Top 5 Best Neo Banks In India 2024

Top 5 Best Neo Banks in India 2024

Neobanks, also known as digital banks or challenger banks, are financial institutions that operate exclusively online or through mobile applications, offering a range of financial services without traditional physical branches. These banks have gained significant popularity in recent years due to their convenience, user-friendly interfaces, and innovative features. Neobanks aims to disrupt the traditional banking industry by leveraging technology to provide a more customer-centric and accessible banking experience.

Unlike traditional banks, neobanks often have lower overhead costs because they don’t maintain physical branches, which allows them to offer competitive fees and interest rates. They typically provide services like savings and checking accounts, payment processing, money transfers, and even investment options. Customers can access their accounts, make transactions, and manage their finances entirely through mobile apps or web platforms, making banking more accessible and convenient.

One of the key advantages of neobanks is their agility and adaptability. They can quickly introduce new features and update their services to meet the evolving needs of customers. Additionally, neobanks often focus on user experience, offering intuitive interfaces and real-time notifications, which enhance financial transparency and control.

However, it’s essential to note that neobanks may not provide the same level of physical support and infrastructure as traditional banks. Some customers may still prefer the security of having physical branches or in-person interactions for complex financial matters. Neobanks also need to navigate regulatory challenges and build trust in a heavily regulated industry.

In summary, neobanks are a growing segment of the banking industry, offering digital, customer-centric financial services that prioritize convenience, lower fees, and innovative features. While they may not replace traditional banks entirely, they are reshaping the way people interact with and manage their finances in the digital age.

1. Niyo

Niyo is a fintech company based in India that offers a range of financial products and services, primarily focused on modernizing and simplifying banking for both individuals and businesses. It is known for its innovative neobanking solutions. As of my last knowledge update in September 2021, here’s a brief overview of Niyo

Niyo offers various banking products, including savings accounts, salary accounts, and corporate expense management solutions. Their goal is to make banking more accessible and user-friendly, leveraging technology to streamline financial processes.

One of Niyo’s standout features is its Niyo IDFC First Bank savings account, which comes with a mobile app that offers features like automated budgeting, expense tracking, and the ability to invest in mutual funds and fixed deposits. This account is particularly popular among salaried individuals and comes with a Niyo Global Travel Card that allows for easy and cost-effective international transactions.

For businesses, Niyo offers corporate banking solutions, including digital salary accounts and expense management tools. These tools help companies manage employee benefits and expenses efficiently.

It’s important to note that the financial technology landscape evolves rapidly, and new features and partnerships may have been introduced by Niyo since my last update. Therefore, I recommend checking the latest information and reviews to get a comprehensive understanding of Niyo’s current offerings and services.

2. RazorpayX

Razorpay is a fintech platform headquartered in India that focuses on providing advanced financial and banking solutions tailored to businesses. As of my last knowledge update in September 2021, RazorpayX has gained recognition for its comprehensive suite of services designed to streamline and enhance various financial aspects of business operations.

One of the standout features of RazorpayX is its digital business banking services. It offers businesses access to current accounts and payment gateway solutions, simplifying financial transactions and facilitating online payments. This capability is particularly valuable for e-commerce platforms and businesses looking to expand their online presence.

RazorpayX also offers payroll management services, making it easier for companies to handle salary disbursements, tax calculations, and compliance requirements. This feature ensures that organizations can efficiently manage their workforce’s financial needs.

Furthermore, the platform provides tools for expense management, allowing businesses to track and manage expenses, reimbursements, and employee spending more efficiently. Integration and automation capabilities enable seamless connections with other financial and business tools, streamlining financial processes and reducing manual efforts.

RazorpayX’s virtual account feature allows businesses to create virtual accounts for specific purposes, such as collecting payments or segregating funds. This feature enhances financial control, simplifies reconciliation, and improves overall financial management.

Please note that the fintech landscape evolves rapidly, and RazorpayX may have introduced new features or services since my last update. To get the most current information about their offerings, I recommend visiting their official website or referring to the latest reviews and resources.

3. Open

Open is a financial technology company that specializes in providing comprehensive banking solutions tailored for small and medium-sized businesses (SMBs). Recognizing the unique financial needs and challenges faced by SMBs, Open offers a range of digital banking services designed to simplify financial management and support business growth.

One of the key features of Open is its user-friendly platform that allows SMBs to open business accounts quickly and without the hassle of visiting physical branches. This digital-first approach makes it easier for entrepreneurs to access essential banking services, such as business checking and savings accounts, expense management, invoicing, and integrated financial reporting.

