Zepto’s ‘Rain Fee’: Redefining Path To Profitability By Monetizing The Weather!

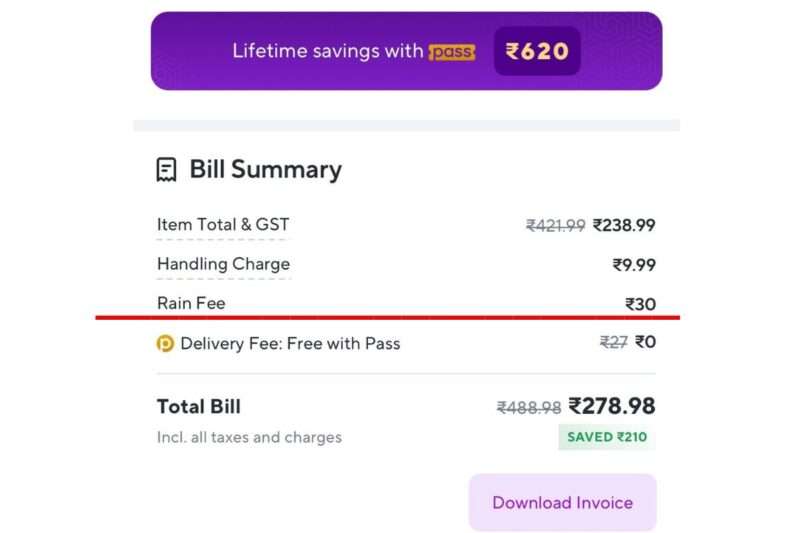

Zepto introduced a ‘rain fee’—and this is in addition to the “monthly pass!”

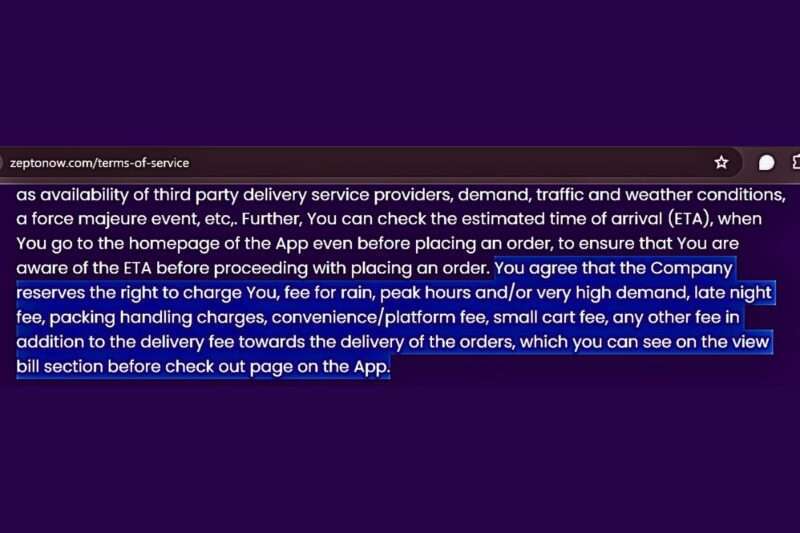

It sounds like Zepto would do anything to turn “profitable”, including a hefty Rs 30 “rain fee” over and above the handling charges, which are hidden till payment happens. However, they are smart enough to write in their ‘terms of service’ that customers ‘agree that the Company reserves the right to charge them fees for rain, peak hours and/or very high demand, late night fees, packing handling charges, convenience/platform fee, small cart fee, any other fee in addition to the delivery fee towards delivery of the orders, which you can see on the view bill section before checking out the page on the App’.

For those who will defend it on morally high grounds, citing the delivery partner’s right, we checked with the delivery partner if that goes into their incentive. He showed his app and it was not. It’s not only us who observed it. An article titled ‘Surge charges on rainy days not paid to delivery executives’ dated August 2022 also mentioned that the delivery executives are not given the extra hefty ‘rain fee’ which was charged on the pretext of their convenience!

Unless you’ve been hibernating, you’ve probably seen many stories about quick commerce making a splash, or rather a tsunami, in the supermarket area. Two players (Zomato’s Blinkit and Swiggy Instamart) dominate this area, with a third (Zepto) attempting to catch up. However, this was not the same from the very start.

In the new decade, from 2020 to 2022, the corporate world revolved around three words: unicorns, start-ups, and funding. In those years, we witnessed 44 new unicorns in 2021 and another 21 in 2022. However, in the very next year, not a single unicorn had appeared. Then came Zepto, a grocery delivery service that became the first Unicorn of 2023. They raised $200 million in new money and were worth $1.4 billion. Recently, their funding rounds have been the great headlines remarking their success and how Zepto could be a ‘hyperlocal Walmart of India’, as the founder, Mr Aadit Palicha, says.

Quick commerce companies are the speedsters of the grocery store industry. They claim to provide anything you want in 10 to 30 minutes. Following the victorious ascent of food delivery behemoths like Zomato and Swiggy, quick commerce companies like Zepto and Blinkit persuaded us all that grocery delivery was the next big thing. A Redseer analysis from 2022 predicted that India’s Quick commerce industry will expand to a staggering $ 5.5 billion by 2025, 15X its current size and surpassing nations such as China in terms of consumer adoption. The opportunity in Quick Commerce was so large that major players like Flipkart, Reliance, Swiggy, and Ola went all in to win it. However, the run is not that easy.

If you dive deep, you will learn how these quick commerce companies have a quick upward and then quick downward momentum.

JioMart, owned by Reliance Industries, has discontinued Express, a high-speed grocery delivery service. However, Jiomart’s recent relaunch may be a hint of its revival.

In December 2022, Flipkart reduced the scope of its Quick commerce service, Flipkart Quick, to develop a sustainable business strategy. However, it is again making efforts to enter the quick commerce segment.

