Top Goldman Sachs Analyst Says The World Is Transitioning Into A New Super Cycle Driven By Artificial Intelligence And Decarbonization

Peter Oppenheimer, top analyst at Goldman Sachs, foresees a paradigm shift marked by the convergence of artificial intelligence (AI) and decarbonization. In his recent insights, Oppenheimer unveils the concept of a new "super cycle" that is set to reshape the global economic landscape. The shift, driven by innovative technologies and sustainability measures, challenges established norms, mirroring historical periods of change while offering unique opportunities and risks. However, do other analysts agree?

Top Goldman Sachs analyst Peter Oppenheimer suggests that the world is entering a new “super cycle” primarily driven by artificial intelligence (AI) and decarbonization.

According to Oppenheimer, super cycles are prolonged periods of economic growth accompanied by increased GDP, high demand for goods leading to price rises, and high employment levels.

Discussing his recently released book, “Any Happy Returns,” Oppenheimer points out that the last significant super cycle began in the early 1980s. During this period, interest rates and inflation peaked, followed by decades of decreasing capital costs, inflation, and rates. This era was characterised by economic policies such as deregulation and privatization, along with easing geopolitical risks and strengthened globalization.

However, Oppenheimer notes that some of these factors may not continue as before, accentuating that interest rates may not decline as aggressively in the coming decade, and there is resistance to globalization, accompanied by increased geopolitical tensions, including the Russia-Ukraine war, U.S.-China trade tensions, and the Israel-Hamas conflict.

While economic developments could theoretically lead to a slowdown in financial returns, Oppenheimer sees positive influences from AI and decarbonization; despite AI being in its early stages, the increasing use of AI as the foundation for new products and services could positively impact stocks.

Oppenheimer also emphasizes the potential for improved productivity resulting from AI applications, which could positively affect economic growth and profit margins.

He draws historical parallels to the early 1970s and 1980s, highlighting similarities in growing geopolitical tensions, rising taxes, and enhanced regulation.

Moreover, Oppenheimer sees parallels with the late 19th century, attributing the current period to a “tremendous twin shock” of rapid technological innovation and economic restructuring for decarbonization.

He draws lessons from historical cycles and structural breaks, emphasizing the importance of learning from history to effectively steer the evolving economic environment.

What Is A Supercycle

A supercycle refers to an extended period of robust economic expansion characterized by sustained demand for commodities that surpass the capacity of producers to meet it; these economic phenomena can persist over several years.

Understanding a Supercycle

Various economic catalysts, typically centered around rapid industrialization or urbanization, can initiate a supercycle.

These catalysts generate heightened demand for commodities, creating a significant imbalance between immediate demand and supply; the mismatch results in

(1) an escalation in commodity prices and

(2) investments by commodity producers to augment their output.

However, the completion of these producer investments can span numerous years, such as the development of oil and gas fields requiring up to a decade.

Due to the constrained supply, the demand for commodities may continue to outpace supply for an extended period, giving rise to a sustained surge in commodity prices known as a supercycle.

Real-World Examples

Over the past 150 years, four distinct supercycles have been identified, each aligning roughly with periods of rapid global industrialization-

