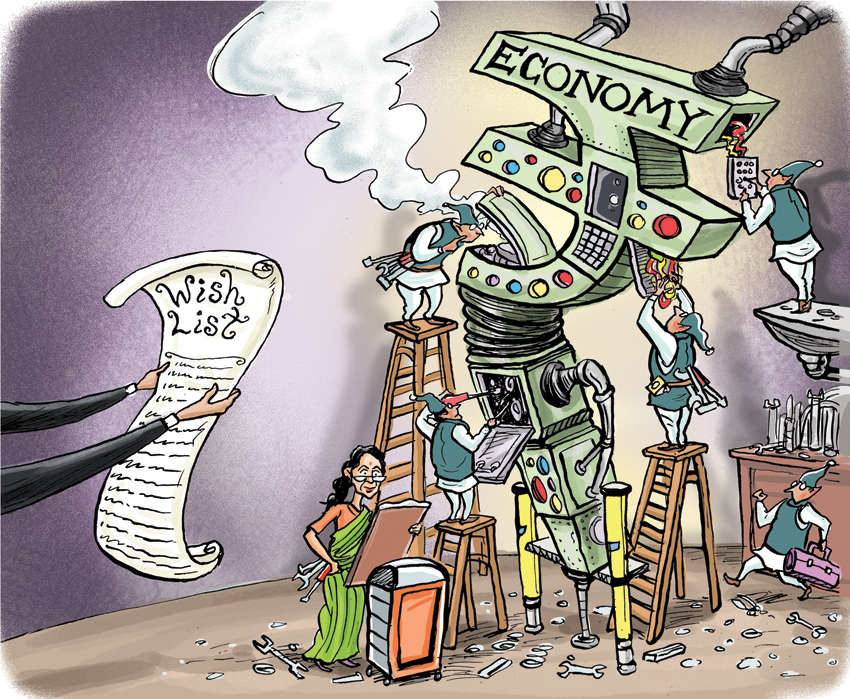

Union Budget 2025-26: CII’s Bold Call For Tax Relief And Economic Justice

Bold Proposals to Fuel Growth, Slash Taxes, and Empower India's Consumers

As India prepares for the Union Budget 2025-26, the Confederation of Indian Industry has presented a desirable wishlist that should boost economic growth and consumer welfare. The apex business chamber has called on the Central government to reduce personal income tax rates and cut excise fuel duties, which it argues will boost disposable incomes, spur consumption, and curb inflation.

Income Tax Reforms

CII has highlighted the growing disparity between the highest marginal tax rate for individuals, currently 42.74%, and the corporate tax rate of 25.17%. According to the industry body, this gap is vast and hampers economic activity by reducing disposable income, particularly for middle—and lower-income groups.

Households, therefore, have yet to experience gains in purchasing power. For such households earning up to ₹20 lakh a year, CII has mooted reducing marginal tax rates. It sees this as putting the “country on a virtuous cycle, with higher consumption, even higher economic growth, and increased direct tax revenues.”

Further, the business body has suggested revising income tax slabs with an inflationary trend. For example, the minimum exemption limit can be increased from ₹2.5 lakh to ₹3 lakh and tax rates can be brought down from 20% to 15% for the slab ₹5 lakh to ₹10 lakh. Such an adjustment, say experts, will put more money in taxpayers’ pockets and stimulate economic activity.

Excise Duty Reduction on Fuels

Fuel prices are crucial for judging inflationary movements, as such costs constitute major household expenses. To this end, the CII has urged the Centre and states to curb excise on petrol and diesel, which command 21 per cent and 18 per cent of market prices, respectively. The nation has seen a 40 per cent reduction in crude oil consumption worldwide since May 2022, but inflation continues to increase due to unchanged high domestic expenses.

CII’s proposal points out that reducing the excise duty on fuel will bring down overall inflation. It would also push more disposable income into consumers’ hands, thus augmenting spending and fuelling economic growth. Such an exercise would further decrease the logistics cost of industries and lower the price of all necessary goods and services.

