Top 10 Most Promising and Scalable Startups in Mumbai 2022

Top 10 Most Promising and Scalable Startups in Mumbai 2022

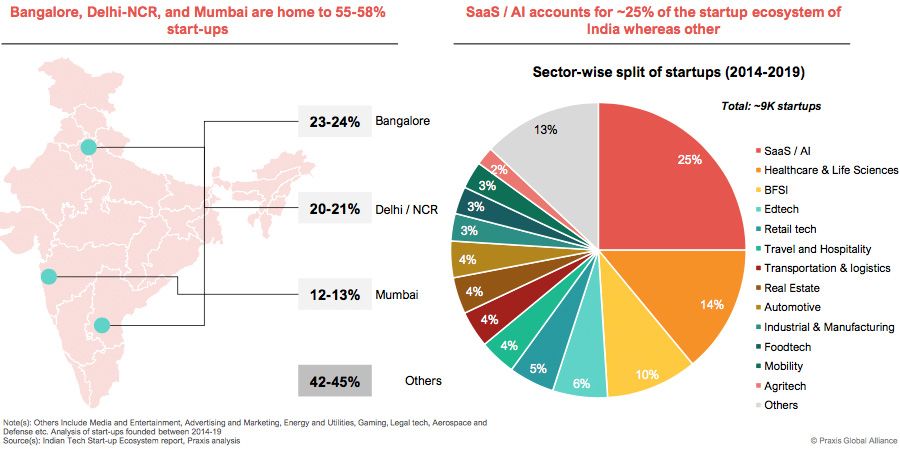

Mumbai has long been India’s financial capital city. The city of Mumbai was already experiencing a startup boom before Prime Minister Narendra Modi’s ‘Make in India’ campaign was launched, with many innovative entrepreneurs establishing their presence in the marketplace here. India receives $5.2 billion in GDP from the seaside city every year. After Bengaluru and Delhi-NCR, it has become India’s third-largest startup hub in the last decade.

Mumbai boasts over 9,000 active startups with eCommerce, fintech, and information technology being the most popular areas and has developed into a major B2B ecosystem. The city’s startup culture is fueled by a state government that is pro-startup, along with a strong financial ecosystem, and a large population. It has established a strong community of investors that favours startups. Mumbai’s large demographic also serves as a strong customer market for businesses, especially in the business-to-consumer sector.

It has witnessed impressive growth since 2017, with the number of startups in the city more than doubling from 4,582, thanks to the Maharashtra government’s innovation-friendly policies, which have helped Mumbai to achieve this success

In the first half of 2019, the third-largest startup in India, Mumbai accounted for roughly 19% of all activities related to startups. The companies raised $726 million through 121 agreements between January and September. The total value of all of the city’s startups was projected to be $12 billion. As a result of Mumbai’s strong financial and entrepreneurial ecosystems, it is considered to be the perfect location for startups.

These are the Most Promising and Scalable Startups in Mumbai.

1. Skillmatics

Legal Name- Grasper Global Pvt. Ltd.

Sector- Pre-school Education, Consumer Goods

Products & Services- Online Educational Games

Founders- Dhvanil Sheth, Camille Sheth and Chetanya Kejriwal

Date Of Starting- 2016

Geographical Range- Global

Number of Investors- 11

Key Investors- Sequoia Capital India, Redwood Trust and Surge

Funding Rounds- 3

Total Funding Amount- $ 10.8 Million

Valuation- $ 39.1 Million

Skillmatics is a full-stack direct-to-consumer Mumbai-based startup that creates cutting-edge educational goods and activities that help children enhance basic skills through learning games. Skillmatics was founded with a clear mission to create new products and fun activities for kids that help them in acquiring fundamental skills and reinforce critical learning ideas all while enjoying the activities. Union Minister Nitin Gadkari named Skillmatics the Most Innovative Indian MSME, and Amazon named it the Global SMB of the Year in 2021.

The startup’s team of educationalists and child experts have developed a wide selection of goods filled with new content and highly engaging exercises and activities, all meant to be age-appropriate, skill-driven, and infinitely engaging for young students. Activity boxes and educational games are available on this platform. It includes skill-building, preschool activities, alphabet games, interactive storytelling, and more. It offers games in various subjects, such as math, connectors, and so on. Users can search for products based on age, rating, price, popularity, and other factors.

