Top 10 Unicorns In Colombia

Top 10 Unicorns In Colombia

Unicorns: Multiple government initiatives have created a thriving market that attracts significant international investment in Colombia’s startup ecosystem, one of the fastest-growing in Latin America. After a turbulent past that slowed early growth, Colombia is now one of the most exciting markets for startups in Latin America, particularly those with a technological focus.

With 50 million people and a GDP of $330 billion, Colombia is the fourth-largest country. 12% of Latin American investments went to Colombia in 2018, which is still relatively new compared to Brazil and Mexico. They can find most of Colombia’s 346 startup companies in Bogota, Cali, and Medell*n.

As technology has developed in Colombia, internet penetration reached 65% in 2018, and mobile penetration currently stands at 64%. There are also the 4th most internet users in Latin America within Colombia, which has led to the rise of mobile startups like Rappi and MUY.

Government programs that support startup growth in Colombia include INNPulsa, an organization that promotes investment and business development and Invest Pacific, which attracts businesses to Cali and Colombia’s Pacific Coast. Science and technology startups are also targeted in initiatives such as Apps.co and the Ministry of Science, Technology, and Innovation, created in 2016. Startups in Medellin also receive funding and mentoring from the government accelerator RutaN.

Approximately 38 seed, venture capital, and private equity funds are available to startups in Colombia and accelerator programs for startups and small businesses, including HubBog in Bogota. Other accelerator programs are Creatic, Macondolab, ParqueSoft, and Corporacion Ventures. In addition, several Colombian investors are interested in startup companies, including Capitalia Colombia, Impulsum Ventures, Polymath Ventures, Condor, and InQlab, and international investors, including Monashees, GE32 Capital, Magma Partners, and SoftBank.

Capital of Colombia and center of the nation’s tech innovation, Bogota is Colombia’s biggest startup hub. Located only five hours from the US, Bogota is ideal for promoting cross-border trade and has grown in popularity in recent years. Many other cities in the country are also known for producing innovative startups, including Medelln, Cali, and Barranquilla.

Colombia’s unicorn ecosystem consists of the top ten companies in the world.

- Addi

In February, ADDI, a Colombian fintech startup, announced that it had raised $12.6M from Andreessen Horowitz, with support from Monashees, Village Global, and Sinai VC. These VC firms have provided support since ADDI’s launch.

ADDI works to solve consumer credit’s inaccessibility and unfairness in Colombia.

ADDI’s co-founder and CEO, Santiago Suarez, provided the following context in a recent blog post:

Despite a steady income and no debt, only 14 percent of Colombians have credit cards, noted Suarez.

Strong backing from the merchant community and a strong team will allow ADDI to improve both its affiliate program and its product:

Starting this summer, ADDI will be available for clients to purchase online and in stores, and we will be announcing a few other exciting products,” said Suarez.

Company overview

|

Legal Name |

Addi |

|

Industries |

Finance, Financial Services, FinTech |

|

Founder(s) |

Daniel Vallejo, Elmer Ortega, Santiago Suarez, Santiago Suarez |

|

Founded Date |

2018 |

|

Total Funding Amount |

$96,300,000 |

|

Investors |

Number of investors: 17 |

- LAIKA

LAIKA, a Latino startup, has two tails at the moment. Over the past months, it’s been growing its platform for pet products and services, and it has received the necessary investments to keep it going.

According to Camilo Sanchez, the startup’s co-founder and CEO, LAIKA has closed its seed round for $5 million.

Some Colombian companies also participated and InQLab, Soma Capital, and Palm Drive Capital.

Also involved were Justin Mateen (founder of Tinder) and the Kan brothers, Justin and Daniel, who raised the round as angel investors.

In addition to expanding the business in Mexico, the funds will also be used to grow in Colombia.

Recent times have seen investors flock to startups that offer products for our pets.

A week ago, Zee.Dog secured US$18.8 million, and in April, Petlove closed US$48 million. Both platforms are based in Brazil. Laika is the first Spanish-speaking company to get investors on board.