Recommendations for Rural and Agricultural Support

CII has also focused on enhancing welfare programs and rural development as part of its Budget 2025-26 recommendations:

- MGNREGS Daily Wage Increase: During the budget presentations, it appealed for the government to increase the MGNREGA daily minimum wage from ₹267 to ₹375, as recommended by the Expert Committee on Fixing National Minimum Wage formed in 2017. This would require an additional expenditure of approximately ₹42,000 crore but is expected to enhance rural purchasing power significantly.

- PM-KISAN Scheme Augmentation: The CII has proposed increasing the annual payout under the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) scheme from ₹6,000 to ₹8,000 per beneficiary. With 10 crore beneficiaries, this measure would entail an additional expenditure of ₹20,000 crore and strengthen the financial stability of farmers.

- PMAY Revisions: The business chamber has called for a revision in the unit costs under the Pradhan Mantri Awas Yojana (PMAY) for rural and urban housing, noting that these costs have not been updated since the scheme’s inception. With improved funding, the affordability of housing and construction activities also increases; it is a significant growth engine for the economy.

The CII has further sought more significant investment in agricultural infrastructure, such as cold storage, irrigation facilities, and technology adoption, to improve supply chain efficiency and reduce post-harvest losses, improving farmers’ incomes.

Innovative Solutions to Drive Consumption

To stimulate demand, CII has recommended the introduction of consumption vouchers targeted at low-income groups. These vouchers could be:

- Designed for spending on specific goods and services.

- Valid for a designated period (6-8 months) to encourage timely usage.

- Allocated to Jan-Dhan account holders not currently benefiting from other welfare schemes.

This measure addresses the demand-side problem by directly injecting consumer spending into targeted sectors. To supplement economic recovery efforts, vouchers could be directed towards sectors such as textiles or small-scale manufacturing.

Enhancing Savings and Financial Inclusion

Notably, CII drew attention to an alarming trend for household savings wherein the share of bank deposits within household financial assets has declined from 56.4% in FY20 to 45.2% in FY24. Among the factors causing this decline were low returns from bank deposits compared to equities and mutual funds and a heavier tax burden on interest income.

To reverse this trend, CII has proposed:

- Taxing interest income from bank deposits at a lower rate makes them more attractive.

- Reducing the lock-in period for fixed deposits with preferential tax treatment from five to three years.

These measures will result in higher rates of saving, better corporate bank liquidity, and a more stable supply for economic growth. CII proposed increasing the contribution ceiling of PPF every year to ₹ 2 lakh instead of its present level of ₹ 1.5 lakh annually. This will boost long-term saving behaviour.

Addressing Inflation and Domestic Consumption

India’s growth story has long been based on domestic consumption. But inflation has risen over the past year and has sapped consumer spending. The economy needs targeted interventions to regain its lost momentum. Government policies must focus on disposable incomes to keep the economic activity going, said Chandrajit Banerjee, Director General, CII.

He noted: “Lower interest from bank deposits than from equities and funds and more tax incidence on income derived from interest-bearing instruments have lessened investment in traditional savings. Increasing disposable incomes and encouraging increased consumption are important factors for maintaining growth momentum.

CII also suggested a tax-free category for essential expenses, such as medical and educational costs, to relieve households. The tax rebate under Section 80C of the Income Tax Act should be extended to encourage more investment in savings instruments.

Boosting Infrastructure Investment

CII has highlighted public infrastructure investment as a driver for economic growth. Proposals are:

- Increasing Capital Expenditure: Schemes to increase funds for road, railway, and urban infrastructure projects.

- Public-Private Partnerships (PPPs): Promoting private sector participation in essential infrastructure projects so that execution speed is enhanced and fiscal pressure is reduced.

- Green Infrastructure Initiatives: Investment in renewable energy projects, electric vehicle infrastructure, and sustainable urban development to achieve climate goals with job creation.

Conclusion

Under Budget 2025-26, CII suggests balancing relief in the short term with long-term growth. Proposals relating to taxation, fuel prices, rural welfare, household savings, and infrastructure would be sought to increase disposable incomes. If adopted, these measures will help reduce inflationary effects. Still, they are otherwise driving consumption-led growth with sustainability while reviving the status of becoming one of the world’s fast-growing economies. Additionally, rural development and savings incentives through infrastructure investment resonate with government objectives, such as inclusive growth and economic resilience.