Top 10 Most Valuable Unicorns in France 2022

Top 10 Most Valuable Unicorns in France 2022

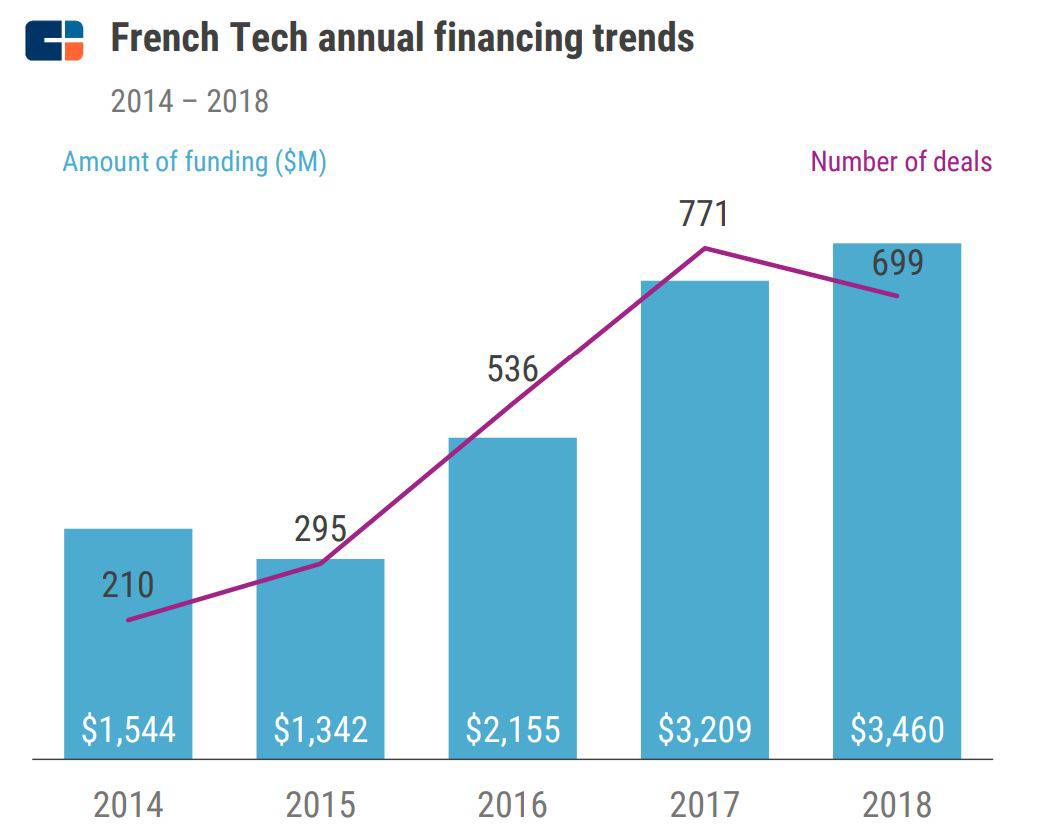

France is producing unicorns at the highest rate among the major European IT hubs. Tech startups in France are thriving in 2022. In France, the number of startups and unicorns worth more than €1 billion has tripled in the last three years, compared to just 69% in the UK and 44% in Germany. With a 165 per cent increase during the same period, Sweden comes closest. For tech investment, France is becoming as important as Germany and the United Kingdom

According to Dealroom data, North American investors significantly increased their support of French startups last year, from 13% to 31% of total investments, catching up to the UK and Germany at slightly over 40%. This is welcome news for President Emmanuel Macron, who has pledged to turn France into a country of unicorns. Reforms to wealth and dividend taxation, as well as a tech visa for non-EU startups, have all contributed to a more vibrant startup ecosystem in the country.

Macron’s proposal for a “startup nation” was always about creating an ecosystem of academics, entrepreneurs, and investors to conceive, fund, grow and sell ideas to repeat the cycle. In the European Union’s digital economy ranking, France is ranked 15th, and in the World Intellectual Property Organization‘s innovation index, it is ranked 11th. France has already surpassed Sweden and the Netherlands, which each have 24 unicorns, and is only second to Germany, which has 53 unicorns.

France announced a goal of 25 unicorns by 2025 in 2019. In less than three years, this aim was achieved. The kingdom of the French Tech has gained 15 new unicorns, with only 3 in 2020 and 12 in 2021. France has counted 5 new unicorns since the beginning of 2022 in less than 18 days. After a record year in 2021, when La French Tech raised €11.6 billion, up 115 per cent from 2020 (€5.4 billion), 2022 is off to a great start for the French startups and unicorns.

Even though some European partners have witnessed a more robust increase in financing, France continues to lead the way in terms of the number of deals completed. Five new unicorns have already arisen in early 2022, well exceeding the aim of 25 unicorns by 2025. FinTech startups were extremely active in 2021 in the country, with many of them making the Next40 and FrenchTech120 lists.