Laika was created by entrepreneurs Camilo and Manuela Sánchez, along with Tulio Jiménez, and was released in April 2018. Several milestones have been achieved since then.

Y Combinator’s Summer 2019 Batch and this current seed round are not all LAIKA’s notable achievements. Last year, the company sold over US$10 million in Colombia and doubled its growth monthly.

Also, last May, LAIKA launched in Mexico, and the company’s CEO says it has been well received.

In addition to its size, Mexico City has a lot of people who are passionate about pets and are seeking solutions that will help them raise such animals, said Camilo Sánchez.

“This has made us very delighted since (…) of the three markets it serves, the debut of LAIKA in Mexico City has had the quickest traction.”

This explains why the majority of its seed investment (US$3 million) is designated for its operations in Mexico.

LAIKA also wants to construct a second distribution facility in the capital and launch into Guadalajara or Monterrey early next year to streamline the delivery process. As a result, LAIKA will be functioning in both cities by 2021.

LAIKA will soon open a series A in Santiago (Chile).

Colombia’s startup is not a marketplace per se. In addition to providing goods and services to pet owners in Mexico City, Bogotá, Medellin, and soon, Cali, it also offers a logistics service.

LAIKA is unique in two ways, Sánchez explained to the press.

The experts, he says, know what they’re doing:

We strive to be experts in every category of pet care. There’s nothing that could match that, not even Mercado Libre. There are more pet owners should expect. A professional ally, who can assist them in caring for their pet better, is needed,” said the Executive.

Their free veterinary care hotline is one way they accomplish this.

A second advantage the startup has over the supply chain is that it has full control of the process.

This makes it easier to manage operations and improve customer satisfaction. Because, as anyone who has ever had a sick pet can attest, timely responses are critical in those stressful situations.

However, LAIKA strives to go the “extra mile” in other ways for its last-mile delivery.

“We don’t want to focus solely on the premium pet market,” the company’s CEO stated. “We also want to reach out to less privileged individuals and provide them with a simple and straightforward answer.”

It’s also partnered with networks like Rappi to make itself more prominent and accessible to pet owners.

In addition to providing food and goods for your pets, LAIKA aims to connect owners with nearly any service their pets may want.

Users in Colombia may locate dog walkers, veterinarians, trainers, photographers, and pet-friendly restaurants.

This startup stands out from the competition because of its meticulous attention to detail. Overall, LAIKA’s early investors are barking up the correct tree.

Company overview

|

Legal Name |

LAIKA |

|

Industries |

Consumer Goods, E-Commerce, Pet, Retail |

|

Founder(s) |

Camilo Sanchez, Manuela Sanchez Villamarin |

|

Founded Date |

2017 |

|

Total Funding Amount |

$17,000,000 |

|

Investors |

11 Number of investors |

- Rappi

It made headlines when it became the first Latin American investment for Andreesen Horowitz by becoming Rappi, a Colombian delivery startup. Rappi raised a second US$200 million round today that added the startup to Latin America’s list of unicorns, as reported by Axios and TechCrunch.

With affordable, flexible, and quick delivery of virtually anything, Rappi has grown quickly. In Latin America, Rappi is rumored to be competing with Uber Eats with this investment.

Prior investors Andreesen Horowitz and Sequoia Capital took part in the round, which DST Global led. Rappi is only the second Latin American startup to achieve unicorn status in 2018, following DST Global, which invested in Nubank in February for a US$1B valuation.

Company overview

|

Legal Name |

Rappi |

|

Industries |

Consumer Goods, E-Commerce, Food Delivery |

|

Founder(s) |

Felipe Villamarin, Sebastian Mejia, Simon Borrero |

|

Founded Date |

2015 |

|

Total Funding Amount |

$1,692,005,447 |

|

Investors |

38 Number of investors |

- Ubits

As part of its preparations to launch into Spain, Ubits has secured a $25M Series B funding round. In addition to Riverwood Capital, Roble Ventures, Endeavor Catalyst, and Owl Ventures were also involved in the round.

