Swiggy, The Upcoming IPO, Saw Loss Widen By 8%. Will It Survive In The Ever-Changing Dynamics Of Indian Society And Consumerism?

Food-tech giant Swiggy saw its losses widen 8 % to Rs 611 crore in Q1 FY25 from Rs 564 crore a year ago on mounting expenses, the company’s updated draft red herring prospectus (DRHP) showed. Swiggy submitted its first amended DRHP to the SEBI recently. The fresh issuance component is for Rs 3,750 crore, while the offer-for-sale (OFS) component will be for Rs 6,664 crore (comprising 18.53 crore shares), resulting in an IPO size of Rs 10,414 crore, or $1.25 billion. It was reported earlier that the company is expected to boost the amount of its IPO by Rs 1,250 crore, or $150 million, bringing the total to Rs 11,664 crore, or $1.4 billion.

So, is Swiggy overvalued?

Some say these new-age Indian startups are not just overvalued, but they are also hypervalued. Well, the statement is not completely wrong. Prominent names like Byju’s that have seen slashing of valuation from billions to zero, which is a testament that there is something problematic with the valuation of new-age Indian startups.

So, what can a retail investor do? Everyone wants to make quick bucks, but success comes to only those who don’t run with speculations and emotions and focus on fundamentals.

So, let’s watch the fundamentals of Swiggy.

The food delivery ecosystem.

Swiggy is a food delivery company with a quick commerce platform. Let’s recall that Swiggy or any other food delivery setup or quick delivery setup doesn’t have its own products. Swiggy does not have restaurants; rather, it partners with restaurants and operates cloud kitchens and private-label brands. Therefore, businesses like these are totally dependent on the demand and supply of the parent business. Here, the parent business is the Restaurants. So if tomorrow, the demand for restaurants falls, so will the situation of food delivery companies like Swiggy.

Moreover, swiggy is not the only company in the food delivery segment. In food delivery, Swiggy competes with market leader Zomato and in the quick delivery segment, it competes with Zomato-owned Blinkit and new player Zepto. All these companies offer convenience in our daily lives. But in the end, it takes no time for a consumer to shift from one company to another, and all that a company can do to retain their customers is to bind them with attractive discounts.

The day the company stop giving discount, any other similar setup will come into the market and will take away all the customers by giving discounts. So, basically, at the end, everyone is playing the discounting wars. This paves the way to the doubt that do these companies really have a robust business model, or they are just betting on the discounts!

Also, Swiggy’s DRHP emphasises that the company’s development is dependent on its capacity to consistently expand products while also acquiring and retaining consumers at a cost-effective way. If this does not happen, financial situations may deteriorate. Therefore, the end game is all about ‘how much discount can you give’?

So, can we expect that the huge discounts led Swiggy to become the market leader?

NO. Even after offering huge discounts, Swiggy lost the market leader position. Swiggy began food delivery operations in 2014 and has since introduced other services, including Quick Commerce in 2020 and Dineout in 2022, among others. While the company’s gross revenue has improved, it has yet to become profitable and continues to generate negative cash flow from operational operations. Experts say that the loss of Swiggy in terms of a market leader is probably because of its lesser penetration in the market.

The Target audiences were Working Professionals & Urban Working Families, & Hostelites who had a demand for delivered food because they were either too tired or too constrained to cook at home or visit a restaurant and order food. So when Zomato or Swiggy was launched, thousands and thousands of these people joined up and swelled the business.

But today, this market is saturated. Mumbai, Delhi, Bangalore, Hyderabad, Kolkata, and Chennai are completely saturated, and the next step is to enter smaller cities, which may or may not see such inflated growth because of traditional consumer habits. Meanwhile, Other Target Audiences of Restaurants like – connoisseurs (who like the ambience and always eat only in restaurants), Small Semi Urban Families, and Tier 2 and Tier 3 City Professionals – Will rarely order from Swiggy or Zomato. And they form almost 65–66% of the Markets.

Every food delivery company is great in Tier 1 cities, but they face tough competition when they embark on their journey in Tier 2-3 cities, as the public there still relies on the traditional way of purchasing food from restaurants and avoiding those extra charges in the name of convenience. So, whether these small cities will be the levers of revenue focus for online food delivery remains a question.

However, some success can be seen in this segment, like Bonfire Pizza and Mysore Raman Idli, which are among the thousands of restaurants from Tier 2,3 cities that have not only polished their own fortunes by partnering with food delivery startups but also have shown that the people are not so rigid in welcoming these tech companies, along with their traditional way of consumption.

What about Dineout?

