Udaan Navigates Funding Discussions Amid Potential Valuation Adjustment

Udaan Navigates Funding Discussions Amid Potential Valuation Adjustment

Business-to-business (B2B) e-commerce firm Udaan is reportedly in discussions to secure a funding round of $200-250 million in an internal investment round. Sources familiar with the matter have indicated that existing internal investors, including Lightspeed, are considering injecting additional equity capital into Udaan. The deal’s specifics are currently being worked out and are expected to be finalized within the next few weeks.

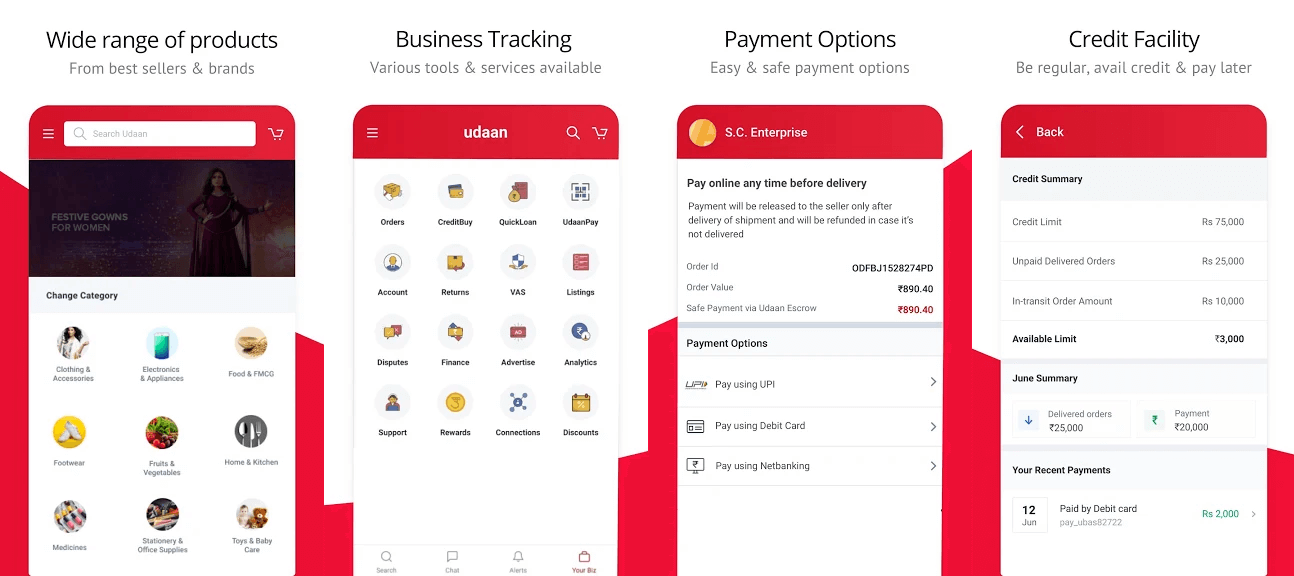

Udaan, which operates as a B2B platform, facilitates transactions between manufacturers, wholesalers, traders, and retailers. The potential funding infusion indicates continued investor confidence in the company’s business model and growth prospects. The company has previously garnered attention for its ability to streamline supply chains and facilitate trade in various sectors through its digital platform.

The participation of Lightspeed, an established venture capital firm, along with other internal investors, underlines the ongoing commitment of existing backers to support Udaan’s expansion efforts. This potential funding round could provide Udaan with additional financial resources to scale its operations, invest in technology enhancements, and explore new avenues for growth within the B2B e-commerce space.

The forthcoming equity round for Udaan marks a significant development, considering the company’s recent funding activities. Over the past 30 months, Udaan has predominantly relied on debt and convertible notes to raise capital. This shift towards an equity funding round reflects the company’s evolving financing strategy.

In January 2021, Udaan secured $280 million in an extended Series D funding round, indicating investor interest and confidence in the company’s growth trajectory. Additionally, Udaan has been able to secure over $350 million in funding through debt instruments and convertible notes since that time. This blend of debt and convertible notes allowed Udaan to address its funding needs while continuing to fuel its expansion plans.

