Top 10 Best Unicorns In Malta

Top 10 Unicorns In Malta

Unicorns: In the Mediterranean Sea, there are more than 200 islands that makeup Malta. Although it is the smallest country in the world, many tech entrepreneurs flock to it. In recent years, Malta has become a hotspot for European startups. However, there is much more to the Maltese startup ecosystem than iGaming and blockchain.

Malta’s economy suffered a significant impact from the pandemic since it is also a popular tourist destination. It is worth noting, however, that many innovative startups continue to flourish on the island despite this setback, providing more jobs for the locals.

According to a recent Eurostat study, small and medium-sized enterprises (SMEs) in Malta use the Internet for promotional purposes more than any other EU country. A study found that 46% of Malta’s SMEs advertise online, while 71% do so using social media. Digital marketing services for iGaming are also very popular.

- Singular

This show is also the launch of the company’s fourth generation of sports betting solutions. In addition, the company also opened its second office in Malta to expand into this gaming hub.

This show is also the launch of the company’s fourth generation of sports betting solutions. In addition, the company also opened its second office in Malta to expand into this gaming hub.

Furthermore, Singular will showcase its complete product portfolio, which includes online casino games, back-office tools, and a comprehensive gaming platform.

Dowling said: “In addition to record attendance and exhibitors, SiGMA has an engaged network throughout the year.” Our 2020 product updates will be launched from this particular event.

In addition to being excited to be back on the exhibition scene, we are eager to share information about the new release with potential partners and clients.”

Singular is bringing player personalization to a new level with its new Sports Betting Platform. As part of the campaign, Singular will reveal for the first time what motivates their company slogan, “Be Outstanding.”

As SiGMA’s founder and group CEO, Eman Pulis, said: “We are honored to have the trust of the industry’s movers and shakers. Throughout SiGMA and the year, I look forward to connecting quickly with pertinent industry players through Singular.”

Company overview

|

Legal Name |

Singular |

|

Industries |

Advertising, Analytics, SaaS |

|

Founder(s) |

Eran Friedman, Gadi Eliashiv, Susan Kuo |

|

Founded Date |

Jan 2014 |

|

Total Funding Amount |

$50M |

|

Investors |

Number of Investors 8 |

- FRVR

A funding round led by Hiro Capital raised $76 million for casual games platform Frvr.

A funding round led by Hiro Capital raised $76 million for casual games platform Frvr.

In addition to Accel, the Makers Fund will contribute to the investment, which will help secure more “high-quality” titles.

Due to Chris Benjaminsen’s departure from Yahoo as director of product and monetization for games and Brian Meidell’s departure from Cape Copenhagen, Frvr was launched in 2017.

Mobile and browser-based HTML games are available from the company. According to the announcement, 1.5 billion players have joined the platform since it launched.

A seed round led by Accel and Makers Fund raised $3 million in 2018, intending to enter Asian markets.

Developer Twin Suns Corp and Frvr received a $6.4 million investment from Hiro Capital last year.

