Top 10 GST Billing & GST Invoicing Softwares In India 2023

GST is India’s first technology-driven tax regime, and the country has one of the most diverse economies with a complex infrastructure. You’ve come to the right place if you’re looking for the best GST Billing & Invoicing Software in India.

Here’s a list of the best GST Billing & Invoicing software for small businesses and startups to help them with their GST issues. GST has also caused an epidemic of misunderstandings among Indian business owners since its inception. Furthermore, after years of debates, discussions, and changes, the GST is the government’s sole tax system, and every business must follow it.

Special Mention: You can also download a mobile invoice generator app Luzenta

Check out our top 10 GST Billing & Invoicing Software in India to help you with GST compliance, invoicing, and accounting.

1. Vyapar- accounting and invoicing.

Vyapar is business GST accounting software. With the Vyapar App, you can create and distribute invoices via WhatsApp, manage stocks/inventory, estimate bills, generate GSTR reports, track unpaid invoices, issue payment reminders, and collect payments directly online via UPI payments. It also provides spending tracking for the company, a daily sale purchase record, and a profit and loss report.

It is an offline program that can be used anywhere, so you will not need an internet connection or connectivity. It also ensures the security of your data by making it only available to the user because it is offline. It is only Vyapar who has access to it.

Here are some of Vyapar’s most valuable features.

a. Use payment reminders to organize and manage your payments and transactions.

b. You can better manage your inventory with customization options for your unique business.

c. Create and print invoices in a variety of formats and styles using a variety of printers.

d. For more information, go to Vyapar or download the app.

2. Swipe – Billing and Payments

Swipe is a free and straightforward GST billing software for businesses. Swipe allows you to create invoices, purchases, and quotations in under 10 seconds and also share them directly with customers/vendors via WhatsApp, SMS, and email. Swipe app simplifies managing your billing, customers and vendors, payments, accounting, stock, and GST return.

Swipe allows you to generate GST reports and file your returns instantly. Customers can be sent payment links and even QR codes, and payments can be collected quickly using UPI and 100+ payment methods. It is simple to send payment reminders.

Swipe assists you in creating an online store and growing your business. You can create your product catalogue and e-commerce store with many product images, pricing, discounts, and offers that you can share with your customers to place online orders instantly.

Swipe provides all the business analytics and reports you’ll need for your company. Swipe is available on both the web and mobile platforms and can be accessed from any device at any time.

Swipe’s Best Features

In less than 10 seconds, create an invoice. Personalized invoices, Multiple invoice templates, credit/debit notes, a delivery challan, and a GSTR report are all available. Send bills via WhatsApp, SMS, and email.

Payment reminders, an integrated payment gateway, a payment ledger, POS billing, A4/A5 and Thermal Print, Edit bills, recurring invoices, estimates, quotations, and proforma invoices are all examples of invoices.

Keeping track of inventory and stock, Unlimited Logins, Products/Bulk Uploads, and Customers Multiple accounts for multiple users/businesses, Multiple GST Accounting, Multiple Price Lists (Wholesale/Retail), Customer/Vendor Details Manage expenses, profit and loss, and generate 25+ reports.

Real-time business analytics Online store with order management. Create and print barcodes for products. Include product categories and variants. SMS campaigns, E-way bills, and E-invoices are all options.

3. Swipez

Swipez is eager to assist you in streamlining your business processes. It recognizes that today’s clients expect high-quality service from their main service providers. It is like you to pay mere attention to their needs and improve your services regularly.

Its goal is to provide the resources you need to retain and upsell your current customers. Hundreds of service providers now use swipez to handle every aspect of their business, from website development to bill presentation, customer data management to payment collections and cross-channel payment reconciliation. Swipe consolidates your customer, accounting, and collect data under one roof, allowing you to increase customer value to new heights.

Swipez automates company operations, simplifies work, and allows businesses to focus on their core competencies, resulting in a simple and quick revenue collection system.

It helps a growing customer base, ranging from small and medium-sized businesses to divisions of more giant corporations, maximize their existing resources and exceed their income targets. It offers various services to assist companies in the running more efficiently, such as invoicing, bulk payments, payment collections, customer data management, GST filing, and more.

It believes investing in people is the most effective way to build a productive, results-oriented workplace. As a result, its hands-on engineering staff in Pune and Mumbai is committed to continuously improving our products. It keeps things lighthearted while remaining serious about our work. It is a mission to work together to solve today’s and tomorrow’s business problems.

