Top 10 biggest scams of all time, in the USA

Internet fraud may be equated to cybercrime or deception that uses the Internet. It could involve hiding information or giving out wrong information to get money, property, or an inheritance from a victim. Internet fraud is not a single, distinct crime. Instead, it includes many illegal and wrong things that people do in cyberspace. However, it is not the same as theft because the victim voluntarily and on purpose gives the information, money, or property to the thief. It is also different because the offenders are in different places and at different times.

The FBI’s 2017 Internet Crime Report says that about 300,000 complaints were sent to the Internet Crime Complaint Center (IC3). In 2017, people were scammed online and lost more than $1.4 billion. According to a study done by the Center for Strategic and International Studies (CSIS) and McAfee, cybercrime costs the global economy as high as $600 billion, which is 0.8% of the total global GDP. There are many kinds of online fraud. It includes things like spam emails and online scams. Internet fraud can happen even if it is only partly based on using Internet services or if it is based mostly or entirely on using the Internet.

Internet ticket fraud

Internet marketing fraud involves selling tickets to popular events like concerts, shows, and sports games. The tickets are either fake, or they are never sent. This kind of fraud has grown because there are more online ticket agencies and more experienced and dishonest ticket resellers. Though they may be based in other countries, many of these scams are run by ticket touts from Britain.

The 2008 Beijing Olympic Games ticket scam, run by a company called “Xclusive Leisure and Hospitality” and sold through a website called “Beijing 2008 Ticketing,” was a good example.

On August 4, it was said that fake tickets worth more than A$50 million had been sold through the site. 12: On August 6, it was said that Terance Shepherd, a British ticket broker, was behind the scam, which took place outside of China.

Online gift card fraud

As retailers and other businesses worry more and more about what they can do to prevent people from making use of stolen credit card numbers to buy gift cards, cybercriminals have been focusing more and more on taking advantage of fake gift cards.

More specifically, hackers with bad intentions have been trying to get their hands on information about gift cards that have been given out but not yet used. Some of the ways that gift card data can be stolen are through automated bots that launch brute-force attacks on the systems that store them at retailers.

First, hackers steal gift card information. Then, they use a retailer’s online service to check the balance and try to use the money to buy goods or sell them on a third-party website. When gift cards are sold again, the thieves take the remaining balance in cash, which can also be used to launder money.

This hurts the gift card experience for customers and how people think of the store’s brand. It can also cost the store thousands of dollars in sales. Gift card fraud can also happen when someone steals a person’s credit card information and uses it to buy brand-new gift cards.