![]()

The Next40 and French Tech 120 rankings have been highlighting the most promising French Tech start-ups for the future since 2019 and every year afterwards. FinTech and HealthTech start-ups are among the most prominent newcomers to these rankings. The government now aims to capitalise on these trends to reindustrialize France and maintain its competitiveness. The French government even hopes to expand this objective to the European level.

According to the US tech investors like Tiger Global Management and Dragoneer driving local startups to unicorn status, Paris is the fastest growing, followed by Berlin of Europe’s major IT hubs. France has boosted the value of startups around the world, particularly in Europe. According to research released by CB Insights, 136 new startups were launched globally in the second quarter of this year, nearly six times as many as years ago in Europe out of which 25 are from France.

These are the Most Valuable Unicorns in France in 2022.

1. Qonto

Sector- Financial Technology and Banking

Products & Services- Financial Services

Founders- Alexandre Prot and Steve Anavi

Date Of Starting- 2017

Geographical Range- Europe

Company Stage- Series D

Number of Investors- 17

Key Investors- KKR, Insight Partners and TCV and European Investment Bank

Funding Rounds- 6

Total Funding Amount- $ 709 Million

Valuation- $ 5 Billion

Qonto is a freelancer and small business payment platform based in France. The financial technology unicorn was created in 2016, and the first product was released in France in July 2017. Since 2019, the service has been extended to Spain, Germany, and Italy. Qonto is the most popular corporate finance solution in Europe. Everything from ordinary banking and finance to bookkeeping and expenditure management is made easier. It is a neobank founded in France that offers business accounts with a debit card and manages all transactions through an iPhone or Android app.

For SMEs and freelancers, the startup is a digital bank. Deposit accounts, financial management tools, corporate debit cards, payment solutions, and other services are available. It also offers bookkeeping services, tailored spending solutions, and other services. Qonto is an online bank that offers small and medium-sized businesses and freelancers financial capabilities. The French Prudential Supervision and Resolution Authority granted Qonto a payment institution licence in July 2018.

In January 2017, Qonto raised €1.6 million in a seed round led by Alven Capital, with participation from Valar Ventures, founded by billionaire Peter Thiel, and a few business angels. Qonto launched its service in July 2017 after raising another €10 million from previous backers Valar Ventures and Alven Capital. Six months after its inception, 5,000 businesses had signed up for the service, and by April 2018, Qonto had surpassed 10,000 users. This unicorn is a neobank that caters to freelancers and small businesses.

The unicorn raised another €20 million from its existing investors in September 2018. The European Investment Bank became a shareholder as well. DST Global and Tencent led a $115 million investment round for Qonto in January 2020. More than 150,000 businesses were using the service in March 2021, according to the company. The online bank nearly doubled its business portfolio during the coronavirus outbreak. Qonto provides a professional current account, payment cards, and other tools that help businesses with banking and accounting.

KPMG and H2 Ventures named Qonto one of the Global Fintech’50 Emerging Stars. Qonto has been a member of the prestigious Next40 index, which brings together the most promising new firms in the French IT industry, since February 2021. In the Linkedin Top Startups 2020 rating of the top 25 startups in France, Qonto was ranked ninth. In January 2021, the company had over 300 workers and is situated in Paris, France.

It is an online bank that offers small and medium-sized businesses and freelancers financial capabilities. It simplifies, streamlines, and transparently conducts company banking, as well as provides digital bank accounts for making and receiving payments that are adaptable to all types of businesses, regardless of legal structure or team size. It also allows clients to simply transfer payments via a mobile application using a physical or virtual card, and handle transfers without having to fill out any paperwork. Qonto presently accepts citizens of France to open mobile bank accounts.

2. Sorare

Sector- Blockchain, Cryptocurrency, Gaming and Fantasy Sports

Products & Services- Online Games

Founders- Fabian Estrada, Nicolas Julia and Adrien Montfort

Date Of Starting- 2018

Geographical Range- Global

Company Stage- Series B

Number of Investors- 30

Key Investors- Benchmark, Accel, IVP and Bessemer Venture Partners

Funding Rounds- 5

Total Funding Amount- $ 739 Million

Valuation- $ 4.3 Billion

Based in France, this unicorn is a blockchain-based fantasy football platform provider. Users can collect virtual player cards on the platform, trade them for real-world cryptocurrencies, and play fantasy football on the platform’s game arena. The startup claims to validate and authenticate player cards using the Ethereum blockchain. Multilingual support, squad creation and management, and periodic reporting are just a few of the features.

Sorare is a digital football game where users can buy, trade, and play official digital cards. Through its global fantasy football game, Sorare is changing online football fandom. Its goal is to become the game within the game, which is both simple and big. It wants to establish a stunningly realistic football game in which every football enthusiast may manage a team.