Skillmatics is developing a cutting-edge business model to disrupt a $100 billion global market. The startup sells directly to customers all around the world, taking advantage of India’s structural benefits in manufacturing, product design, technology, and content development. Its vertical supply chain management and a data-driven approach to product development allows it to iterate, launch, and scale new goods 5X faster than its competitors.

Skillmatics has sold 3 million devices around the world to date, mostly in the North American market, through multiple e-commerce marketplaces and a web of 15,000+ worldwide retail locations (including Walmart and Target). On Amazon USA, Skillmatics’ best-selling product recently rose to the top of the Toy & Game category. Skillmatics has raised $8 million in funding from a group of high-profile investors led by Sequoia Capital.

2. InCred Finance

Legal Name- InCred Financial Services Pvt. Ltd.

Sector- Financial Technology, Finance

Products & Services- Consumer Lending and Financial Services

Founder- Bhupinder Singh

Date Of Starting- 2016

Geographical Range- India

Number of Investors- 17

Key Investors- FMO, Kotak Mahindra Bank, Franklin Templeton India and Investcorp

Funding Rounds- 8

Total Funding Amount- $ 254.4 Million

Valuation- $ 307 Million

InCred Finance is a Fintech and financial service startup that makes lending simple and rapid by combining technology and data science. Incred Finance is an Indian NBFC (Non-Banking Financial Company). The startup has a wide coverage of financial services that include low-cost home loans, personal loans, student loans, and SME company loans.

The startup has its headquarters in Mumbai, Maharashtra. It was formed by Bhupinder Singh, the former chief of Deutsche Bank’s Corporate Finance section. Anshu Jain, the former Co-CEO of Deutsche Bank, has joined the company’s Advisory Board. M D Mallya is one of the board’s other members (former Chairman, Bank of Baroda). Consumer loans, including personal loans, education loans, and small business loans, are the startup’s main focus.

The startup makes lending quick, easy, and painless by combining technology and data science. Consumer and commercial loans are available through an online portal. Customers can choose from a variety of financial options, including personal loans, education loans, SME loans, automotive loans, and more. The amount to be loaned is determined by a variety of factors, including the rate of interest, credit scores, terms of the amount, and more. Credit/debit cards, bank transfers, and wallets are options available to repay the sum.

Ranjan Pai (MD & CEO, Manipal Group), Gaurav Dalmia (Founder & Chairman, Landmark Holdings), IDFC PE, and Alpha Capital provided the first round of funding of 500–600 crore to Incred Finance. In 2015, the startup acquired the FinTech platform InstaPaisa.com. In March 2017, an investment of Rs. 25 crores in the startup was done by Paragon Partners. The company got a debt fundraising round of 500 crores from public sector banks and other financial institutions in 2020.

3. MyGlamm

Legal Name- Sanghvi Beauty and Technologies Pvt. Ltd.

Sector- Beauty & Cosmetics, Marketplace

Products & Services- Cosmetics, Skincare, Haircare and Beauty Products

Founders- Priyanka Gill, Darpan Sanghvi

Date Of Starting- 2015

Geographical Range- Global

Number of Investors- 19

Key Investors- Ascent Capital, Stride Ventures, Alteria Capital and Bessemer Venture Partners

Funding Rounds– 12

Total Funding Amount- $ 311.9 Million

Valuation- $ 1.2 Billion

MyGlamm is a direct-to-consumer beauty startup that markets international spa and salon products through an online marketplace. MyGlamm is based in Mumbai, Maharashtra, and was formed in 2015. The startup is one of the first in India to have had success with combining content and commerce to increase its market demand. MyGlamm believes in forming a community with its consumers, connecting with them, and ultimately co-creating products with them. Supported by a community of over 220,000 influencers, it aids buyers in spotting new commodities and encouraging engagement.

Through its App, MyGlamm combines technology, content, and social media to allow customers to build a valuable, personalised, content- and tutorial-rich post-purchase experience in addition to discovering new products. With 60 million monthly active users and 100 million monthly video views, MyGlamm bought POPxo in July 2020, becoming India’s largest Content to Community to Commerce platform. MyGlamm provides around 800 SKUs in skincare, and personal care, providing innovative, rich, feel-good formulas that are cruelty-free, promote Clean Beauty, and contain skin-friendly ingredients.