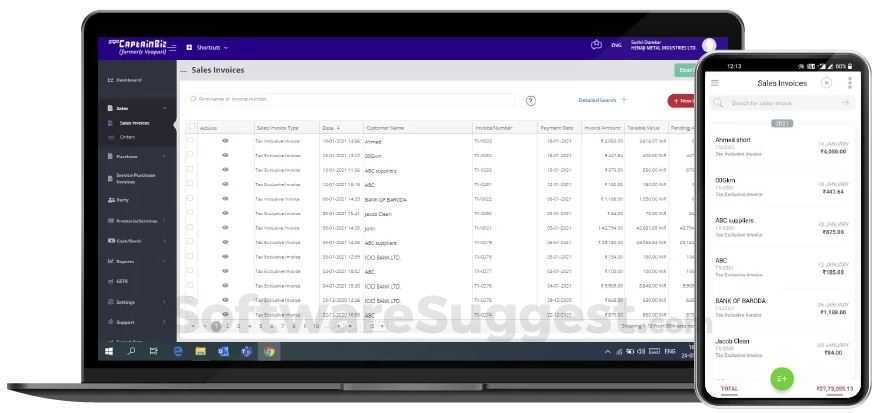

4. CaptainBiz

CaptainBiz is a GSTN-certified and verified pre-accounting and billing solution. It’s a straightforward pre-accounting program that lets you record and executes sales, purchases, accounting transactions, and GST reports.

This GST-compliant pre-accounting program allows you to manage your business processes and send all error-free and accurate invoices. For timely GST Returns filing, provide timely data to your GST Practitioner/Tax Professional or Accountant. The CaptainBiz App is completely GST-compliant.

All inbound and outbound operations, including purchase orders, sales invoices, material deployments, and financial transactions, are fully compliant with the GST.

It also makes it easier to generate online sales invoices and compile required GSTR reports. CaptainBiz uses automated report production tools to help organizations monitor inventories, conduct audits, and manage inbound and outbound activities. The app is also available for many Android smartphones and POS terminals.

CaptainBiz can be installed on any mobile device with just three clicks. Based on previous GST return filings, the master data is easily imported and produced for current taxpayers.

CaptainBiz is designed explicitly for Indian SMEs and MSMEs, ensuring long-term success for all entrepreneurial businesses. CaptainBiz provides complete security through secure logins, user access privileges, and essential security procedures. CaptainBiz helps small and medium-sized businesses establish themselves professionally and run their businesses smoothly and efficiently.