As a member of the founding team, you will have a significant impact on the future of Blockchain-powered football collectables. The contract includes freedom, autonomy, and ownership. The unicorn has a world-class team, and with over $60 million in funding, it is poised to take the globe by storm. Sorare’s licence agreements with leagues like the K League and clubs like Real Madrid allow the Sorare cards to include official branding with season-specific player photographs and names.

The unicorn is revolutionising online sports fandom by providing a new way for fans to connect with their favourite teams and players. Since January 2021, the site has sold over $80 million in cards per month in 140 countries. Sorare, based in Paris, France is backed by a world-class team that includes Benchmark, Accel Partners, e.ventures, and footballers Gerard Piqué, Antoine Griezmann, and Rio Ferdinand, among others.

It is a football fantasy game in which participants use digital player cards to buy, sell, trade, and manage a virtual team. Using blockchain-based Ethereum technology, Nicolas Julia and Adrien Montfort developed the game in 2018. Participants in the Sorare platform assemble virtual teams of five footballers from blockchain cards. Just like in traditional fantasy football, teams are ranked and awarded points based on how their players perform on a real-world soccer pitch.

Some of the cards are digital collectables with a licence (limited, rare, super-rare and unique cards). Because of the usage of blockchain technology, digital cards have a proven scarcity. Sorare was created in 2018 by football enthusiasts and is aimed at football fans. The company is on a goal to become the game within the game using blockchain digital collectables and worldwide fantasy football.

To safeguard the ownership and distribution of cards, Sorare uses Ethereum’s underlying blockchain network. The number of cards available is limited, and they can’t be changed, copied, or erased. The ERC-721 token standard on Ethereum is used to represent each player card as a non-fungible token (NFT). Each player card is one-of-a-kind and owned by the gamer, it is confirmed via the blockchain, and its value can appreciate or depreciate depending on market conditions.

In May 2019, the company announced a €550k pre-seed round, which included Xavier Niel, a technology entrepreneur. The startup raised $4 million in July 2020, with the help of German football World Cup champion André Schürrle and others. Ubisoft, E-Ventures, Partech, and Consensys are also on board. The company raised another €3.5 million in December 2020, this time with World Cup champion Gerard Piqué and others.

As of June 29, 2021, there are a total of 140 clubs in the game. When compared to March, this represents an increase of almost 50 club sides. A total of 30 Major League Soccer clubs are operating without a licence. Instead, Sorare has reached a contract with the Major League Players Association, which means that portraits of every player wearing the uniforms of those teams will feature in the game, except for MLS and its clubs’ image rights. Sorare has been licenced by the Belgian Jupiler Pro League.

3. Mirakl

Sector- E-commerce, Saas and Enterprise Software

Products & Services- Enterprise Management and Solutions

Founders- Philippe Corrot and Adrien Nussenbaum

Date Of Starting- 2012

Geographical Range- Global

Company Stage- Series E

Number of Investors- 10

Key Investors- Silver Lake, Elaia, Permira and Bain Capital Ventures

Funding Rounds- 6

Total Funding Amount- $ 948 Million

Valuation- $ 3.5 Billion

Mirakl, situated in Paris, France, is a cloud-based e-commerce software startup. Retailers, manufacturers, and wholesalers can use its online marketplace software. Mirakl is the first enterprise marketplace solution (EMS) that gives real-time cross-channel demand information and tools for identifying trending products, allowing you to build and scale an EMS. Philippe Corrot and Adrien Nussenbaum co-founded Splitgames, a B2C e-commerce marketplace. In 2012, Corrot and Nussenbaum established Mirakl.

The unicorn provides marketplace businesses with cloud-based shopping cart solutions. Multi-channel retailers can develop their online companies using the SaaS platform, which allows both B2B and B2C organisations to launch marketplace platforms. Onboarding and management, multi-vendor inventory management, orders management, customer administration, billing, security, performance analysis, and more are among the capabilities available to sellers.

Mirakl is a French cloud-based e-commerce software unicorn company. Retailers, manufacturers, and wholesalers use its online marketplace software. It has created 66 new online marketplaces in 2020, including Carrefour, H&M Home, Decathlon, and Kroger platforms. StopCovid19 was developed by the company to aid in the distribution of Personal Protective Equipment (PPE) to battle the COVID-19 epidemic. In less than a week, they delivered 300,000 litres of hand sanitiser and 320,000 face masks. Ahold Delhaize used Mirakl’s software platform to launch its digital marketplace in early 2021.

The startup announced the release of new features in May 2021, including AI-assisted categorization, unified drop ship operations, and simplified B2B selling. In June, L’Oréal’s SalonCentric used Mirakl’s Marketplace Platform to launch a new e-commerce marketplace, and Debenhams did the same in October. Macy’s, Inc. announced in November 2021 that it will collaborate with Mirakl to develop an online marketplace at macys.com and bloomingdales.com. Octobat, a French invoice and compliance business, was also revealed as Mirakl’s first acquisition.

