Top 10 Most Promising Wealthtech Companies In India 2022

Top 10 Most Promising Wealthtech Companies In India 2022

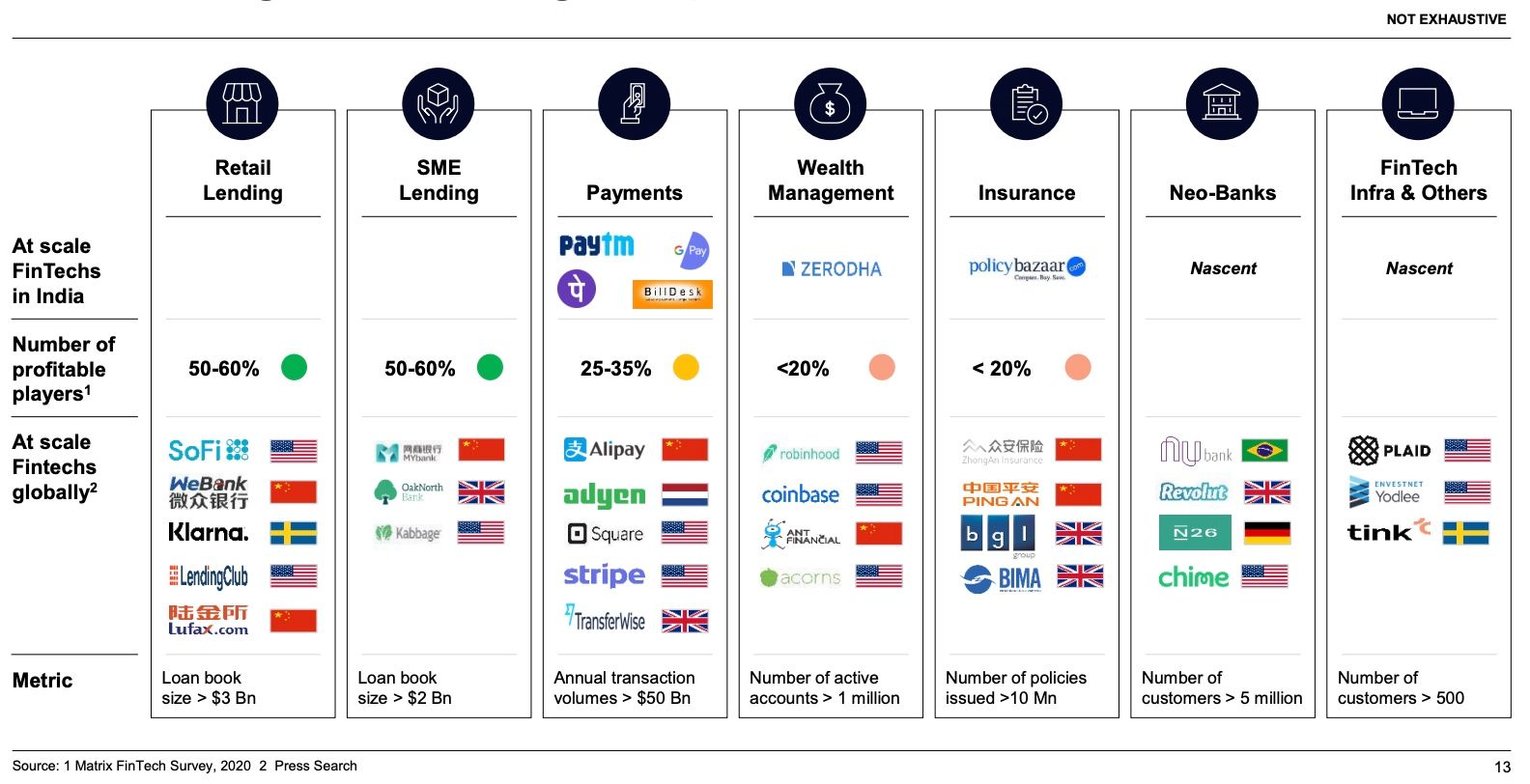

With growing digital adoption and increased investor interest, the wealth tech sector in India has seen a robust growth rate. More than 300 startups have emerged in India in the health tech sector, including Robo-advisories, online brokerages, personal finance management, and investment platforms.