Let’s talk about the Top 10 Biggest scams in the USA of all times

-

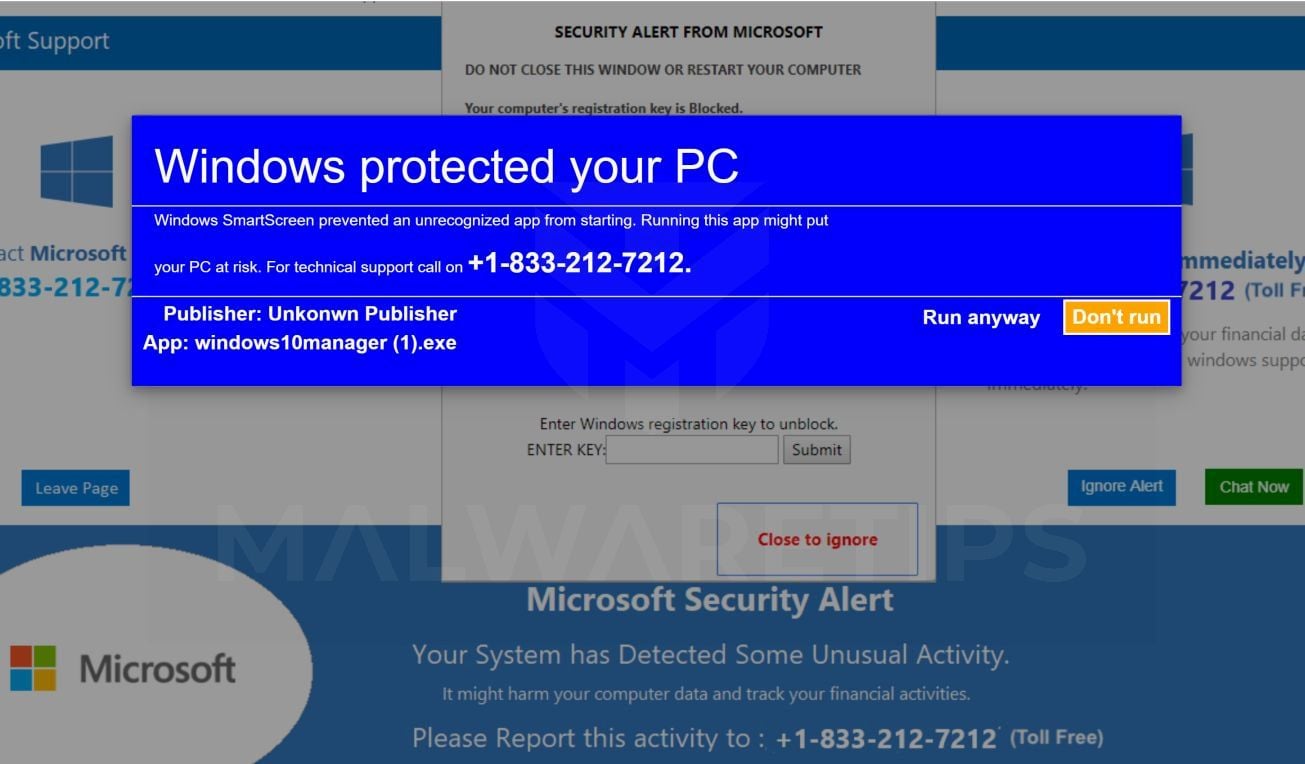

Computer Tech Support scam (Variation)

The scam: A variation on the typical Computer Tech Support scam. You get a phone call, text message, or email from a computer saying that you have been charged for an online order, have a balance on your account, or sent something you didn’t order. The scammer then tells the person to call a number given in the scammer’s messages to get a refund or fix the problem. At this point, they will either ask you for your card number to “confirm your account” or asks you to let them access your computer remotely. Once the scammer has remote access to your device, they can see every document, file, and transaction you’ve saved on it.

How to tell if it’s a scam: Companies won’t call tech support unless you’ve asked them. Check your transaction history to see if you were charged for a package you don’t remember ordering. Packages that don’t have a return address are a big red flag.

What to do:

- Don’t call back and hang up the phone right away.

- Do not click on any links in an email or text message about a package delivery or order you have made. The email should be marked as “Junk” or “Spam.”

- Never give remote access to your device to people you don’t know. If you are worried about charges that have been made to your account, you can log in to your account and talk to your bank.

- If you get a package you didn’t order, mark it “return to sender” and give it back to the mail carrier

2. Social Security Number Phishing

The scam: You get a phone call (often a robocall) saying that your Social Security number has been used in a crime or to commit fraud. The caller may even say that you’ll lose your benefits or that they’ll run out.

To spot the scam: Social Security and government agencies usually contact you by mail before they call you. So usually, you call them first, not the other way around. They also wouldn’t use threats to get information or money from you.

What to do:

- Check it out when you get a contact you didn’t ask for.

- Don’t give personal information to people you don’t know.

- Report robocalls to CAP so that they can be stopped.

3. Computer Tech Support (Traditional)

The scam: You get a phone call, a pop-up, or an email from a well-known tech company like Norton, Microsoft, Apple, or another. They will say things like your electronic device has a virus, your device security subscription has been automatically renewed, or you have been charged for services you did not receive or ask for. You might be asked to click on a link or call a number. Then, they will try to get you to give them remote access to your device so they can fix the problem. Sometimes they will even ask for payment right away.

How to spot the scam: Legitimate tech support companies don’t send messages to their customers by popping up on your device at random. Tech support won’t call you about security problems or that your account has been renewed for a service you don’t know about. They also won’t send you random links, often shortened URLs, with instructions to click on them.

What to do:

- If someone contacts you about a supposed business relationship, check it out, especially if you don’t remember signing up for services.

- Never click on links in emails or pop-up messages from people you don’t know or give them remote access to your computer. If you got a pop-up message that you can’t get rid of, you can’t close it, restart it, or unplug it.

- If “tech support” calls you, don’t answer.

- Be careful when looking for help with technology online.

Some people have been tricked when they call fake phone numbers they found on the internet.

4. Legal Authority Imposter

The scam: Someone calls you out of the blue and says they are a police officer, a U.S. Marshall, U.S. Customs and Border Protection, or a lawyer with legal power. The person calling you says that you will be arrested or sued. When you agree to something, you have to pay right away to make the problem go away. Even if you pay them, it doesn’t solve the problem, and they keep calling.

How to spot the scam: If the police had a warrant out for your arrest, they would not tell you ahead of time. If you were being sued, the papers would be given to you without warning.

