The National Financial Information Registry and Its Vision for a Transparent Future: Unleashing a New Era of Financial Accountability in 2023

Is the Registry ready to Transform the Financial Landscape, Combat Corruption, and Empower Citizens to Make Informed Decisions?

The National Financial Information Registry and Its Vision for a Transparent Future: Unleashing a New Era of Financial Accountability in 2023

Honourable Finance Minister Nirmala Sitaramam said that a Financial Information check in could be carried out as a part of India’s ambition for openness withinside the country’s fiscal system and budget at some stage in the Union Budget deal of 2023 – 2024 on February 1, 2023.

She claims that this inflow came to offer the Indian fiscal system balance and effectiveness. Also, the system to enhance credit score glide is applaudable. To administer this registry, a brand new legislative shape could be in place.

The National Data Governance Policy, which objects to offering admission to anonymized data, was unveiled via the Finance Minister at some stage in the speech in Parliament. According to the Union Minister, this will vend studies and inventions throughout council and incipiency groups.

All about Financial Information Registry.

FIR, or Financial Information Registry, is a centralised electronic database that stores financial information related to the citizens and entities in India.

The database is maintained by the Reserve Bank of India (RBI) and operated by the Credit Information Companies (CICs) authorised by the RBI.

The purpose of the Financial Information Registry is to provide an in-depth research of a citizen’s or entity’s financial transactions and credit history.

It will contain information on credit facilities, including loans, credit cards, and other forms of credit, along with details of payments and defaults.

The Financial Information registry is intended to be a valuable tool for financial institutions and regulators to assess the creditworthiness of citizens and entities and to monitor the health of the financial system.

It is a measure provided by the government to help the country combat financial crime, converting black money into legit money by providing a more comprehensive view of a citizen’s or entity’s transactions.

As mentioned earlier, the RBI maintains the Financial Information Registry. It has authorised four CICs in India to operate the registry. These CICs are:

1. Credit Information Bureau (India) Limited (CIBIL)

2. Equifax Credit Information Services Private Limited

3. Experian Credit Information Company of India Private Limited

4. CRIF High Mark Credit Information Services Private Limited

The CICs will be responsible for collecting and processing the financial information that is stored in the FIR. They will be held accountable for ensuring the accuracy and integrity of the data stored in the database.

All the measures will be taken to keep information in the FIR confidential, they will only be accessed by authorised entities, for instance, financial institutions and credit bureaus, for specific purposes, for example, assessing creditworthiness.

Is there a need in India for Financial Information Registry (FIR)?

In recent years, India has seen a growing need for a Financial Information Registry, or FIR, to better track and manage financial transactions.

Here are some reasons why FIR is essential for the Indian economy:

1. Improved Financial Oversight – The game is all the Financial Information Registry providing better supervision and working of the financial sector. By collecting data on financial transactions, the government can identify and track financial crimes, as we discussed about converting black money, financing malpractices, and tax evasion. This information is also mandatory for income tax authorities (ITA) and helps in detect and prevent the tax fraud and evasion.

2. Enhanced Credit Availability -FIR can be instrumental in skyrocketing credit availability in the country. The registry can help economic institutions to assess the creditworthiness of borrowers more accurately. By accessing the financial history of a citizen or a business, financial institutions can make more structured lending decisions, leading to better credit availability.

3. Reduction of NPAs – Non-Performing Assets (NPAs) is quite a tedious work faced by the Indian banking sector. Financial Information registry can play a power ranger role in reducing the number of NPAs by providing banks with the financial history of borrowers. The information can help banks to evaluate the risks associated with lending and take measures to mitigate them.

4. Boost in Financial Inclusion – Also, FIR can be instrumental in promoting financial inclusion in the country. The registry can help create a credit history for citizens who has earlier been excluded from the formal financial sector. This can make it easier for them to access credit and other financial services, leading to malpractices.