It is the fastest-growing fintech market in the world, ahead of the United States. Wealthtech in India has especially grown rapidly. Additionally, because of the pandemic, India’s internet penetration has surged by 8.2% in a year, resulting in greater usage of digital technology. Wealthtech solutions are also in higher demand as disposable incomes increase. Wealthtech companies in Tier-II cities in India are benefiting from these factors, as well as increased investor participation in the sector.

Redseer recently reported that the Indian wealth tech market is estimated to triple in size from US$20 billion in 2020 to US$63 billion by 2025. Also, the report noted that wealth tech stands to benefit from a number of tremendous opportunities in the world’s largest democracy. As opposed to the United States, only 2% of its population invests.

Here are some of the key players in the wealth tech market as the industry is poised for growth.

According to a new report, global fintech funding is expected to reach $210 billion in 2021, up from $125 billion and 3,674 deals in 2020.

India topped the global fintech deal rankings once again, with four out of ten of the region’s top deals coming from the country.

KPMG’s Sanjay Doshi, Partner, and Head, Financial Services Advisory, said this development reveals India’s growing influence in the fintech sector. The arrival of the digital rupee will make new models around neobanking, wealth tech, and insurtech more interesting in the future, Doshi said.

In the second half of last year, fintech funding totaled $101 billion, according to the ‘Pulse of Fintech H2’21 report.

A total of $51.7 billion in investments were made in the payments sector in 2021 – up from $29.1 billion in 2020 – and $30.2 billion was invested in blockchain and cryptocurrencies in the past year.

The report found that a robust payments space has been helped by growth in areas such as embedded banking, ‘buy now, pay later, and open banking aligned solutions.

Investment in wealth tech ($1.62 billion) and cybersecurity ($4.85 billion) also reached new highs.

The value of cross-border fintech M&A deals increased by more than threefold year over year, to $36.2 billion.

The total value of fintech-related mergers and acquisitions increased from $76 billion in 2020 to $83.1 billion in 2021.

“P.E. financing to fintech more than twice from its record estimate in 2021, with $12.2 billion in a business case study to $5.2 billion in 2018,” according to the research.

V.C.’s investment in fintech has more than doubled in the last year, rising from $46 billion in 2020 to a new high of $115 billion in 2021.

The United States received $88 billion in total finance and $52.7 billion in venture capital funding.

Fintech investment in the Asia-Pacific area then doubled between 2020 and 2021, rising from $14.7 billion to $27.5 billion.

The wealth tech sector in India has grown rapidly as a result of the increased development of digital technologies and increased investor interest in the sector. India has over 300 companies offering wealth-Tech services such as Robo-Advisory, online brokerages, investing platforms, and other wealth management services.

India’s wealthy technology sector has seen rapid expansion. India, along with the United States, is developing a record amount of fintech, giving it among the quickest fintech marketplaces. The epidemic has resulted in an increase of 8.2 percent in internet penetration, resulting in increased digital development in India.

A shift in the demography of investors. A future breed of customers who need more than simple, functional, and smooth interactions. Decades of lack of investment in technology have necessitated the creation of a digital world that will drive market distinctiveness. Cybersecurity dangers are always evolving in response to technological advancements.

These are just a few of the obstacles wealth management organizations face as they work to enhance the wealth technology (wealth-tech) they require to service individual and institutional clients. Such advancements in wealth-tech have created winning market opportunities for anyone who can stay up.

The wealth management sector has changed as a result of waves of innovation. The earlier insular, product-based, in-house technology has provided a way to the DIY investor age, which emphasizes wealth firms’ involvement and contacts with their customers, as well as offering them digital, identity tools.

With rapid technological advancements over the years, the period among each latest influx of asset research and innovation has decreased as wealth-influence tech’s, and acceptance percentage by wealth firms has increased. This necessitates wealth managers concentrating their attention on initiatives that assist them in capitalizing on these innovation waves, which begins with keeping up with current wealth-tech developments.