Company overview

|

Legal Name |

FRVR Limited |

|

Industries |

Android, Casual Games, Electronics, Gaming, Software, Video Games |

|

Founder(s) |

Brian Meidell, Chris Benjaminsen |

|

Founded Date |

Aug 13, 2014 |

|

Total Funding Amount |

$82M |

|

Investors |

Hiro Capital and Makers Fund are the most recent investors. |

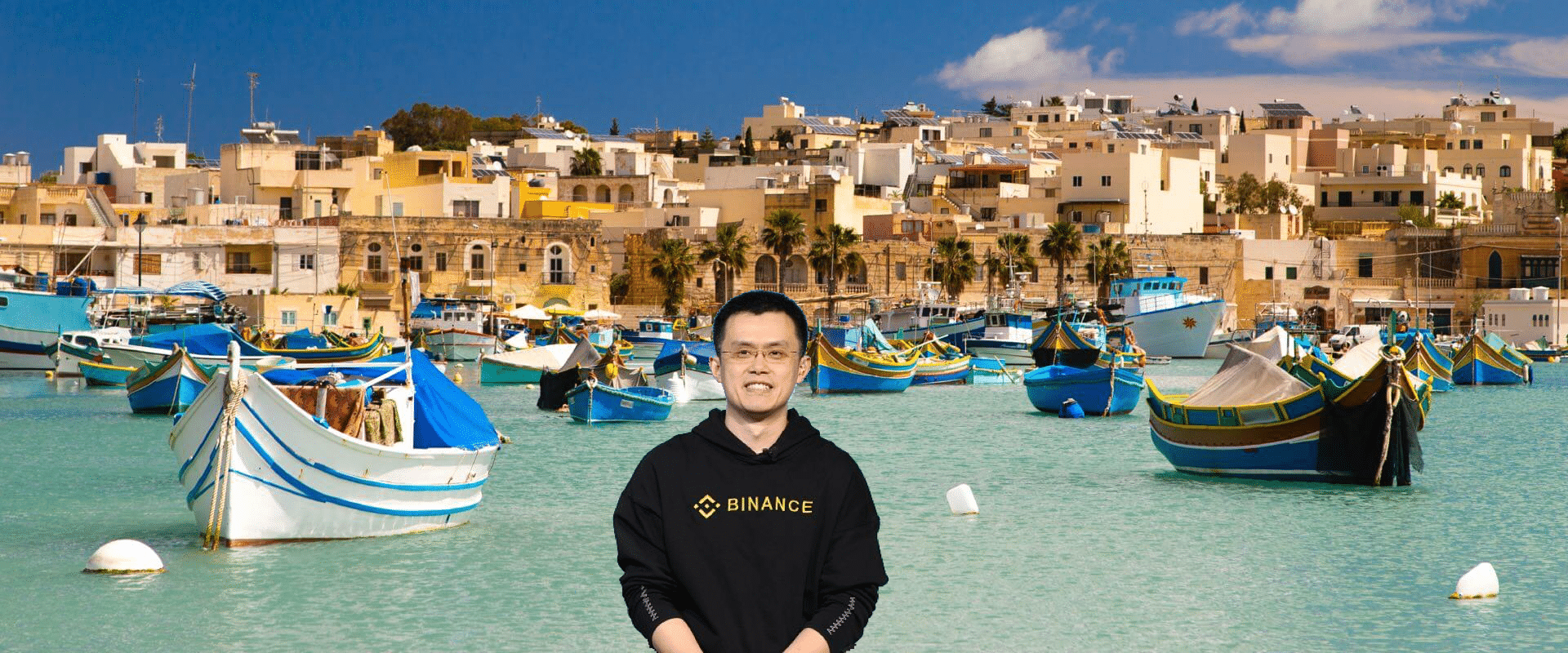

- Binance

Binance is the most popular cryptocurrency exchange for traders today. Its safety and reliability are therefore so frequently requested.

Binance is the most popular cryptocurrency exchange for traders today. Its safety and reliability are therefore so frequently requested.

Currently, most countries do not fully legalize or regulate cryptocurrency use. Furthermore, investors wonder whether this trading market is worth the risk given its relative infancy.

Despite this, Binance is a top choice if you’re interested in cryptocurrency trading. First of all, there are more than 100 currencies available. Aside from that, fees are extremely low at 0.1%, minimum deposits are comfortable at $15 or €15, and transfers are convenient. Besides two-factor authentication, withdrawal address restrictions, device linkage, and a decentralized wallet, they offer security measures. Almost no other company pays as much attention to the security of its users. Even so, you can bypass verification procedures if you wish to preserve your anonymity.

