5 reasons why a startup’s own budget matters more than the government budget

Why a startup’s own budget matters more than the government budget

While there’s an understandable obsession with the annual government budget, in my opinion, this event has little to no bearing for most young startups. There are of course, exceptions in the form of new regulations or in categories where the government plays a big role. Instead of pondering over the Union Budget, I believe startups should use this as a timely reminder to focus on their own budget.

(I also had an interesting free wheeling conversation with LinkedIn’s senior editor Ramya Venugopal on this as well as other issues about startups and the government in this video above.)

Like any other budget, the government’s has two components – expenses and revenues. Most revenues come from direct or indirect taxes and also through the sale of capital/government assets. The expenses are largely spent on infrastructure, citizen welfare, and for the general running of the country.

Likewise, for a startup, the key financial metrics are around the source of incoming funds and expenses. The source of funds can be either from customers (ideal!) or from investors (angels, VCs, etc.). Expenses are typically what is required for running any company and can fall under several categories such as marketing, sales, human resources, infrastructure, etc.

The core role of a startup CEO / founder is to ensure that the company never runs out of money. There’s a fabulous A16Z blog post on various financial metrics for a startup.

Here are my top 5 metrics to keep in mind while preparing your startup’s budget:

Monthly Recurring Revenue: It is also popularly called the MRR. A sister metric is the Annual Revenue Run rate (ARR) which is the revenue in the last month times 12. In addition to the MRR, most startup companies need to focus on the revenue velocity.

That is, how fast is the month on month growth (MoM), and for later stage startups, year on year revenue growth for identical time periods. For example, the golden rule for SaaS startups is 3,3,3,2,2 (Triple revenue every year for the first 3 years and then double twice after that in year 4 and 5). Paul Graham, the founder of YCombinator, has a nice post on growth in an early stage startup.

/money-4655836_1920-694c33b88d7245efa233005565dc635f.jpg)

In some cases, if the startup is pre-revenue, one might consider the user or customer metrics.

Recommendation: Grow revenue faster than your category and get to a key milestone such as $10K (for pre-revenue startups), $100K (Series A), $500K+ (Growth stage) in exiting MRR.

Note: Few product startups (well under 1%) have broken past the $5M ARR mark!

Expenses: There are two major categories of expenses – fixed and variable. The fixed expenses are employee salaries, office rent, and other similar categories. Variable expenses are in the areas of marketing and possibly sales. The key defining metric here is Cost of Customer Acquisition (also known as CAC). A sister metric is the time it takes to acquire a customer and the repeatability of the process.

Recommendation: Get your CAC such that it is close to the monetizable value of the customer in the next 12-18 months (see Lifetime Value).

Contribution Margin: This is all about unit economics. Is the startup profitable or not on a per unit basis just on variable cost. This is a key milestone in any startup’s journey and also an indicator of the profit potential of the business. Of course, for later stage or growth startups, one would want to start looking at EBIDTA for an overall perspective on the business health.

Recommendation: Get POSITIVE on contribution margin in 2017 while still maintaining strong business growth!

Burn rate and runway: Your burn rate is simply your monthly revenue minus your expenses (fixed, variable and capex). This is the end-game that helps you determine your runway. As in, it will indicate how much time you have before your startup runs out of money. This is the holy truth!

Recommendation: Ensure you start fundraising at least 6 months before you run out of cash.

Extra credit: Build your budget to optimise not just for revenue but also for cash flow (esp. Critical in Enterprise companies where collections are not linear, nor predictable).