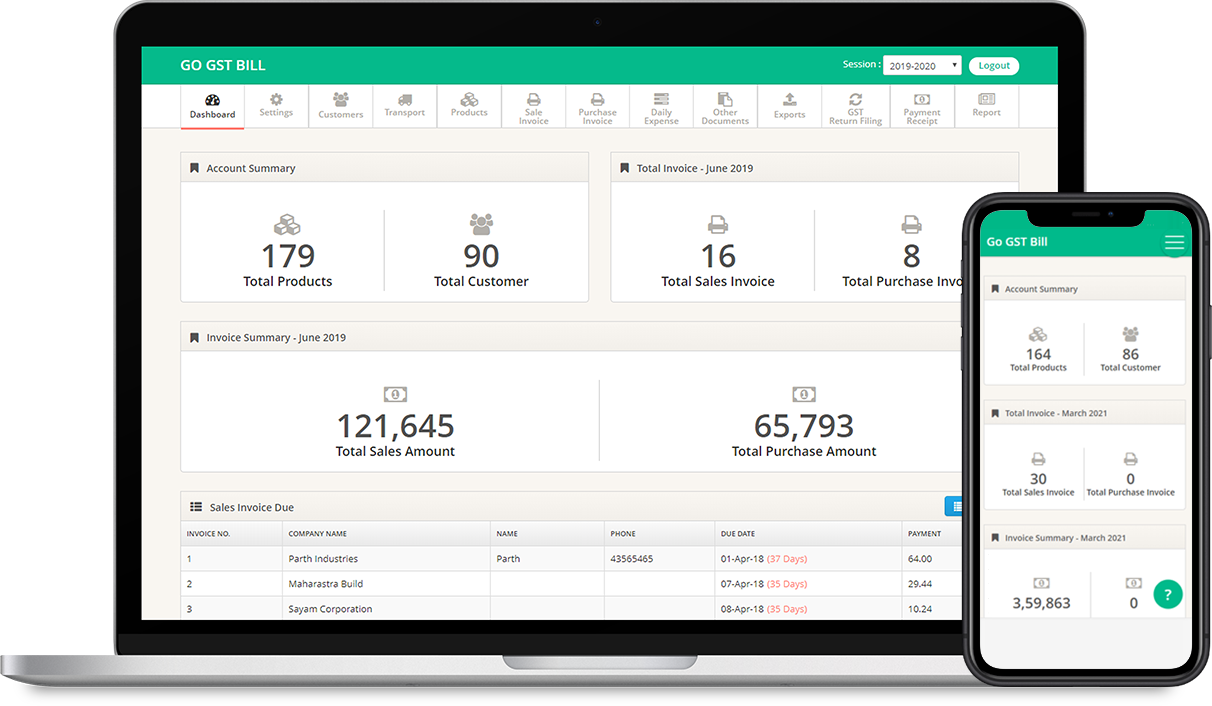

5. goGSTbill.com

Because of the recent GST reforms, it was created specifically for the Indian market. It has everything you need, from product management to calculating and creating beautiful customer bills. It is safeguarded by solid encryption techniques and includes daily backup functionality. There will be no stress or coworkers.

goGSTbill.com is a free online GST billing program that you can use for the rest of your life. It is entirely secure with a Complex Encryption Algorithm and Strong Firewall Rules.

It is simple to register for gogstbill.com. It will only take 2 minutes to begin creating your beautiful GST invoice with gogstbill.com.

We also offer simple phone support if you have questions about the software or need help with your gogstbill.com account.

goGSTbill.com provides

- You can add as many customers/vendors as you want. You can also enter an unlimited number of items, each with its Sell Price, Purchase Price,also GST percentage, and HSN code.

- Sales Invoice: You can create an infinite number of stunning sales invoices, and the quantity will be automatically deducted from stock.

- Purchase Invoice: You can upload an unlimited number of purchase invoices, and the stock amount will be automatically credited.

- Stock – quickly determine the total number of available goods.

- Daily Expanse – This app will help you keep track of your entire daily expanse.

- Delivery & Quotation Quotation & Delivery Challan Challan is easy to make.

- It also has a straightforward backup function that allows you to export all of your data to an Excel file anytime.

- Yes, it is free for the rest of your life, including all new features and upgrades.

6. Cleartax

ClearTax billing software also makes keeping track of payments simple. It allows you to keep track of all prices and invoice information. ClearTax also will enable you to send automated reminders to ensure that your company does not incur financial losses.

Cleartax offers everything from GST return simplification to error-free automatic ingestion and sophisticated reporting to ERP integration.

Every time you use ClearTax, you can save up to 7% on taxes and an average of 4% on GST. It is three times faster than other options and can save up to two person-months per GSTIN per month.

ClearTax offers multi-validation at every stage of the process and has been reviewed by over 60 specialists. It can match 6000 invoices in less than a minute, find 100% tax credits, and generate more than 25 intelligent reports.

ClearTax was developed in-house by a team of 60+ chartered accountants and 200+ engineers. In as little as currently seven minutes, it can help you save the most money on taxes. It offers IT return filing, mutual fund investing, and expert assistance. Small and medium-sized businesses can also use its GST, e-invoicing, and e-waybill services.

ClearTax Invoicing Software Advantages

Here are some of the features provided by ClearTax software.

a. Create GST-compliant invoices: ClearTax allows you to create detailed GST-compliant invoices as a business owner.

b. GST Returns ClearTax billing software allows you to file GST returns automatically by aggregating your financial data.

c. Payment Monitoring: ClearTax allows you to track pending payments and communicate with customers.

d. Inventory Control: ClearTax has a clear stock management tool that automatically updates your inventory as you create new invoices.

The Benefits of ClearTax Invoicing Software

The following are, moreover, some of the benefits of using Cleartax invoicing software.

- ClearTax Invoicing enables business owners to access their data from any location. It allows users to track their transactions anywhere and at any time.

- To keep your all data safe from prying eyes, it employs 128-bit SSL-encrypted security technology.

- ClearTax is a multi-user interface that enables project collaboration.

- It is GST compliant and allows you to track changing tax rates.

- ClearTax includes a backup system that stores all your data in the cloud.