Many traders wonder, “Is Binance safe?” There was an incident in 2019. A hacker gained access to personal information and funds stored on the source. The company lost a total of 40 million dollars as a result. Rather than lose money from their pockets, they decided to return it all. As a result, traders escaped without loss but with slight shock. After that, they reported no further security issues.

Ultimately, they cannot question this platform’s security objectively. Utilize all the safety measures and functions they provide; however, if you want to reduce all risks.

According to Bahrain’s Central Bank, Binance has been granted a category four license to operate as a crypto-asset service provider.

Binance, one of the world’s leading blockchain and cryptocurrency exchanges, has been granted a new license by Bahrain’s Central Bank to offer a full array of crypto exchange services, according to its statement.

Bahrain’s Central Bank granted a category four license to Binance, the world’s largest cryptocurrency trading platform.

The lack of regulation of cryptocurrency exchanges has been criticized worldwide as Binance has been banned in several countries. Therefore, traders should not use these unregulated products.

In response to this, Binance has said that they would like to cooperate with regulators. As a result, regulatory approval was recently granted for the platform to operate in Italy and France.

It is an important accomplishment for Binance to be licensed as a category four exchange in Bahrain. Richard Teng, Binance’s head of MENA, said in a statement, “The move will allow us to offer our users the complete suite of services and products that they expect from an exchange.”

Since Bahrain and UAE already have regulatory frameworks and sandboxes, Binance intends to place cryptocurrency hubs there.

Company overview

|

Legal Name |

Binance |

|

Industries |

Bitcoin, Cryptocurrency, FinTech, Stock Exchanges |

|

Founder(s) |

Changpeng Zhao, Roger Wang, Yi He |

|

Founded Date |

2017 |

|

Total Funding Amount |

$10M |

|

Investors |

NA |

- TechMet Limited

This company produces, processes, and recycles “technology metals” that are critical to creating electric vehicles, renewable energy systems, and electrical storage systems. There are several metals that TechMet targets, including lithium, cobalt, nickel, rare earth metals, tin, tungsten, and vanadium. Investments made by TechMet include:

This company produces, processes, and recycles “technology metals” that are critical to creating electric vehicles, renewable energy systems, and electrical storage systems. There are several metals that TechMet targets, including lithium, cobalt, nickel, rare earth metals, tin, tungsten, and vanadium. Investments made by TechMet include:

- Cobalt and nickel production at Brazilian Nickel PLC

- A Canadian and US company that recycles lithium-ion batteries.

- US Vanadium produces a vanadium specialty chemical in Arkansas (USA).

- Rwanda’s largest mines for tin and tungsten – Tinco

TechMet is also developing TechMet Ventures to invest in new opportunities across the supply chain and is interested in the production of Rare Earth metals.

The second round of equity fundraising for TechMet has closed at $120 million. An oversubscription of 50% was achieved on the $80m targets. In total, the company raised $60 million at a price increase of 32 percent over Round 2 and 140% over Round 1.

The green industrial revolution is based on metals, which form the basis of electric vehicles and renewable energy systems that TechMet invests in across the supply chain.

The US International Development Finance Corporation (DFC – the Foreign Development Agency of the United States); Lansdowne Partners (one of the top investment companies in London); Mercuria (the global energy trading company) are TechMet’s largest shareholders.

As the world moves to clean energy technologies, worldwide demand for metals will greatly outweigh global supply as the company develops assets for producing those metals. Founder Brian Menell is British/South African and founded the critical metals company in 2017. There are several assets under its ownership, including Li-Cycle Corp, a lithium-ion battery recycling company whose share price recently merged with Peridot SPAC; Brazilian Nickel, which extracts nickel and cobalt for use in electric vehicles; US Vanadium, which manufactures vanadium concentrates for use in redox flow batteries; and Tinco, which produces tin and tungsten mines.

According to Brian Menell, the company’s founder, chairman, and CEO:

As a company, TechMet is proud to announce the completion of this funding round. The oversubscription demonstrates the level of valuation built in a short time and the level of value the team has created. In addition, these funds will enable us to expand our operations substantially and expand our portfolio of companies.”