The decision to return to an equity funding round could be influenced by various factors, including the company’s valuation, investor interest, and the strategic priorities for its growth. Equity investments can provide Udaan with a more stable and long-term capital base, which could support its ambitions to further solidify its position in the B2B e-commerce landscape.

Udaan’s efforts to secure equity funding reflect its commitment to strengthening its financial foundation and pursuing its growth goals. Negotiations surrounding valuation are a crucial aspect of these fundraising discussions, as both the company and potential investors seek to arrive at a mutually agreeable assessment of Udaan’s worth.

The potential valuation range of $1 billion to $1.5 billion, as suggested by sources, underscores the dynamic nature of valuation discussions in the startup ecosystem. Valuations can be influenced by a variety of factors, including market conditions, financial performance, growth prospects, and investor sentiment. While Udaan’s valuation in this round may undergo an adjustment from previous rounds, it’s essential to note that valuation is just one facet of a comprehensive funding arrangement.

Ultimately, the valuation discussions aim to strike a balance between the company’s financial needs, investor expectations, and the strategic direction Udaan aims to take. The equity funding, even if at a potentially lower valuation, can provide Udaan with the resources required to drive its business expansion, technology enhancement, and overall competitiveness in the B2B e-commerce landscape.

The varying valuations mentioned reflect the fluid nature of startup valuations, which can be influenced by market dynamics, business performance, and investor sentiment. The discrepancy between Udaan’s self-valuation of $7.5 billion in 2019 and the reported discussions for an equity round at a lower valuation underscores the reality that valuations can evolve over time based on a multitude of factors.

It’s worth noting that early-stage funding discussions are often subject to change, and the terms of any funding arrangement can be impacted by a range of factors, including investor interest, market conditions, and the strategic direction of the company.

Both Udaan and Lightspeed have indicated that the reported details are factually incorrect. This highlights the need to approach reports about fundraising and valuation discussions with caution, as such information can sometimes be subject to misinformation or misinterpretation.

Udaan’s growth trajectory and financial performance reflect a common pattern observed among many startups, particularly unicorns, where rapid expansion and investment in growth often lead to initial losses. In FY22, the company achieved significant growth in its gross revenue, increasing by 66.8% from the previous fiscal year. This growth indicates the company’s ability to scale its operations and capture market share.

However, it’s also important to note that the company reported losses exceeding Rs 3,000 crore during the same period. This pattern of high revenue growth paired with losses is not uncommon among startups that prioritize aggressive expansion and market penetration over short-term profitability. Such companies typically aim to capture a dominant position in their respective markets and then focus on optimizing their business models to achieve profitability in the long term.

The absence of audited financial numbers for FY23 indicates that Udaan’s financial performance for that period is not yet publicly available. This information will be essential to assess how the company’s growth and profitability trajectory has evolved further.

Udaan’s journey mirrors the broader startup landscape, where balancing growth and profitability is a strategic challenge that many companies face as they strive to establish themselves in competitive markets and build a strong customer base.

Layoffs in startups, including unicorns like Udaan, can occur for various reasons and may not always signify financial desperation. In the case of Udaan, the company’s decision to lay off around 500 employees could indeed be attributed to an efficiency enhancement drive. Startups often go through periods of reevaluation and optimization, especially as they mature and navigate different stages of growth.

Efficiency enhancements can involve restructuring to align the workforce with evolving business priorities, streamlining operations, eliminating duplications, and reallocating resources to areas that are more strategic for the company’s long-term objectives. While layoffs can be challenging for employees affected, they can also enable the company to operate more efficiently and effectively in the long run.

It’s worth noting that the decision to lay off employees is typically made after careful consideration and analysis of the company’s operational needs, financial situation, and overall business strategy. While layoffs can be disruptive, they can also contribute to a company’s ability to focus on core initiatives and allocate resources where they are most impactful.

In Udaan’s case, the layoffs should be seen in the context of the company’s efforts to optimize its operations and position itself for sustained growth in a competitive market landscape.