Top 10 Best Finance Mobile Apps in India in 2023

Top 10 Best Finance Mobile Apps in India in 2023

The software or program you download on your mobile phone to do a specific financial job is known as a financial “app.” There is an app for everything; whether you want to keep track of your monthly spending, rapidly send money to a kid or grandchild, or simply double-check your most recent bank account balance, it can be easily done using a finance mobile app.

In fact, there are economic apps for almost every element of your financial affairs, such as apps that can help you save even more money, budget apps, debt-reduction apps, trading apps, and more. So it makes sense that, based on a Bankrate survey, 63% of smartphone owners have at most one financial app.

However, you must first access a virtual “store” online and download the app before you can genuinely install any financial application, including the one from your bank. If you have an Apple iPhone or iPad, you can download any program you want by going to the App Store. Download your bank’s app from the Google store if you own an Android tablet or phone.

How frequently have you found yourself grabbing your phone to check your balance and perform short online banking transactions? The mobile financial app is among the first to be installed on a new smartphone.

Stock brokers are an example of how apps are used to assist the financial markets. They are constantly on the phone, monitoring the stock market and conducting transactions and business. Because the finance sector can be complicated, mobile experiences must focus on the customer.

As a financial services provider, there is a wealth of information available, and it is essential for the information to be seamlessly transmitted into online platforms so that it can be used. Companies should embrace mobile graphing as a powerful tool for informing app users of important information.

The financial sector is benefited in a variety of ways from mobile apps. Let’s take each one in turn:

Cellular Banking

By 2019, it is expected that 2 billion individuals will use mobile banking, and those users will be able to track, conduct transactions, and make purchases directly from their apps. In addition to drawing in clients, the simplicity with which the applications function also draws in potential staff. Every employee wants to work for a company that uses innovative software and appealing apps to market itself.

Cellular Payments

Today, a sizable number of users utilize mobile apps to pay their bills for a variety of services, including phone service, power, credit card bills, etc. Apps for mobile networks make it simple to accomplish this. Payments always include some degree of privacy and secrecy.

Apps assist users in maintaining the privacy and security of their data. The mobile apps assist the clients in transacting with the least amount of work and the highest level of anonymity as the connection across places and platforms increases. In addition to this, mobile apps offer a wide range of payment options:

- Credit card payments

- Netbanking

- Mobile Wallets; Debit cards;

Boost Business

Additionally, mobile apps make ensuring that businesses in the financial sector are booming. Mobile apps have guaranteed that the firm captures the most market share and generates more revenue by creating a business more accessible. Mobile apps have improved the relationship between current customers and the company by enabling safe and secure transactions. This guarantees ongoing business and employment. Financial institutions’ mobile applications can give underserved customers a way to monitor and take advantage of investments or new businesses.

Reduce the cost of operations

The operational costs of running the firm have decreased thanks to the adoption of mobile apps. One-stop shopping for purchasing, returning, obtaining, exchanging, and remitting products and services is made possible by mobile apps. In addition to this, mobile applications have made sure that data is sent seamlessly and virtually from customers to managers and vice versa. Virtual customer service centres are now possible thanks to mobile apps, which have also further cut costs.

Here are a few of the top finance applications that consumers can easily use to track their income and expenditure on their cell phones.

1. Money View

One of the top lending apps and managing money applications in India is Money View. Individuals can quickly apply for loans with amounts ranging from 10,000 to 5,000 at flexible terms. The best aspect of an on-demand Android personal loan application in India is that it offers a wholly paperless or electronic loan application process and quickly determines a candidate’s eligibility.

Additionally, the app keeps track of financial transactions and offers the most proper financial guidance in real-time. Additionally, a well-known Android finance software called Money View in India would give customers tailored payment reminders and free them from significant fees. The app has received over 10 million installations and a 4.4 out of 5-star rating as of 2021.

2. The Money Manager Budget & Expense App

![]()

The Android financial app Money Manager Expenses & Budget by Realbyte is well-liked in India. The software is well-known as one of the best money management apps, including over 15 million downloads. It aids users in better budgeting, cost tracking, investment management, and personal finance management, among other things.

Custom filters built into the software allow users to examine incomes and expenses independently on a single dashboard. People can manage their balances more wisely thanks to a simple UI. People in India can review their transactional records daily, monthly, or monthly as they choose using this on-demand budgetary control tool.

