UK’s Debt Hits 100% of GDP. How did a once-strong economy fall into such deep debt? Will the UK bounce back from its worst debt crisis in over 60 years?

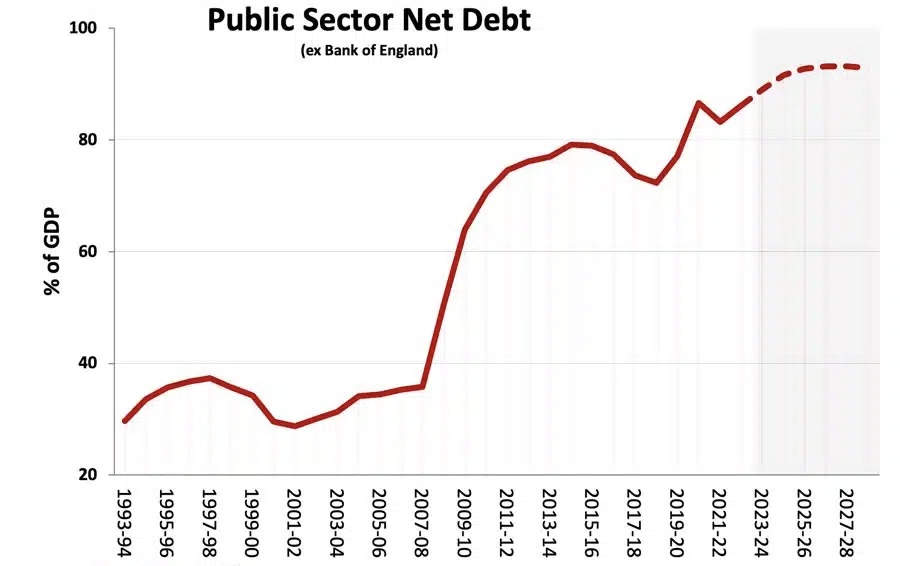

The UK, which was considered to be the superpower in terms of its strength and resources, is now declared as one of the worst economies that we have today. The British government is found to be wholly in debt covering 100% of GDP in August 2024 which is the highest percentage it was ever since 1961. The economic forecast for the country is blurry; this is caused by issues such as debt-inflated economic growth and social ones.

In 2024, the UK is facing a major economic crisis which is considered to be one of the worst in history. UK debt reached a point where it is 100% of national GDP. The country has now been able to pay its creditors in full. The sharp rise in debt was driven by a mixture of these factors- the global financial crisis of 2008, the impact of the COVID-19 pandemic, weak economic growth, and challenges such as Brexit.

Before looking at why the public debt is increasing, let us begin by looking at what public debt here means. Public debt, in this case, concerns the money borrowed by the government to its creditors, locally or internationally. Banks loan government money for building projects such as,-road construction, bridges, defense, schools, and other welfare activities. Theoretically, when a government’s spending is more than its revenues, it begins borrowing and this will be added to the national debt in the long run.

Regarding the UK, for instance, the public debt has increased in recent years. For instance, the government traditionally and massively borrowed £64.1 billion in March 2024 to finance its expenditure during the first five months of the fiscal year 2024. Its debt level reached 100 percent of the GDP It is for these reasons that so many big events have happened this situation has emerged.

Causes of the UK’s Debt Crisis

Global Financial Crisis (2008)

The first large event that led to United Kingdom liabilities was the global financial crisis in 2008. This crisis started with severe credit problems in the banking sectors both in the United States, and subsequently global, arising from a problem of credit risk. It thus paved the way to a severe turmoil in the banking industry that had resulted in steep economic contraction in many nations, including the UK.

This forced the government to bail out the banks of the UK and bring the errant banks into line to prevent total capital meltdown. The government invested millions of pounds fixing the problem in order to make sure that people did not lose their money. But this came at a huge cost and was funded by borrowing.” From here started the debt problem for the UK as the government felt it needed to spend hundreds of pounds of money than it earned.

COVID-19 Pandemic (2020–2022)

After the outbreak of Covid 19, the UK’s debt position was even worse off. In the year 2020, when the virus started to infect many people around the world, nations such as the UK had no option than to lock down to avoid escalation of the disease. This led to an economic slow down Therefore, it caused many firms to be shut down and people were fired as well as the general economic activities were brought to a halt.

