World Economic Outlook for 2023 is Increasingly Gloomy

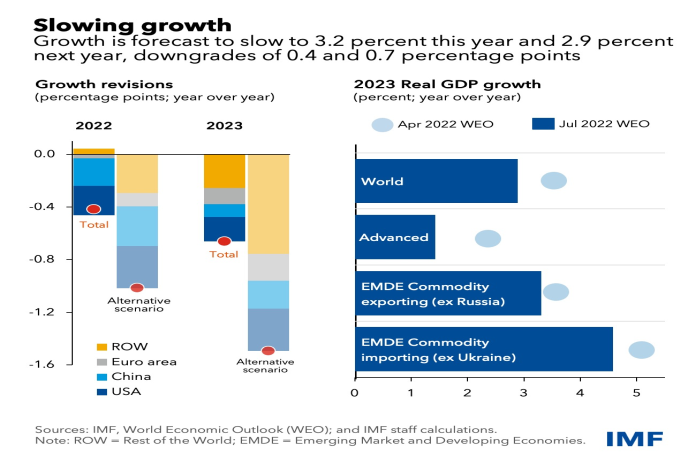

According to a number of recent economic analyses, the outlook for the global economy in 2023 has deteriorated as the ongoing conflict in Ukraine continues to mainly restrict trade, particularly in Europe, and as markets wait for China’s economy to fully reopen after months of disruptive COVID-19 lockdowns.

Fears of a recession increased in the United States as indicators of a tightening labor market and also a slowdown in business activity emerged. Inflation increased globally, and also business activity decreased overall, especially in the eurozone and the UK.

In a report released this Thursday, the Institute of International Finance forecast that the world’s economy will grow by just 1.2% in 2023, on par with the pace of 2009, when the world was just starting to recover from the financial crisis.

The gloomy prognosis is shared by the Organization for Economic Cooperation and Development (OECD). Alvaro Santos Pereira, the organization’s temporary chief economist, stated in a report released this week: “We are also currently facing a very difficult economic outlook. Our current primary scenario does not involve a global economic downturn but rather a significant slowdown in global economic growth in 2023, along with persistently high inflation in many nations despite its recent decline.

American interest rates in the economic value

Most analyses of the current and future states of the economy in the U.S. have mainly focused heavily on inflation and also the Federal Reserve’s efforts to combat it.

With prices starting to rise significantly in the middle of 2021, the U.S. is currently experiencing its highest levels of inflation in 40 years. Annualized rates reached over 6% at the start of 2022 and, despite some fluctuation, reached a peak of 6.6% in October.

The Federal Open Market Committee (FOMC), which controls base interest rates at the central bank, started raising them very dramatically in March. As a result, the current benchmark rate has now increased from between 0.0% and also 0.25% to between 3.75% and 4.0%.

The Fed’s actions are intended to alter the incentives for consumers. The central bank is also attempting to reduce demand and, as a result, slow the rate of price increases by making the interest rates on savings more enticing and the rates on borrowing less so.

The Federal Reserve considers a main healthy inflation rate of 2% per year to be its long-term objective.

Keeping a recession at bay

The Fed’s objective is to reduce inflation without sending the economy into a destructive recession. And even though some of the economic indicators suggest that measures to slow demand may be effective, the possibility of a recession still exists.

The evidence made public this week revealed that companies responded to declining consumer demand by slowing down business activity in the United States for a fifth straight month. Despite the fact that the new economy has also continued to create jobs recently, more good people are applying for unemployment benefits, which may signal a potential softening in the labor market.

The FOMC meeting minutes from the first meeting of November were made public this week by the Federal Reserve. The minutes showed that the central bank’s staff economists had a negative outlook for the U.S. economy in the upcoming year.

They came to the conclusion that the possibility of the economy entering a great recession at some point in the coming year was “almost as likely as the baseline.”

According to a “substantial majority” of the main committee’s voting members, it is time to slow the rate of interest rate increase. This suggests that the FOMC will scale back its recent rate increases from 0.75% to perhaps just 0.5% when it meets in December.

Global Conflict

Governments around the world are faced with a challenging task: helping their citizens during a period of sharp price increases, particularly for basic commodities like food and fuel, which have been severely impacted by the conflict in Ukraine.

The International Monetary Fund (IMF) highlighted the challenging juggling act governments must perform in a report released this week, noting that “many people are still struggling, governments should continue to prioritize helping the most vulnerable to cope with soaring food and energy bills and cover other costs — but governments should also avoid adding to aggregate demand that risks dialing up inflation.” Fiscal restraint can lower inflation and reduce debt in many developed and developing economies.

The Institute of International Finance (IIF) predicts that while overall growth will be modest but net positive in 2023, some regions will experience declines. Europe is foremost among them, where the IIF projects a 2.0% decline in total GDP.

Bright areas

If there are any promising regions for the global economy in 2023, they include China and Latin America.

Global inflation has been advantageous for many Latin American nations where the export of raw materials, such as timber, ore, and other important economic inputs, drives many economies. This is because the prices for those goods have increased. Despite much of the rest of the world experiencing an economic contraction, the IIF report forecasts a 1.2% increase in GDP across the region.

President Xi Jinping’s “zero-COVID” strategy, which forced widespread lockdowns of entire cities and regions and severely disrupted economic activity, has cost China economically. In the upcoming year, the IFF and other organizations anticipate significant easing in Chinese policy, which could result in the economic growth of as much as 2.0% as China tries to revive its economy.

British suffering

The United Kingdom has the bleakest outlook for the upcoming year of any of the largest economies in the world, with the exception of Russia, which is still suffering from crippling sanctions related to its invasion of Ukraine.

Annualized price increases are anticipated to reach 10% by year’s end due to inflation that is significantly higher than in other nations, before gradually declining in 2023.

The U.K. is the only one of the G-7 nations whose economic output has not yet reached its pre-pandemic levels, and it is expected to decline even more. According to OECD predictions, the British economy will contract by 0.3% in 2023 and expand by just 0.2% in 2024.

Edited by Prakriti Arora