Tesla sales drop brings BYD closest ever to global EV crown

Tesla sales drop brings BYD closest ever to global EV crown

BYD Co., a prominent Chinese automaker, is on the verge of surpassing Tesla Inc. to become the world’s largest seller of electric vehicles (EVs). This shift in the EV market landscape is attributed to BYD’s successful global sales efforts.

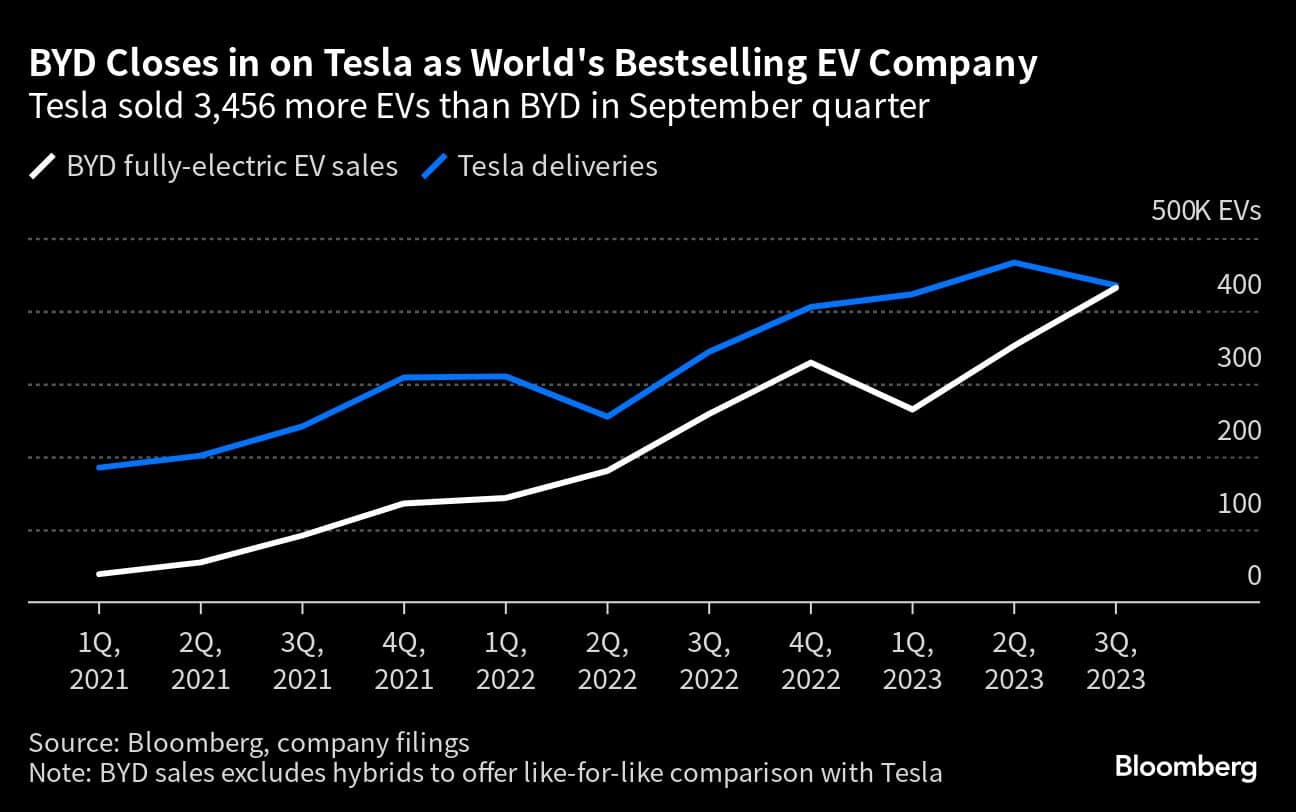

In the last quarter, BYD came incredibly close to overtaking Tesla. Tesla experienced a decline in deliveries for the first time in over a year due to factory downtime. During the same period, BYD sold 431,603 fully-electric vehicles, marking a 23% increase from the previous quarter. Tesla, on the other hand, shipped 435,059 cars globally in the same quarter. The gap between the two companies in terms of sales was only 3,456 units, making it the narrowest it has ever been.