MyGlamm is the quickest-growing direct-to-consumer beauty brand in India. MyGlamm has approximately 20,000 physical locations in almost 100 cities in India. With products including SUPERFOODS, Treat Love Care, Wipe Out, GLOW, YOUTHFUL, and K. Play, the startup has grown into personal care categories like hair care, skincare, and bath & body, along with new beauty niches, to establish a broader branded house. L’Occitane, Bessemer Venture Partners, along with Accel, global e-commerce behemoth Amazon, are its major investors.

The parent company of the startup MyGlamm, the Good Glamm Group, is the latest Indian startup to join the unicorn club. In the beauty and personal care industries, MyGlamm’s parent company is a house of brands. Most of its products are sold through its website, app, and over 30,000 retail locations. Good Glamm Group has a present annualised revenue of 740 crores, according to Darpan Sanghvi, and is predicted to reach Rs 1800 crores by March 2022.

4. CarTrade

Legal Name- MXC Solutions India Pvt. Ltd.

Sector- Automotive, E-commerce, Marketplace

Products & Services- CarTrade Exchange, AutoBiz Services

Founders- Rajan Mehra and Vinay Sanghi

Date Of Starting- 2009

Geographical Range- India

Number of Investors- 9

Key Investors- March Capital, Canaan Partners and IIFL Finance

Funding Rounds- 8

Total Funding Amount- $ 328 Million

Valuation- $ 954 Million

Mumbai-based CarTrade is an app-based pre-owned car listing startup. Customers can buy, list, and sell their automobiles on the platform or through auctions, and the classifieds portal provides them with a detailed report on the automobiles state listed on the site. Users can use filters including city, brand, car type, cost and more. Road prices, upcoming models, cumulative EMI, and recommendations are given to users as well. The CarTrade app is compatible with both iOS and Android devices.

CarTrade is a business-to-business (B2B) and business-to-consumer (B2C) transaction platform. CarTrade.com, a B2C portal where users may purchase and sell new and used automobiles, and CarTradeExchange.com, a B2B dealer portal where dealers can manage their online auctions and sales, are the two parts of the service. Apart from the internet marketplace, it has a physical presence in India, with over 4,000 dealers spread across 80 cities. Over 1,65,000 certified used cars are presently listed on the website.

The startup gives price information, insurance, used car finance, comparisons, on-road prices, certifications and reviews, in addition to car classifieds. The used car certification programme is run jointly by CarTrade engineers and sellers, who check the cars’ state at several levels and provide a complete report on the car as part of the online listing. On the Bikewale webpage, the startup offers services for bikes (new and old).

An online classifieds service, CarWale, was acquired by CarTrade in November 2015. In May 2017, it acquired Adroit Inspection, a vehicle inspection and assessment company. Shriram Group sold CarTrade a 51 per cent ownership in Shriram Automall in January 2018. CarTrade India became India’s largest physical and online car market as a result of this transaction. CarTrade Tech Limited conducted its IPO in August 2021 and was listed on the NSE and BSE.

5. Zepo

Legal Name- Zepo Technologies Pvt. Ltd.

Sector- E-commerce, Consulting and Logistics

Products & Services- Inventory and Order Management, Website Creation Services

Founders- Nitin Purswani and Ashok Purswani

Date Of Starting- 2011

Geographical Range- India

Number of Investors- 8

Key Investors- Lets Venture, Astir Venture and Morpheus Gang

Funding Rounds- 6

Total Funding Amount- $ 1 Million

Valuation- $ 4 Million

Zepo is a Mumbai-based e-commerce startup that provides a DIY e-commerce platform to its clients allowing small businesses to create and manage their online store. It helps in building online websites and provides inventory management, order management, store design, and other services. Zepo was formed in mid-2011 and was incubated by The Morpheus Gang, an Indian business accelerator. The company has headquarters in Mumbai and Bengaluru, and its platform now hosts over 1500 online stores.

The startup assists customers in quickly bringing their businesses online by providing them with the whole package required to run an eCommerce business. Customers get a fully customizable eCommerce website with 100+ themes to select from, a free payment gateway to accept online payments, logistical support to ship the orders, and marketing help to promote the website when they use Zepo. Mumbai-based Zepo is one of India’s most rapidly growing startups, powering more than 2000 online businesses around the country.

In just over three years, Zepo grew from a basement office to a large workforce spread across four locations (Mumbai, Bangalore, Delhi and Noida). Zepo, which is well-funded by several investors, aspires to continue to evolve in a successful corporation. Multiple journals, including The Economic Times, CNBC Awaaz, ET Now, Financial Times, and The Hindustan Times have identified the startup as an industry leader. In 2014, the company received the Express IT award in the Entrepreneurship category.