It is a suitable time in history to be at both an inflection point and a turning point. For the materials that go into EVs and renewable energy systems, our industry is experiencing a dislocation of supply-demand that must be addressed rapidly if we expect a clean energy future to be successful.

For this 21st-century clean energy and electric vehicle revolution to succeed, TechMet strives to build ethical, independent, and environmentally friendly supply chains.

Chairman of TechMet’s Advisory Board and former US Joint Chiefs of Staff Chairman Admiral Mike Mullen commented:

This funding round demonstrates TechMet’s foresight, positioning, and ability. As the world adopts new technologies, the supply of critical metals is becoming an increasingly urgent national security issue. TechMet’s accomplishments and credibility now raise its chances of helping to meet these challenges.”

After securing this round, TechMet will raise a third round to raise an additional +/- $250m to expand its portfolio and scale its operations.

Company overview

|

Legal Name |

TechMet Limited |

|

Industries |

Energy, Renewable Energy |

|

Founder(s) |

Brian Menell |

|

Founded Date |

2017 |

|

Total Funding Amount |

$121,500,000 |

|

Investors |

Number of investors 6 |

- essDOCS

Throughout history, the name Goulandris has been used by seafarers to describe how shipping has evolved.

Throughout history, the name Goulandris has been used by seafarers to describe how shipping has evolved.

Taking shipping from paper to electronic bills of lading (eBLs) makes sense for EssDocs, founded in 2005 by CEO Alexander Goulandris.

The new blood is overhauling the conservative-minded shipping industry by taking over these companies from their fathers and mothers, says Goulandris. The generation uses Bloomberg terminals and laptops and considers telex old-fashioned and sweet. Generation Y is looking at it differently.”

Managing costs has always been a priority for shipowners, but sometimes this is misdirected.

I think the next generation is more attuned to looking for the bigger picture when it comes to eBLs. He tells Maritime CEO. “Most of them do business differently from their fathers, so they look for opportunities. Many of these guys went to business school, did an MBA, or worked for a merchant bank or another shipping company.

People are turning to ship differently due to the public markets and the industry’s professionalization. Is there a way to optimize vessel utilization? You start to realize that paper is costing me a lot of money when you look at vessel and human utilization. Shipping has undergone many changes, and I believe these new companies have greatly improved.

Increasing the ROI [return on investment] on a costly capital investment means you can get the vessel out and turn it around faster.

Keeping berths or jetty delays to a minimum also reduces terminal operators’ operating costs.

Everyone wants to get rid of paper, so all businesses must digitalize at some point. What is the best time to do it? What’s the best way to proceed?” Goulandris says.

Documentation is increasingly being done electronically. Over 2,100 companies use EssDocs’ electronic documentation products, including 10% of Fortune Global 500 companies.

As part of a multi-year agreement with EssDocs, Bunge signed a deal in March to use CargoDocs electronic bill of ladings (eBLs) and supporting electronic documentation on all shipments of grains and oilseeds. A trial of the system was conducted by Bunge last year on grain shipments to Spain, Italy, and Vietnam from Brazil, Argentina, and the United States.

ARA’s (Amsterdam-Rotterdam-Antwerp) ports will soon use eBLs as well. Operators now use EssDocs to automate timesheet information for calculating demurrage using the system they bought a couple of years ago.

It is harder to crack the container shipping market, however. An exciting market for Goulandris is producing house BLs for container carriers. During M&As, companies are attempting to keep their cost base to a minimum, which makes eBLs less attractive. Although EssDocs isn’t perfect, it’s making progress and is now being tested by several big-name container lines.

Goulandris says he has worked with NYK Line, MOL, and PIL around the world so far. Several chemical and Agri cargoes have been handled by us. In a few weeks, we will start shipping metal cargoes in containers. Three more container lines are likely to go live within the next quarter.

