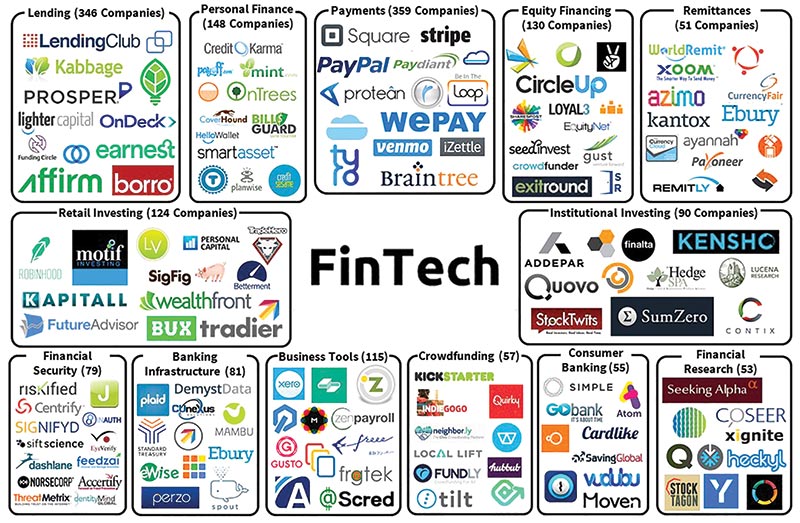

Fintech companies are businesses that use technology to offer financial products and services to consumers and businesses.

The term “fintech” is a combination of “finance” and “technology.” Fintech companies use technology to streamline and improve financial services, such as banking, investing, lending, payments, insurance, and more.

Fintech companies often leverage emerging technologies, such as artificial intelligence, blockchain, and cloud computing, to create innovative financial products and services. These technologies allow fintech companies to offer faster, cheaper, and more convenient financial services than traditional financial institutions.

Examples of fintech companies include online banks, mobile payment platforms, robo-advisors, peer-to-peer lending platforms, and cryptocurrency exchanges.

list of some of the top fintech companies as of my knowledge cutoff date (September 2021). Please note that this list is not exhaustive and may not represent the current state of the industry in 2023.

- Stripe –

Stripe is a fintech company founded in 2010 that provides an online payment processing platform and financial services to businesses of all sizes. The company’s software platform enables businesses to accept payments over the internet, including credit and debit cards, digital wallets, and bank transfers. Stripe also offers additional financial services, including fraud prevention, subscription management, invoicing, and treasury management.

Stripe is known for its ease of use, customizable API, and developer-friendly tools, which have made it a popular choice among startups and larger enterprises alike. The company has raised significant amounts of funding from investors, including venture capital firms such as Sequoia Capital and Andreessen Horowitz, as well as high-profile individuals such as Elon Musk and Peter Thiel.

- Square –

Square is a fintech company founded in 2009 that provides a range of financial services, including mobile payment processing, business loans, and peer-to-peer money transfers. The company’s flagship product is its mobile point-of-sale system, which enables businesses to accept credit and debit card payments using a smartphone or tablet.

Square’s other products and services include Square Cash, a mobile app for sending and receiving money, and Square Capital, a lending service that offers small business loans to merchants who use the company’s payment processing tools.

Square has become a popular choice for small businesses and independent merchants due to its low fees, ease of use, and accessibility.

- Ant Group –

Ant Group is a Chinese fintech company founded in 2014 that provides a range of financial services, including digital payments, wealth management, and insurance. The company’s flagship product is Alipay, a digital payment platform that enables users to make payments, transfer money, and pay bills using their mobile phones.

Ant Group has become one of the largest fintech companies in the world, with more than 1 billion users and over 80 million merchants using its services. The company’s rapid growth has been driven by its focus on innovation and technology, as well as its strong partnerships with Chinese banks and financial institutions.

- PayPal –

PayPal is a fintech company founded in 1998 that provides a range of digital payment services, including online payments, money transfers, and mobile payments. The company’s flagship product is its digital wallet, which allows users to securely store and use their credit and debit card information to make purchases online and in stores.

PayPal has become one of the most widely used digital payment systems in the world, with more than 400 million active users in over 200 markets around the world. The company has also expanded its services to include mobile payments, peer-to-peer money transfers, and business payments, among other features.

- Coinbase –

Coinbase is a fintech company founded in 2012 that operates a digital currency exchange and wallet platform. The company’s platform allows users to buy, sell, and store cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, among others.

Coinbase has become one of the most popular and trusted cryptocurrency exchanges in the world, with over 56 million verified users in over 100 countries. The company has also expanded its offerings to include other financial services, such as a cryptocurrency debit card, institutional trading services, and a platform for merchants to accept digital currency payments.

Coinbase went public in April 2021 in a highly anticipated direct listing on the NASDAQ stock exchange, becoming one of the first major cryptocurrency companies to do so

- Klarna –

Klarna is a Swedish fintech company founded in 2005 that offers a range of payment and financing options for online and in-store purchases. The company’s payment solutions allow users to buy now and pay later, with the option to split purchases into installments or delay payment for up to 30 days.

Klarna has become one of the largest fintech companies in Europe, with over 90 million active users and partnerships with more than 250,000 merchants worldwide. The company’s success has been driven by its focus on providing a seamless and convenient user experience, as well as its strong partnerships with major retailers and e-commerce platforms.

In addition to its payment and financing services, Klarna also offers a range of other financial products, including savings accounts, insurance, and loyalty programs.