This platform helps clients improve their professional skills through various online classes. In addition to serving 300 companies, the platform helps enhance employee skills and train staff.

The company will next expand into Spain.

“Spain is a vital market for us.” “We aim to launch there and triple revenues and strengthen our presence in Central America,” said Julián Meló, co-founder and CEO.

Ubits is currently a B2B platform that works with large corporations around Latin America. Meló, on the other hand, indicated that the company was investigating a B2C model to help it scale and attract more clients.

Ubits started the year on the right foot. The corporate training startup, founded in 2019 by Marta Forero and Julián Melo, raised $25m in a Series B investment led by the Riverwood Capital fund. With that money, the next stop is Spain.

“Spain is a market of interest. We want to get there to at least triple sales and consolidate our presence in Central America and the Latin countries where we operate, Mexico, Colombia, Peru, and Chile,” details Julián Melo, co-founder, and CEO. of Ubits.

Other investors in the Series B round included Roble Ventures, Endeavor Catalyst, and Owl Ventures, the EdTech fund that previously invested in startups like Masterclass, Degreed, and Byju’s.

With this capital, Ubits also plans to double its workforce, which is currently made up of 268 people, and strengthen its platform technology with machine learning and artificial intelligence experiences to assign and recommend content based on each student’s profile and professional interests.

According to Melo, the startup said goodbye to 2021 with a 250% increase in its annual turnover compared to 2020 and with a portfolio of 300 companies, including Adecco, Alsea, Grupo Bal, Grupo Uifin, Linio, Mercado Free, Sodexo, and Vinoteca.

“Ubits has developed a disruptive employee-centric corporate learning platform with an attractive Spanish-language offering that includes content for employees to advance their career path and grow with their companies while improving retention, productivity, and results. Companies,” said Francisco Álvarez Demalde, co-founder and managing partner of Riverwood Capital, who will serve on the startup’s Board of Directors.

As we see companies across all sectors and countries in Latin America continue to undergo digital transformation and increasingly take training and career development seriously, we are excited to partner with them throughout this important time of growth.”

The growth of online education does not stop. According to the research company Research and Markets, the e-learning sector will reach a value of 325,000 million dollars in 2025. However, for Melo, the majority is focused on the end-user in the educational platform market. And although in recent months, some players have begun to bet on the B2B ( business to business ) segment, its structure is not one hundred percent designed to meet the demands of companies.

“We were born with the idea of developing talent within companies. So we have content that takes someone from being an intern to a director. But on the other hand, the business model is designed so that workers apply what they have learned in practical cases. And finally, they receive certification, since we have alliances with universities and technology companies, such as Stanford University and Coursera”, explains the manager.

Ubits does not offer individual courses or courses for freelancers. But Melo considers this to be a competitive advantage in the market since its objective is to maintain the essence of its business model and position itself as a platform that only provides corporate training solutions.

“By focusing on a business and customer model, you can scale at a much faster rate. In addition, the companies we focus on have thousands of employees, allowing us to grow in thousands and not as a unit. We have also been able to move more easily between regions. In Mexico, for example, we started working with Alsea, and then expanded to Colombia, Chile, and the rest of the countries where this company operates”, explains the co-founder.

Melo knows that companies will always have to train their staff to be at the forefront. That is why Ubits has contracts of one to three years, representing stability for the startup. “On an individual basis, it’s harder to be profitable in the long run,” he says.

This year, Ubits projects to have more than 1,000 corporate clients and one million active students. However, the CEO recognizes that to be more competitive, he needs to expand his educational offer, so they will use part of the investment obtained in the Series B round to create 2,000 courses and the 700 he already has.

The objective, he says, is to strengthen the portfolio with courses on emerging technologies and management, from user experience, digital skills, data science, machine learning, and blockchain, to the digital market and feedback from leaders.

