Top 10 Best Credit Cards in India in 2023

Top 10 Best Credit Cards in India in 2023

A credit card is a small, rectangular plastic piece of metal given by a bank or other financial institution. It allows its holder to borrow money to pay for products and services at businesses that accept credit cards. Credit cards enforce the need that cardholders repay the borrowed funds, plus any relevant interest and any other agreed-upon charges, in whole or over time, either by the invoice date or a later date.

The card’s issuer may additionally provide cardholders with a money-to-spend line of financing (LOC) in addition to the usual credit limit, allowing them to borrow funds in the form of personal loans that can be accessed through bank teller machines, ATMs, or credit card utility checks.

Compared to transactions that tap the main credit line, such cash advances often have different terminologies, such as no time limit and higher interest rates. Issuers typically set borrowing caps depending on a person’s credit score. Credit cards continue to be one of the most widely used payment methods for purchasing goods and services for consumers today. The majority of companies allow customers to use them to make transactions.

Credit Card Types

Visa, Mastercard, Express, and American Express are just a few popular credit cards often provided by banks, community banks, or other financial companies. Many credit cards entice users with rewards like airline miles, hotel stays, gift cards to popular stores, and cashback offers on purchases. These credit cards are usually referred to as incentive credit cards.

Numerous national businesses issue branded credit cards with the business’s name prominently displayed on the front to foster client loyalty. Store cards can only be used to buy items from the issuing merchants, which may provide cardholders with benefits like exclusive discounts, marketing notices, or deals. Store credit cards are often more straightforward for consumers to apply for than big credit cards. Large retailers may also provide co-branded credit cards with the major MasterCard or Visa logos that may be used outside retailer locations.

Credit cards that require a security deposit from the cardholder are known to be secured cards. These cards provide constrained credit lines with limits equivalent to the down payments, frequently repaid when cardholders use their cards responsibly and repeatedly over time. Those with weak or restricted credit histories typically apply for these cards.

Prepaid debit cards are a form of a protected payment card, much like secured credit cards, where the funds available are identical to the monies that the cardholder has previously parked in a connected bank account. Unsecured credit cards, in contrast, do not call for collateral or security deposits. These cards typically have more proper credit limits and cheaper interest rates than secured cards.

Numerous credit cards are available in India that offer alluring perks, including reward programs, cashback, gasoline savings, insurance advantages, travel benefits, etc. You may get the most out of your credit card if you choose it carefully, depending on your lifestyle needs. The best ten credit cards in India according to different categories and criteria are covered in detail below.

1. HDFC’s MoneyBack credit card – best for beginners

There are some customers who don’t know much about credit cards, but the HDFC MoneyBack credit card can be the best bet. Using this card to increase your credit score while saving money is a great idea. Due to its cashback benefits, you’ll save money for every dollar you spend.

For every 150 dollars spent, you will earn two reward points; if the purchase is made online, you will earn twice as many. These rewards can then be redeemed for gifts or airline miles from the exclusive rewards catalog. But bear in mind that you need at least 2,500 pts to be able to save it.

What’s even more intriguing is that anyone who earns more than $15,000 per month can qualify for this card, which makes it ideal for a young person who has recently begun working.

2. HDFC Diners Club Black card – best premium credit card

With unrestricted access to international lounges and appealing perks, this credit card provides the total package for high-end consumers. The ideal luxury credit card is the HDFC Diner Club Black card, which has an available credit of 4 lakhs. With good reason, it has been labeled the major international credit card. At 2.0%, it provides one of the cheapest foreign exchange rates.

Additionally, you will access six free golf rounds each quarter. It gets even better because you may make up to 3.33% on every retail purchase (excluding fuel). And you can earn five reward points for every 150 transactions. You automatically access a wealth of lifestyle, travel perks, and rewards cards.