Mirakl Catalog Manager is a product catalogue management tool for marketplace owners and sellers. It’s a product data manager that adds information from a database of other sellers to the user’s existing data or product information management (PIM). MCM is designed to help both operators and sellers with responsibilities including product duplication, incoming product moderation, data equity enforcement, large-volume order administration, feedback, and validation mistake correction.

In the e-commerce industry, the unicorn provides technical solutions, strategic business consultancy, and value-added services (VAS) to retailers, brands, and publishers. The business has created a marketplace platform that can be directly incorporated into e-commerce ecosystems. The platform’s capacity to detect and onboard new sellers, as well as link with the features of e-commerce websites via application programming interfaces (APIs), seeks to help businesses maintain product quality and increase efficiency and overall business growth.

Mirakl won the “Best Solution” award in the E-commerce Awards’ New Services category in 2012. The startup unicorn earned the IBM Smartcamp Award the following year. Mirakl was also a nominee for the TED Prize in May 2014. The company launched the StopCovid19 platform to assist in the distribution of Personal Protective Equipment (PPE) in the fight against the COVID-19 pandemic. In less than a week, 300,000 litres of hand sanitiser and 320,000 face masks were delivered.

4. Content Square

Sector- Artificial Intelligence, Saas, Analytics and Automation

Products & Services- Customer journey Analytics Software

Founder- Jonathan Cherki

Date Of Starting- 2012

Geographical Range- France, UK and US

Company Stage- Series E

Number of Investors- 15

Key Investors- KKR, BlackRock, Canaan Partners and Idinvest Partners

Funding Rounds- 6

Total Funding Amount- $ 812 Million

Valuation- $ 2.8 Billion

Based in France, Content Square is a customer journey analytics platform that is cloud-based and AI-powered. The platform may be used to track online and application traffic, as well as optimise and analyse data related to user experience. Zone analysis, in-site navigation and heat maps testing and optimising user journeys, and personalization of the website and application utilising artificial intelligence technologies are among the product’s capabilities. Lacoste, Loreal, Uniliver, Orange, Accor Hotels, and PepsiCo are among its clients.

Contentsquare creates a digital experience analytics tool that allows companies to measure client activity online. The retail, supermarket, automotive, financial, and energy industries are all served by the unicorn. Jonathan Cherki founded the French business Contentsquare. It provides modules for gathering data on user activity on a website or mobile application, as well as content adaptation advice for businesses that provide these services or sites. Interactions with applications or websites are used to collect data.

Contentsquare can make the digital world a more humane place. Its AI-powered platform provides rich and contextual insight into customer behaviours, feelings and intent at every touchpoint in their journey enabling businesses to build empathy and create lasting impact. ContentSquare licenced its software in 2014. Gartner named the solution one of the most innovative e-commerce technologies in the world.

The unicorn, a global leader in digital experience analytics, helps brands around the world revolutionise the way they conduct business by enabling them to take action at enterprise size and establishing customer trust through security, privacy, and accessibility. By 2015, the company has established a presence in London. It was accepted into the 2015 class of the Pass French Tech, a programme that helps French digital innovators thrive. It was also named one of the top 100 most exciting firms of all time.

Jonathan Cherki, who started developing the technology four years prior as part of the ESSEC business school Ventures incubator, created the startup in 2012. Tremplin Enterprise, an awards committee co-managed by ESSEC and the French Senate, acknowledged his idea in 2012. Seed4Soft, a French business angel, gave the startup a 450,000 Euro funding.

More than 850 leading brands rely on startups to expand their businesses, increase customer satisfaction, and move more quickly in an ever-changing world. Its data is used to improve the user experience on over 1 million websites around the world. Contentsquare, based in Paris and with offices throughout the world, has raised $810 million in capital from renowned investors such as Softbank, BlackRock, and others. Highland Europe, a venture capital firm, invested $20 million in ContentSquare in 2016. Deloitte’s Fast 500 list listed the unicorn at the time.

ContentSquare studied over 29 million online shopping sessions across 14 retail accounts to get a sense of what things shoppers were discarding in their carts. In January 2018, a venture capital consortium led by US-based firm Canaan and Highland Europe, Eurazeo, and H14 invested $42 million in ContentSquare to better understand how consumers and users interact with the website and apps. London, New York, San Francisco, and Munich are among the company’s locations.

In March 2018, ContentSquare announced a new integration with Adobe Analytics and Adobe Target, allowing users of Adobe’s marketing solutions to obtain specific data on-page components and assisting marketers in understanding the worth of each content component. In 2018, Auto-Zone, an AI-based recognition system, was added, which designed sites based on a semantic understanding of the site’s components. When new buttons are introduced, Auto-Zone keeps note of the accompanying behaviour and recognises it.