As Goulandris informs Maritime CEO, it just makes sense to do business this way.

Company overview

|

Legal Name |

essDOCS |

|

Industries |

Electronics, Finance, FinTech, Logistics Service, Industry, Shipping |

|

Founder(s) |

Alexander Goulandris, Martin Glesner |

|

Founded Date |

2005 |

|

Total Funding Amount |

$2.5M |

|

Investors |

BOOST&Co and Thyra Global Management are the most recent investors. |

- GamyTech

The GamyTech platform offers backgammon and 2048 as mobile games where players can bet real money. With the introduction of real-money betting, we make new and classic games more exciting by giving people the chance to compete against each other. Besides developing our games, we can also integrate existing games.

The GamyTech platform offers backgammon and 2048 as mobile games where players can bet real money. With the introduction of real-money betting, we make new and classic games more exciting by giving people the chance to compete against each other. Besides developing our games, we can also integrate existing games.

Our marketing strategy includes social media, affiliate marketing, and ad networks on which we run campaigns. The App Store is being optimized a lot at the moment. Backgammon is either the top backgammon app in the App Store or one of its top five titles in many countries around the world when searching for it.

The number of users on our site grows by over 100% each month. In our seven-month history, we have had over half a million downloads of our games, and millions of games have been played on our platform. In addition, users engage with us about the game and provide feedback on our social media channels.

They care about the products we are building. Backgammon, in particular, is a game that fosters a sense of community. Thousands of players return to the backgammon game every day – they post blogs about it and talk about it on social media; the game is generating tremendous interest. People can make a living out of their passions on our platform, and we have professional players who make a living off it. Some users are making a living out of gaming by cashing out hundreds of dollars a month.

GamyTech’s Snake and 2048 are two well-known games. Are new players attracted to that familiarity?

Educating the public on betting on classic and mobile games was one of our goals when creating the concept, and it was easier to do with games that people are already familiar with. To address this, we selected classic games such as backgammon and 2048. They will update the platform in the future and create new types of fun now that our players are confident playing on our platform and know our platform well.

Company overview

|

Legal Name |

GamyTech |

|

Industries |

Gaming, Internet, Video Games |

|

Founder(s) |

Jonathan Swerdlow |

|

Founded Date |

May 1, 2014 |

|

Total Funding Amount |

$2.5M |

|

Investors |

GamyTech is funded by Makor. |

- Changelly

Changelly provides customers with a holistic experience of interacting with cryptocurrencies through an ecosystem of products and services.

Changelly provides customers with a holistic experience of interacting with cryptocurrencies through an ecosystem of products and services.

With over 200 cryptocurrencies available, Changelly provides users with easy access to over 200 cryptocurrency exchanges, all of which can be easily traded within 10 minutes on a computer, desktop, or Changelly mobile app.

Changelly expanded into the retail market in 2020. To facilitate efficient retail purchasing of digital tokens and coins, Changelly Professional was developed as a customer-centric platform. In addition to high limits, efficient prices, fast executions, and 24/7 live support, Changelly Pro is backed by Changelly’s excellent support system.

.crypto, and they can now create .zil domains on Unstoppable Domains. Unstoppable Domains is one of the top autonomous identity platforms on Website 3. In addition, the exchange of cryptocurrencies on Changelly has been made easier by allowing users to customize their wallet addresses.

NFT domains can be privately owned and controlled by a user, so long as they replace their long wallet addresses with them. As a result of Changelly’s partnership with Unstoppable Domains, exchanges and purchases of cryptocurrencies are made faster, and the possibility of entering the wrong wallet address is eliminated. In addition, no recurring hosting or administration fees are charged – users only pay once for their Domain. Unstoppable Domain does not interfere with domain transfers, updates, or links to other services. Unstoppable Domains has registered over 1.7 million usernames. Unstoppable Domains also support over 270 cryptocurrencies.