Company overview

|

Legal Name |

Ubits |

|

Industries |

Corporate Training, Education, Human Resources, E-Learning, EdTech |

|

Founder(s) |

Julián Melo, Marta Helena Forero Sepúlveda |

|

Founded Date |

2013 |

|

Total Funding Amount |

$7,450,000 |

|

Investors |

11 Number of investors |

- La Haus

The company is transforming Latin American real estate by offering buyers and sellers an end-to-end marketplace that addresses the many issues that Latin Americans face. For example, many people in Latin America can now become homeowners due to the company’s affordable services, where access to information and infrastructure can be limiting factors. Since its launch in 2017, Lahaus has operated property search portals in Colombia and Mexico — innovative websites that ensure high-quality de-duplicated listings and a brokerage that facilitates more than $400 million in gross transactions every year.

A Medellin, Colombia-based company, La Haus has offices in Medellin, Bogota, and Mexico City.

La Haus, the major player in the Mexican and Colombian proptech market that is transforming the real estate sector in those countries, announced today it had raised $35 million from Greenspring Partners in Series B. In addition to expanding its product offering and geographic reach in other parts of Latin America, the new funding will enable the company to expand its product and service offerings.

In early 2020, the company raised $10M in Series A funding.

La Haus enables the entire real estate transaction process to be transacted online and builds an end-to-end, first-of-its-kind marketplace for Latin America. Many people in Latin America who lack access to infrastructure and transparent information can’t purchase homes because of the company, which increases homeownership accessibility. La Haus facilitates the annualized gross transaction value of over $500 million.

It is the most popular proptech company in Mexico and Colombia, having facilitated almost 4,000 transactions.

“No one could have imagined a year ago what the pandemic would do to the housing market in Latin America. But we’re thankful that the company we built pre-Covid was in a position to help so many people as they searched for and bought their perfect homes,” said Rodrigo Sánchez-R*os, La Haus co-founder and president. “Housing has an important role in creating wealth and stability. Unfortunately, until now, most Mexicans and Colombians have been unable to afford it. We’re glad to be utilizing the funding that this investment brings to Latin America.”

During the Covid saga, La Haus was well-positioned to provide Latin Americans with online housing options and assist the sellers and developers with the sale of these homes. Its revenue and efficiency are increasing while it experiences double-digit month-over-month growth in a booming housing market. The company has grown its business in Mexico fivefold in the last 12 months, and its Mexico City brokerage facilitates more transactions than any other in the country.

A management team with scaling experience has been hired at La Haus in the past year. Thomas Floracks, the co-founder of VivaReal, one of the leading real estate portals in Brazil, is among the company’s leaders. OLX Brazil purchased VivaReal for US $650 million after merging with Zap Imoveis. Floracks has transformed La Haus into a Latam leader in product experiences for people searching for, viewing, and transacting properties.

Seyonne Kang, Partner at Greenspring Associates, says an incredibly high growth opportunity in proptech firms in Latin America, a region with over 600 million people and a relatively low but rising homeownership rate. Despite facing fewer competitors, La Haus serves a vast and growing market that is just starting to adopt online transactions. Their long track record and vision have made them a leader in this space, having scaled globally across two countries. We are joyful to be a part of La Haus’ growth.”

La Haus has also formed strategic alliances with major developers in Mexico and Colombia, including GDC Desarrollos, CLASS, Punto Destino, Yukon, and Terraforma. As a result, developers have taken advantage of La Haus’ audience and transaction technologies to bring a previously showroom- and staff-driven sales process online, reducing sales time.

Jerónimo Uribe, CEO, Rodrigo Sánchez-Ros, president, Tomás Uribe, director, and Santiago Garcia, CTO formed La Haus. Before La Haus, Jerónimo Uribe and Sánchez-Ros met at Stanford University and co-founded and led Jaguar Capital, a Colombian real estate development firm with over $350 million in retail and residential developments. Garcia formerly worked at Jaguar Capital, where he established technology platforms.