We’ve selected five strategic initiatives that industry executives may want to pursue to remain relevant and prepare themselves for success.

Initiating five strategic initiatives:

- Meeting the changing needs of clients by enhancing the client experience

- Data-driven recommendations to strengthen client relationships

- Drive differentiation with technology

- Combat rising cyber-threats by investing in cybersecurity

- Introducing wealth-tech and preparing the workforce for its benefits

In India, there are a plethora of I.T. areas that are thriving. It is the fastest-growing fintech market among major countries, along with the U.S., and producing record amounts of fintech. The epidemic has resulted in an 8.2% increase in web penetration, prompting a more advanced response in India.

Furthermore, increased access to abundant technology setups is directly related to increased disposable income. In addition to these factors, the wealth tech sector in India is seeing an increase in economic backer demand from Tier-II urban neighborhoods.

According to a new analysis by Redseer, the Indian wealth tech market is projected to expand rapidly from roughly US$20 billion in 2020 to around US$63 billion in 2025.

The paper also highlighted the enormous market potential for wealth tech in the world’s largest vote-based system, where only 2% of the population invests in equities, compared to 55% in the United States.

India is a global fintech powerhouse, with over 2,100 fintech firms which is one of the greatest fintech acceptance rates in the developed world, kudos to initiating internet infrastructure initiatives, a vibrant venture capital (V.C.) landscape, and growing populations, along with a young, digitally savvy population and a rising middle class.

Investors around the world are positive about India’s fintech prospects, having invested billions into the sector.

Fintech funding in India exceeded US$8 billion in 2021, according to data from Invest India, the national investment promotion agency. In the United States today, 17 fintech unicorns are valued at more than $1 billion. The startup scene is exploding, with a plethora of smaller yet fast-growing companies making their presence felt, gaining funding and traction from investors worldwide.

Most Promising Wealthtech Companies In India 2022

1. INDWealth

Through INDWealth, consumers can track their wealth, save, and grow it. SuperMoneyApp automates the process of keeping customers’ money organized, and it provides tips on how customers can save money and earn more on investments, loans, and expenses. Meanwhile, INDWealth, which offers tax planning, trust administration, private family offices, and succession planning, is a privately owned wealth management platform.

INDWealth offers users the opportunity to keep track of their finances by keeping an eye on loan payments, taxes, and investments. As a result, the machine-learning algorithm helps users improve cash flow and accomplish financial goals.

The company’s parent company, Finzoom Investment Advisors, is a licensed investment adviser with SEBI.

Over the past few years, the startup has earned over US$58 million. Steadview Capital, Tiger Global, and Dragoneer are investors.

2. Zerodha

Zerodha is one of India’s original cheap brokers and promises to be among the country’s largest stock brokers. Zerodha has more than 5 million clients who trade and invest in a wide range of products, accounting for over 15% of all wholesale volume of orders in India daily. Futures and options, bonds, stocks and IPOs, commodities and currency derivatives, direct mutual funds, and government securities are all available to Zerodha customers.

In the case of interday trades, the company allows users to trade for free. For intraday equities, currency, and commodities trading, Tt pays a nominal 0.03 percent of the deal or US$0.27 (INR 20), whatever is lower.

It’s worth noting that the firm, which is now profitable, has been bootstrapped since the beginning. In comparison to the previous year, revenue increased by 11% to approximately US$127 million in FY2020. The company has a self-value of $1 billion.

3. Upstox

Stockbroking company Upstox limited operates in India. Headquartered in New Delhi, India, the company has a global presence. Investors and professionals can find a variety of investments on the company’s website, including stocks, mutual funds, commodities, derivatives, currencies, and ETFs.

As part of its commitment to complete transparency, Upstox offers zero brokerage fees for equity delivery customs and up to Rs. 20 per demand for intraday and F&O trades, commodities, and currencies. From the moment a client opens an account to the moment they execute financial transactions, the company ensures that they have access to a high-tech online trading platform backed by best-in-class services.