To make cryptocurrencies easier for people to send and receive, Unstoppable Domains’ integration with Changelly is another great step. Regardless of what you do in cryptocurrency, you must enter long addresses.

Unstoppable Domain is one project that we are excited to see changing the crypto world. Changelly is excited to collaborate with Unstoppable Domains to offer the best digital currency exchange and buying experience for our customers,” stated the Changelly team. As a result of this partnership, we believe our customers will be able to exchange money more quickly.”

There are several interesting uses for blockchain protocols, including domain name generation. A blockchain domain can be controlled by a private key instead of a conventional domain name. Unlike centralized domains, decentralized domains have no renewal fees or price increases.

Users are increasingly using NFT domains to access apps, make cryptocurrency transactions, and access the web. With Unstoppable Domains, you can register NFT domain extensions with the extensions .nft, .crypto, .wallet, .dao, .888, .blockchain, .bitcoin, .x, .coin and .zil for as low as 5 USD without any fees. They can use Brave, Opera, Chrome, Edge, and Firefox browser extensions to access the decentralized website via these domains.

Company overview

|

Legal Name |

Changelly |

|

Industries |

Cryptocurrency, Financial Exchanges, FinTech |

|

Founder(s) |

Konstantin Gladych |

|

Founded Date |

2015 |

|

Total Funding Amount |

NA |

|

Investors |

NA |

- Tipico

The German sports betting company Tipico will be acquired by Fanatics, according to CNBC.

The German sports betting company Tipico will be acquired by Fanatics, according to CNBC.

Following the sale of the Philadelphia 76ers and New Jersey Devils by Harris Blitzer Sports & Entertainment, Fanatics is looking to enter the sports betting market. They gave a $3 billion valuation to HBSE earlier this month.

The NBA’s rule prohibiting team owners from operating gambling platforms allowed Fanatics to enter the sports betting market.

In addition to its merchandising and retail business, Fanatics is predicted to generate over $5 billion in revenue in 2022.

- In January, it paid $500 million for trading card maker Topps.

- In a $250 million deal, Mitchell & Ness was purchased by a consortium.

If Tipico is purchased, the company will have an immediate presence in the U.S. betting market. Colorado and New Jersey currently have betting licenses for Tipico.

Tipico’s latest funding round will not pose a problem for fans. A $1.5 billion round of funding was raised earlier this year, valuing Fanatics at $27 billion.

A $320 million investment by the NFL drew attention from Brooklyn Nets owners Joseph Tsai and Qatar Investment Authority, as well as other investors in the round.

The Tipico founders have been in the betting business for more than 25 years. They make billions in sales and have broken the law. But, unfortunately, most of this has not become known.

Business Insider tells the story of Europe’s largest betting provider: from the beginnings at high school in Karlsruhe, from the power struggle with the state, from self-reporting to the tax office, and from the day Oliver Kahn was suddenly on the phone.

For the first time, one of the Tipico founders speaks about a company that is respected in the sports world but despised in society.

The Germans have already bet tens of billions of euros against Dieter Pawlik. But he never needed luck for that. “Betting is about being right,” says the lawyer. And he is a person who has mostly been right in his life. So it was the players, the gamblers, the losers that made him, Mister Tipico, rich.

With two school friends from Karlsruhe, Pawlik has built up the largest provider of sports betting in all of Europe over the past two decades. The franchise empire has been controlled from the Tipico Tower directly on the Mediterranean coast of Malta since 2004, with more than 7000 people in 1300 betting shops. According to Business Insider, the unpublished annual turnover is around four billion euros. And on the company website, Bayern players Serge Gnabry, Joshua Kimmich, and Leon Goretzka continue to heat the betting fever in Germany. “We maximize excitement,” it says next to the pictures of the superstars.

