Why Deloitte & Adani ports parted ways 2023 ?

Why Deloitte & Adani ports parted ways 2023 ?

Deloitte requested a more prominent auditing role for other listed Adani companies because it needed to look at intra-group transactions to provide the correct conclusion.

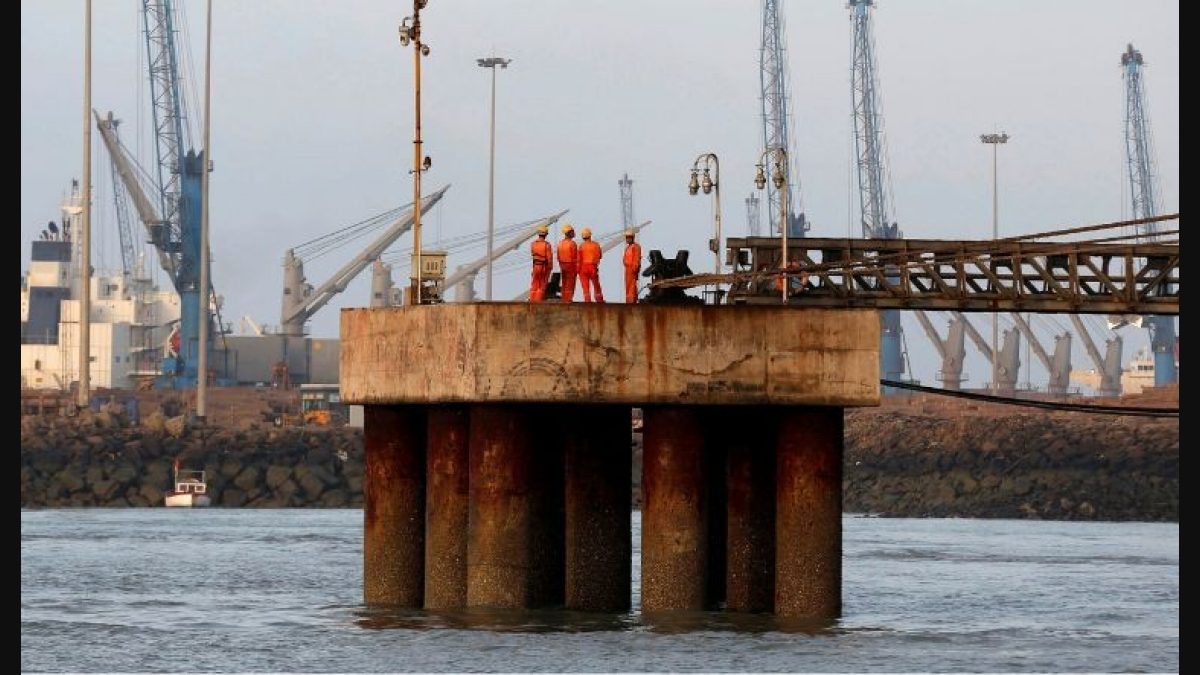

Adani Ports and SEZ (APSEZ)’s board last week named MSKA & Associates the organization’s auditors. Previously, it had accepted Deloitte Haskins & Sells’ resignation as statutory auditors on the recommendation of its audit committee. We investigate Deloitte’s resignation’s causes and examine its assessments of the financial statements.

Deloitte requested a more prominent auditing role for other listed Adani companies because it needed to look at intra-group transactions to provide the correct conclusion. According to APSEZ, group-wide appointments are outside its board’s purview.

It claimed that the other businesses were independent, had independent boards, and had minority shareholders. Deloitte’s argument appears to have been that the audit’s scope did not include any possible transactions or balances between the group businesses’ suppliers, customers, or other parties.

Auditors are now vigilant of fraud and other wrongdoings and are hesitant to take on obligations without having access to all the facts. The audit committee for APSEZ thought Deloitte’s justifications for leaving were unpersuasive.

Deloitte noted APSEZ had entered into significant EPC (engineering, procurement, and construction) purchase contracts with a fellow subsidiary—The contractor—of a party named in the allegations made by the Hindenburg report in a qualified opinion on the consolidated financial statements of APSEZ.