The outstanding attributes of this finance program include double-entry accounting, bookmarking, expenses display by category, and calendar connection. For iOS devices, there is also a free option for this well-known budget and cost-tracking software.

3. Goodbudget

Here is a well-known budgeting app for iOS and Android devices. One of the top cost-tracking applications in India is called Goodbudget. One million people utilize it regularly. On the Appstore Store, the app has ratings of 4.7 and 4.5 stars, respectively.

It allows users to track their financial inputs and outflows in real time easily. Additionally, it supports timely bill payments and properly organized financial management. The users of this personal money manager can better manage their household costs thanks to the comprehensive financial reports provided to them.

One of this financial app’s top features is effortlessly synchronizing applications between online and mobile devices. Are you anticipating the development of fashionable Money Tracker Apps?

4. Bajaj Finserv Experia App

The largest financial brand in India is Bajaj. The company’s mobile app platform provides a wide range of digital financial services. The app offers a one-stop shop for all your financial needs, from investments and personal loans to wallet transactions and insurance policies.

This well-liked tool helps users keep track of their credit card payments, EMIs, and recharges. The software supports roughly 14 Indian languages for content delivery. People may get a free copy of this well-liked cost organizer from the iPhone App Store and Google Play Store.

5. Monefy

The top expense-tracking applications in India include Monefy. This mobile personal financial app functions without issues on both Android and iPhone computer systems. It is a straightforward, practical smartphone application for automatically documenting all transactions and purchases.

Thanks to Money’s user-friendly interfaces, users may track their necessary costs by category. Users of Monefy may track monthly bills in multiple currencies, which is a fantastic tool. Both iOS and Android mobile devices can be used to access the best and most user-friendly money management tool.

Overall, Monefy has surpassed the milestone of 5 million installations as of 2021 because of its intelligent spend tracker features, data backup, constructed calculator, and highly secure passcode.