Company overview

|

Legal Name |

TIPCO Treasury & Technology GmbH |

|

Industries |

Business Intelligence, Financial Services, Risk Management |

|

Founder(s) |

NA |

|

Founded Date |

2013 |

|

Total Funding Amount |

NA |

|

Investors |

NA |

- Zebrainy

Zebrainy provides students with mind games with interactive stories, animations, letters, arithmetic, sizes, colors, shapes, and more. This app is suitable for ages 2-6, helps develop emotional intelligence, and teaches logic and reasoning. It is based on the experiences of Zebra, who travels to many unique places; They encounter interactive problem-solving and storytelling activities.

Zebrainy provides students with mind games with interactive stories, animations, letters, arithmetic, sizes, colors, shapes, and more. This app is suitable for ages 2-6, helps develop emotional intelligence, and teaches logic and reasoning. It is based on the experiences of Zebra, who travels to many unique places; They encounter interactive problem-solving and storytelling activities.

Igor Rybakov, the co-founder of the Prytek technology group of companies, became interested in Skazbuk after an incident happened to his youngest daughter, the entrepreneur told Vedomosti. Arriving in Croatia, for a long time, she could not learn the Latin alphabet on her own. “Skazbuka” turned out to be an application with which the girl was able to understand it quickly and in an entertaining format, says Rybakov. After that, the entrepreneur held a meeting with the founder of Zebrainy Ltd, who developed Skazbuka, Kesha Skirnevsky, offering him cooperation.

As a result, the group invested $4 million in Zebrainy, which developed Skazbuka, a representative of Rybakov told Vedomosti and confirmed in the press service of Prytek. However, the share that Prytek received as a result of the transaction was not disclosed.

“Skazbuka” is a mobile application for teaching children from 2 to 6 years of age the alphabet, arithmetic, and logic, as well as for the development of emotional intelligence. The application is distributed by subscription (999 rubles for three months).

Prytek was founded by Russian entrepreneurs Rybakov and Andrey Yashunsky. The group of companies is engaged in MSP (outsourcing of internal business processes) for banks using deep tech solutions, educational projects, and retraining personnel in IT and cybersecurity. Prytek, according to its data, owns shares in 25 serious tech companies. Prytek itself estimates the total value of these companies at $1 billion.

Zebrainy Ltd was established in 2017, Skirnevsky says. First, they made the first version of the application in Russian. Then an English version appeared to be launched on the world market. “We made the prototypes at our own expense, the second version (English) by Zebrainy Ltd. I did it in partnership with Israeli entrepreneur Vadim Barshtak, who invested $300,000 in the company. And Prytek has already joined,” says Skirnevsky.

The main reason for Prytek’s investment in Zebrainy Ltd was Skazbuka’s visual appeal, as well as its “strong” content, says Yashunsky. According to him, against the background of Skazbuka, other children’s applications look unpresentable.

According to Skirnevsky, the application has already been downloaded in the App Store and Google Play about 2 million times. They will use the investment received from Prytek to expand the business and enter the US, Canadian and Australian markets, Skirnevsky says.

In 2018, Zebrainy Ltd’s revenue was $50,000. In 2019 – $200,000, and 2020, the figure will be increased to $2.5 million, the company predicts. According to Yashunsky, the segment of education for children is growing rapidly. “Over the past 12 months, Skazbuka has shown an increase of 1400%. At this pace, the company can reach the unicorn category in the coming years,” the entrepreneur notes. In three years, Zebrainy’s capitalization may exceed $100 million, Rybakov hopes.

The market for mobile applications for children today is developing at an active pace. In contrast, educational applications have gained particular popularity due to the coronavirus pandemic, says Igor Kuzora, head of the educational programs department at 1C. In the future, such “Skazbuk” applications will become even more widespread, the expert is sure.

Online education and training using mobile applications are very relevant today. Still, we must not forget that there is high competition in this area, says Dmitry Chikhachev, founder and managing partner of the Runa Capital fund. In addition, he says the b2c market is quite complex in economics.

