Will Offline Push Aid Unacademy, BYJU’S, and Companies in Overcoming the Edtech Blues?

Unacademy, BYJU’S, and other companies have invested millions of dollars in offline models while also trying to reduce labour costs and reorganize teams in their primary tech platforms.

Startup valuations will continue negatively impacted by excessive marketing spending without a clear and measurable return on investment, sizable sponsorship agreements, and unproven acquisitions.

Many people wonder what edtech is bringing to the table that legacy players like Allen, who are launching their own digital plays, cannot match even as edtech unicorns go offline.

India’s most prominent startups, including BYJU’S, Unacademy, Vedantu, and others, are moving away from pure-play online models and toward hybrid or phygital models in a year where the credibility of edtech has been damaged.

While the reopening of physical learning centres and shifting market conditions have forced this transition, it’s not as though the online models were making money.

Investors and valuation experts are concerned about how long-term this will be viable, and the competitive environment for hybrid or offline learning presents difficulties for edtech startups. But, despite these “pivots,” edtech startups are still very much in the game.

Increasing losses in edtech-

Unacademy revealed last week that it had lost a staggering INR 2,700 Cr in the fiscal year that ended March 31, 2022.

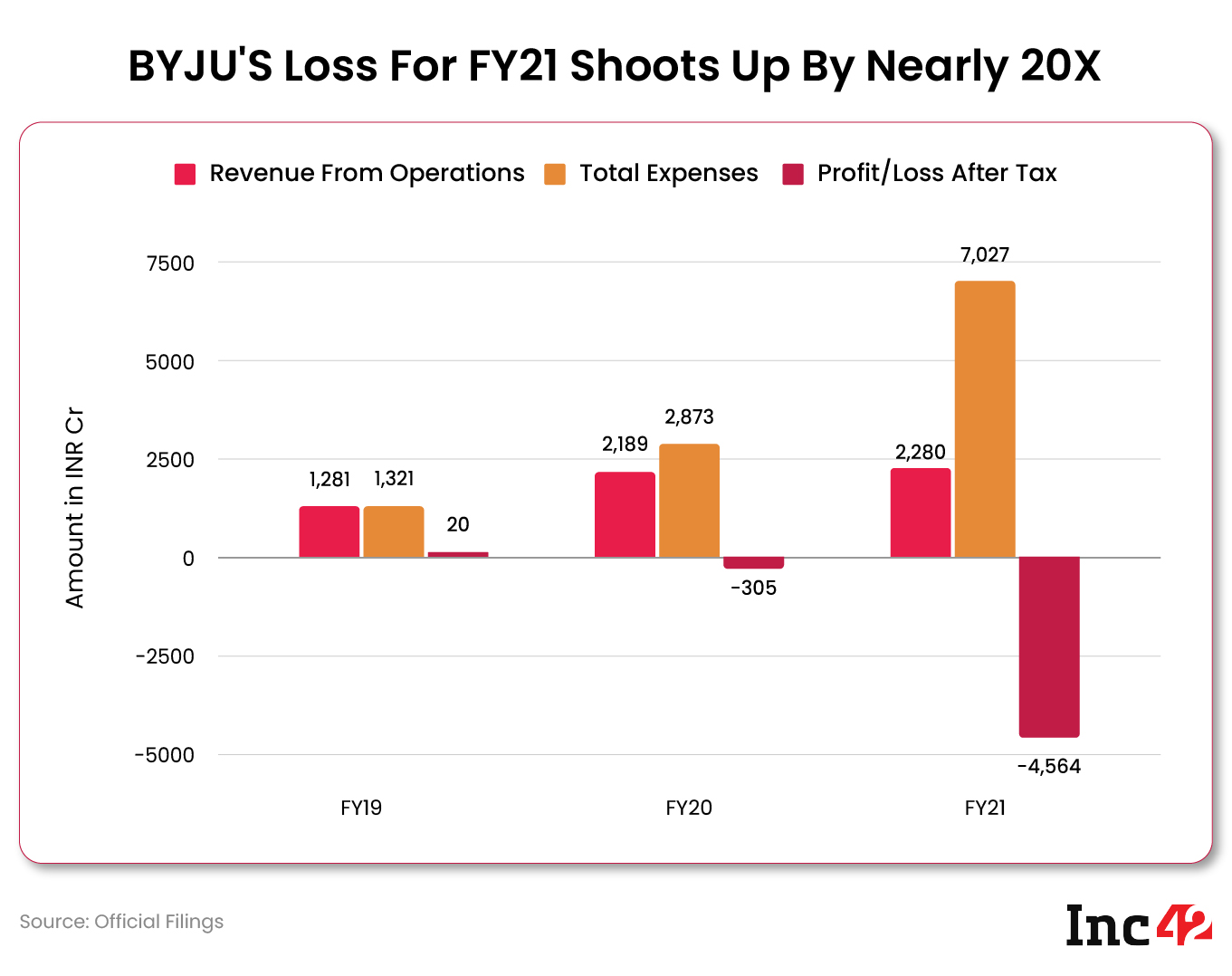

Even though the fallout from BYJU’s INR 4,600 Cr losses in FY21 had not yet subsided, the miserable situation at Gaurav Munjal-led Unacademy is the best example of the edtech downturn.

BYJU’S has not yet released its FY22 figures, despite having previously stated that its top-line revenue for the fiscal year had reached INR 10K Cr. However, given that the business went ahead and let over 2,500 employees go, closed offices in close to 60 cities, and completely reorganized its sales team, it is unlikely that this was done at a profit.

Given that Vedantu has also terminated employees in order to reduce costs, all indications point to the company posting another loss in FY22.

Even with massive advertising campaigns, numerous product launches, billions of dollars in funding, acquisitions, and hefty international sponsorship deals, like BYJU’S, edtech startups have not been able to demonstrate any appreciable progress toward profitability.