Company overview

|

Legal Name |

La Haus |

|

Industries |

Information Technology, Residential, Marketplace, Real Estate, |

|

Founder(s) |

Jeronimo Uribe, Rodrigo Sánchez-Ríos, Rodrigo Sanchez-Rios, Santiago García, Tomás Uribe |

|

Founded Date |

2017 |

|

Total Funding Amount |

$58,174,998 |

|

Investors |

12 Number of investors |

- Liftit

Liftit , a B2B platform to optimize cargo delivery in the last mile in LatAm, has closed a Series A round worth 14.3 million dollars. IFC, Monashees, as round leaders, Jaguar Ventures, Mercado Libre Fund, NXTP, and other industry investors have participated in the operation.

“This is one of the most relevant investments that have been made in Latin America. We are proud to have IFC (The World Bank and the most important financial organization globally. Also with Monashees, the most important investment fund in Brazil), as our leading investors”, commented Felipe Betancourt CSO and co-founder.

“We are glad to have this investment in the stage that Liftit is going through. It motivates us to accelerate further our expansion process with which we will reach all of Latin America”, added Ángel Celis, co-founder of the company.

Through the Liftit platform, companies connect with a network of drivers who own different types of cargo vehicles, which allows them to manage any delivery in the last mile with real-time visibility and traceability of key metrics.

By automating and optimizing delivery processes, companies achieve a noticeable reduction in operating costs by automating and optimizing delivery processes, with average savings of up to 25%.

On the other hand, Liftit positively impacts its network of hundreds of drivers. In addition, the platform allows you to decrease your downtime and increase your revenue by 20%-30% after joining the platform.

With key clients such as Bimbo, Homecenter, and Walmart, Liftit is already the market leader in Colombia and has operations in Mexico, Brazil, Chile, and Ecuador. As of this investment round, the company plans to accelerate and deepen its regional expansion plans.

Company overview

|

Legal Name |

Liftit |

|

Industries |

Freight Service, Logistics, Internet, Last Mile Transportation, Marketplace, Transportation, Supply Chain Management |

|

Founder(s) |

Angel Celis Botto, Felipe Betancourt Celis, Brian York |

|

Founded Date |

2017 |

|

Total Funding Amount |

$39,000,000 |

|

Investors |

27 Number of investors |

- Chiper

VC firm Nosara Capital and the US investing giant Tiger Global have invested $53 million in Chilean startup Chiper.

It has developed a platform that makes inventory management, supply chain organization, and procurement dramatically more efficient and allows store owners to take their inventories online.

The Latin American convenience store industry generates around $330 billion in annual revenues despite remaining largely manual.

Chiper CEO Jose Bonilla told Insider that obtaining funding during this pandemic has been incredibly difficult.

Despite the systemic issues our economies, governments, and societies have faced, demand has not decreased. People all need to buy food and essentials. This situation has bared the weak points every business has. Fortunately for us, Chiper is an important business for consumers.

As a result of this funding, the company will be able to expand its network to 100,000 “mom-and-pop” corner stores in Brazil by 2022, the country with the largest population in the region.

Chiper wants to make this change by leveraging its platform to bulk order so retailers can save money by using digital channels to procure goods and groceries.

$25 million in funding was raised before this round of funding from family and friends and a $13 million Series A round led by Monashees, WIND Ventures, and Kaszek Ventures.