In mid-2014, Zepo developed ChotuChaiWala.com, a social project that allows Mumbai tea vendors (Chaiwallahs) to sell their tea online. Customers could subscribe to tea at the store, and they could sign up for weekly, fortnightly, or monthly deliveries on the website. Due to the consulting and marketing skills gained by Zepo over the past 6 years of helping businesses, its customers receive anywhere between 2 to 30 times the return on investment.

6. PharmEasy

Legal Name- Axelia Solutions Pvt. Ltd.

Sector- Pharmaceuticals, E-commerce, Healthcare

Products & Services- Healthcare Products and Medicine Supply

Founders- Dhaval Shah, Dharmil Sheth, Ashish Kumar and Mikhil Innani

Date Of Starting- 2015

Geographical Range- India

Number of Investors- 43

Key Investors- Accel, Bessemer Venture Partners, IIFL Finance, Steadview Capital and TPG

Funding Rounds- 14

Total Funding Amount- $ 1.12 Billion

Valuation- $ 4.44 Billion

PharmEasy is a Mumbai-based healthcare app and eCommerce startup that sells online drugs, diagnostics, telehealth, and online doctor consultation services to consumers. Its a subsidiary of Ascent Health founded in 2015 by Mikhil Innani, Dharmil Sheth, and Dhaval Shah. An online pharmacy service by the startup connects patients with local pharmacies and diagnostic centres to meet their medical needs.

The four main services including medicines, diagnostic tests, healthcare products, and e-consultancy services are provided by PharmaEasy all available online. Caisse de Dépôt et Placement du Québec (CDPQ), Ascent Health, Bessemer Venture Partners, Orios Venture Partners, Eight Roads Ventures, InnoVen Capital, and Temasek Holdings are the major investors in the startup.

PharmEasy is a health-tech startup that provides teleconsultation, medicine delivery, diagnostic test sample collection, and medical services. Users can buy and order pharmaceuticals, nutrition and supplement products, and medical equipment through the platform. It aids the users to search for diagnostic testing and arrange health checkups, along with collecting samples at home.

In March 2020, PharmEasy launched the “Gift a Mask” campaign, in which residents could donate a mask to COVID-warriors. PharmEasy included a mask with each purchase. The startup even launched the ‘Go Corona Go’ campaign in India to speed up the COVID-19 vaccine push, which was then followed by a vaccination drive with doctors. Their collaboration with McKinsey and Fractal Analytics, an artificial intelligence business, aided in the monitoring and tracking of COVID-19 patients, preventing cases of people disobeying self-isolation or quarantine.

7. Purplle

Legal Name- Purplle

Sector- E-commerce, Beauty & Cosmetics

Products & Services- Skin-care, Hair-care and Make-up Products

Founders- Rahul Dash, Suyash Katyayani and Manish Taneja

Date Of Starting- 2011

Geographical Range- India

Number of Investors- 18

Key Investors- Sequoia Capital, Goldman Sachs, Blume Ventures and Brand Capital

Funding Rounds- 13

Total Funding Amount- $ 276 Million

Valuation- $ 728 Million

Mumbai-based Purplle is a multi-brand beauty boutique startup in India that markets cosmetics and wellness products. Purplle was founded by Manish Taneja and Rahul Dash as an online retailer in December 2011 and in January 2017 it established its first physical retail store at Phoenix Market City Kurla, Mumbai. Beauty products from a variety of categories are available on this online marketplace. Makeup, skincare, fragrances, body care, hair care, face care, men’s grooming, eyecare, beauty appliances, and more from a variety of brands are the products available.

It offers a wide choice of products from 650 different manufacturers, with 50,000 SKUs and 300 beauty-focused vendors. Purplle was able to customise the beauty product discovery process for customers by merging their beauty persona with Purplle’s beauty knowledge engine. It has recently launched a cosmetics line. The company wants to produce skin cream, face wash, and soap under its new skincare brand. The company provides warehouse and logistics services to merchants to assure product quality and timely delivery. The startup has partnered with 6,000 salons to provide customers with accurate price information on the site to help them choose the best service.

Moda Cosmetics (Turkey) and Vipera Cosmetics (Poland) are two global brands that the company has imported to India. The startup, which was founded in 2011, is one of India’s largest e-beauty platforms, with over 7 million monthly active users. On its website and app, it offers around 50,000 goods from over 1000 brands.