Open also understands the importance of seamless integration with other business tools and software. Their banking solutions are often designed to work seamlessly with accounting software, payment gateways, and other financial management applications, streamlining financial processes for SMBs.

Moreover, Open places a strong emphasis on providing valuable insights and analytics to help SMBs make informed financial decisions. This includes real-time transaction tracking, spending analysis, and cash flow management tools, empowering business owners to have better control over their finances.

In a rapidly evolving business landscape, Open’s banking solutions cater to the needs of modern SMBs, offering convenience, flexibility, and the essential financial tools required for success. By combining cutting-edge technology with a deep understanding of SMBs’ financial needs, Open is contributing to the growth and prosperity of small and medium-sized businesses.

4. YONO by SBI

![]()

YONO, short for “You Only Need One,” is a revolutionary digital banking platform offered by the State Bank of India (SBI). It has transformed the way customers engage with their banking services by providing a one-stop solution for all their financial needs.

YONO offers a user-friendly mobile app that allows customers to access a wide range of banking and financial services at their fingertips. From checking account balances and transferring funds to paying bills and applying for loans, YONO provides a seamless and convenient banking experience.

One of YONO’s standout features is its integration with various third-party services, offering customers access to a wide range of lifestyle and financial products. Users can book flights, and hotels, and even purchase insurance through the app, making it more than just a banking platform.

Security is a top priority for YONO, and it incorporates robust security measures to protect user data and transactions. Biometric authentication, two-factor authentication, and encryption ensure that customer information remains safe and secure.

YONO has gained immense popularity in India for its convenience, accessibility, and comprehensive range of services. It reflects SBI’s commitment to innovation and customer-centric banking, making it an essential tool for modern banking in the digital age. Whether you’re managing your finances or exploring new opportunities, YONO by SBI simplifies the process and puts control in the hands of the customer.

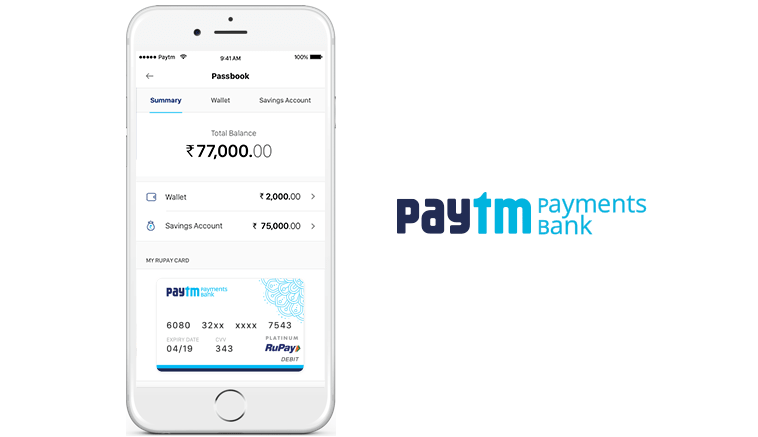

5. Paytm Payments Bank

Paytm Payments Bank, a subsidiary of the Indian digital payment giant Paytm, is a prominent player in the country’s banking and financial services landscape. Launched in 2017, it operates as a digital-only bank, blending the convenience of mobile payments with traditional banking services.

Paytm Payments Bank offers a range of financial products and services to cater to the needs of both individuals and businesses. These services include savings accounts, fixed deposits, debit cards, and digital wallets, all accessible through the user-friendly Paytm app. Customers can easily open a savings account with zero minimum balance requirements, making it inclusive for people from various economic backgrounds.

One of the bank’s standout features is its seamless integration with the Paytm ecosystem, enabling users to make digital payments, pay bills, and even invest in mutual funds and insurance products through the app. This convergence of banking and digital payments has made it a go-to choice for millions of Indians.

Paytm Payments Bank also prioritizes financial inclusion, serving underserved and remote areas of India. It offers doorstep banking services and supports government initiatives like Direct Benefit Transfer (DBT) and pension payments.

Security is a paramount concern for the bank, and it employs robust encryption and authentication measures to safeguard customer data and transactions.

In summary, Paytm Payments Bank has become an integral part of the Indian digital financial landscape, providing customers with easy access to banking services, digital payments, and a diverse array of financial products, all from the convenience of their mobile devices.

Conclusion

NeoBanks are reshaping the banking industry by leveraging technology, innovation, and customer-centric approaches. While they face challenges, their ability to provide convenient, accessible, and specialized financial solutions positions them as influential players in the future of finance. As the financial sector continues to evolve, NeoBanks are likely to play an increasingly significant role in shaping its direction.