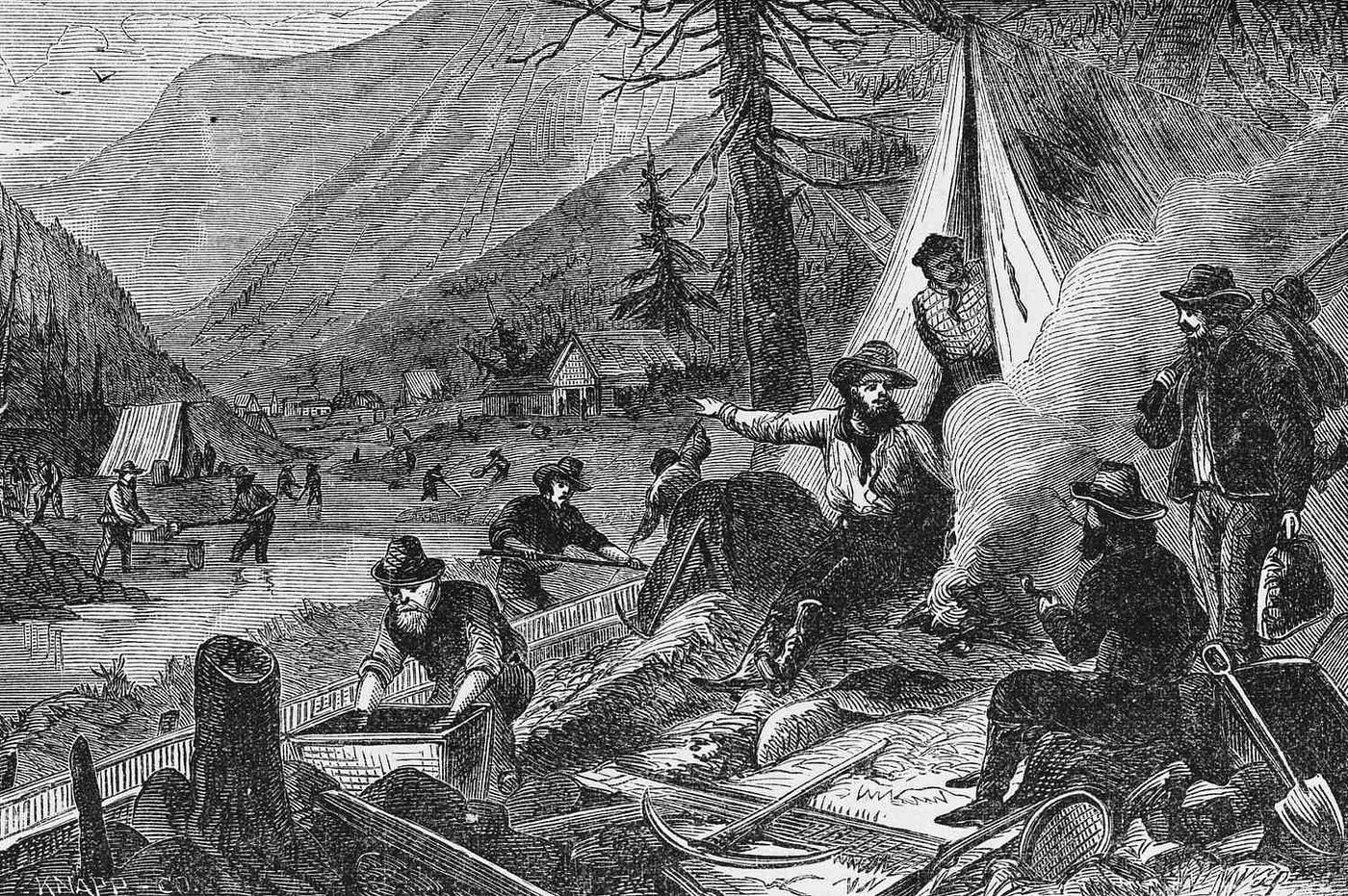

–The late 1800s witnessed the first supercycle propelled by U.S. industrialization and the utilization of oil in manufacturing, shipping, and automobiles.

–The 1930s marked the beginning of the second supercycle driven by global rearmament before the Second World War.

–The 1960s marked the start of the third supercycle fueled by the reindustrialization of Europe and Japan.

–The late 1990s marked the commencement of the fourth supercycle, attributed to China’s industrialization and its membership in the World Trade Organization (WTO) in 2001.

Types of Commodities in Demand During a Supercycle

During a supercycle, historically, there is a heightened demand for two specific types of commodities –

- Industrial Metals, include materials like iron ore, copper, and aluminum.

- Energy, including natural gas, crude oil, and coal.

Supercycles and Inflation

As elucidated, supercycles lead to an upswing in commodity prices; given that commodities serve as essential inputs in various sectors, this surge can elevate the cost of goods and services, contributing to increased inflation.

Unchecked inflation may prompt central banks to adopt restrictive monetary policies to alleviate inflationary pressures, potentially impacting financial markets adversely.

New Supercycle in 2024?

Goldman Sachs’ Peter Oppenheimer anticipates the inception of a new supercycle in 2024, foreseeing its endurance over several decades.

Oppenheimer cites historical context, reflecting on the significant super cycle that commenced in the early 1980s. He acknowledges the remarkable changes during this period – from peaking interest rates and inflation to subsequent decades of falling capital costs and increased globalization.

However, he cautions against assuming a linear continuation of these trends. Geopolitical tensions, trade disputes, and the resistance to globalization, underscored by recent conflicts, present formidable challenges.

Despite these challenges, Oppenheimer identifies two pivotal forces that could propel the global economy forward.

Firstly, the nascent stage of AI, as it evolves into the backbone of new products and services, promises a positive impact on stocks.

Secondly, the ongoing pursuit of decarbonization introduces a unique dimension to the economic landscape, reshaping industries and business models.

Oppenheimer emphasizes the potential for AI-driven productivity gains, addressing concerns surrounding job displacement – the parallels drawn with historical periods, such as the early 1970s and the late 19th century, offer valuable insights.

The combination of rapid technological innovation and a concerted move towards decarbonization mirrors the challenges and opportunities witnessed during these transformative phases.

However, this viewpoint does not enjoy unanimous agreement, as some analysts propose a cyclical upturn in products and services instead of a full-fledged supercycle.

The Last Bit, Peter Oppenheimer’s insights paint a vivid picture of a world at the precipice of a new super cycle led by the interplay between AI and decarbonization amid geopolitical uncertainties, calls for a nuanced understanding of historical parallels.