- ClearTax invoicing software is priced starting at Rs. 3000.

7. Zoho Books

Zoho Books is also sophisticated online accounting software that can assist you in automating business procedures, streamlining back-office operations, and securely communicating with your accountant online.

Zoho Books is a free online accounting program that can assist you in managing your finances. You can keep track of your sales and also costs and generate important financial reports such as a profit and also loss statement, a balance sheet, and a cash flow statement.

Zoho Books allows you to collaborate with coworkers, accountants, and customers. Businesses can use the Client Portal in Zoho Books to send estimates, invoices, and customer statements directly to their customers. Workflows can also automate repetitive tasks like reminding clients about late payments or sending notifications about significant sales.

Businesses can avoid duplicating data entry in these programs by utilizing Zoho Books, pre-integrated with mainly Zoho Expense, Zoho Subscriptions, and Zoho CRM.

Companies can use the Zapier connector to connect Zoho Books to their favourite app. Using Zoho Books’ two-factor authentication, you can keep your financial data extremely secure. Zoho Books is available for iOS, Android, and Windows. The Zoho Books app is now available in the Amazon app store, making it easier for business owners to stay more connected to their company from anywhere.

Zoho Books has the following features:

- Invoices can be sent professionally.

- Accept payments via the internet.

- Keep track of your expenses.

- Document Management Workflow Automation

- Real-time inventory tracking is possible.

- Connect your bank account to Zoho Books for real-time cash flow updates.

- The Profit and also Loss Statement, Balance Sheet, and Cash Flow Statement are all accessible financial reports.

- Apps are available for iOS, Android, and Windows Phones.

- Zoho provides a comprehensive set of business solutions to assist you in increasing productivity and also staying ahead of the competition.

Advantages of Using Zoho:

- Connect remotely to save time and money! With Zoho Assist, you can provide remote assistance to customers via web-based, on-demand small sessions.

- Maintain vigilance over inventory management! Businesses can use Zoho Inventory to manage orders, inventory, and stay GST-compliant.

- Organize projects efficiently and on time! Zoho Projects’ extensive project management tools assist in monitoring project tasks, tracking progress, and facilitating seamless team collaboration.

- Keep track of your expenses! Zoho travel and cost management software streamlines corporate operations and aids businesses in auditing, budgeting, and spending control.

- Now is the time to simplify your billing processes! Zoho Invoice is an advanced GST invoicing software for small businesses that comes with pre-built invoice templates.

- Increase efficiency by automating accounting operations! Organizations can use Zoho Books to help with financial management, cross-departmental collaboration, and GST compliance.

- Manage your customers’ subscription billing lifecycles with ease! By automating recurring billing operations, Zoho Subscriptions enables organizations to automate subscriptions and save time, money, and effort.

8. ProfitBooks

Accounting entails more than just keeping track of your transactions; it also entails figuring out how to make more money! ProfitBooks’ user-friendly design keeps you in control of your business no matter where you are. On your mobile device, you can view critical financial statistics such as the balance sheet and profit and loss.

- Determine which product is the most profitable.

- Determine your most valuable customer.

- Maintain a record of your payables and receivables.

- Spend no more than two hours per day on physical labour.

- Determine the amount of main Service Tax, VAT, and also other payable or receivable taxes in a matter of seconds. Detailed reports are only a few mouse clicks away and can be accessed at any time. You can create professional invoices and email them to your customers with a single click.

- Customers are the lifeblood of any business. ProfitBooks makes it simple to manage all of your clients in one place. You can generate a statement and examine the numerous transactions logged for a specific client. Similarly, you can manage employee leaves, run payroll, and even print pay stubs with a few mouse clicks.

ProfitBooks’ distinguishing characteristics include the following:

- Sales Order Management Tasks and Projects

- Dropbox document management integration

- Support is only a single click away, and there’s a lot more.

- ProfitBooks is a relatively secure platform. Constantly available Thousands have placed their trust in us!

- ProfitBooks is cloud-based, so you can access your data from any location and at any time. ProfitBooks is accessible via mobile phones, tablets, and other internet-connected devices. Data is transmitted over a 256-bit encrypted HTTPS connection to ensure maximum security. To protect data and provide secure access, our data servers employ five layers of security.