Company overview

|

Legal Name |

Chiper |

|

Industries |

B2B, E-Commerce, Retail Technology |

|

Founder(s) |

Carolina Garcia, Jose Jair Bonilla, Oscar Sarria Guerrero |

|

Founded Date |

2018 |

|

Total Funding Amount |

$25,000,000 |

|

Investors |

10 Number of investors |

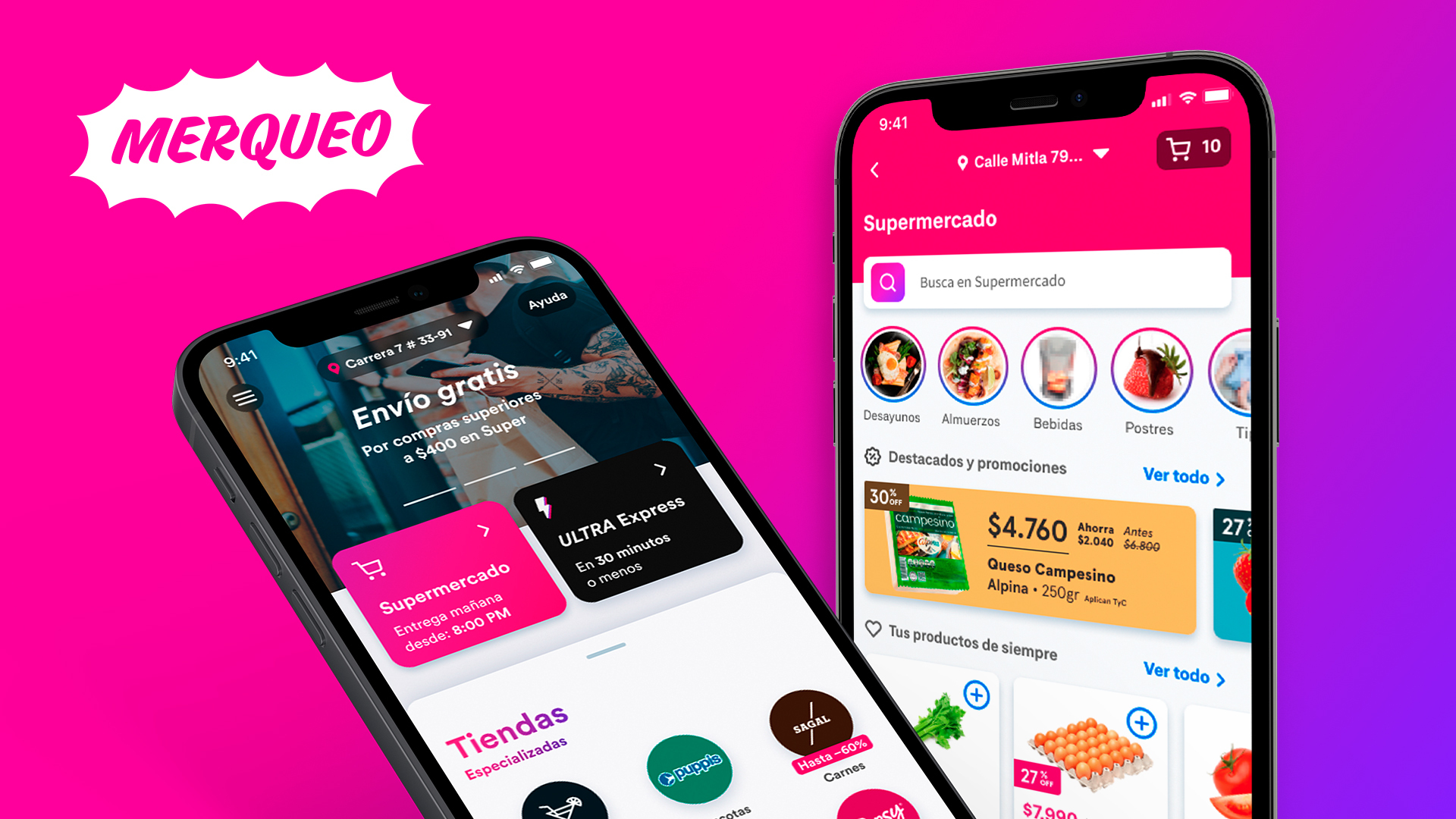

- Merqueo

Merqueo, an enterprise delivery company based in Mexico City, has raised $50m in series C funding.

Lead investors were IDC Ventures, Digital Bridge, and IDB Invest, supported by MGM Innova Group, Celtic House Venture Partners, Palm Drive Capital, and previous investors.