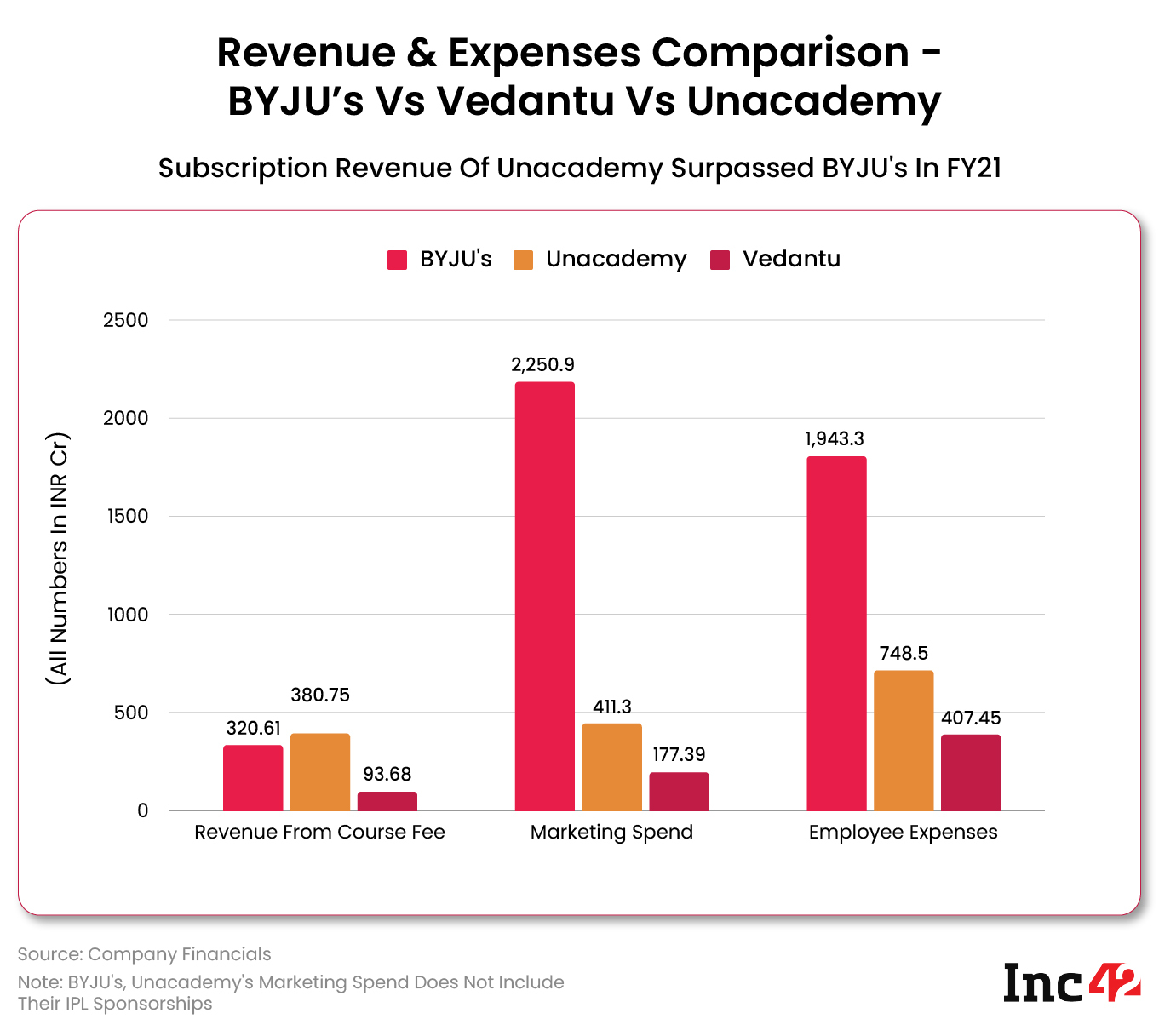

Although Unacademy’s marketing expenses increased 33% in FY22 to INR 549 Cr, BYJU’S spent INR 2,250 Cr in FY21.

Despite the scale disparity between BYJU’S and Unacademy, our goal is to emphasize how heavily invested both businesses have been in creating their brands and communicating their stories.

For instance, this week, BYJU’S announced that soccer legend Lionel Messi had been appointed as a global brand ambassador for its non-profit arm.

But how successful was this media blitz? Due in large part to the fact that such spending is inconsistent with sustainability, investors and valuation advisors predict that it will have a negative effect on startup valuations.

Flat Rounds Are Now the Standard for BYJU’s

Startups are already delaying the announcement of funding rounds, according to Umakanta Panigrahi, managing director of Kroll’s valuation advisory team in Mumbai, who spoke to Inc42. This is because some of them have experienced down rounds and don’t want to give the market that signal.

“The fix is already in progress. Flat rounds are regarded as an up-round if you observe the new normal. Additionally, investors currently anticipate a higher return on investment from physical education than from edtech, Panigrahi continued.

The biggest challenge has been demonstrating that startups can generate revenue, as in the cases of BYJU’S and WhiteHat Jr. or Toppr, and Unacademy with its unsuccessful PrepLadder and Master acquisitions.

Startup investors have learned a difficult lesson over the past year, dry powder or not.

“Cash burn calculations cannot be used to project sales for new products. All investors are currently challenging any business plan that edtech companies are presenting, and they are posing important questions, Panigrahi continued.

He thinks that a lot of the issues in edtech are caused by overhiring and a lack of a clear strategy for new verticals. In 2020 and 2021, BYJU’S, Vedantu, and Unacademy lavished on new hires, but they are now all downsizing.

Over 7,000 people have been let go by edtech companies overall this year, and many more part-time teachers have also been affected by the downturn. However, this does not imply that all spending has stopped.