In 2010, Up stock Limited was founded. In 2012, the firm became the first in the sector to provide fixed-price unlimited trading plans. In 2016, RKSV raised a round of funding from Kalaari Capital, Ratan Tata, and GVK Davix to help speed the company’s technology rollout and operations, with a strong focus on mobile and robust trading systems. The company’s underlying idea of making stock market trading easy and accessible for everyone remains unchanged.

Ravi Kumar and Shrini Viswanath launched Upstox Limited. Ravi Kumar is the company’s founder and an Indian businessman. He graduated from the University of California, Irvine, with a bachelor’s degree in information technology and computer science. Kumar created R.K. Trading Partnership in 2006 and Upstox Limited Company in 2010.

Shrini Vishwanath is a co-founder of the company and an Indian businessman. He earned a Bachelor of Science degree at the University of Illinois at Urbana-Champion between 2003 and 2007. He worked as a Technology Analyst at Morgan Stanley in 2006. He began working at Citi in 2008 as a program manager. Upstox Limited was created by him in 2010. Hard labor, honest effort, and sincerity are the characteristics that the organization believes determine the quality of the product.

4. Groww

Groww is one of the most popular online investment platforms. Groww App, which can be downloaded free of charge, allows its users to safely trade stocks, mutual funds, U.S. stocks, and even digital gold. In 2016, Neeraj Singh, Harsh Jain, Lalit Keshre, and Ishan Bhansal founded Groww, a mobile app startup based in Bengaluru.

With its parent company, Next Billion Technologies, now being an authenticated broker with the BSE, Groww is expanding its stock market services. Users of Groww can use the app and the Groww services for free.

Groww offers no recommendations but encourages users to select their portfolios according to the available information. The SIP option is also available to investors.

Whether you’re ready to invest or not, Groww is a good choice. It provides a secure and convenient platform. To maintain the security of the transactions, routine and strict safety checks are performed. Groww does not pay any fee on its purchases. The platform just acts as a mediator, and all payments are conducted through BSE.

Ribbit, Sequoia, Kauffman Fellows, and other well-known investors have backed the app and its services. It is run by a group of professionals with extensive experience in both technology and finance.

Groww was founded to offer only regular plans. However, beginning in 2018, it has moved to direct plans. Direct plans do not have a distributor commission.

Groww features a feature called ‘Smart Save.’ This function is geared towards saving customer accounts, where the funds will be placed in a money market fund with just an option for immediate redemption.

5. Kuvera

A re-branded version of Wealth Generators, Kuvera Global, was launched on March 1, 2018, as a re-branding of Wealth Generators. During the time the company operated under the name Wealth Generators, the company provided investment advice and financial services.

Investview acquired Wealth Generators in 2017, and the company now focuses on Cryptocurrency mining contracts. An ROI of 1200 days was earned on one mining contract costing approximately $4999.

Wealth Generators and Investview Inc. operate in a somewhat different way than traditional MLM companies that offer securities. Upon closer inspection, we observed that Wealth Generators (Kuvera Global) did not register under the SEC for its mining contracts.

Kuvera Global has continued to offer cryptocurrency mining contracts through Kuvera Wealth. Several percentages of Kuvera are involved in mining leasing.

With Kuvera Wealth as a side business, the company offers mining contracts similar to what they offered previously under their old name:

- Generator: investment $499.99

- Business: investment $999.99

- Executive: investment $2499.99

- Premier: Investment $4999.99

On the website, the company does not provide any information about its “VIP mining programs,” which cost $ 25,000. According to the above discussion, the old company’s brand had an ROI of 1200 days, which is a long time. Kuvera Wealth now offers consumers open-ended contracts:

Although all mining contracts are valid for 1000 days, they last over the lifetime of the equipment.

We can find two things mentioned on the Kuvera global website: “Market Education” and “Financial Fitness.”

6. Scripbox

Scripbox, an online investment platform, was launched in Bengaluru, Karnataka, in 2012 by Askoh Kumar E R, Atul Shingal, and Sanjiv Singhal. Scripbox is now one of the fastest-growing asset management firms, with an AUM of 1500 crores and over 1 million customers helping them achieve their financial goals!