After launching its operations in Brazil this month, the company plans to use this capital to grow in Latin America, hire international talent, and scale its operations across Mexico.

With the help of its proprietary technology, Merqueo is a full-stack grocery delivery company owned by Miguel Mc Allister that controls the entire vertical supply chain. Besides fresh fruits and vegetables, the company carries imported goods, liquor, household items, and personal care items. We are currently operating in Mexico, Colombia, and Brazil.

A pioneer in the Latin American food delivery market, McAllister also founded Domicilios.com in 2001, a company that Delivery Hero purchased in 2017.

IDC Ventures, Digital Bridge, and IDB Invest led a $ 50 million Series C round of funding for Colombia’s scaleup Merqueo, the first digital megamarket in Latin America. In addition, it was announced by MGM Innova Group, Celtic House Venture Partners, Palm Drive Capital and previous shareholders that MGM Innova Group and Celtic House Venture Partners participated in the investment round.

Disintermediation and internal technology are key elements of Merqueo’s disintermediation model, allowing for reduced logistics costs, controlled customer experience, and accessibility to a larger number of people who are unwilling or unable to pay high fees. Your commission rate or delivery fees on your products.

These funds will expand the company’s dark store network into one of the largest and most ambitious in Latin America. It has also recently announced that it would expand its team across Mexico and began operations in Brazil just a few days ago. Latin America alone offers a market worth $ 700 billion.

Merqueo focuses on creating a platform with a high level of scalability to deliver high-quality service at a competitive price. The Colombian scaleup sought funding after testing its model, says Miguel Mc Allister, CEO, and founder.

Company overview

|

Legal Name |

Merqueo |

|

Industries |

Delivery, E-Commerce, Food and Beverage, Grocery |

|

Founder(s) |

Jose Guillermo Calderon, Miguel Mc Allister, Miguel Mc Allister, Sebastian Noguera Escallón |

|

Founded Date |

2017 |

|

Total Funding Amount |

$16,000,000 |

|

Investors |

5 Number of investors |

- RobinFood

A food technology company called RobinFood has raised a debt investment of $16 million from the MGM Sustainable Energy Fund II LLC to accelerate its growth in Latin America.

Following earlier investments from ALLVP and Seaya Ventures, RobinFood has raised $36 million in total funding.

Previously known as Muy, the Colombian firm rebranded as RobinFood in early 2016. It will combine both its virtual and physical restaurant operations under the same brand to establish itself as the leading cloud-serving company in the region.

The company has grown rapidly in the past year, having opened 50 cloud restaurants and eight brands in Mexico, Colombia, and Brazil. In addition, multiple RobinFood brands offer customers delivery of meals, including Muy, El Original, Just Burgers, and The Cut.

Within five years, RobinFood plans to add another 3,500 brand locations to its network in Latin America and accelerate its growth across Colombia, Mexico, and Brazil.

This investment will spread over many phases, including a lease for energy-efficient equipment. Up to $16 million may be invested in the first installment, which is $5 million.

According to the company, its delivery sales increased fivefold from February to September. Founder and CEO of RobinFood, José Guillermo Calderón, said, “We are proud to have the RobinFooders team create this industry-changing company.”.

Our goal is to provide good food at affordable prices to all Latin Americans while developing the region with employment and technological advancements.

MSEF II is energy efficiency and clean energy fund managed by MGM Innova Capital, which benefits several countries in Latin America and the Caribbean.

MGM Innova Capital investment director Alejandro Paz says, “We became interested in RobinFood because it includes efficient energy sources in its operations while also having positive and tangible effects on the environment, food supply, and social aspects.

Despite being classified as an inclusive business in all aspects of its operation, RobinFood is committed to providing high-quality food and service.

Additionally, we are optimistic about the company’s accelerated expansion in the region and its innovative model that seeks to effect significant changes within the conventional foodservice industry.”