Taylor Ogan, the CEO of Snow Bull Capital, a hedge fund based in Shenzhen, which holds shares in both BYD and Tesla, expressed confidence in BYD’s prospects. Ogan stated, “BYD will sell more fully electric passenger vehicles than Tesla in the fourth quarter.”

This development underscores the growing competitiveness of Chinese EV manufacturers in the global market. BYD’s success in narrowing the gap with Tesla is a testament to its expanding presence and the increasing popularity of its electric vehicles, particularly in China, the world’s largest EV market.

It’s important to note that the global EV market is highly dynamic, and competition among automakers is intensifying. While Tesla has been a dominant player, Chinese companies like BYD are aggressively working to capture market share and challenge Tesla’s leadership position. This competition is expected to drive innovation and advancements in the EV industry, benefiting consumers and accelerating the transition to electric mobility.

Shares in BYD experienced a decline of as much as 3.6% in Hong Kong during Tuesday morning trading, reflecting broader market trends in the Hang Seng Index, which reached its lowest intraday level since November 2022. This decline was not unique to BYD; other Chinese electric vehicle (EV) manufacturers such as Li Auto Inc. and Geely Automobile Holdings Ltd. also saw declines.

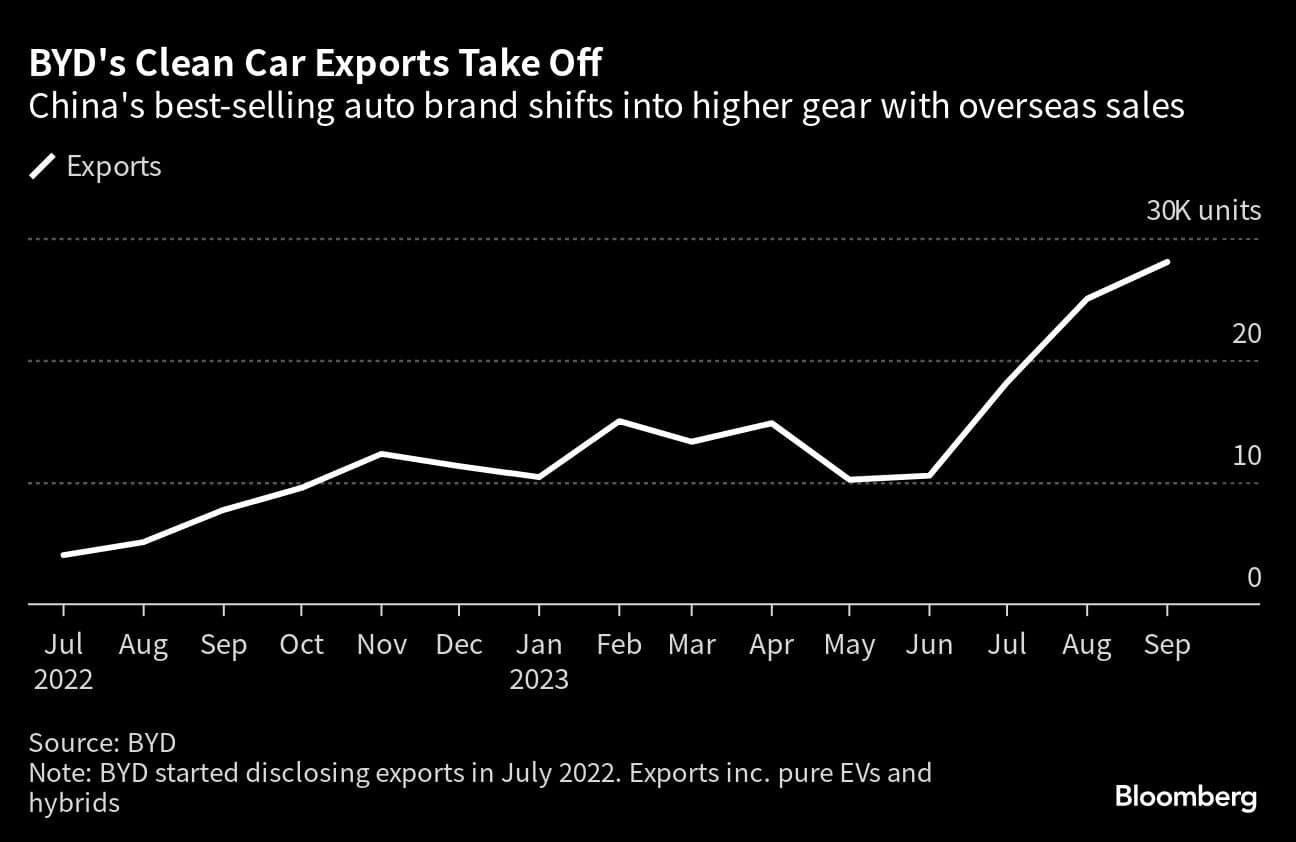

It’s worth noting that BYD’s sales performance in the EV market remains strong. Including both fully-electric and hybrid vehicles, BYD sold a total of 822,094 vehicles, marking another record-breaking quarter. This achievement solidifies BYD’s position as China’s best-selling car brand.

Traditionally known for offering affordable cars for mass consumers, BYD has been strategically expanding its product portfolio to attract a wider range of customers, contributing to its impressive sales growth. The company has ventured into the luxury EV market by introducing two premium EV brands, Yangwang and Fang Cheng Bao, which target the 1 million-yuan ($137,000) price category. This move allows BYD to compete with higher-end vehicle offerings in the market, significantly expanding its market reach.