Club Hyatt, Forbes, Amazon Prime, Dineout Passports, MMT BLACK, and Times Prime annual subscriptions are all free. Free Ola taxis, Cult. fit Live, BookMyShow, and TataCliQ gift cards for monthly purchases exceeding Rs. 80,000. For every Rs. 150 spent, you earn 5 reward points. Reward Points with SmartBuy up to 10X and on the weekend dining up to 2X Free golf tournaments in some of the best facilities in the country ( 6 per quarter)

3. IndusInd Bank Pioneer Legacy card – best zero annual fee credit card

Among the lifetime free credit cards in India, the IndusInd Bank Pioneers Legacy card provides the highest reward percentage. Customers can get 1 point for every $100 spent on their weekday purchases and an even better 2% on weekends. Own an IndusInd Bank Pioneer Heritage Credit Card to take advantage of some of our best promotions!

These luxury brands were hand-selected to meet your demands and are created to provide you with a once-in-a-lifetime experience by giving you the best. We’d want to impress you with first-rate benefits for your travel, restaurant, and shopping excursions.

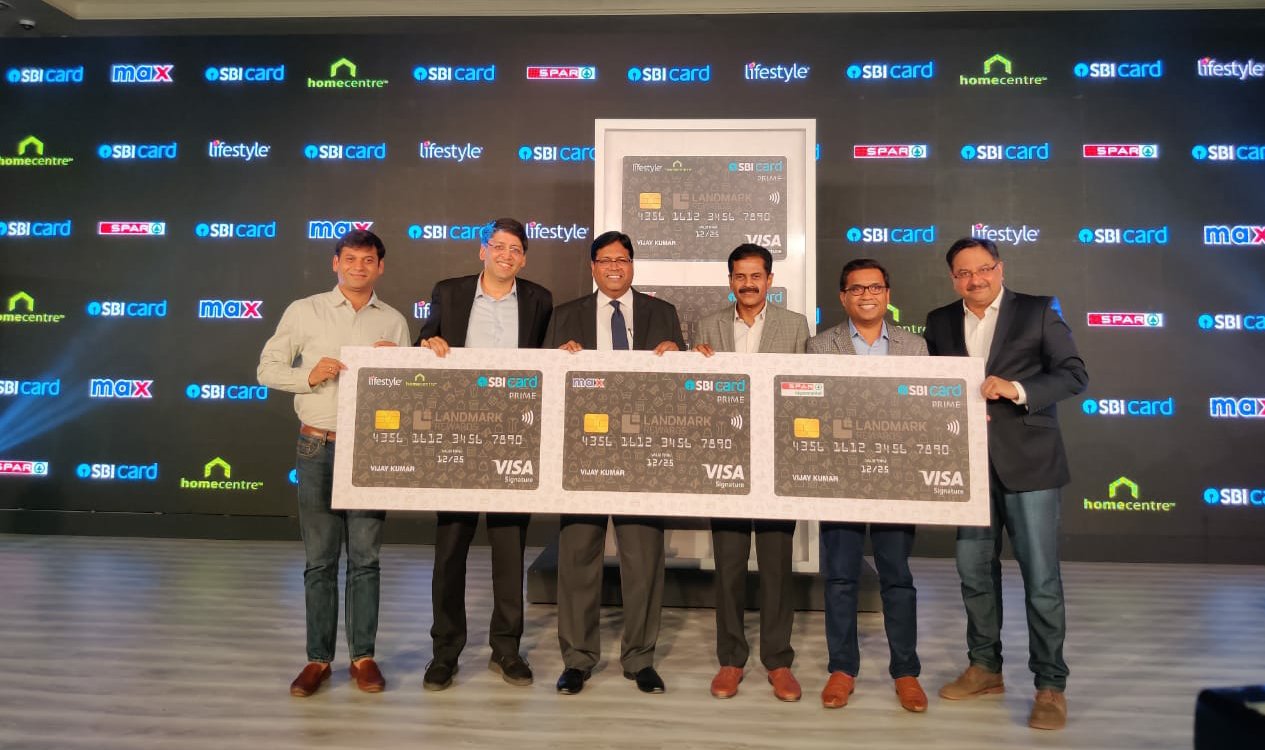

4. SBI Card PRIME – best lifestyle credit card

It has priority access to 4 free domestic and eight free international airport lounge visits. It is hailed to be the best credit card for energy bill payments. It includes welcome e-gift cards with a value of $3,000 within. These brands, including Pantaloons, Yatra, Bata/Hush Puppy, Shoppers Stop, etc., can be purchased with this. The extra charge is removed for users with at least three lakhs in expenses. Both the MasterCard World and Card Signature versions of this card are offered.

