Zomato shares drop 69% so far in 2022; What should investors do now?

The Indian restaurant and food service company Zomato has been in the news a lot this year for their controversial string of decisions. Recently, around 69% of shareholders have backed out from investing in this company, which might be a sign that investors are starting to lose faith in Zomato.

Zomato’s earnings report for the Q2 of this year showed a 14% overall revenue increase from the Q1 and around 24% from the same quarter last year. But, their net loss increased by around $25 million, which led to a massive loss overall. That said, they did manage to earn Rs 9.8 billion in revenue, which was an increase of 36% against the previous quarter and around 23% higher than last year’s quarter.

Zomato, founded in 2008 and headquartered in Gurgaon, India, was one of the most popular restaurant-discovery apps until a few weeks ago when Zomato shares reached a low of ₹3.60 ($0.0034). This drop is 69% so far in 2022, which has caused some investors to sell their shares for fear of them dropping even lower.

Zomato shares have been on a roller coaster ride in the past few weeks. On Thursday, the Indian restaurant guide provider plunged as much as 30% after it reported a wider-than-expected loss in what was its biggest quarter to date. The drop has left investors scratching their heads and considering whether Zomato is worth buying.

Zomato’s loss for the quarter was lower than its previous estimate of Rs 85 crore. However, it saw its revenue growth slow down to 50% from over 60% in Q1 of 2019. The food ordering and discovery website saw a slowdown in its user base growth period compared to previous quarters. At the same time, Zomato continues to lose money.

Zomato shares dropped 69% so far this year, and it’s not making the company any more appetizing to investors. The company has been suffering from declining revenue and an inability to maintain consistent profitability in recent years. This new drop is likely a result of Zomato carrying out layoffs and struggling to compete with US-based Yelp Inc.

Jefferies says night is the darkest before dawn; maintains buy on stock

Zomato’s losses have been mounting, but Jefferies analyst Samik Chatterjee says there could be a new dawn on the horizon. In a research note dated 13 July, the analyst maintained his buy rating on Zomato and his target price at Rs 1,127. The stock was trading at Rs 819 on Friday, giving it a market valuation of about Rs 15,000 crore.

Zomato shares are down 50% from their listing price of Rs 1,096 on the BSE. At this level the stock trades at a price-to-earnings multiple of 3.6 times, still higher than the multiples of 2.2 times and 3.2 times traded by analysts for Swiggy and Foodpanda respectively. The stock is also trading at a premium to its peer Swiggy, which on the BSE trades at Rs 324.

In the H1 FY19, Zomato reported revenue at Rs 278 crore and gross-profit of Rs 12 crore. The company’s revenue grew 61% year-on-year to Rs 285 crore. Zomato has been making good strides in its financials as well as improving its user base throughout the past few quarters.

Zomato had a difficult time in the last few quarters and will probably have even more difficulty in the next. The company has been struggling to maintain its forward guidance, stock price and profitability. The company’s losses have been widening despite growing revenues for the past few years.