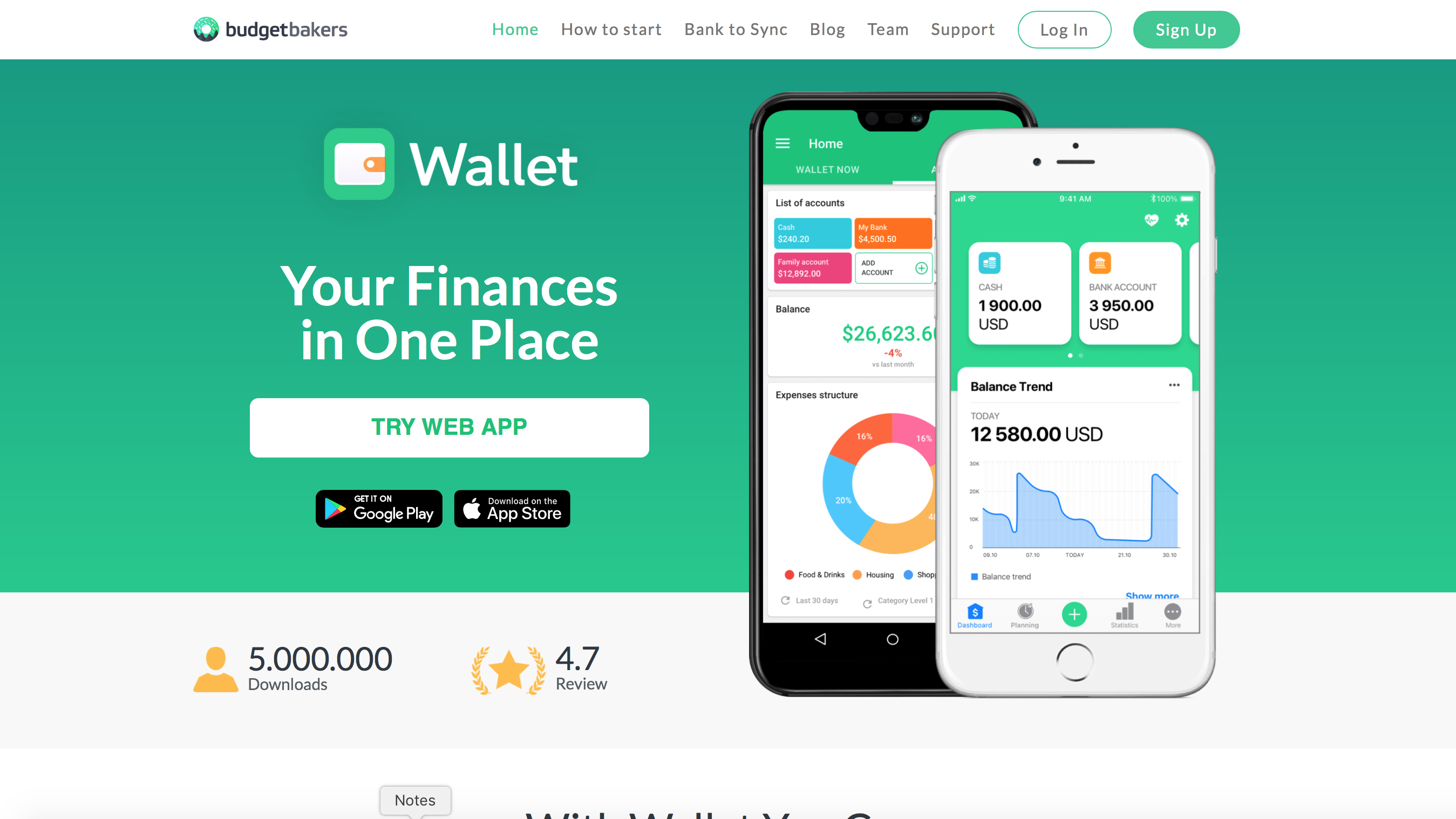

6. Wallet

The best budget cost-tracking app is available for both iPhone and Android. It enables users to manage their spending in real time from their cell phones and plan their budgets. This industry-leading personal finance management tool is made to help users manage their balances for upcoming financial demands. Consequently, you can effortlessly manage your spending and increase your savings by using the finance monitor and plan features of this well-known finance software in India.

Some of the better features of Wallet-like budgetary control apps include automated transaction updates, budget target reminders, easy-to-understand expense charts, support for several currencies, automatic cloud sync, and valuable tips on shopping or other expenses.

7. Expense Manager

One of the top custom finance tracker apps, expense Manager, was created with practical tools. As with the leading finance applications in India, Expense Manager has the following features and capabilities:

- It is highly suited for keeping track of expenditures and earnings.

- Users may manage debts, card bills, and taxes.

- Users can examine and categorize various bills.

- Users can easily schedule regular payments.

- Users can view costs and incomes on a calendar.

- Users can track transactions easily by category for better comprehension.

With a few clicks, exports and imports account activities. The program automatically keeps data back on Dropbox and Gmail Drive • Charts and graphs for a clear understanding of expenses.

8. Digit App

Digit is designed for people who want to save money quickly and easily. Similar to Big Brother, Digit tracks your spending patterns and transfers funds from your associated bank account to the Digit account. What procedure underlies it? Every two to three days, Digit initiates a transfer after assessing your bank balance, expected income, impending bills, and past spending habits.

Using these factors, Digit determines a non-essential sum that, depending on your purchasing habits, you won’t notice. You might think, “Wait, can’t I do this on my own?” Possibly. However, Digit is aimed at a generation that values technology highly and has implicit faith in it. The cost and convenience are certainly worth it for those people.

In fact, Digit customers get a 1% annual Savings Bonus for each, and they save with the company every three months. If you refer a friend to the service, you will receive a $5 bonus. Customers can perform everyday banking tasks (including checking their balance, starting withdrawals, and viewing future bills) via Digit’s messaging service, which employs SMS texting, without needing to use a computer. Digit was developed to help the generation of tech-savvy millennials make smaller saves.

9. Personal Capital

Users of Personal Capital can monitor their expenditures and assess their financial portfolios with this comprehensive tool. Personal Capital enables you to combine all your assets in one location for simple administration and viewing, just like many other programs on our list.

You may use it to determine your combined wealth, which will offer you a clear picture of your financial situation and enable you to set a specific objective for where you would like to be in the future. You can get a tailored financial plan via the app based on advisor analysis. Personal Capital distinguishes out from competing programs because it provides excellent mobile apps and user-friendly desktop interfaces.

It also helps you look through your finances and identify any expenses that might keep your portfolio from generating as much as possible. Personal Capital offers free tools for managing finances to anyone. You must first open a bank account with a necessary reserve of $100,000 to qualify for its advisory services.

10. Joy

The user’s enjoyment with purchases is the main emphasis of the Joy savings and financial education app. The user is prompted to add their spending account to the application after establishing a profile (a checking bank or credit card) (a checking account or credit card). The client is then prompted to provide information regarding recent purchases.