5. Support to Government Schemes – Finally, Financial Information Registry can provide critical support to the government schemes, for example, Jan Dhan Yojana, Pradhan Mantri Jeevan Jyoti Bima Yojana, and Atal Pension Yojana. By providing financial information, the registry can help the government to identify eligible beneficiaries and ensure that the benefits of these schemes reach the intended recipients.

Hence, Financial Information Registry in India is crucial for the efficient functioning of the financial sector and for the overall growth of the economy.

It can help the government to regulate the financial sector better, promote financial inclusion, and support various government schemes.

Is this a cure to some problem India is facing or just propaganda to get a vote bank?

India has faced numerous issues due to the non-existence of a comprehensive Financial Information Registry (FIR) in the past.

Without a centralised electronic database for financial information, it was challenging to assess an individual’s or entity’s creditworthiness, monitor their financial performance, and combat financial crime.

Some of the problems India faced due to the non-existence of an FIR are:

1. Inefficient Financial institutions have to rely on incomplete and inconsistent credit information, making it difficult to assess the creditworthiness of citizens and entities. This resulted in inefficient credit allocation and an increased risk of default.

2. Lack of Transparency: Without a centralised database, the financial system lacked transparency, and it was challenging to monitor money performance. This created opportunities for the financial crime again as black money, fraud, and other illegal activities.

3. Limited Access to Credit: The non-existence of a comprehensive financial information registry made it difficult for citizens and small businesses to access credit. Being a borrower were hesitant to lend to those without a verifiable credit history.

4. Inaccurate Credit Reporting: Inaccurate credit reporting is an enormous issue in the non-existence of an FIR. Individuals and entities had no recourse to verify inaccurate information, which could negatively impact their creditworthiness.

5. Data Security Concerns: Non-accessibility of a centralised database has also come up with concerns about the security of financial information. This created a scope for data breaches, which could compromise the financial information of millions of citizens and entities.

Is India the only country establishing a Financial Information Registry (FIR)?

Several countries worldwide have established Financial Information Registries (FIRs) or similar centralised credit reporting systems to facilitate efficient credit assessment and monitoring of financial activities.

Some examples of countries that have established Financial Information Registry are:

1. United States of America: The United States has several credit reporting agencies, for example, Equifax, Experian, and TransUnion, that provide credit information to financial institutions and lenders.

2. United Kingdom: The United Kingdom has a centralised credit reporting system called Credit Reference Agencies (CRA) that maintains credit information on citizens and entities.

3. Australia: In Australia, there are four major credit reporting agencies, namely Equifax, Experian, Illion, and Tasmanian Collection Service, which maintain credit information on citizens and entities.

4. Canada: Canada has two major credit reporting agencies, Equifax and TransUnion, that provide credit information to financial institutions and lenders.

5. Japan: Japan has a centralised credit reporting system called the Credit Information Center (CIC) that provides credit information to financial institutions and lenders.

6. South Korea: In South Korea, there is a centralised credit reporting system called the Credit Information Analysis System (CIAS) that provides credit information to financial institutions and lenders.

7. China: In China, there is a centralised credit reporting system called the Credit Reference Center (CRC) that maintains credit information on citizens and entities.

There is already an Alternate in India for Financial Information Registry- Credit Bureau System.

What is the Credit Bureau system?

The credit bureau system in India is well-established and has been in operation for over two decades.

India’s credit bureau system is a centralised system similar to FIR. It collects and maintains credit information on citizens and entities which is used by lenders to evaluate the creditworthiness of borrowers.

It plays a crucial role in improving the credit ecosystem in the country. By providing credit information to lenders, the credit bureau system has facilitated efficient credit allocation, reduced the risk of default, and promoted financial inclusion.

Brief about Major Credit Bureaus in India.

There are four major credit bureaus in India collect and maintain credit information on citizens and entities, and provide credit reports to lenders for credit assessment and monitoring.