The most expensive credit card in the market is SBI Card PRIME. For example, the card offers the major benefits for utility bill transactions in India at 5%, or 20 points for every 100 rupees. The daily expenses reward rate of 0.50% is the only drawback.

5. American Express Platinum Travel credit card – best credit card for travel

The American Express Platinum Travel credit is good for someone who travels frequently. This card provides free lounge access in addition to an extra travel gift. The key is to collect those milestone rewards. This card enhances your travel experience and gives extra benefits like frequent savings at MakeMyTrip and other redeeming opportunities. Moreover, for every 50 spent, you will receive one reward point. Nothing is more major than this.

First-year yearly fee: $3,500 + relevant taxes. after the second year: 5,000 + any applicable taxes. American Express’s Platinum Travel Credit Card is a high-end travel credit card that provides many travel benefits.

The American Express Platinum Travel Credit Card offers the following travel perks like 4 complimentary domestic airport lounge visits per year (one per quarter) and complimentary membership in the Priority Pass lounge access program.

As milestone rewards, vouchers from prestigious chain hotels like the Taj, SeleQtions, and Vivanta hotels. In addition to these travel advantages, dining expenses at American Express member establishments are reduced by up to 20%.

6. Standard Chartered DigiSmart – best credit card for online shopping

Anyone who prefers online shopping should apply for a Standard Chartered DigiSmart credit card. You can receive up to 25% discounts on transportation, apparel, food, groceries, cinema tickets, and cab services. You can save up to $3,450 per month using this credit card.

You can use this card on a few online platforms to take advantage of the discount offers. You receive a 20% price on Myntra for each purchase, a 20% discount on Yatra for domestic ticket bookings, and a 25% discount on Myntra for domestic hotel bookings.

Additionally, you will receive a 10% discount on supermarket purchases made through Grofers and Zomato’s online ordering system. in addition to a 15% savings on Ola cab reservations.

This card’s distinguishing characteristic is that, depending on the transaction type; you can receive benefits in the form of reward pts or cashback. On everyday spending and utility bill payments, you receive 5% cashback, and all other transactions earn you just one reward point.

An advantage of 100% cash back on gasoline purchases made within 90 days of card issuance. 5% cashback on utility bills, phone, and petrol purchases. One reward credit for every 100 rupees spent in the remaining categories. Customers of premium banking have the right to a free membership in the Priority Pass airport access program.

7. SBI Student Plus Advantage credit card – best for students

The SBI Student Plus Plus credit card is an option for college students who want to keep track of their spending. Clients who have taken out a student loan with SBI are the only ones eligible for this card. Using a fixed deposit as collateral, you can obtain a secured card without an annual charge.

Additional benefits provided by this credit card include 2.5% cashback on supermarket and department shop purchases. If the total purchases made with the card during the previous year were less than 35,000, there is a 500 annual fee.

One of SBI Card’s top entry-level credit cards, the SBI SimplyCLICK Credit Card has a low yearly membership cost of Rs. 499 and provides a high reward percentage at partner e-commerce sites like Amazon, Cleartrip, BookMyShow, Lenskart, and Techniques that can help, etc. The following are some of the critical characteristics of the SBI Just Click Credit Card:

Milestone rewards, like the free e-vouchers and the cancellation of annual fees, upon reaching the needed spend-based milestones. 10X Reward Points for online purchases from participating retailers, including eBay, BookMyShow, Cleartrip, etc. Except for fuel, all other online purchases earn 5X Reward Points. One reward for every 100 rupees spent offline.

8. Kotak Mahindra Essentia Platinum card – best for grocery shopping

They have to spend a major part of their monthly income on groceries. According to a poll, the average Indian spent nearly 28% of their total income on groceries. The Kotak Mahindra Ore Platinum credit card is an amazing cashback option for grocery shopping. It is the best option because you receive 10% cash back on all supermarket and retail purchases. This card is ideal if you spend a minimum of 1,500 on supermarket purchases.

In addition, as part of their birthday offer, if you spend 1.25 lakh in six months, which equates to up to 24,000 points or six accessible PVR seats in a year, you will receive 12,000 pts.