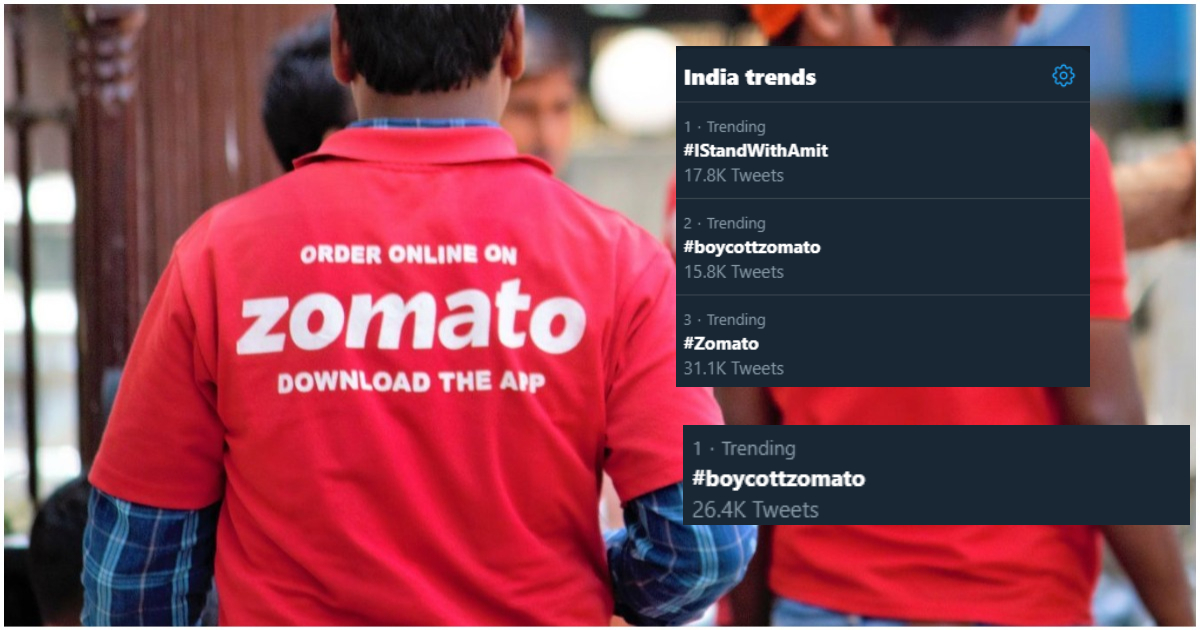

How Twitter greeted the fall of Zomato

Twitter users have reacted to the news of Zomato’s downfall, with some making jokes about the situation. One Twitter user wrote, “Zomato is down this morning and I’m like, whoa! I didn’t buy it and now it’s gone. And I’m like: whoa!” Another tweet from a Zomato investor goes on to say that the company has donated 1% of its turnover as charity.

Bull, bear and base case

India’s leading restaurant review and discovery site, Zomato has faced challenges in the past. The company has faced a lot of backlash over its data collection practices, which has led it to form partnerships with other companies. Buffer, for example, is an app that is made by Bitly. This is a common practice by online business profiles and social media sites as an effort to combat fake information.

On 23 February 2014, Zomato pulled out of the Indian market to focus on international markets in Asia and Middle East. On 9 March 2014, it was reported that Zomato had raised an undisclosed amount from Sequoia Capital and its existing investors including Rs 550 crore in series C funding. The investment was a formalization of its partnership with Sequoia Capital VC fund. The total valuation of the company stood at $200 million (Rs 1,600 crore).

Zomato shares begin to recover as company beats losses forecast

Last month Zomato shares fell 28% in just two sessions after it missed revenue forecasts for the first quarter (Q1) in 2019, when it reported a wider-than-expected loss. The stock was down by 30% this morning too, but a strong set of results has seen its price drop by just 2%. In fact, it has added over Rs 1,000 crore to Zomato’s valuation since this morning.

The company’s revenues in the first quarter (Q1) of 2019 were up 55% year-on-year to Rs 34 crore. It was also profitable for the first time since the year ended 31 March 2015, with a net profit after tax of Rs 31 crore. However, that positive didn’t last very long, as the company has said it will be back in the red again in its next set of results.

Blinkit aiding growth

On 12 May, 2018, Zomato revealed its announcement of BlinkIT on the occasion of Mother’s Day. “BlinkIT” is an app that would enable users to order food for delivery using a shared link. Users with this app can pre-book food and receive food in three to six hours from the user’s selected restaurant

In September 2017, Zomato partnered with the Government of Telangana to promote food delivery in Hyderabad. The company has also partnered with the State of Maharashtra during their festivals to promote food delivery in Mumbai. In December 2017, Zomato has made a partnership with Foodpanda through which they will offer discounts on the first delivery fee.

Zomato share price falls to new low; may be attractive to buy now

Zomato, which had fallen to a new low on April 17th, has plunged further. The stock has now shed 50% of its value from January this year as the company struggles with loss-making operations. The company has struggled to stay relevant in recent times and seems to be facing several issues with its business model. In fact, the company’s losses have been widening despite growing revenues for the past few years.

Zomato has been criticized for violating privacy rights of users. It is alleged that Zomato has been collecting data from user’s mobile phones through an application called ‘Zomato App’. It is alleged that the company is tracking exact location of users. The company is also alleged to have been tracking user’s personal information related to timing of consumption, regularity and preferences.

Zomato shares extend decline as lock-in ends

Zomato shares fell slightly today after their lock-in period ended. The stock had fallen 69% from its listing price of Rs 1,096 on the BSE in December last year. At this level, it trades at a price-to-earnings multiple of 3.6 times, still higher than the multiples of 2.2 times and 3.2 times traded by analysts for Swiggy and Foodpanda respectively.

Citing a major threat, Zomato to change business model

Zomato is facing a lot of economic issues. The company has been struggling to stay relevant for a very long period of time and it might be turning ‘bad’ in the future. It had to sacrifice its operations in India in order to focus on international markets. The stock is trading at a significant premium from its peers as it faces new threats and issues.

The digital world is changing extremely fast and every single day. As a result, businesses are struggling to update themselves with the new technologies. Zomato, as it turns out, does not have a path forward for itself in the future. The company has been struggling with decreasing user base in recent times and might be experiencing huge difficulties in the future too. There have been reports that the company may close down its operations in India citing a major threat to its business model.

Zomato is suffering from loss of market share

Zomato has been losing market share to companies like Swiggy, Deliveroo and Foodpanda. Though the company enjoys the highest brand value across India but in Delhi NCR only it is losing to Swiggy by 0.9%. It is also losing market share to its competitors. In February this year, it had lost 8.7% market share to rivals Swiggy and others. It also lost 17.4% in December 2017, which is a big setback for the company.