Its digital-first beauty brands, such as Good Vibes, Purplle, and NY Bae, have scaled successfully. Good Vibes, one of the top three brands in the Naturals Skincare on the app, has already grown to be worth INR 150 crore. The startup has created a differentiated, highly personalised digital shopping experience for consumers with its app, which includes detailed user personas, the ability to test make-up, and product recommendations based on personality, search phrases, and purchase behaviour.

Purplle, a Manash Lifestyle startup, has raised $7 million from Blume Venture Advisors, IvyCap Ventures, and JSW Ventures in three stages. Verlinvest, Sequoia Capital India, Blume Ventures, and JSW Ventures invested $45 million in Purplle.com recently. It is well-positioned to be a leader in the booming Indian e-beauty industry, with over 800 workers and a CAGR of more than 90%.

8. WhiteHat Jr.

Legal Name- WhiteHat Education Technology Pvt. Ltd.

Sector- Edtech, Distance Education

Products & Services- M-learning, Video Classes and Online Tutoring services

Founder- Karan Bajaj

Date Of Starting- 2018

Geographical Range- Multinational

Number of Investors- 3

Key Investors- Owl Ventures and Nexus Venture Partners

Funding Rounds- 2

Total Funding Amount- $ 11.3 Million

Valuation- $ 29.7 Million

Acquired By- BYJU’S (2020)

Acquisition Price- $ 300 Million

WhiteHat Jr. is a Mumbai-based ed-tech tutoring business that educates young students on how to code through one-to-one live video lessons. It was founded by Karan Bajaj in 2018 and is aimed at children aged 6 to 14 in countries such as India and the United States. IIT/IIM alumni designed WhiteHat’s curriculum. The startup’s goal is to empower an entire generation to become creators of technology rather than consumers.

WhiteHat Jr. is a live online 1:1 platform that links kids with top early childhood coding experts from the comfort of their own homes. The startup helps children develop creative solutions by teaching them the principles of coding structure, logic, and algorithmic thinking. The software encourages kids to learn computer programming by allowing them to utilise code to create their games, animations, and apps, converting their connection with technology from one of the consumers to one of the developers.

The startup employs a live education method as well as a well-researched curriculum. The data framework, machine learning, app and game development, and space technology are the topics covered. For students in grades 1 through 12, it delivers four levels of courses: beginning, advanced, professional and intermediate. Among the characteristics of online coding, the coaching platform offers learning code sequencing and coding structure. To provide even more value to its students, WhiteHat Jr now provides Mathematics and Music programmes.

The startup founded in 2018, also provides AI classes for children aged six to fifteen. WhiteHat Jr’s aims to empower kids to identify themselves as inventors. Different subscription-based pricing structures are available depending on the content presented and the student’s grade. Over 7,000 teachers are listed on the Mumbai-based startup’s website presently. WhiteHat Jr. was acquired by BYJU’S in 2020 for USD 300 million.

9. Housing

Legal Name- Housing.com

Sector- Real Estate, E-commerce

Products & Services- Real Estate Search Portal

Founders- Abhimanyu Dhamija, Abhishek Anand, Sanat Ghosh, Saurabh Goyal, Advitiya Sharma, Amrit Raj, Neeraj Bhunwal, Rishabh Agrawal, Snehil Buxy, Rahul Yadav, Ravish Naresh, and Vaibhav Tolia

Date Of Starting- 2012

Geographical Range- India

Number of Investors- 16

Key Investors- Nexus Venture Partners, Softbank Group and Helium Venture Partners

Funding Rounds- 8

Total Funding Amount- $ 157 Million

Valuation- $ 123 Million

Acquisition By- PropTiger (2016)

Acquisition Price- $ 75 Million

Housing is a Mumbai-based startup that presents a platform for listing real estate properties including land purchases, apartment sales, rents, PGs, and hostels. It connects brokers/owners with those looking for a home. Brokers are charged a fee to list their homes. It helps real estate builders and developers to showcase their upcoming projects in the New Projects zone. The user interface is built on a map. The founding team is from IIT Bombay. The startup deals with over 40,000 developers and real estate agencies.

Every day, nearly 2,000 new residencies are added. There are 25 cities where the services are available, including a dozen tier-2 cities. The startup has recently shifted its focus to buying and selling a network of residential properties. Housing.com paid $1.2 million for Indian Real Estate Forum (IREF), a discussion platform for real estate and $2 million for Realty BI, a real estate projects risk estimate agency. The company paid $2 million for HomeBuy360, which is a cloud-based sales lifecycle management tool.