Offline Push Has a Price

In fact, significant financial resources have been devoted to offline models. However, the shift to a physical model won’t immediately produce more reliable unit economics.

It is expensive to set up offline centers and hire teachers for centers. Additionally, among startups, the competition for real estate is about to heat up.

To enter this market, BYJU’S paid $1 billion for Aakash Educational Services, and at the same time, it expanded its hybrid tuition center model. It obtained an unsecured loan for INR 300 Cr (roughly $40 Mn) from Aakash to fund the marketing of BYJU’S Aakash’s primary business.

With its new centers in Kota and other student hubs, Unacademy has competed against established coaching behemoths like Allen Career Institute and others. With annual salaries ranging between INR 1 Cr and INR 10 Cr for some of the more well-known educators, Unacademy’s foray into offline learning includes 2x–3x pay hikes for teachers who are snatched up from Allen.

Vedantu spent $40 million to buy offline learning company Deeksha, and results from this acquisition won’t be seen for several months. Vedantu hopes to make more headway in the test preparation and higher secondary coaching with this agreement (11-12 grades). This happened soon after more than 700 workers were let go.

This year, PhysicsWallah raised $100 Mn to open its first physical learning facility in Kota. With the help of its YouTube-based acquisition, the company is also considering expanding the blended learning model.

According to a Moneycontrol report, PW reported INR 98 Cr in profits for FY22. But because the business hasn’t yet made available its financial report, it was impossible to independently verify this number.

Many people wonder what exactly edtech is bringing to the table that legacy players cannot match, even as these edtech unicorns compete with well-established offline coaching classes. In fact, Allen is copying this strategy and creating digital platforms to compete with startup offerings.

Winter in EdTech Will Be Colder

BYJU’S faced some difficulties in 2022, but Unacademy was unable to take advantage of this blunder. Overhiring, unsuccessful acquisitions, and an unsuccessful multi-product strategy are just a few of the problems at the Gaurav Munjal-led business.

Over three phases, Unacademy has fired about 1,000 workers so far, including teachers. Relevel By Unacademy underwent a restructuring exercise in August, moving its staff to different areas of the larger Unacademy organization.

All of this is done in an effort to become profitable. This week, Munjal tweeted:

Unacademy is in discussions with investors to raise $150 million to $200 million this year, according to sources, even as it shifts its attention to cash management and profitability.

Additionally, Munjal tweeted that Unacademy’s monthly burn has decreased from $20 million to $7 million and will continue to decrease.

With the launch of Unacademy One, a YouTube-focused acquisition strategy, the company is returning to its roots. Will this result in long-term, profitable revenue growth?

In the hopes that it will be a more efficient way to attract new students, BYJU’S has consolidated the majority of its K–12 operations and switched to inside sales. But in order for this “passive” sales strategy to succeed, the product pitch must be very alluring.

The path in front of edtech unicorns won’t be simple. The coming months will see a worsening of the winter, as Munjal has already hinted.

In addition, as we had previously reported, many employees at BYJU’S and Unacademy worry that additional layoffs will result from the cost-cutting measures and team restructuring.

Investors will probably be more cautious about supporting companies as a result of the customary year-end sell-off trend in stock markets. “Today, there is no rush or FOMO. Everyone is waiting and looking,” Panigrahi continued for Kroll.

Because of the long-term promise of edtech, venture capitalists and startup investors are not yet in a panic. Even though there is some optimism that edtech will turn the corner, the short-term outlook for edtech startups is not promising.

For some industries, like edtech, experts project that the funding winter will likely last for another year or longer while startups develop the most sustainable business models. By then, the wheat will have been distinguished from the chaff, which may cause the startup ecosystem to consolidate.

Even though the physical mode is currently popular, edtech giants will need to quickly transition to something else or risk falling by the wayside if it doesn’t turn out to be the magic solution they anticipate.

Edited by Prakriti Arora