These credit bureaus are –

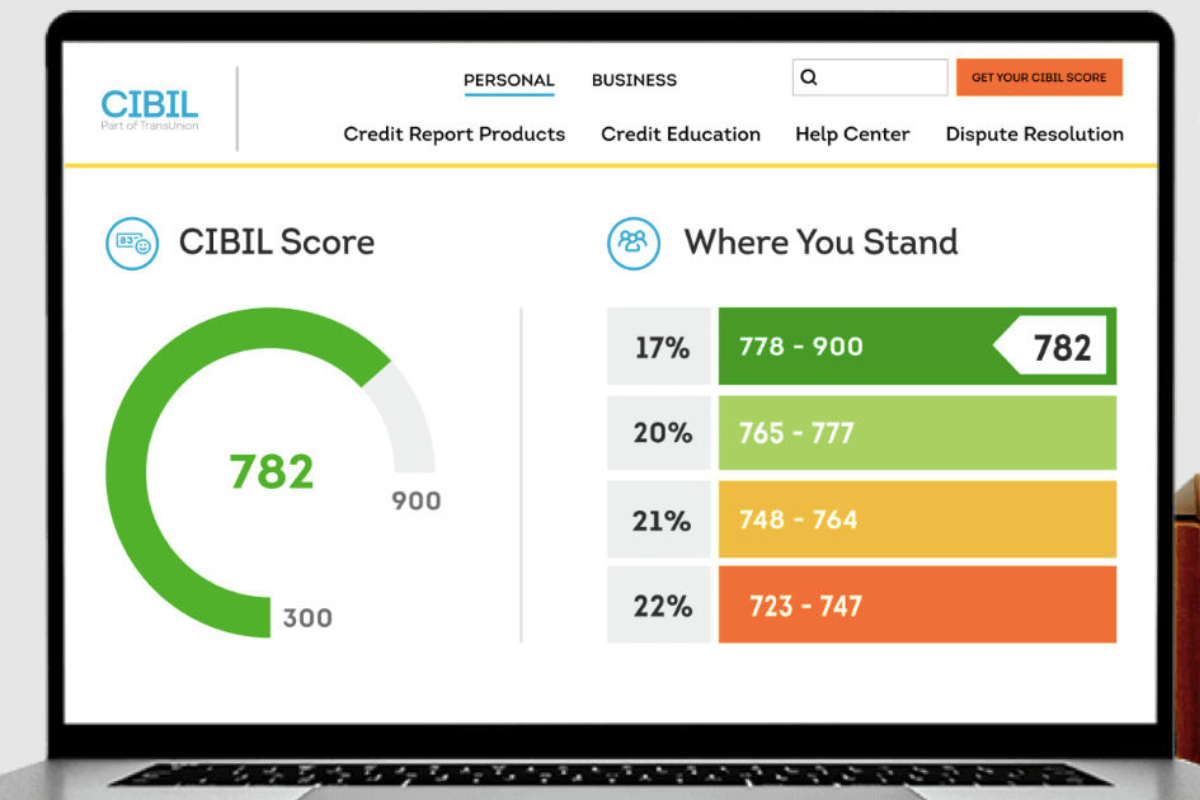

1. Credit Information Bureau (India) Limited (CIBIL) – CIBIL is one of the oldest and most widely used credit bureaus in India. It was established in 2000 and provides credit information on citizens and entities, including credit scores and credit reports.

2. Equifax – Equifax is a global credit bureau that operates in India and provides credit information on citizens and entities. It uses proprietary algorithms to assess creditworthiness.

3. Experian – Experian is another global credit bureau that operates in India and provides credit information on citizens and entities. It used innovative data and analytics to help businesses make smarter decisions.

4. CRIF Highmark – CRIF High Mark is an Indian credit bureau that provides credit information on citizens and entities. It was established in 2007 and used proprietary algorithms to assess creditworthiness.

Will FIR be a replacement for the credit bureau system?

The upcoming existence of the Financial Information Registry (FIR) in India is not intended to replace the existing Credit Bureau system but to complement it.

The FIR will provide a centralised database for financial information that can be used to evaluate the creditworthiness of citizens and entities and combat financial crime.

The FIR is intended to provide a more comprehensive view of an individual’s or entity’s financial activities and will be maintained by the Reserve Bank of India (RBI).