9. Easy GST- GST Ready Accounting

If you are a very small business, a person, or an accountant, the correct answer is simple. Refrain from squander your money on high-priced solutions from industry titans. It serves as a one-stop shop for all of your requirements. We cover everything from accounting to payroll to invoicing. Everything is provided. There are no extra charges for any add-ons.

It is a growing and enthusiastic company based in central London, and our goal is to provide small businesses and accountants with a low-cost, powerful, and simple accounting solution. It provides accurate figures to small businesses at any time and in any location. Small businesses are at the global economy’s heart, acting as the engine that propels it forward.

It aims to provide fantastic tools and also information to small businesses in order to help them grow. As a result, it collaborates closely with them to make Easy a unified platform for all businesses. Easy has grown day by day and year by year, with more simplicity and user-friendliness at its core, since its inception in 2008. We can help businesses from all over the world because we have over 10,000 subscribers.

10. HostBooks GST

HostBooks GST mainly aims to provide fantastic tools and also information to small businesses in order to help them grow. As a result, it collaborates closely with them to make Easy a unified platform for all businesses. Easy has grown day by day and year by year, with more simplicity and user-friendliness at its core, since its inception in 2008. It can help businesses all over the world with over 10,000 subscribers.

GST HostBooks Advantages

- The GST audit report

- Bank-Grade Security for GST Compliance Built-in error detection for HSN and SAC codes

- The mobile app makes reconciliation simple.

- Integration with email for document printing for billing and invoicing

- Invoice for GST

A GST invoice is a bill or receipt for goods or services provided to a customer by a seller or service provider. It specifically lists the services/products as well as the total amount owed. A GST invoice can be used to determine product or service prices before CGST and SGST are applied.

A GST invoice bill also shows the amount of taxes levied on each product or service purchased from the seller or provider.

GST Bill Formats Prescribed

To understand the main exact format of a tax invoice, one must also refer to Section 31 of the Central Goods and also Services Tax Act of 2017. Section 31 provides a general guideline for GST invoice formats but does not go into detail.

Section 31 does, however, specify the requirements or entries that such an invoice must include in order to qualify as an official GST document. Furthermore, such an invoice can be both electronic and manual.

What information should a GST Invoice Bill contain?

The following points must be included in such a bill:

- An input distributor should issue this invoice.

- All current additional bills/invoices

- Any previous revisions to the main invoice generated by the supplier.

- Aside from these sections, a GST tax invoice must also include the following information –

- GSTIN, name, and address of the GST invoice-issuing supplier

- Date of publication

- A unique serial number of no more than 16 digits.

- In the case of most registered recipients, this bill should also include the receiving party’s name, GSTIN, and address.

- A detailed description of all services or goods provided, including the HSN code.

- If applicable, the amount of the discount on these taxes.

- The tax amount.

- Invoice estimation.

- The rates for CGST, SGST, and IGST should be specified on this bill.

- The billing address and details.

- Shipping information and address.

- Reverse or forward charging.

- The signature of the tax invoice issuer or an authorized representative is required.

When is it appropriate to issue a GST invoice?

In some cases, it can be difficult to generate a GST invoice as soon as items are all shipped or services are rendered. As a result, the Indian government has been established a general time limit for suppliers to adhere to.

Goods suppliers must create such an invoice on or before the date the products are removed. Removal of goods can also mean one of two things under Section 2 (96) of the current CGST Act of 2017.

The goods have been dispatched for main delivery to the recipient. Goods collected from the main supplier by the recipient or an authorized representative acting on the recipient’s behalf.

If the invoice is for a recipient with whom the supplier has a regular order of business, the supplier may issue an invoice under GST on or also before the main account statement is also generated or payment is received.

In the case of a main GST invoice bill for all services rendered, the bill must be also issued within 30 days of the services being rendered.

In the case of financial services provided by all banks and also other financial institutions, the deadline for currently issuing a GST receipt is 45 days from the date of service supply, rather than 30 days as it is for all other services.

Copies of Goods Supply Invoices

If a GST invoice for goods supply is issued, the issuer must make three copies for the following parties involved in such transactions:

The recipient will receive the original copy. The duplicate copy is for the individuals in charge of transporting the goods from the supplier to the recipient.

The supplier will benefit from the triplicate copy. Copies of Service Supply Invoices

Because no transporters are involved in the supply of a service, issuers only need to create two copies of the GST invoice bill.

The original document is the property of the service recipient. The supplier keeps the duplicate for internal use.