Zomato has been showing some good performances over the years. Its revenue for the financial year 2012–13 was $2.1 million. The revenue for 2013–14 was $13.6 million and for 2014-15 it was 19.8 million U.S dollars.

In 2015, Zomato was awarded the “Emerging Entrepreneur Of The Year” accolade at the Digital and Mobile Association of India annual awards. In April 2016, Zomato launched its online ordering app in Indonesia, its first market outside India and home to the third-largest population of tech-savvy millennials in Southeast Asia after Thailand and Vietnam.

Zomato shares dip on weak guidance

Zomato’s shares fell by 3% today as its revenues fell short of expectations. The company has been struggling to remain relevant in recent times and is experiencing huge losses in the operations of the company. The company is suffering from loss of market share and the slowdown in business growth. The stock has a PE of 17 times and is trading at a premium of around 53% over its closest competitor Swiggy. It is also trading at a high price-to-earnings multiple of 3.2 times.

In October 2017, Zomato was said to be in talks with Microsoft and Google for investments. However, the deal finally fell through as the companies agreed on a lesser amount than what was initially intended. The capital was to be used by the company in hiring tech experts and also in building its artificial intelligence (AI) and machine learning departments. On October 26, 2017, Zomato announced that it had raised $200 million (about Rs 1,335 crore) in a round led by Ant Financials affiliate Ant Capital.

What is the reason of shares of Zomato are getting fall?

Zomato’s shares have been fluctuating for quite some time now and have been making some drops. There are many reasons for this and it is usually due to economic issues of the company. It has also been reported that the company might be closing down its operations in India citing a major threat to its business model. One of the main reason why Zomato is losing market share is that it is trying to focus on different markets like Indonesia, Thailand, Vietnam and other markets.

Zomato, the Indian food-ordering company and a unicorn company by some estimates, has seen its value fall by more than 50% in April. In the past two years, Zomato has continued to be one of Asia’s most high-profile startups, but it has been losing ground as it struggles to find profitability. The company started off as a reservations app for restaurants, but now works with over 300,000 restaurants across India. Last year was its best ever when it delivered over 10.

Zomato claims ₹1,000 cr revenue target

It seems that Zomato is all set to achieve its profit run this year. The company has ambitious plans for the next few years and it is confident of achieving targets. It is estimating to bring in $1000 million (Rs 6800 crore) revenue this year and is also planning to expand its operations to Dubai by 2021. The company has also revealed that it will invest ₹3,000 crore in the next 2 years.

Zomato’s operations in India were severely affected by the 2017 ban on online food delivery services in the country. Zomato is still operational in Mumbai and Pune, but its operations in some other states including Delhi NCR, Gujarat, Karnataka and Kerala are severely affected. The company is expected to operate with reduced business hours from March 21. Zomato expects this to impact it by around $5 million for the financial year ended March 2018.

Zomato, the Indian food-ordering company and a unicorn company by some estimates, is weathering a slowdown in business growth. The company has been struggling to be profitable and has been affected by increasing competition from other similar companies. Zomato, which reported revenues of Rs 103 crore for FY14 and losses of Rs 31.4 crore, is now looking to tap into tier-2 cities for new growth opportunities.

Zomato has raised $200 million (around Rs 1335 crore) in a new round of funding led by Chinese financial giant Ant Financials affiliate Ant Capital. This is Ant Financial’s first investment in India and brings Zomato’s total funding to over $500 million. Zomato plans to use the money to increase its presence in new markets including the Middle East and South-East Asia, invest in technology and ramp up its customer care capabilities.

Conclusion

The company has been facing some challenges in terms of profitability and also with regard to its market share. The main reason for this is that the company is struggling to maintain the same level of customer satisfaction, which is posing as a threat to the survival of the company. Another major reason for this is that other competitors like Swiggy have been quite aggressive in expanding their market and are slowly leaving behind Zomato, which at one point was considered as market leader in food delivery segment.

According to Business Standard, Zomato will pay nearly Rs 1.1 crore as income tax and Rs 2.2 crore as service tax until December, 2019. The company booked net loss of Rs 55.7 crore on a revenue of Rs 321.8 crore in FY18, down from a net loss of Rs 127 crore on revenue of Rs 431.7 crore in FY17. Lack of profitability and huge losses have led to a fall in the valuation of Zomato.

The company was valued at nearly $2 billion in August, 2015. However, the valuation of Zomato has come down by around 50% in FY18. The company’s revenue went down by 74% to Rs 322 crore in FY18 from Rs 3,572 crore in FY17 while its operating loss increased by a huge 212% to Rs 54.7 crore from Rs 20.9 crore in FY17.

Out of the total funding that Zomato has received, $250 million went into the market, while the rest was for the expansion and development of its technology. The company is planning to expand to South-East Asia in 2021, as well as Dubai by 2021. The company plans to invest Rs 3,000 crore in next two years across multiple products which include engineering, AI, big data and customer care. Zomato will also be acquiring new companies in different areas of food delivery and tech.