Swiggy acquired the Dineout in 2022, which is India’s leading dining out and restaurant tech platform. This attempt was thought to capitalise on Dineout’s unique assets and king position in the dining-out space, giving Swiggy the opportunity to cater to every food occasion. However, the agreements got bitter just after a few months when, in September 2022, the National Restaurant Association of India (NRAI) urged its members to exercise caution before joining Swiggy’s and Zomato’s newly introduced dine-in programmes.

Just a month after, over 900 eateries exited Swiggy Dineout, citing deep discounts and raising concerns over their aggregator’s table-booking app, alleging it gives heavy discounts and cashback on in-restaurant dining. This act, they said, hurts the restaurant industry, which was battered for over a year by the pandemic and was now dealing with rising food inflation. Riyaaz Amlani, who is now the president of NRAI, said at that time that ‘this practice was not a restaurant friendly practice. Swiggy’s delivery segment has plateaued, and now they’re finding ways to eat in the dining-out business’.

Even when in January 2023, as Zomato restarts its controversial Zomato Gold loyalty programme with discounts on deliveries and dining, industry body NRAI sent advisories to restaurants to boost up their own loyalty programs on discounts through other apps, while many big companies said they are not on Gold. Sounds like another typical case of tech companies fighting with traditional companies. This shows that, in the end, it is all about the game of discounts, questioning the sustainability of the business model.

Expectation of exponential demand- A confusing factor.

Almost all Indian startups expect exponential demand infinitely. This can be miscalculating. On the pretext of a growing population, they say the customers will be onboarded as the population seems to go up. However, in reality, only a small segment of the population are their customers. Most of the customers of these food delivery companies are either the millennials or Gen Z.

To date, the millennials have been alone in their lives with no responsibilities for their families, and Gen Z is at a growing age. Both of them have never seen any bear market, as most of them were in their knickers during the last one and probably enthusiastic enough to cheer in the bull market. However, as they enter into the next segments of life, situations paint a different picture.

Reports have claimed that food-ordering apps are eating into millennials’ income. In 2018 and 2019, many millennials, who are probably in their new careers (towards 30s) and who are in college (20s), do not have time to cook after coming back from a long day and hectic work schedule. Hence, doing Swiggy is the most hassle-free option left to them, and they took pride in choosing that way of life. The pandemic arrived (2020-2022), and people were detained inside their homes; hence, this also fueled the engine for food delivery companies.

The customers- Will they always love Swiggy and spend their money on Swiggy?

Cut to 2024, India was named the cancer capital of the world. By the fourth year of the new decade, millennials have understood that they are now in their 30s, where they have to be conscious about their own health and be mindful of spending as they venture into the parental phase of their lives.

This led to the culinary revolution in India, where urban youths, who were earlier the fans and pride custodians of online food ordering habits, are now looking towards more authentic meals and embracing the art of cooking at home. This can even be proved by a Statista survey, which revealed that 93% of meals in India are home-cooked, highlighting a strong preference for homemade food over outside options, which account for just 7% of consumption.

Also, the Gen Z, is way more conscious about their health choice from a very starting part of their life. As they are entering the workforce, they MAY contribute by being the customer of the food delivery companies, but they can also OPT for healthier options of home cooking or affordable options of purchasing their food from local mess to avoid that extra cost spend on delivery.

This gap of healthy food alternatives has been found by another person and this led to the development of Cookr, an early-stage food tech startup on a mission to revolutionise the Indian food industry by building an e-commerce marketplace offering a broad range of healthy alternatives to restaurant-delivered food. If this succeeds, then it can become a direct threat to food delivery companies like Swiggy and Zomato, which are dependent directly on the demand of restaurant partners.

The onset of quick commerce- the ‘apple of the eye’ or just ‘pulling the wool over the eye’.

Swiggy also has this quick commerce segment, called Instamart, which is now the flavour of the season. Every business honcho is trying to land their feet in the quick commerce segment. Earlier last month, it was reported that Swiggy took Instamart to 43 cities ahead of the festive season, and recently, it launched 24*7 free delivery in three cities to cater for the needs of the festive season. All these factors denote a hypothesis that the success of quick commerce depends upon the spending habits of the customer, which spurs either in the festive season or if the person belongs to the affluent working class.

This quick commerce segment, or the 10-minute delivery, was the new holy grail for grocery store delivery services. And it all started thanks to Zepto. A duo of 19-year-olds persuaded investors that they could master ultra-fast delivery. They gathered tremendous funds for a blitzkrieg. When Zepto unveiled its huge intentions, rivals had to join in.

Swiggy also jumped in, raised money, and instead of spending on its core food delivery segment, it set aside the entire $700 million (a staggering ₹5,500 crores) just for quick commerce. Forward to 2024, Instamart, which contributes around 17% to Swiggy’s overall revenue, has been bleeding money over the past year as it fights off tough competition in the quick-commerce space.