5. ManoMano

Sector- E-commerce, Home Improvement, Home and Garden

Products & Services- DIY Gardening

Founders- Christian Raisson and Philippe Chanville

Date Of Starting- 2013

Geographical Range- Europe

Company Stage- Series F

Number of Investors- 14

Key Investors- Temasek, Bpifrance, General Atlantic and Partech Partners

Funding Rounds- 8

Total Funding Amount- $ 725 Million

Valuation- $ 2.6 Billion

France-based ManoMano is a home renovation marketplace that operates online. Garden materials and DIY products, as well as bathroom supplies, electrical appliances, and plumbing accessories, are all available. Fiskars, Pradel, Legrand, and Bosch are among the brands offered. Domestic repairs and renovations are also available from the startup, depending on the needs of the customers. The website debuted in France in June 2013 under the moniker MonEchelle, before changing its name to ManoMano in September 2015 and expanding to France, Spain, Italy, the United Kingdom, and finally Germany.

ManoMano obtained €150,000 in investment in July 2012 to help fund the debut of its marketplace in France. The startup obtained €300,000 from angel investors in May 2013 and launched its website a month later. The third round of €150,000 was raised with the historic stockholders in February 2014. The unicorn raised another €2 million in September 2014 from the CM-CIC Capital Privé fund and other investors. This funding helped ManoMano to penetrate the European market and the platform was launched in Spain in June 2015. It debuted in Italy in July 2015. In January 2016, it opened in the United Kingdom.

The unicorn startup again raised €13 million in March 2016 from Partech Ventures, Piton Capital, CM-CIC Capital Privé, and Bpifrance’s Numerical Ambition Fund, allowing the company to expand to 70 workers and accelerate its European deployment. In the same year, Google’s Scale-Up initiative, which aims to assist entrepreneurs in their growth, was integrated into the firm. The unicorn launched its platform in Germany in November 2016. The company has 1.2 million products that have been cited as of April 2017. ManoMano raised 60 million euros from General Atlantic in September 2017.

The company, which began as an internet marketplace in France in 2012, has been present in France, Belgium, Spain, Italy, the United Kingdom, and Germany since the end of 2016.

Nearly 900 employees now work at the company. It is an e-commerce unicorn company based in France that specialises in DIY and gardening. Colibri is the corporation that owns it. MonEchelle changed its name to ManoMano in September 2015 and launched the Supermano service in November 2015, a platform that connects DIYers and individuals with occasional requirements for modest services.

ManoMano selects the top businesses through a thorough screening procedure. It does, however, have distinct addresses for contacting customers in different nations. ManoMano, being a Niche Marketplace, has extensive experience in the DIY and Gardening categories. It also has professionals who look after all of the needs of the target audiences and a proactive ManoMano Community that troubleshoots any issues that arise.

It also caters to all of the specific requirements of sellers. It offers a website that is dedicated to the DIY and gardening community. It ensures that products/items are stocked in real-time and that the delivery standard is in line with the seller’s shipping requirements. ManoMano sells the most cost-effective DIY, gardening, and home renovation tools.

6. Voodoo

Sector- Gaming, Online Games and Mobile Application

Products & Services- Gaming Services

Founders- Laurent Ritter and Alexandre Yazdi

Date Of Starting- 2013

Geographical Range- Global

Company Stage- Series E

Number of Investors- 6

Key Investors- Goldman Sachs, Tencent, Welikestartup and Entier Capital

Funding Rounds- 4

Total Funding Amount- $ 200 Million

Valuation- $ 2.31 Billion

Voodoo is a gaming startup established in Paris, France that creates unique mobile video game experiences by combining innovation, suspense, and emotion. Arcade and simulation games are the core of this mobile game development studio. Helix Jump, Snake Vs Blocks, and Paper.io are some of the Android and iOS games developed by the company. Marketing, monetization, and other game publishing services are also available. The use of advertisements and in-app purchases helps the unicorn make money.

Voodoo is a mobile game and app development firm. It is the world’s second-largest mobile publisher, after Google, with 6 billion downloads and over 300 million monthly active users. With over $1 billion in funding and backing from Goldman Sachs, Tencent, and GBL, the startup is one of the most stunning examples of hypergrowth in the ecosystem. Voodoo has stated that it will spend $200 million on blockchain gaming studios to lead the change in mobile gaming, as part of the further expansion of its product line.

Voodoo was founded by Alexandre Yazdi and Laurent Ritter in 2013. Yazdi was promoted to CEO of Voodoo, and Gabriel Rivaud was promoted to Vice-President of Games. Rivaud claims that the company was in turmoil during the first four years of its existence and that it decided to change its business strategy after that. The business created its newer games using data gained from earlier games to attract more players. Voodoo tested one new game every week using the Unity game engine. Paper.io was successfully launched in 2016 as a result of this method.