In addition to its foray into the luxury segment, BYD has introduced two more affordable models, the Seagull and Dolphin, to compete effectively with rivals in the lower-priced EV market segment. This diversification in product offerings and price points has played a crucial role in attracting a broad customer base and boosting BYD’s overall sales performance.

While the stock price may have experienced a temporary decline due to market factors, BYD’s strong sales numbers and strategic product expansion indicate that the company remains a significant player in the rapidly evolving global electric vehicle industry.

The decline in BYD’s shares during Tuesday’s trading session in Hong Kong, along with similar declines in other Chinese electric vehicle (EV) manufacturers like Li Auto Inc. and Geely Automobile Holdings Ltd., can be attributed to broader market trends impacting the Hang Seng Index. The Hang Seng Index reaching its lowest intraday level since November 2022 reflects overall market sentiment and may have led to a temporary downturn in the stock prices of these companies.

Despite the short-term stock price fluctuations, BYD’s sales performance in the EV market remains robust. The company achieved a record-breaking quarter by selling a total of 822,094 vehicles, which includes both fully-electric and hybrid models. This accomplishment further solidifies BYD’s position as China’s leading car brand, underscoring its popularity among consumers.

Traditionally known for offering affordable vehicles for mass consumers, BYD has strategically expanded its product portfolio to appeal to a wider range of customers. One notable move is BYD’s entry into the luxury EV market through the introduction of premium EV brands like Yangwang and Fang Cheng Bao. These brands target the 1 million-yuan ($137,000) price category, allowing BYD to compete effectively with higher-end vehicle offerings and broaden its market reach.

Additionally, BYD has introduced more affordable models, such as the Seagull and Dolphin, to compete in the lower-priced EV market segment. This diversification in product offerings, spanning different price points and customer preferences, has played a pivotal role in attracting a diverse customer base and driving BYD’s impressive sales growth.

While stock prices may experience fluctuations due to market dynamics, BYD’s strong sales figures and strategic product expansion demonstrate its resilience and prominence in the continually evolving global electric vehicle industry.