In order to support businesses and individuals then, the British government put forward a number of support measures; furlough schemes where the government paid wages of workers who could not work, business loans, and increased spending on healthcare. All these actions were fully and entirely proper to avert a near total economic downturn; however, they led to surging the government borrowing more rather drastically. It reached billions of pounds by the end of 2022 after the pandemic was contained, thereby pushing it up the debt levels.

Poor Economic Growth

An important reason for the growing UK debt is weak economic growth. The rise in value of all goods and services produced in a country is termed economic growth. In an expanding economy, it makes more money in taxes to pay for its debt. Since the financial crisis around the world, though, the UK’s economy has not been growing at a fast rate.

One of the factors driving this weak growth is stagnating productivity. Productivity is defined by how much work is done during any given time. The more productive workers are, the more they are able to make goods and services, which equates to an increase in the economy. This is where the UK really is concerning the UK; productivity has been mainly flat since the 2008 crisis. This meant that the economy was not expanding at the rate it could, therefore subjecting the government to low revenues on tax and offering much strain for reimbursement of debt.

Additionally, the exit of the British from the European Union, termed as Brexit, has also resulted in low growth. Businesses have not invested in the UK because of the uncertainty of higher tariffs and unsettled economies due to their exit from the European Union. That is what further slowed down the growth of the economy.

Brexit

The long-term effects of the Brexit referendum, in which the UK voted to leave the EU, have been much more profound. Those arguing for Brexit believed that after leaving the EU, full control over the laws and trade policies in the UK would occur, while its economy immediately suffered negatively.

Leaving the EU made it harder to do trade with the UK’s largest trading partner, Europe. Before Brexit, there were no tariffs or customs checks on trade with the UK from EU countries. There are now rules, regulations, and tariffs in place when doing trade with the EU countries, which have cost businesses more and been far more bureaucratic, making trade more expensive and complicated, with falling exports and economic growth deceleration.

Consequently, Brexit did not only jeopardise the interests of the country’s various sectors but also posed a threat to its economy. Left without access to many other sources of labour, specific sectors, such as agriculture and healthcare, suffered labour shortages because most of the people that the former drew from different European nations were mainly recruited in Britain.

As their freedom to work in the UK was gradually withdrawn, it really became hard for European citizens to work in the country, causing a serious shortage of laborers, especially in such critical sectors as health and transport. This shortage has presented problems in maintaining the levels of production and services within the UK and has further impeded economic growth, thus increasing debt.

Effects of Increasing Debt

The more immediate effect of the rising debt is the pressure it mounts on public services. Since there is less money for the UK government as it increasingly borrows to service its debts, some subsectors get cut back. As such, the institutions get hospitalised, the delivery of health services gets delayed, and there is a scarcity of all school facilities.

This is how badly most of the United Kingdom’s healthcare centres, particularly the NHS, have been stressed lately- long waiting times for treatments and many unstaffed places. It has even led to many nurses leaving the profession due to woeful working conditions and low wages, making it very hard to provide adequate care to patients. This case has been made worse after Brexit because the NHS relied upon workers who were coming from the EU, who are not likely to work in the UK for the first time due to new immigration rules imposed by Brexit.

Increased Inflation

An impact of the increasing debt is an increase in inflation. Inflation is the rising general increase in prices with time. Given that the government borrows lots of money, there always tends to be more money floating around, but not necessarily a supply chain. Hence, it leads to price increases in everyday goods, including food and energy due to the increased cost of living.

The inflation rate in the UK has been raised to 11% as of 2024, and this is the highest level that this country has faced in the last 40 years. This has led to an increase in the expenses charged by various traders and businessmen to levels which is far beyond the reach of many families to meet basic needs, including food, shelter, and fuel.

This has directly contributed to rising inflation, which has caused a direct rise in the number of poor people in the UK, with millions of them facing financial problems.