Know what your rights are. Harassing debt collectors is against the law, and collectors can’t make claims they can’t or won’t follow through on. Stop all threats and tell the police.

5. Sweepstakes/Lotteries

The scam: You will get a phone call, an email, or a letter telling you that you won a prize or a certain amount of money. In some cases, you might even get a check that looks real but isn’t. To get your award, you have to pay fees and give information about your finances and yourself. Often, they use the name of real sweepstakes, like Publishers Clearing House.

How to spot the scam: If you win a big prize from sweepstakes or a contest run by an honest company, like Publishers Clearing House or the Mega Millions lottery, the company will contact you in person. For prizes worth less than $10,000, winners are notified by certified mail or overnight delivery services (FedEx, UPS). They won’t call you or ask for a payment or processing fee before giving you your prize.

What to do: If something seems too good to be true, it probably isn’t. You don’t have to pay any fees or give any financial information to claim a prize.

/identity-theft-in-asia-56fe41915f9b586195f2a98d.jpg)

6. Identity Theft

The scam: You get a letter that says you have asked for government benefits, opened a bank account, filled out a credit card application, or been told about a security breach. Sometimes, you’ll stop getting bills and other important mail, or you’ll start getting bills for products and services you didn’t ask for.

How to tell if it’s a scam: Be wary of phone calls, mail, and emails you didn’t ask for that tell you about unexpected bank transactions, credit card applications, or applications for benefits. Report it if your bills don’t come when you expect them to or if you get mail in someone else’s name.

What to do: Don’t give out personal information like your Social Security number, passwords, unique identification numbers, and financial accounts. At least once a year, you should look at your credit report. Check your bank account statements and benefits carefully to ensure transactions are correct. Shred them before you throw away old papers and credit cards that are no longer valid. Check the Attorney General’s website to see if the security breach letters you got are actual. If a thief steals your information, you should take steps to protect yourself from identity theft.

7. Online Listings

The trick is to fake websites or fake ads on sites like Facebook Marketplace and Craigslist, trying to get you to buy something that sounds too good to be true. This scam can also be found in online rental ads or when a buyer offers a lot more than the item is worth. As a seller, the fake buyer sends a phoney check or uses a stolen credit card to pay you. They then ask you to send money to another fake vendor, which means you lose the money.

Tell if it’s a scam: Be wary of deals that seem too good to be true. Be careful if someone asks you for money (gift cards, wire transfers, cash) when they are not there in person. Most scammers won’t want to talk on the phone or meet face-to-face. Pay attention to what people say in user reviews and other online comments.

What to do: To be safe online, you have to do a little detective work to figure out if an offer is genuine. First, find out more about the person selling the item. If their profile is new and doesn’t have any photos or friends, they are probably trying to scam you. Next, look up online reviews and state business registrations for any different websites you’re thinking of doing business with. Take note of how long the company has been in business. Next, look up the business online using the words “scam” and “complaints” to see if there are any problems. Finally, do your business with cash, preferably in person and in a safe place.

8. Medicare Cards Phishing

The scam: Scammers will pretend to be from Medicare and call you, often with a live call and a fake caller ID number, to get your personal information and money. Most of these scams happen during the open enrollment, but they can happen at any time of the year. The scammers will say they need your Medicare card or Social Security number to keep your coverage active and check your medical information. The calls could also say that coverage is about to end or needs to be renewed. Scammers may also ask if you got a “new Medicare card,” which is sometimes called a “gold card” or a “red, white, and blue card.”

How to tell if it’s a scam: Medicare cards don’t usually expire. Medicare won’t call you unless you’ve reached the 800 number on your card and asked to be called back. If you need to talk on the phone, the Social Security Administration will send you a letter telling you when to call. Representatives from Medicare will never contact you to check your information, sell you something, tell you that your coverage is ending, or give you a new card.

What to do: Don’t give your Medicare number or any other personal information or payment to people who call you who you don’t know. In Vermont, Medicare questions can be answered by calling 1-800-642-5119 to talk to someone from the State Health Insurance Assistance Program (SHIP). If you have any other questions or concerns about Medicare coverage, you can call 1-800-MEDICARE and talk to someone there. You can also tell the Federal Trade Commission about this scam.

9. Family Emergency/ Imposter

The scam: Thieves pretend to be someone you know and trust and say they are in trouble to get you to send them money or do them a favour. These con artists pretend to be grandchildren, friends, family members, or close contacts, and they look like the real thing. Scammers pretend to be people you care about and use your fears to get you to send money quickly. After the first call, you may be told that a lawyer, parole officer, or courtroom worker may call you to find out more.