Dunzo, a Reliance-backed Quick commerce start-up, had to lay off a significant part of its workforce and close half of its dark storefronts and eventually walked on the path of shutting down.

Ola took one step further and completely stopped down its Quick commerce initiative, Ola Dash.

So, Quick commerce startups bleed like anything. Some quit, and others stayed, and those who stayed emerge as having taken the oath to become profitable at any cost, if not by unique growth strategies, then by keeping prices surging under the pretext of convenience fees, rain fees, peak hours fees, late night fees, and whatnot.

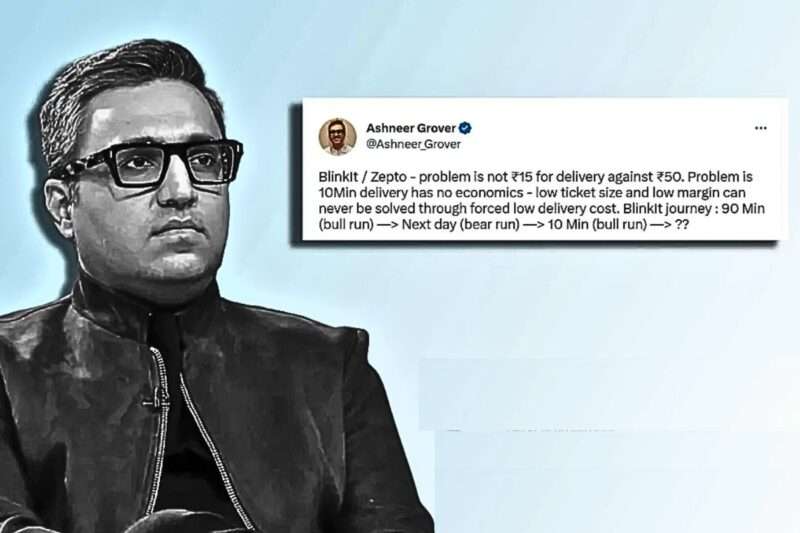

Maybe this is what businesses do when they are devoid of fundamental unit economics. And it is not only us, as customers, saying that; a prominent figure from the startup world, Mr Ashneer Grover, ex-MD of fintech Bharat Pe, who is also ex-CFO of Grofers ( Now Blinkit ), mentioned in an interview that ‘10-minute delivery has no economics, adding that low low margin and low ticket size can never be solved through forced low delivery cost. As per Mr Grover, the 10-minute delivery model, or the entire domain of quick commerce, possesses no unit economics’.

This issue emerged when Blinkit workers went on a strike in March 2023 regarding their low pay calculation. This development came against the backdrop of several investors focusing more on profitability and other financial metrics. As a result, several companies that have come under the scanner for not being profitable have slashed pay and incentives, laid off employees, and taken measures to cut down their expenses.

After all, it emerges that when they found no route to development and profitability, these 10-minute delivery titans ultimately drifted to the surge pricing model in the name of platform fees, convenience, fees, rain fees, and many more. Up to a point, introducing a certain platform fee is justified; however, introducing a rain fee, which doesn’t even go to the delivery executive, is unacceptable.

Mr Grover added that ‘Some business ideas, like quick commerce, will never sense. The unit economics in quick commerce will never get better. The industry will naturally correct itself as funding becomes scarce, and companies will refocus on their core operations. When money is abundant, everyone starts thinking they can do the impossible.

What’s the profitability outlook in the context of customers?

The early business prosperity may appear predetermined now. After all, why would anyone refuse a 10-minute delivery? But in this logic, we simply ignore the intrinsic trade-off between speed and cost. Are we willing to pay extra (how much more?) to have our groceries delivered in 10 minutes? And, as frequently stated, Indians are price-conscious buyers. Leaving aside the hypnotic appeal of super-fast delivery, the fundamental difficulty in this domain is making it work for both the customer (fair product prices and acceptable platform fees) and the platform (fulfilment costs).

The quick-commerce business’s survival and growth may be attributed to both the funding it received (despite the fact that many other industries were hungry for cash) and the urgency with which the incumbents are attempting to achieve the appropriate profitability balance, like Zepto, which is on a high note to attain profitability before its anticipated IPO next year.

To ordinary people, the novelty of 10-minute delivery may have worn off. We may take this delivery speed for granted, forgetting that only a few years ago, it was unheard of. We don’t realise it, but maintaining a supply chain with a guarantee of 10-minute delivery is close to miraculous. To create this symphony of 10-minute delivery, the correct number of dark shops with the right kind and amount of SKUs at the right locations, as well as the right number of delivery riders at the right places, are necessary.

One false note and the 10-minute promise fall apart. Most of the quick-commerce expenses have gone into realigning the network to expedite delivery to 10 minutes, putting a massive drag on the bottom line of platforms. Hence, maybe, to justify these bottom lines of platforms, various kinds of fees like the rain fee are passed on to customers.

These fees, which began as experiments and proved to be net positive, are here to stay, given that users have not abandoned the platform. We may anticipate platforms will get even more innovative in extracting more value from customers until they hit a breaking point. An added fee of INR 20-25 (over and above the product price) may not appear to be much, but it adds up to 5-8% of the order value (assuming an average order value [AOV] of INR 300-400).

From a customer’s perspective, a greater AOV means sacrificing more notional discounts that they would have obtained on slower platforms (scheduled delivery or even larger physical storefronts).

So, in either case, it emerges that these extra charges, as rain fees, will remain in the domain, as the customers are now okay with paying extra fees rather than taking out their scooters and getting into the nearby Kirana stores. But will these extra fees help the quick commerce segment achieve its organic profitability? That is still a point of question, kept to be revealed with time in the future!