9. Axis Pride Signature – best credit card for NRIs

Do you require a credit card that gives the amazing value back on all purchases because you are an NRI? There is no need to search more because the Axis Pride Signature is the best available.

For the first year, no fees are associated with using this credit card. The annual cost of $500 is waived for the following years if you spend a minimum of 40,000 in one year. An exceptional 1.6% value generates most of the credit card’s worth in return on all purchases other than fuel. That indicates that for every 200 paid, you receive eight reward points.

If the total purchases made with the card during the other year were less than 40,000, there is a 500 annual fee. The card has an Rs. 495 yearly membership fee and is best used for recharging mobile phones and paying utility bills because it offers a high incentive rate of 5% on transactions made through Google Pay. The key characteristics of the card are as follows:

5% cashback on Google Pay mobile/DTH recharges and direct debits (internet, gas, electricity, etc.);4% cashback on Swiggy, Zomato, and Ola; and 2% cashback on all other offline and online purchases made with the card. Four free visits per year to domestic airport lounges at some airports in India. Take advantage of the bank’s Dining Delights program to receive discounts of up to 20% on all restaurant bills at partner establishments.

10. ICICI’s Business Advantage Black card – best business credit card

One of the top business cards available is the Business Advantage Black card from ICICI. This premium card is intended to promote secure corporate operations. You might get up to 1% cashback on domestic and foreign purchases. This card can be used for everything, including air travel, automobile rentals, and business services like accountancy, marketing, and advertising.

The fact that the cashback is based on total spending makes this card stand out, which implies that the payback will be more significant the more you spend. Users are also eligible for cashback when bills are paid and cashback on business expenses.

Benefits of having a top credit cards

Let’s explore the advantages of credit cards now that we understand what they are. A credit card offers a variety of features and benefits based on your needs to help you save money when making purchases. The top benefits of credit cards are listed below to assist you in learning more about them:

- Simple shopping procedure

Shopping is now more convenient and easy thanks to having the most significant credit card. You are no longer required to make purchases in stores or at malls. You can make sizable purchases using your credit card while lounging in your house. It might assist you in avoiding adding any debt on your credit card bill to your monthly budget.

You can purchase goods and services with a credit card and low-cost EMIs. The Buy Now, Pay Now option is another one that has gained popularity and is excellent for salaried debtors with fixed monthly incomes.

- No requirement to carry cash

The best cash substitute is a credit card because they eliminate the need to carry cash. You can use a credit card practically everywhere. If you lack funds, you can pay your bills with your Kotak Mahindra credit card and make up the difference at the end of the month. Making a trade is an easy process. To make an online purchase, you must scan your cards at the Point of sale terminal or input your card information.

- Offers, bonuses, and cashback

The most acceptable credit card offers cashback and perks that meet your needs. Your credit card may come with various exclusive discounts, cashback, or cashback rewards for items purchased with it, depending on the card’s issuer. Evaluating your needs before applying for a credit card is essential. If you travel frequently, getting a credit card with free access to airport lounges or travel insurance can be a good idea. Additionally, some credit cards provide exclusive discounts on purchases of goods, travel arrangements, and lodging.

- Quick withdrawal of money

Another advantage of having the best credit card is the ability to withdraw cash whenever necessary. It is important to remember that using your credit card to make a cash withdrawal entails a modest fee you will have to pay while completing your ongoing debt repayment.

- Generally regarded

A credit card’s most significant benefit is its universal acceptance as it is the most widely used form of payment worldwide. You may easily make foreign reservations and purchases with your Kotak Mahindra credit card at restaurants, hotels, retail locations, and gas stations. It facilitates your international travel. However, using your credit card overseas may result in hefty foreign transaction charges and exorbitant currency rates.

- Respond to crises

If you’re wondering what a credit card is, it’s a form of loan that promises to pay for your family’s and your expenses during emergencies. For example, you can pay your health fees with a credit card. It takes the stress off of figuring out how to pay for your medical expenses. Please remember that timely payments are required to prevent exorbitant interest rates and APR%. So, fill out an application for a credit card to simplify your life and finance management.

Edited by Prakriti Arora