Even if the losses may continue to reduce till FY26, as per sources privy to the company’s projections, Swiggy is still losing ground to its food delivery rival Zomato’s Blinkit, which is expected to operationally break even in the current quarter, as per Zomato’s guidance. And the newbies Zepto is already way ahead with huge chunks of funding in their pockets. Moreover, the big players like Reliance (with Jiomart) and Tata (with BigBasket) are also joining. Let’s hope that Instamart fastens its belt and survives, or otherwise, it will reach a point where it will become dunzo!

At the end.

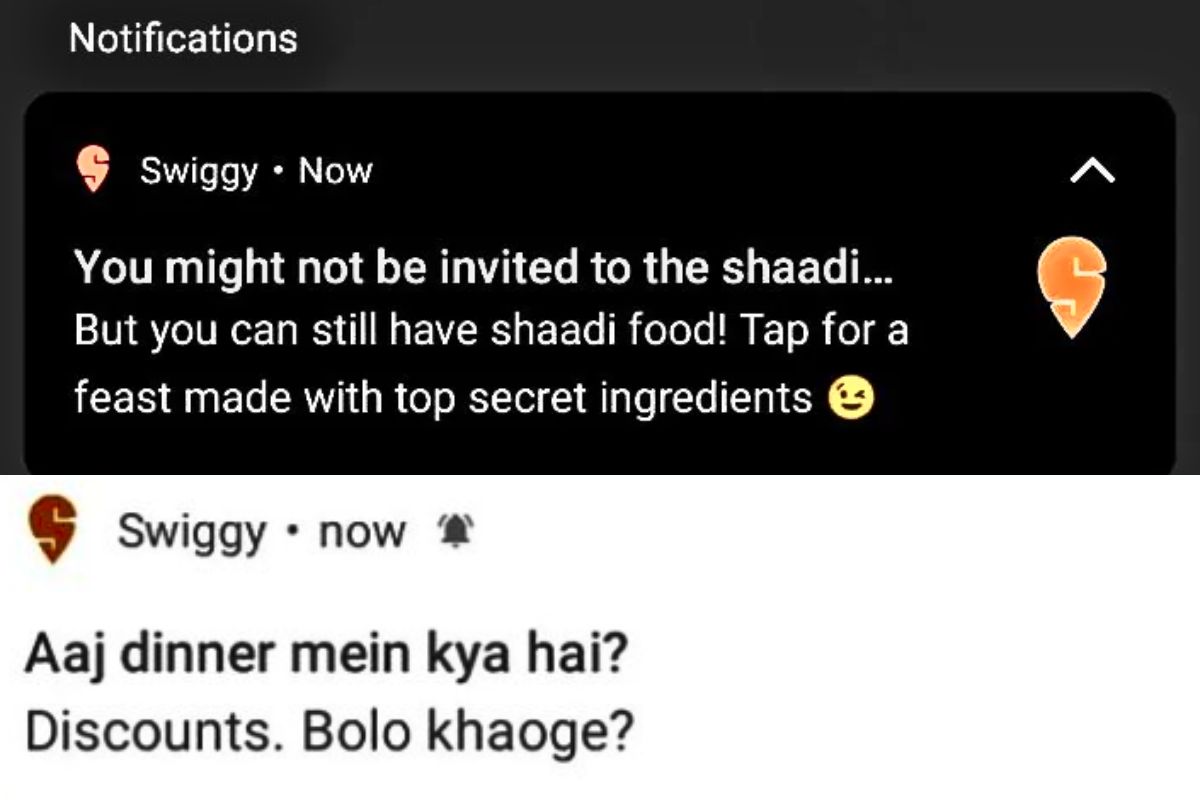

The modus operandi of approximately all new-age startups is advertising. But to what point can they make customers fools? Food delivery companies and quick commerce companies that give magnificently cute notifications to lure their customers can only achieve this to a certain point. Afterwards, if the public is conscious of their inflated bills, which puts pressure on their credit cards, then they will opt for feasible options of getting out and saving their pockets. As mentioned, as the young cohort is entering into the next chapters of life and new responsibilities of family life are kicking in, which demand mindful finance calculations, then this will put a dent in these online food delivery and quick commerce companies.

No doubt that companies like Swiggy had broken all barriers and availed our favorite meal right at our doorstep. Now, we just need to grab our smartphone, turn on Swiggy app, and order. As easy as sipping tea. But till what point ‘we’ will be ‘Swiggying’ and ‘easyfying’ our life at the cost of cash over convenience? Therefore, hope Swiggy sustain in the ever changing dynamics of Indian society!