Debt Interest Payments

With an ever-rising UK debt, interest payments on that debt are going up, just as they do for individuals who take loans. Such governments have to pay interest on borrowed money. The higher the debt is, the more that means the government has to spend on paying interest and less on other essential items like healthcare, education, and infrastructure.

The UK already spends billions of pounds annually through interest on the borrowed money. And they will only rise in the next few years as the level of debt keeps rising in the subsequent years. This creates a vicious circle in which because of growing interest costs that the government bears, it has to borrow more money and hence step up the debt burden

A country with high debt levels is less attractive to investors. Investments in countries with high debts are somehow discouraged since, sooner or later, the government will take back its loans or impose unfair policies and taxes to clear the debt. Reduced foreign investment in the UK is thus one of the significant causes of disinflation.

Foreign investment brings new businesses, jobs, and innovation into a country. Without this source of investment, the economy of the UK would find it rather difficult to grow to the level that could help in reducing the national debt.

Comparisons with Other Countries

From the UK’s perspective, in the context of other countries, one would realize that their situation is the most dangerous.

For example, Germany, up to 2024, had a debt of 63.7% of its GDP, Ireland had a debt of 42.5%, and India had 58.2% of its GDP in terms of debt. On the other hand, the UK is at the top with its debt as 100% of GDP, thus making the UK worse than many important economies.

One of the main reasons is that countries such as Germany and Ireland have a more robust manufacturing sector that helps recover relatively faster from economic crises. Contrary to this, the UK economy relies more on services such as the finance and real estate sector, which has been affected more mainly by the recent waves of economic shock such as COVID-19 and Brexit.

How Can the UK Deal with the Debt Crisis?

As the UK looks to rein in its debt crisis, there are so many aspects it should zero down on, and these include;

Economic Growth Booster

One of the best ways of getting less debt is through the boost of economic growth. This is so because with economic growth, there is more money collected in the form of taxes, which can be used to pay off the debt. It is high time that the UK aimed at sectors that have the potential to grow in the future, like IT, energy, especially the green energy, manufacturing industries, etc

Productivity Increase

As mentioned earlier, one of the causes of a low growth rate in the economy of the UK is productivity stagnation. Then, there is an imperative need for the government to invest in schemes like education and training that can further make the labor force available for work with added skills, which, in turn, will help the country increase its productivity. The second requirement is investments for new age technology, innovations that can assist companies in producing goods and services more effectively.

Attracting Investment

The UK has to ensure a flow of foreign investment. For this, the government should be able to give the country a stable and business-friendly atmosphere so that investors are tempted to invest their money in the UK. Reducing bureaucracy, lowering taxes on businesses, and giving incentives to those companies investing in the UK will be helpful.

The UK economy’s biggest challenge is labour shortages. Immigration policies by the government must be rewarded with incentives to make their entry smoother, particularly in the healthcare and agriculture industries. The government must stress the creation of job opportunities and employment for home workers, especially in areas that are affected by unemployment.

The UK debt crisis is a very important lesson for all other countries. And one very important thing is that maintaining a balanced economy and control is very essential. Those nations that have only one particular sector to depend on, like services, are more susceptible to economic shocks; this is because if it were to be hit by something it would lead the way in distress. Those economies that have a strong base of manufacturing, as well as agriculture, tend to support themselves during bad times.

Political decisions will finally teach the lesson of considerable prudent political decision-making. Brexit is a lesson that warns against making all macro-political choices without a clear understanding of their economic implications. Such decisions in the country should be taken after an almost adequate estimation of their possible economic implications.

This UK crisis shows to mankind that the most pressing thing needed is to invest in public services, not only health but also education. Such services improve the quality of life for citizens, and they further strengthen long-term economic growth with a healthy and productive workforce.

The current UK economic emergency is therefore a result of several crises including the global financial crisis, the COVID-19 pandemic, slow economic growth and the consequences of Brexit. However, national debt has reached 100% of GDP, bequeathing severe trials for the UK-inflation, increasing poverty, and imposing a strain on public services.

To address these challenges, the UK government must shift its focus to boosting economic growth, increasing productivity, attracting investment, and relieving labour shortages. Then, learning from the UK’s experience, other nations can avoid similar mistakes and ensure a more stable future in terms of economics.