Tell if it’s a scam: People contact you by phone, email, or online message. Sometimes it’s someone you haven’t seen or talked to in a long time. They need to be done quickly and ask for privacy. You might not be able to call your friend or family member.

What to do:

- Do things to check.

- Even if they sound like a loved one, check to see if they are who they say they are.

- Slow down and talk to someone you trust to find out if there is an emergency. You can also choose a “code word” with your friends and family to ensure the person is who they say they are.

They are not your friend or family member if they don’t know the word.

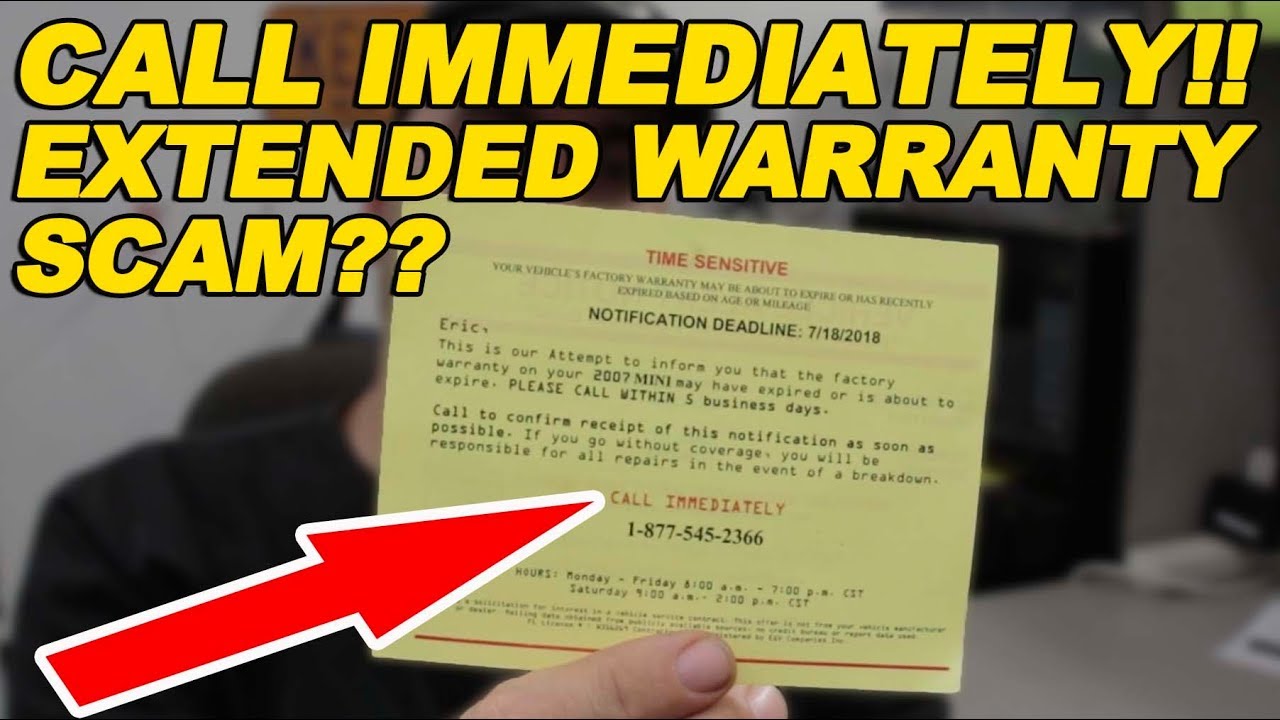

10. Auto Warranty Expiration

The scam is that you get a call or letter from people pretending to be from auto dealers, manufacturers, or insurance companies. They can try to get you to renew your auto warranty or insurance or say that your contract has ended. Instead, you might be told to press a number or stay on the line until someone who sounds like a natural person answers. When these scammers get in touch with you, they may ask for information about you and your car and information about your finances so that they can pay off this fake claim.

How to tell if it’s a scam: Keep in mind that only the company that made the car can extend the factory warranty. Don’t answer any phone call or letter that says you need to act right away to keep your car’s warranty.

What to do: If you have any type of questions about your car or its warranty, call the number on the paperwork you got when you bought it. You can also talk to the dealership where you purchased the vehicle to learn about the warranty. Stop talking to or throwing away any strange mail or person who claims to know about your car warranty. Do not give out any type of personal or identifying information unless you are sure you are dealing directly with a business you know and trust.