The majority of Voodoo’s games are free-to-play hyper-casual games for Android and iOS mobile platforms. By April 2019, the startups’ games had been downloaded 2 billion times, 3.7 billion by May 2020, and 5 billion by May 2021. Voodoo games had 2.6 billion downloads, 300 million monthly active users (MAUs), and 1 billion unique players as of December 2019. H8games’ Helix Jump is Voodoo’s most popular game, with more than 500 million downloads as of August 2021.

Voodoo SAS is a Paris-based French video game developer and publisher. It is estimated that Voodoo’s games, which are mainly free-to-play “hypercasual” games, have been downloaded 5 billion times as of May 2021. In exchange for a royalty share, the corporation sponsors and supports certain studios during the prototyping phase. Additionally, Voodoo created the Wizz social network platform in 2020. The platform has 1 million MAUs in the United States as of August 2021.

The unicorn tripled its workforce in 2019 and expects to reach 1500 by the end of 2022. Goldman Sachs, an American investment firm, invested $200 million in Voodoo through its West Street Capital Partners VII fund in May 2018. Since 2015, it was the largest fundraising in the French technology sector. The unicorn has offices in Montpellier and Strasbourg, in addition to its Paris headquarters. In December 2018, general manager Alexander Willink launched a development studio in Berlin, Germany. The studio began with about ten individuals and plans to grow to 40 in the future.

7. AnkorStore

Sector- E-commerce, Wholesale and Retail

Products & Services- Online shopping services

Founders- Nicolas Cohen, Pierre Louis Lacoste, Nicolas Daudifferet and Matthieu Alengrin

Date Of Starting- 2019

Geographical Range- Europe

Company Stage- Series C

Number of Investors- 9

Key Investors- Alven, Index Ventures, Bond Capital and Bain Capital Ventures

Funding Rounds- 4

Total Funding Amount- $ 423 Million

Valuation- $ 2.26 Billion

Based in France, Ankorstore is an online B2B marketplace that connects brands and designers with boutiques across Europe. It was founded in 2019. The unicorn enables on-trend brands to sell through small businesses, as well as shops to sell things that aren’t typically available on major e-commerce sites or through giant retail chains. Ankorstore is a wholesale marketplace that connects local merchants with small company owners and speciality products.

It offers a platform for multi-category grocery products over the internet. From diverse companies, the product catalogue covers home & lifestyle, food, kid’s products, beauty products, fashion, and more. Users can sell their stuff on the platform. Ankorstore is a thriving environment for independent businesses and retailers. The startup is on a mission to reimagine retail and restore it to its natural order by putting independents back in the centre of their communities.

The unicorn provides benefits to both retailers and brands who use the service. Retailers may explore and choose from thousands of products in just a few clicks, make use of 60-day payment terms, test sales with a minimal minimum order size, and take advantage of the platform’s continually growing technologies. It also allows companies and creators to sell their items to stores all over Europe, benefiting from direct contact and returns with retailers, as well as payment upon delivery, which eliminates cash flow difficulties.

The unicorn has already attracted close to 1000 retailers and more than 300 brands. Its objective is to provide businesses with creative solutions that enable them to find and order products that are most suited to their customers. The platform, which is currently available in France, accepts businesses from all across Europe and wants to rapidly expand worldwide in the future, beginning with Germany and Spain. Ankorstore’s concept is to adapt B2C principles for a B2B world: choose which shops you deal with, send your box with ease thanks to their UPS relationship, and get paid on delivery.

Global Founders Capital, Alven, and Aglaé Ventures led the €6 million first round of fundraising for the Paris-based firm. Ankorstore wants to quadruple its employment in the coming months by employing developers, business developers, and customer service representatives. Ankorstore covers the cost of shipping on all of your orders. The unicorn plans to use the new funds to expand its customer base in Europe, which now includes 5,000 brands and 50,000 independent merchants. It also wants to help these same clients gradually reopen their operations now that the lockdowns have been removed.

In a Series A round, Ankorstore raised roughly 25 million euros, and now it has raised even more money in a round backed by Tiger Global and Bain Capital Ventures. In a Series B fundraising round, Ankorstore, a wholesale marketplace based in France, raised $100 million (82.4 million euros). The funds will be used to enhance the online marketplace’s presence in Europe and boost its consumer base. During the year 2021, the unicorn had tripled its revenue.

8. Exotec

Sector- Logistics, Software, Supply Chain Management and Robotics

Products & Services- Logistics Solutions

Founders- Renaud Heitz and Romain Maulin

Date Of Starting- 2015

Geographical Range- Global

Company Stage- Series D

Number of Investors- 6

Key Investors- 83 North, 360 Capital Partners, Iris Capital and Dell Technologies Capital

Funding Rounds- 4

Total Funding Amount- $ 446 Million

Valuation- $ 2 Billion

Exotec Solutions is a logistics and supply chain company that develops order preparation systems based on three-dimensional robot fleets. Exotec (formerly Exotec Solutions) is a firm based in Croix, France, founded in 2015. For grocery stores, manufacturing, and e-commerce, the French business creates and develops solutions that combine robotics and software to optimise order preparation and logistics. The company designs robotic solutions to optimise order preparation using its machine learning and robotics expertise.