Joy asks consumers to rate their purchases as “happy” or “sad,” which helps it understand how money and satisfaction relate to one another. Low-value purchases (also known as “sad”) should be avoided, but high-value purchases (also known as “happy”) are permitted.

By standardizing contemplation on expenditures, the program aims to help the user make the connection between spending that enhances life and price that contributes little to none. Joy also regularly provides up-to-date, straightforward financial articles. This set of resources can help people get motivated to save money and keep their goals top of minds.

Joy users open a Joy Saving account. With the user’s permission, the software finds possibilities for savings and subsequently transfers funds to the user’s account. Customers have unlimited access to cash withdrawals and can close their savings accounts at any time.

In the past ten years, the finance business has experienced various ups and downs. Who can remember the 2008 financial crisis, which caused massive losses across many companies? But soon after this temper outburst, a phrase appeared that is now the financial and corporate world’s lifeblood.

Fintech is a brand-new term that combines the words finance and technology. It was once thought of as a platform for processing back-end data but is now the main engine for processing end-to-end transactions. The mobile app sector is another critical actor making a significant contribution to the digitization of financial services and banking.

The financial sector must be prepared to provide services that are on-demand, simple, and handled in real-time as individuals spend more time on their smartphones. These features are undoubtedly present in financial apps to meet client expectations.

The Obstacles in the Way of Creating a Financial App

The mobile development business, however, faces specific difficulties as it plans to develop a distinctive and practical financial app, so the road ahead is not exactly smooth. To offer the most advantages to the end users, app developers must thoroughly understand these difficulties and problems.

The worries about data security

Security has always been among the top concerns for app developers when creating any mobile app. The importance of security becomes crucial as attention shifts to banking and financial applications. Therefore, you must prioritize it.

There is no space for error because online banks contain highly private and sensitive information about the users, including their internet banking username and password, credit and debit card information, pin or CVV number, etc. The tiniest crack or opening in the door will allow hackers to see inside and steal those intimate details.

The Challenges of Regulatory-Based

The financial sector is heavily regulated globally because various governments and other prestigious organizations create the majority of the rules and policies. As a result, it is absolutely essential for app developers to follow all applicable laws and regulations while establishing new apps.

For example, suppose you are developing an app for a firm that operates in Europe. In that case, you must adhere to the General Data Privacy Regulation (GDPR) standards, which went into effect on May 1, 2018.

To be added features to the app.

The choice of the right platform and the incorporation of appropriate functionality is the next duty for app developers. Your program must be made to perform flawlessly on all platforms, including Android, iOS, the web, and a variety of devices.

But the question of how many and which features to include or omit confounds developers the majority of the time. Even for financial software, it might be wise to start by creating a Minimum Viable Product (MVP). You will be able to separate the most essential features and functionalities from both the user’s and the bank’s perspectives as a result.

Of course, it is necessary to include features like real-time fund transfers, instant balance checks, e-wallet use, customer support integration, simple customer information updates, etc.

Outstanding User Experience (UX)

According to a recent survey by Google, 4 out of 10 smartphones use their handsets for financial transactions. According to another study, 63% of smartphone users had at least one finance application store.

The sole purpose of including these statistics is to emphasize how seriously you should take the app’s user experience and make no compromises in any area. The app must focus on the user experience and the needs of its users.

Even if clients are completing a complicated purchase, they shouldn’t encounter any problems. Of course, you also need to pay attention to technical issues because they keep reoccurring. Regular upgrades and adherence to the platform’s most recent OS version are requirements.

The Rewards of Financial Applications

Thus far, we have examined the numerous difficulties developers typically encounter when creating financial apps. Now, though, we’d like to concentrate on financial apps’ advantages for both consumers and financial organizations.

From the perspective of the client, it offers the following benefits:

- Check Amount in Real-Time – Users of financial apps can check their checking account in real-time from any location at any time.

- The Financial applications are straightforward to use and reasonably priced.

- They can efficiently execute all banking tasks, such as creating a new account, moving money, and setting payments, with only a few touches on the screen.

- The banks also frequently make exclusive deals and discounts to their clients. Since the apps are very secure, all of your confidential information will be kept protected and encrypted.

- They provide secured codes so that transactions can be made. They are notified by email or SMS text if there is a credit or debit in the clients’ accounts.

Edited by Prakriti Arora