Omidyar Network, Accel Partners, and different angel investors have all contributed to the company’s growth.

Millions of dollars have been invested in this quest.

Scripbox’s mission is straightforward: to educate and assist consumers in investing in mutual funds by making communication easy and jargon-free. By thoroughly examining the market, the business has built an algorithm that selects just the top-performing mutual funds. It selects the top ten performing mutual funds out of over 8000 accessible, then divides them into four categories: long-term, short-term, tax-saving, and emergency fund.

7. Sqrrl

Sqrrl was one of the first purpose-built systems for this critical Security Operations Center (SOC) function as a pioneer in corporate threat hunting. Sqrrl’s threat hunting platform, which comes with a wealth of hunting ideas leadership, such as the tracking loop and tracking maturity model, makes it easier than ever for businesses to start a hunting program, even if they haven’t done it previously.

Hunting does not have to be only a practice of the top 1% of security practitioners, thanks to Sqrrl, which lowers the barrier of entry for less experienced analysts. The Sqrrl platform combines aspects of multiple separate hunting tools into one, investigation recording, incorporating a linked data model, asset tagging, a search language, and fusion of multiple domains.

The analyst can then access everything they need in one place.

Sqrrl has developed a platform that combines three key parts of SOC activity: proactive threat hunting, incident investigations, and automated analytics to make hunts repeatable and machine-powered. Neither threat hunting tool in the industry has attempted to address each of these critical components of security and integrate them into a single platform.

8. Cube Wealth

Cube Wealth, a Bengaluru-based fintech, has raised $500K in mid-series fundraising from its current investors, including Singapore-based startup fund Beenext and Japan-based Asuka Holding. The cash will be used to expand the company’s technology and development marketing teams. The company raised around $2 million earlier this year to extend its operations for NRIs.

“I think this pandemic is a critical point for digital wealth management,” says Satyen Kothari, founder and CEO. “Customers will now become used to and require digital services including everything from KYC to managing their investments.” They will also want their wealth providers to be more transparent and ethical. On several fronts, technology performs admirably.”

Satyen Kothari launched the company in 2018 to create an app that is simple to use, delivers the best advisors, and aids in wealth accumulation, particularly for busy professionals. Designers, Engineers, Wealth Coaches, Marketers, and Operations Experts make up the team.

Building Your Perfect Portfolio of Investments, simplistic portfolio tracking, more alternatives apart from mutual funds, over 17,000 funds investment choices such as mutual funds, foreign equities, digital gold, and trading platforms, pretty much any time assistance from wealth coaches, and so on are some of the unique features of the app.

9. WealthDesk

WealthDesk has reviewed the material in this post.

WealthDesk is India’s first B2B2C platform, capturing the whole Investment/Asset Management/Advisory value chain, from portfolio development on top of equities and exchange-traded funds (ETFs) to WealthBasket investment products.

In India, WealthDesk is leading the way in terms of investment product innovation. WealthDesk’s platform is used by more than 50 partners to align their brokerage and consulting offerings. Among them are well-known full-service brokers like Motilal Oswal, J.M. Financial, Anand Rathi, and Prabhudas Lilladher. WealthDesk, as a B2B2C SaaS platform in this market, can bring in B2B and build a larger ecosystem at scale.

10. ETMoney

In addition to re-branding itself and adding Mutual Funds transactions to its services, Smart Spends, backed by Times Internet, has become ET MONEY. With the change in the brand name, the company will be able to meet all the financial needs of Indians through a mobile-first platform.

It is also crucial to brand it as ET MONEY to make it credible, familiar, and trustworthy.

“We believe retail consumers in India are completely disadvantaged in the financial journey,” Mukesh Kalra, COO at ET MONEY, commented. Through our user-friendly platform, we help users manage their money more efficiently than other providers. With seamless mutual fund investing, we are now helping consumers grow their money.”

Article Proofread & Published by Gauri Malhotra.