Exotec has developed a cutting-edge order preparation system that is based on a fleet of collaborative mobile robots. It is a unicorn company that specialises in industrial robots for warehouse automation. By enhancing site efficiency, the robotic device Skypod enables automated order picking systems and lowers tiredness and dangers connected with pedestrian traffic in the warehouse. It offers solutions in industries such as food, e-commerce, retail, and logistics, among others.

Exotec has transformed the way its customers organise their warehouses and logistical processes thanks to its fleets of three-dimensional robots. The startup provides a clear alternative to standard warehouse automation solutions with seamless collaboration between humans and robots that results in long-term warehouse efficiency. The Skypod system, which is Xotec’s flagship solution, uses robots that can reach a height of 12 metres (36 feet) to allow for high-density inventory storage and retrieval.

The unicorn startup provides a flexible solution that can scale with the needs of its customers by simply adding robots and racks, and can be implemented in months rather than years with minimal downtime. The robots are intended to assist warehouse workers in picking products from shelves that are up to 12 metres high. Exotec today supports 50+ industry-leading businesses across e-commerce, grocery, retail, manufacturing, and 3PL industries, and employs over 300 employees internationally, following the first successful deployment of its system in 2017.

The startup unicorn relocated from Paris to Lille in 2017 and began producing its first robots. It launched the first Skypod robotic devices in Bordeaux in the second half of 2017, which can move horizontally and vertically to restock orders in the warehouse. Exotec concluded a fresh 15 million euro investment round with Iris Capital, 360 Capital Partners, and Breega in June 2018 to industrialise its manufacturing.

To expand its capacity, Exotec relocated to Croix in December 2018 and set up its R&D lab, new offices, and two manufacturing lines. Exotec and AHS, a North American logistics solutions integrator that works with Walmart, eBay, and Sephora, inked a strategic collaboration in 2019. In the same year, the company collaborated with Uniqlo to automate one of its Dutch warehouses. Uniqlo has chosen the French business to automate two more logistics centres in Japan by 2020.

To supervise and manage the operations of the robots, the company began creating robotics software driven by machine learning. Exotec raised 3.3 million euros in another round of funding in December 2016 from two investment partners, 360 Capital Partners and Breega Capital. The funds were used for the development of further prototypes. Through the integrator AHS, the robotics company signed its first contract in the United States in 2021. Exotec also inked a partnership with Decathlon in Canada the same year. Exotec established operations in Atlanta in May 2021 to assist the expansion of its business.

9. Alan

Sector- Insurance Technology and Health Insurance

Products & Services- Insurance Services

Founders- Charles Gorintin and Jean Werve

Date Of Starting- 2016

Geographical Range- France

Company Stage- Series D

Number of Investors- 17

Key Investors- Temasek, Index Ventures, Agoranov and Partech Partners

Funding Rounds- 5

Total Funding Amount- $ 361 Million

Valuation- $ 1.68 Billion

Based in France, Alan, founded by Jean-Charles Samuelian and Charles Gorintin on February 10, 2016, is based on the total digitalization of health insurance. Individuals and corporations can use Alan’s app-based health insurance programme. There are a variety of plans available, including Alan Green for health care protection, Alan Blue for reimbursement for uncovered hospitals, Alan Pension for employees, and more. It has policies for freelancers, small enterprises, hotels, restaurants, and startups, among other things.

Since 1986, Alan has been the first certified health insurance startup in France. It is a technology-based platform that makes health insurance more accessible and inexpensive. The unicorn permits businesses to join up on the company’s website at first. Employees are subsequently asked by the corporation to join Alan and handle their accounts independently.

Alan announced its certification by the ACPR in October 2016 and entered the health insurance market. CNP Assurances led a €12 million seed round, which was co-directed by Open CNP and Partech Ventures. The unicorn announced a €23 million ($28 million) Series A fundraising round on April 10, 2018. Index Ventures led the charge. Investors from the seed round as well as Xavier Niel were among its other investors. This startup insures 850 corporate customers and 7000 customers as of April 2018.

The startup company established a service for freelancers in February 2017. Alan chose to expand its services in July 2017 by including disability insurance for businesses. For insurance firms, the end of the year is a very busy period. Alan took advantage of this time to begin an advertising campaign in Paris. The unicorn has positioned itself in a market where many other long-standing organisations, such as AXA or Allianz, are already present, as it has been officially recognised and approved as an independent insurance provider.

Alan’s health insurance policy was the first new one in France in decades when it was launched. For years, the life insurance industry had remained flat. The French startup Alan debuted a completely new full-stack health insurance. The company launched corporate-owned life insurance to serve as a one-stop-shop for all of your corporate insurance needs. The corporation did not anticipate a high level of demand for this product. However, it turns out that the majority of their clients prefer to streamline their insurance contracts by consolidating everything with a single insurer.