- Revolut –

Revolut is a UK-based fintech company founded in 2015 that provides a range of digital banking services, including mobile payments, foreign exchange, and cryptocurrency exchange. The company’s flagship product is its mobile app, which allows users to easily manage their money and make payments in multiple currencies.

Revolut has become one of the fastest-growing fintech companies in Europe, with over 16 million users in more than 35 countries. The company’s success has been driven by its focus on providing innovative and low-cost financial services, as well as its strong emphasis on user experience and customer service.

In addition to its core banking services, Revolut also offers a range of other financial products, including insurance, savings accounts, and investment products

- Adyen –

Adyen is a Dutch fintech company founded in 2006 that provides a range of payment processing and gateway services for online and in-store transactions. The company’s platform allows merchants to accept multiple payment methods, including credit cards, digital wallets, and alternative payment methods, in over 200 countries and territories.

Adyen has become one of the fastest-growing fintech companies in Europe, with over 4,500 merchants worldwide, including global brands such as Uber, Spotify, and Netflix. The company’s success has been driven by its focus on innovation and technology, as well as its ability to provide a seamless and secure payment experience for both merchants and consumers.

In addition to its payment processing services, Adyen also offers a range of other financial products, including point-of-sale solutions, risk management tools, and data analytics

- Robinhood –

Robinhood is a US-based fintech company founded in 2013 that provides commission-free trading and investment services through its mobile app and website. The company’s platform allows users to buy and sell stocks, ETFs, options, and cryptocurrencies, among other assets.

Robinhood has become one of the most popular investment apps in the US, with over 22 million users as of my knowledge cutoff date (September 2021). The company’s success has been driven by its user-friendly platform, low fees, and emphasis on democratizing access to financial markets.

In addition to its core trading and investment services, Robinhood also offers other financial products, including cash management accounts and margin trading.

- Nubank –

Nubank is a Brazilian fintech company founded in 2013 that offers a range of digital banking services, including credit cards, loans, and savings accounts, among others. The company’s flagship product is its no-fee credit card, which has become one of the most popular credit cards in Brazil.

Nubank has become one of the fastest-growing fintech companies in Latin America, with over 40 million customers across Brazil, Mexico, and Colombia. The company’s success has been driven by its focus on providing affordable and accessible financial services, as well as its strong customer service and user experience.

In addition to its core banking services, Nubank also offers other financial products, including insurance and investment options.

- Chime –

Chime offers no-fee banking services, including checking and savings accounts, as well as a debit card and mobile app for managing finances. The company has gained popularity for its user-friendly interface, early direct deposit feature, and various other benefits, such as automatic savings tools and overdraft protection. Chime has become one of the fastest-growing digital banks in the United States, with over 12 million accounts and counting.

- TransferWise –

TransferWise is a UK-based financial technology company that provides an online money transfer service. The company was founded in 2011 by Estonian entrepreneurs Kristo Käärmann and Taavet Hinrikus, and has since expanded to serve customers in over 70 countries around the world.

TransferWise uses a peer-to-peer system to facilitate international money transfers, which allows users to exchange currencies with each other at the mid-market exchange rate, without the markup typically added by traditional banks. This often results in lower fees and better exchange rates for users.

In addition to its money transfer service, TransferWise also offers a multi-currency account that allows customers to hold and manage money in multiple currencies, as well as a debit card that can be used for transactions in multiple countries without incurring foreign transaction fees.

- Wealthfront –

Wealthfront is a US-based financial technology company that offers automated investment management and financial planning services. The company was founded in 2008 by Andy Rachleff and Dan Carroll, and has since grown to become one of the leading robo-advisors in the United States.

Wealthfront’s investment management service uses algorithms and machine learning to automatically create and manage a diversified investment portfolio for its clients. The company offers a range of investment options, including ETFs, individual stocks, and mutual funds, and charges a flat fee based on the size of the account.

In addition to its investment management services, Wealthfront also offers a range of financial planning tools and resources, including retirement planning, tax optimization, and college savings planning.

- SoFi –

SoFi (Social Finance) is a US-based financial technology company that provides a range of financial products and services, including loans, investment management, and banking. The company was founded in 2011 by Mike Cagney, Dan Macklin, James Finnigan, and Ian Brady, with the aim of providing affordable and accessible financial services to consumers.

SoFi’s lending products include student loan refinancing, personal loans, home loans, and more recently, student loan origination. The company’s investment management arm offers automated and active investment management services, as well as a robo-advisor platform for self-directed investors.

In addition to its lending and investment management services, SoFi also offers a range of banking products, including checking and savings accounts, debit cards, and cash management tools.

- Zopa –

Zopa is a UK-based financial technology company that provides peer-to-peer lending and other personal finance products. The company was founded in 2005 by Giles Andrews, Richard Duvall, David Nicholson, James Alexander, and Tim Parlett, and was one of the first peer-to-peer lending platforms to be established in the UK.

Zopa’s peer-to-peer lending platform allows individual investors to lend money directly to borrowers, who are typically seeking loans for personal reasons such as home improvement, debt consolidation, or car purchases. Zopa uses algorithms and data analysis to assess credit risk and determine interest rates for both borrowers and lenders.

Zopa’s peer-to-peer lending platform allows individual investors to lend money directly to borrowers, who are typically seeking loans for personal reasons such as home improvement, debt consolidation, or car purchases. Zopa uses algorithms and data analysis to assess credit risk and determine interest rates for both borrowers and lenders.

In addition to its lending services, Zopa also offers a range of other financial products, including savings accounts and a credit card. The company has gained popularity for its transparent fees, competitive interest rates, and user-friendly digital platforms.