Creating a New GST Invoice

Revised tax invoices can be raised against issued invoices under Rule 53 of the CGST Act, 2017. The revision of the GST invoice bill may result in a decrease or increase in the prices of goods or services supplied. It may also result in a change to the CGST/SGST/IGST rates that were previously applied to this bill.

A revised GST invoice must include the following information:

- ‘Revised Invoice’ should be noted on this bill wherever applicable.

- GSTIN, address, and supplier name

- The date the document was issued.

- The document’s nature.

- A registered recipient’s name, GSTIN/UIN, and address

- The date and serial number of the associated GST invoice.

- Shipping information and address

- A serial number that is unique and consecutive and does not exceed 16 characters.

- The issuer’s or authorized representative’s signature is required.

When is it not necessary to issue a tax invoice?

Only under the following two conditions can a supplier avoid issuing a GST invoice:

- The transaction’s recipient is unregistered.

- When the recipient expresses a desire not to receive such an invoice.

- Keep in mind that a supplier must meet both of these criteria in order to avoid the legal requirement of issuing a GST invoice. Instead, at the end of each day, the registered supplier can issue a consolidated tax invoice for all such supplies in question.

Invoice Varieties

A bill of supply is similar to a GST invoice, except that it does not include any tax amount because the seller cannot charge GST to the buyer.

When the aggregate or bulk invoice value of multiple invoices is less than Rs. 200 and the buyer is unregistered, the seller can issue an aggregate or bulk invoice for the multiple invoices every day.

When the amount payable by the buyer to the seller increases, the seller issues a debit note. When the value of the invoices decreases, the seller issues a credit note.

Systems prior to and the following e-invoicing

Prior to the implementation of e-invoicing, businesses generated invoices using various software, and the details of these invoices were manually uploaded in the GSTR-1 return or using ERP.

The invoice information is reflected in GSTR-2B for the recipients once the respective suppliers file the GSTR-1. The consignor or transporters, on the other hand, had to generate e-way bills by manually or through ERP importing the invoices in Excel or JSON.

The process of generating and uploading invoice details will remain the same under the e-invoicing system. It is accomplished through the use of the Excel tool/JSON or through API integration, either directly or through a GST Suvidha Provider (GSP). The data will flow seamlessly for GSTR-1 preparation as well as e-way bill generation. The e-invoicing system will be the primary tool for accomplishing this.

Obtaining an electronic invoice

The stages involved in creating or raising an e-invoice are as follows.

The taxpayer must use the reconfigured ERP system in accordance with PEPPOL standards. He could work with the software service provider to incorporate the e-invoicing standard set, i.e. e-invoice schema (standards), and must have the mandatory parameters notified by the CBIC at the very least.

Any taxpayer has primarily two options for generating IRNs:

The computer system’s IP address can be whitelisted on the e-invoice portal for direct API integration or integration via a GST Suvidha Provider (GSP) like ClearTax.

To bulk upload invoices, download the bulk generation tool. To generate IRNs in bulk, it will generate a JSON file that can be uploaded to the e invoice portal.

Following that, the taxpayer must generate a regular invoice for that software. He must provide all necessary information, such as billing name and address, GSTN of the supplier, transaction value, item rate, GST rate applicable, tax amount, and so on.

After selecting one of the above options, create an invoice in the appropriate ERP or billing software. After that, upload the invoice details, particularly mandatory fields, to the IRP using the JSON file, an application service provider (app or GSP), or a direct API. The IRP will serve as the central registrar for electronic invoicing and authentication. There are several other ways to interact with IRP, including SMS and mobile apps.

IRP will validate the B2B invoice’s key details, look for duplicates, and generate an invoice reference number (hash) for future reference. IRN is generated based on four parameters: the seller’s GSTIN, the invoice number, the fiscal year (YYYY-YY), and the document type (INV/DN/CN).

IRP generates the invoice reference number (IRN), digitally signs the invoice, and generates a QR code for the supplier in Output JSON. The supply seller, on the other hand, will be notified of the e invoice generation via email (if provided in the invoice).

For GST returns, IRP will send the authenticated payload to the GST portal. Details will also be sent to the e-way bill portal, if applicable. The seller’s GSTR-1 is automatically filled out for the applicable tax period. This, in turn, determines the tax liability.

A taxpayer may continue to print his invoice with a logo as is currently done. The e-invoicing system only requires all taxpayers to report invoices in electronic format on IRP.