For this product, Alan also serves as a modern web service. Customers may use their smartphones to send documents and pay for them online. Employees are provided with their dashboard. Alan automates all of your accountant’s paperwork and transmits data to your payroll source immediately. Unlike most of his competitors, Alan does not require you to sign a long-term contract. When you sign up, the corporation tells you how much you’ll pay and guarantees that it will stay the same for at least a year.

10. Ledger

Sector- Cryptocurrency, Blockchain, Cyber Security and Saas

Products & Services- Cryptocurrency Security Solutions

Founders- Joel Pobeda, Thomas France, Eric Larcheveque and Nicolas Bacca

Date Of Starting- 2014

Geographical Range- Global

Company Stage- Series C

Number of Investors- 30

Key Investors- First Mark, XAnge, Draper Associates and Siparex

Funding Rounds- 5

Total Funding Amount- $ 466 Million

Valuation- $ 1.5 Billion

Ledger is a computer and network security company based out of France with a presence in the United States. It is a market leader in cryptocurrency and blockchain security and infrastructure solutions. The unicorn offers a wide range of products and services to protect bitcoin assets for consumers and businesses, including the Ledger hardware wallets, which are now available in 165 countries. The company’s headquarters are in Paris, France and the United States.

Ledger was founded in 2014 by eight specialists with diverse backgrounds in integrated security, cryptocurrencies, and business, who came together intending to develop safe blockchain solutions. In Paris, Vierzon, New York, Zurich, and Singapore, Ledger SAS and its subsidiaries are operational. It is a growing startup that uses patented technology to offer security and infrastructure solutions for cryptocurrencies and blockchain applications for consumers and businesses.

The unicorn offers a hardware wallet for cryptocurrencies based on the blockchain. Nano X, Nano S, Blue, and OTG Kit are among the company’s offerings. Bitcoin, Ripple, Ethereum, Bitcoin Cash, EOS, and other cryptocurrencies are also supported. Vault is a multi-authorization cryptocurrency wallet management system offered by the company. For consumers and institutional investors, Ledger delivers security and infrastructure solutions for essential digital assets.

Ledger wallets are multi-currency USB storage devices that can be used offline. It saves your private keys on the device, making online hackers’ access to your accounts more difficult. Users rely on a 24-word backup recovery phrase to access stored cryptocurrency if their physical device is lost. The company assures that the smartest way to secure, buy, exchange and increase the value of your crypto assets is using Ledger. The company has 4 million clients presently.

Over 3 million hardware wallets have been sold by Ledger. 1.5 million individuals use Ledger Live, the company’s software solution for managing crypto assets, every month. According to the business, it presently holds about 15% of all cryptocurrency assets in the world. The Ledger Nano S was the company’s first product. A USB cable is required to connect the gadget to a computer. More recently, the Ledger Nano X, which works over Bluetooth, allows you to send and receive assets from your phone. Companies which want to incorporate cryptocurrency into their balance sheet might use Ledger’s enterprise solution.

The startup unicorn wants to protect the new disruptive class of crypto assets: financial assets such as cryptocurrencies or Initial Coin Offerings (ICOs), data assets such as sensors, IoT devices, or a machine, and digital identities such as second-factor authentication or passwordless login. By leveraging a unique, proprietary technology, the fast-paced, growing company develops security and infrastructure solutions for cryptocurrencies as well as blockchain applications for consumers and businesses.

The core product of Ledger is a hardware wallet for managing crypto assets. They’re designed like USB keys and have a little screen on the front to confirm transactions. Your private keys never leave your Ledger device, which is why that screen is so critical. In other words, you don’t want to leave a huge number of cryptocurrencies on an exchange account if you wish to store them. If someone gains access to your account, they may be able to withdraw all of your crypto assets. The company helps keep control of your crypto assets using a hardware wallet.

10T Holdings led a $380 million Series C fundraising round for French company Ledger. The company has a $1.5 billion valuation following this investment round. Cathay Innovation, Draper Associates, Draper Dragon, Draper Esprit, DCG, Korelya Capital, and Wicklow Capital were among the other investors in the round. Tekne Capital, Uphold Ventures, Felix Capital, Inherent, Financière Agache, and iAngels Technologies are among the new investors in the round.

The startup has created the BOLOS operating system, which is incorporated into either a secure chip for the Ledger wallet line or a Hardware Security Module (HSM) for a variety of enterprise applications. Ledger has been the only company on the market to offer this technology thus far.

Conclusion

This blooming of the French startup and unicorn ecosystem is due in part to the French government’s increased focus on the country’s startup scene, supporting its fast-growing digital startup ecosystem and achieving the status of a Digital Republic. It’s not unexpected, given that VC investment in French companies has more than doubled in the last year, to more than US$11.3 billion in 2021, according to Dealroom data.