Companies (NBFCs). NBFCs are small financing units in the economy which finance the ventures that banks are unwilling to fund.

But given the reckless rise of NPAs in the economy, it is quite a struggle to believe that banks don’t just provide credit to anyone and everyone in the economy. On the other hand, households welcomed access to much structural, cheaper and institutionalized sources of credit. It is to be noted that this led to setting up of newer consumption pattern in the economy.

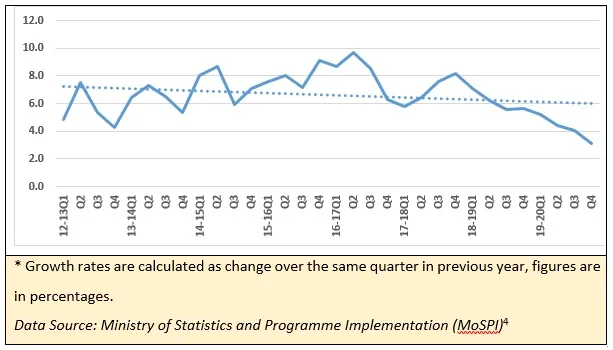

But there came a roadblock quite soon in the euphoric world of retail business. This unsolicited threat was household income perceptions that began to show a secular fall from 2012 onwards. According to reports, GDP and disposable income started to fall by 2 percentage points even before the decade pre-Covid.

One reason that could be given for the same is that maybe consumption was being financed by households that were robustly running down savings and running up debts in the economy. And it is no news that Debt-fueled growth works for the briefest of times and quite often leads to catastrophes. This is to mean that debt fueled growth works best in the good times. But as a consequence when the economy began to slow from the financial year 2017-18, it was only a matter of time before households became extremely cautious.

With rising NPAs and bad debts in the economy, tighter lending standards curtailed NBFCs freedom. This was intensified after late 2018 shocks which only accentuated these trends.

Thus given the tighter restrictions that plagued the consumer market and demand, it’s quite hard to envision a sustained consumption revival, once pent-up demand is exhausted, which in the current scenario has dried up given high predictions of third wave. The latest RBI Consumer Confidence Surveys showed that households are now highly expressing visible caution about future spending. This fear has been accentuated particularly in regards with discretionary goods. This is quite understandable given the heightened income and job uncertainty that pandemic has ensured in the economy.

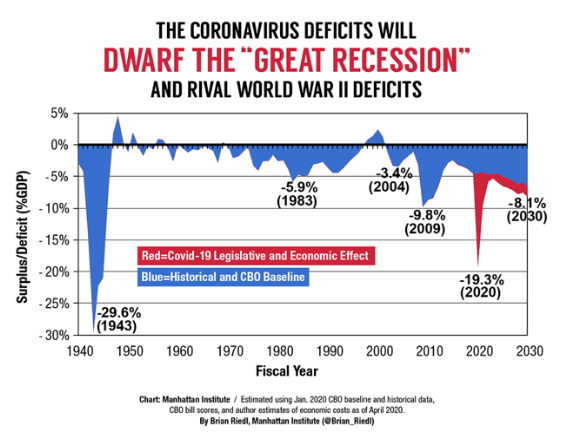

picture credits- VoxEU

Thus, it can be rightly stated that consumption will be the slowest to recover to pre-pandemic levels on the demand side.

How to revive the growth of economy?

But how can the demand be revived in the economy in a gloom scenario as such? According to various analysis exports, public investment and intervention are a key source for revival.

According to reports, the global economy is witnessing its strongest growth in years, as many are coming out of their economic slump. Given the Delta variant threat is kept constant, global growth is emphatically expected to remain much above the conventional trend for the next 6-8 quarters. The main way to revive the economy is through reopening its borders and robust vaccination drives. This will certainly bode well for the external sector given there will be strong elasticity between global growth and India’s exports.

On the other hand, sustained growth can be assured through robust public investment that will be needed to supplement exports as one growth formula alone cannot support the economy. Here it is to be stated that the government has already embarked on this strategy with central capital expenditure growing by 75% in the second half of the previous financial year.

picture credits- ORF

The Centre, along with states has budgeted 30% growth in the capital expenditure for the financial year 2021-22. Huge capital expenditure in the form of physical and social infrastructure spending can also help create jobs and invariably improve the economy’s competitiveness.

Thus, as aforementioned, exports and public investment will effectively and emphatically need to create a jobs and growth bridge until private investment, consumption and investors’ and consumers’ confidence revives or recovers.

The government in its pursuit to raise economic sentiments has unveiled a growth-oriented budget but many analysts still consider it quite inadequate given how MSME and contact intensive sectors have suffered immensely. Thus, this year, the Budget made an important statement in several key areas like asset sales, public investment and robust privatization of two public sector banks, whose sale has been differed to next year. Now execution is the next vital step in the series of steps that will help in deepening and broadening the reform agenda. Thus, will government’s reform strategy bore fruit is still a mystery which will unravel only in future.

Edited by Aishwarya Ingle