According to Chikhachev, the scale of Zebrainy in the context of the consumer market remains tiny. Unlike b2b applications, success for b2c comes only when they become massive enough, and mass applications have an order of magnitude higher numbers, he says.

The online education market was actively developing even before the crisis, but the pandemic attracted particular interest from users and investors, says Ivan Sebedash, product director at Uchi.ru. In addition, many users discovered online educational platforms after the transition to distance learning for schoolchildren and students.

According to Sebedash, significant growth in the audience and revenue of EdTech companies is a long-term trend that has interested investors. And although other segments of EdTech are still considered promising (for example, in July, Coursera closed the next round of funding of $130 million), projects in the development of preschool children and additional education for schoolchildren have great potential for further growth, the expert concludes.

Company overview

|

Legal Name |

Zebrainy |

|

Industries |

Children, Education, Gamification, Gaming |

|

Founder(s) |

Kesha Skirnevsky, Vadim Barshtak |

|

Founded Date |

Nov 26, 2015 |

|

Total Funding Amount |

$2.6M |

|

Investors |

Zebrainy is funded by PRYTEK. |

- EZ Exchange

Want a secure environment where you can trade, buy, and sell cryptocurrency? Have you ever used cryptocurrencies before? Your best option might be EZ Exchange.

Want a secure environment where you can trade, buy, and sell cryptocurrency? Have you ever used cryptocurrencies before? Your best option might be EZ Exchange.

EZ Exchange simplifies control for users by providing a single interface. Signing up and purchasing coins with a credit card, bank transfer, or online money transfer are all ways to buy coins. Then, with a button tap, They can convert currencies into cash.

Bitcoin and other cryptocurrencies can be purchased using credit cards and other major payment methods using popular services like Coinbase. To make cryptocurrency markets more accessible to beginners, EZ Exchange hopes to offer a similar service.

We are in the process of developing EZ Exchange. However, the exchange has not yet been launched as of April 2018. They can subscribe to the company’s mailing list by entering your email address on EZExchange.com.

Beginners and experts alike can benefit from EZ Exchange’s tools. Coins are available for users as soon as they are released. They can also purchase cryptocurrency with the help of a credit card, a bank transfer, or an online money transfer. Then, touch a button to convert coins into cash.

Our customer service agents are available 24 hours a day, 7 days a week by phone, chat, or email. You can also learn how to buy and trade cryptocurrencies with EZ Exchange’s step-by-step tutorials.

According to its website, a company that protects global stock markets built EZ Exchange so that cryptocurrency traders can benefit from “the rigors of established financial market security.” These features include preventing server redundancy and social engineering, preventing DDoS attacks, and ensuring compliance with KYC/AML regulations. The exchange is also preparing for a future ISO 27001 certification.

As far as we know, EZ Exchange does not offer any exciting features or functions beyond these basic ones. However, we expect that they will reveal more details over the coming months, as the exchange has not yet been launched.

Eddie Kotler (President) and Russell Korus (CEO) founded EZ Exchange.

As an entrepreneur who co-founded EZ Exchange in January 2018, Korus describes himself as a “blockchain visionary and cryptocurrency evangelist.” Since 2002, Kotler has developed his call center business.

Toronto is the headquarters of EZ Exchange.

Cryptocurrency exchange EZ Exchange is based in Toronto. Using conventional payment methods, such as credit cards and bank transfers, the exchange plans to make cryptocurrency markets accessible to everyone. In addition, EZ Exchange intends to provide advanced functionality for experienced traders.

Company overview

|

Legal Name |

EZ Exchange |

|

Industries |

Blockchain, Cryptocurrency, FinTech |

|

Founder(s) |

Eddie Kotler, Russell Korus |

|

Founded Date |

Jan 2018 |

|

Total Funding Amount |

NA |

|

Investors |

NA |

edited and proofread by nikita sharma