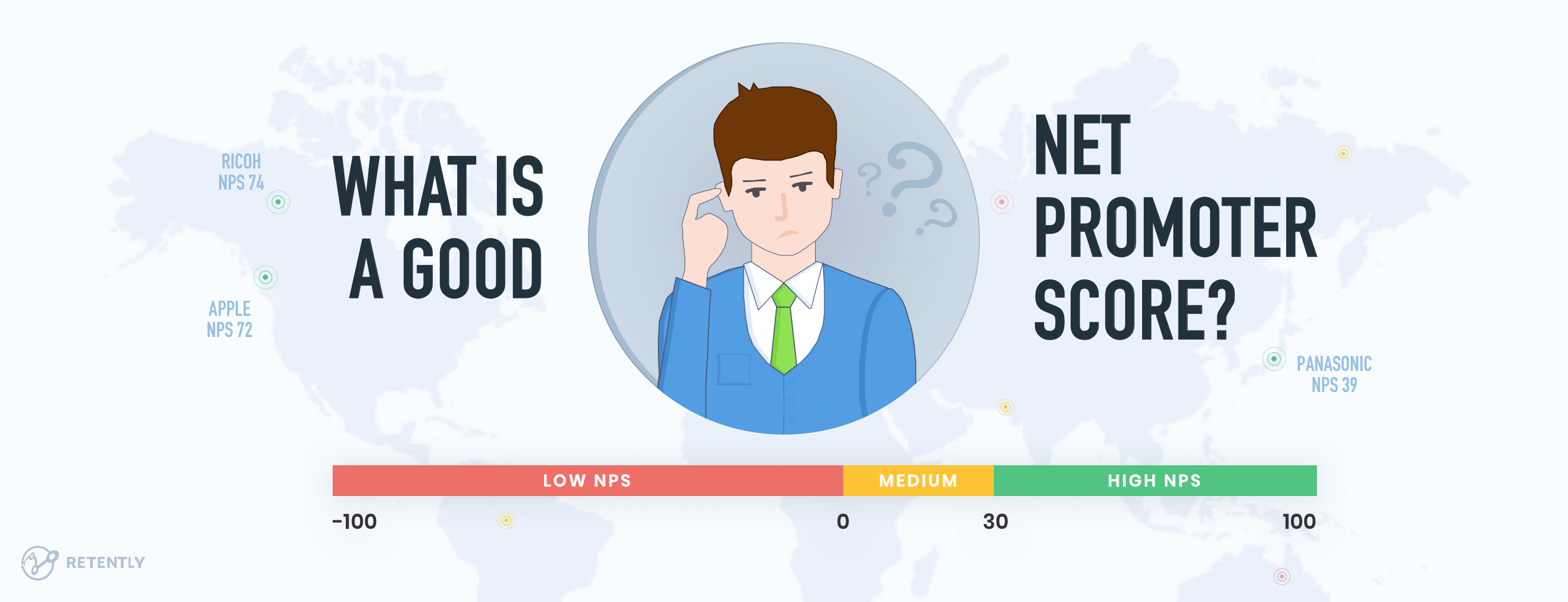

Net Promoter Score (NPS): NPS is one of the simplest but most underused instruments in startupland. It is the easiest way to figure out if your product or service has mojo (my earlier blog post on this topic). Effectively, it is a measure of customer love.

Why is this important in an article on budgets? Well, as it turns out, this metric is directly correlated to at least two key financial metrics – Revenue, of course. And organic, Word-of-Mouth Marketing which has a direct impact on your contribution margin! It is also a leading indicator of future revenue potential.

Here is how it is computed. Your customers, B2B or B2C,are asked to rate you on a scale of 1 (worst) to 10 (best). Then you compute the score which is defined as promoters (9,10 raters) less the detractors (1-6 raters) divided by the total population.

Recommendation: Aspire to get an NPS of at least 50%. For calibration, some of the best brands in the world such as Amazon, Nike, Tesla, Apple, etc. are all at 75+% at scale!

So go ahead, do a budget. Surprisingly, simple as it is, I couldn’t find any good existing budget templates for startups. This template from Tim Raybould comes close; focus especially on the revenue and expenses sheet to start out. I recommend doing the budget bottoms up, especially for early stage startups. I believe most, if not all, top down budgets are useless. Triangulate the budget two or even three different ways to get to a more accurate representation.

As John Wimber says above, the budget is not just a financial statement but really a reflection of your priorities and your values. Here’s wishing you budget effectively and hit, and hopefully deliver a “Surplus” budget in 2017.