A net sum of Rs 3,749.65 crore was recoverable from this contractor as of March 31, 2023, of which Rs 2,036.63 crore was related to security deposits made to the contractor and Rs 1,680.23 crore was related to capital advances.

Deloitte also made note of security deposits of Rs 1,075.63 crore that were made before April 1, 2022, of which Rs 253.6 crore were made concerning projects that had yet to begin as of March 31, 2023.

The Adani Group advised Deloitte that the Securities and Exchange Board of India (Sebi) was looking into the claims in the Hindenburg short-seller report. Thus it did not believe an outside investigation was necessary. According to the Group, the shares do not affect the consolidated financial accounts. This was based on its assessment and a document written by an outside legal firm regarding the Group’s reply.

The Group’s evaluation, however, was not deemed by Deloitte to be “appropriate audit evidence” for its audit. Regarding the sale of the container facility, without an outside investigation and while waiting for Sebi’s findings.

Deloitte stated that it would be unable to comment on whether or not these or other transactions would alter or disclose the accounts. It failed to say whether the Group “should have complied” with requirements.

Deloitte noted that APSEZ had changed the conditions of selling its container terminal built in Myanmar after the year ended. APSEZ owned this terminal and was being sold to Solar Energy Limited, a business with Anguilla Incorporation.

Deloitte noticed that an impairment loss of Rs 1,273.38 crore had been recorded as an expense in the P&L statement and that the consideration value had been reduced from Rs 2,015 crore to Rs 246.5 crore. The purchase is not a linked entity, APSEZ has told Deloitte.

Adani Harbour Services (AHS) lent another Adani subsidiary Rs 2,590.13 crore in FY22 at a 7.5% contractual interest rate. The fellow subsidiary could decide whether to pay the interest and principal. Deloitte stated that it could not identify the effect of this transaction on the financial statements for FY22 and FY23 since AHS did not determine “the fair value on the initial recognition.”

It was observed that AHS ought to have employed an alternative financial strategy. According to AHS, this party was “not a related party” and was named in the Hindenburg claims. The firm allegedly engaged in financing transactions with this party.

In 2023, the business world witnessed a significant shift when Deloitte, one of the ‘Big Four’ accounting firms, parted ways with Adani Ports and Special Economic Zone Limited (APSEZ), India’s largest commercial port operator. This decision marked the end of a long-standing relationship between the two giants.

This move sent ripples through the industry and prompted questions regarding corporate ethics, governance, and the future landscape of business partnerships. As both entities have long and storied histories, this unexpected separation caught stakeholders, regulators, and the public by surprise, fueling speculation about the factors that precipitated such a drastic step.

Deloitte, a globally renowned professional services network, has been known for its uncompromising commitment to integrity, ethical conduct, and quality services. Adani Ports, a flagship company of the Adani Group, has been a critical player in India’s infrastructure and port development, contributing significantly to the nation’s economic growth. Together, they formed a partnership that seemed beneficial for both parties: Adani Ports received the stamp of credibility from a reputable auditor. At the same time, Deloitte secured a significant client in one of the world’s most dynamic economies.

However, 2023 brought an unexpected change. The once symbiotic relationship became a prominent example of how external pressures, evolving regulatory landscapes, and differing corporate strategies can sever a seemingly robust partnership.

In this article, we tried to delve deep into the reasons for this unprecedented parting between Deloitte and Adani Ports. We will explore the timeline of their collaboration, scrutinize the events that led to this separation, and analyze the regulatory, ethical, and financial implications it had for both parties.

Furthermore, we will look at the broader context in which this decision was made—considering global trends related to corporate governance, environmental, social, and governance (ESG) criteria, and increasing scrutiny of multinational companies and their partners.

We will also consider the perspectives of various stakeholders involved, from shareholders and employees to regulators and the general public, providing a comprehensive understanding of the multi-dimensional impacts of this decision.

Through interviews with industry experts, examination of public records, and analysis of internal communications, this article presents a clear, detailed, and unbiased account of why Deloitte and Adani Ports ultimately chose to walk separate paths in 2023.