In November 2014, the company raised $90 million, with SoftBank taking a 30% stake as the lead investor. In 2015, the site received 85 million views, with 1.7 million verified listings as of January 2016. A $5 million investment from Softbank was completed in November 2016. In the same year in December, Housing.com partnered with Tata Housing to create a unique integrated PAN-India brand platform displaying Tata’s current inventory (luxury homes and Tata Value Homes) and the exclusive launch of their new projects.

Housing has been acquired by PropTiger in a $ 75 million arrangement. As part of the agreement, it has tied up with PropTiger in September 2016 to utilise its offline services to close transactions with customers. The collaboration began in major cities like Mumbai, Bengaluru, Delhi, and Pune, with the first stage comprising roughly 20-25 new projects. As part of a strategy to improve the senior management team, Nikhil Rungta, ex-Senior VP at Reliance Jio, was named Chief Marketing Officer, and Vivek Jain, from Google and Amazon, was named CTO.

10. Haptik

Legal Name- Jio Haptic Technologies Ltd.

Sector- Artificial Intelligence, Software, Machine Learning

Products & Services- Virtual Assistance Solutions and Chatbots, IM App

Founders- Swapan Rajdev and Aakrit Vaish

Date Of Starting- 2013

Geographical Range- India, U.S., Europe, Middle East, Australia and South-East Asia

Number of Investors- 3

Key Investors- Times Internet and Kalaari Capital

Funding Rounds- 2

Total Funding Amount- $ 12.2 Million

Acquired By- Reliance Jio (2019)

Acquisition Price- $ 100 Million

Haptik is a smartphone application that uses artificial intelligence to provide users with information on web-based support services. Users can submit a service request or a complaint, make a restaurant reservation, locate a coupon, compare pricing and values, etc. It has an in-house staff of professionals who can assist in locating relevant information about assistance services. This Mumbai-based startup is one of the largest Conversational AI startups in the world, with over 100 million devices and 3 billion conversations handled to date. It has a 4.5+ rating and claims to be increasing at a 30 per cent rate each month.

An Android and iOS chat-based personal assistant, the Haptik app, was the startup’s first creation, released in India in March 2014. With over 2 million downloads and 15 million app instals, this turned into a full-fledged conversational commerce app. By May 2016, the company’s chat volume, downloads, and user additions had all increased by 20% month over month. From a technological standpoint, the platform had already automated 25% of responses. In November 2017, the company released a complete enterprise bot management platform with an analytics dashboard.

Haptik introduced a new speech bot for KFC India in 2019, allowing customers to purchase KFC using Alexa. It helps users in locating the nearest KFC restaurant and gives real-time product availability. For HDFC Life, the company produced a Life Insurance chatbot and a Baap Bot for Father’s Day. The Maharashtra government collaborated in a deal with Haptik in March 2019 to develop a chatbot for their Aaple Sarkar platform. The bot facilitates conversational access to information on the 1,400 services of state governments. The Indian government launched a WhatsApp chatbot called MyGov Corona Helpdesk in March 2020 to raise awareness of Coronavirus created by the startup Haptik.

Fortune 500 companies around the world use the company’s intelligent virtual assistant solutions to improve the customer experience while reducing costs and increasing sales. Haptik gained a lot of acclaim in the business and has won several awards including the Frost & Sullivan Award for Conversational AI Company of the Year 2018 and has been recognised as one of AI Time Journal’s Top 25 AI Companies in the World 2018. Haptik received a special honour from the State Minister for External Affairs in December 2021.

Samsung, Oyo Rooms, KFC, Club Mahindra, Coca-Cola, Tata Group, and Zurich Insurance are its noteworthy customers. Freecharge, Indiaproperty.com, Concierge, TicketNew, DineOut and Hammer and Mop, have also partnered with Haptik. It supports over 200 other brands and services. Haptik has been acquired by the Reliance group of enterprises, which bought an 87 per cent stake in the company in April 2019 for $100 million.

Conclusion

According to research, Mumbai now has an active startup foundation of over 9,000. The city even brags the most millionaires in the country, making it the only Indian city to make the list of the top 20 wealthiest cities in the world. The city’s wealth concentration makes it a haven for high-net-worth people (HNIs) who own massive corporate empires.

edited and proofrea by nikita sharma