Company overview

|

Legal Name |

RobinFood |

|

Industries |

Food and Beverage, Restaurants, Food Delivery, Retail Technology |

|

Founder(s) |

Jose Guillermo Calderon, Miguel Mc Allister |

|

Founded Date |

2018 |

|

Total Funding Amount |

$36,300,000 |

|

Investors |

4 Number of investors |

- Frubana

Fabian Gómez Gutiérrez has expertise in Colombia’s food chain and supply chain management from field to table. Rappi’s former expansion leader is the son of a mango, lime, and papaya farmer who runs Rappi’s LatAm operation. He noticed a pricing dynamic while working with Rappi. When he realized that his father was receiving 30 cents for the same amount, he wondered why restaurants on Rappi were buying limes for $1 a kilogram.

He realized that neither growers nor restaurants – of which 87% are independently owned in this region – were being treated fairly because of multiple middlemen in the supply chain.

Gutiérrez believed there must be a way to decrease the distance between restaurants and producers, resulting in better costs for all parties. Still, it wasn’t as simple as putting the procedure online. The previous system relied heavily on offline transactions, with restaurants obtaining their items from various local marketplaces that included merchants selling products from a variety of small-scale farmers.

“We tried to design an app for farmers to use, and it was a big failure,” Gutiérrez tells Forbes. He then realized he could interact with them using WhatsApp, as many were already users.

After the growers were in the system, he established Frubana, a B2B marketplace for restaurants and merchants to buy directly from farmers and manufacturers. After continuing to expand during Covid-19, the firm is currently raising a $65 million Series B round.

In addition to Lightspeed Venture Partners, former investors such as SoftBank, Tiger Global Management, and Monashees joined the round led by Hans Tung of GGV Capital. As a longtime investor in the company, Tung notes that Gutiérrez immediately reminded him of Southeast Asia’s Grab, founded by Anthony Tan.

Additionally, Tung points out that the company still has a long way to go. Tung says Rubbana’s purpose is to ensure restaurants get products and food as efficiently as possible. “What’s interesting about this is that the items they supply to restaurants might include more than food over time.

I look forward to seeing what happens with Frubana.”

Restaurants were struck hard by Covid-19 last year, and Frubana was coming off a year of 15x growth. Rather than cutting back, Gutiérrez claims that his organization created a vision for where it wanted to be in 2030 and devised a strategy to get there. To help get more restaurants on the platform and expand Frubana’s inventory, the business grew the number of its technical team rather than cutting its personnel, as many restaurant software startups have done.

Fruits and vegetables accounted for 90% of the company’s goods when it first debuted, but it expanded into other categories last year to become a more one-stop shop. As a result, Frubana doubled its restaurant count and tripled its revenue.

Gutiérrez says restaurants have come to rely on e-commerce and delivery platforms at home. Upon their return, they were already accustomed to using electronic devices. That made it easier for us.”

The firm also contributes to a more sustainable supply chain by hiring a fleet of gig economy truck drivers who pick up orders in bulk, reducing the pollution generated by vendors hauling their items to marketplaces separately. The firm is now active in Mexico City, Bogotá, and So Paulo, with plans to soon expand to more Latin American cities.

According to Gutiérrez, the company begins by examining the most popular products in each new region, focusing on those products, and gradually introducing others as they acquire popularity. Then, in the same way that Square Money has helped retailers, the business aims to be able to provide working capital to its restaurant customers. They are currently piloting the program and hope to be able to roll it out more by the end of the year.

Tung says of the food supply chain category in Latin America, “Frubana has done the best and gone the furthest.” “When new players from Europe or Asia come to the region, they ask Frubana if there are any opportunities to collaborate.” We admire their efficiency and believe they have a bright future ahead.”

Company overview

|

Legal Name |

Frubana |

|

Industries |

AgTech, B2B, E-Commerce, Logistics, Restaurants |

|

Founder(s) |

Fabian Gomez Gutierrez |

|

Founded Date |

2018 |

|

Total Funding Amount |

$102,000,000 |

|

Investors |

10 Number of investors |