SEBI’s Chairperson Had Stake In Obscure Offshore Entities Used In Adani Money Siphoning Scandal. Was This The Reason SEBI Chairman Madhabi Puri Buch Never Took Any Action Against Adani Group?

Was Madhabi Puri Buch Planted By Adani In SEBI, Even The RTI Says That Government Had No Information About The Merits Of Madhabi Puri For Selection As Chairperson Of SEBI

Was Madhabi Puri Buch Planted By Adani In SEBI, Even The RTI Says That Government Had No Information About The Merits Of Madhabi Puri For Selection As Chairperson Of SEBI

Citing whistleblower documents, a new report by Hindenburg Research said Madhabi Buch, chairperson of market regulator Securities and Exchange Board of India (SEBI), and her husband owned stakes in offshore entities linked to the Adani Group’s alleged financial misconduct.

According to the Hindenburg report, Madhabi Buch and her husband had undisclosed investments in obscure offshore funds in Bermuda and Mauritius, the same entities allegedly used by Vinod Adani, brother of Gautam Adani, to manipulate the financial markets. These investments reportedly date back to 2015, well before Madhabi Buch’s appointment as a whole-time member of SEBI in 2017 and her elevation to SEBI chairperson in March 2022.

The report alleges that just weeks before Buch’s appointment to SEBI, her husband requested the transfer of their investments into his sole control, potentially to avoid any scrutiny related to her new regulatory role. The couple’s investments were reportedly funnelled through a complex, multi-layered offshore structure, raising questions about their legitimacy and purpose.

Hindenburg’s report suggests that SEBI’s alleged lack of decisive action against the Adani Group’s suspicious offshore shareholders may stem from Buch’s personal financial ties to the same entities under investigation. The report also points to her role in promoting Real Estate Investment Trusts (REITs) in India, an asset class significantly benefiting Blackstone, where her husband serves as a senior advisor.

The Hindenburg report is the latest in a series of allegations against the Adani Group, a conglomerate accused of stock manipulation and financial misconduct in a January 2023 report by the same research firm. That report led to a steep decline in Adani’s stock prices, wiping out over $100 billion in market value.

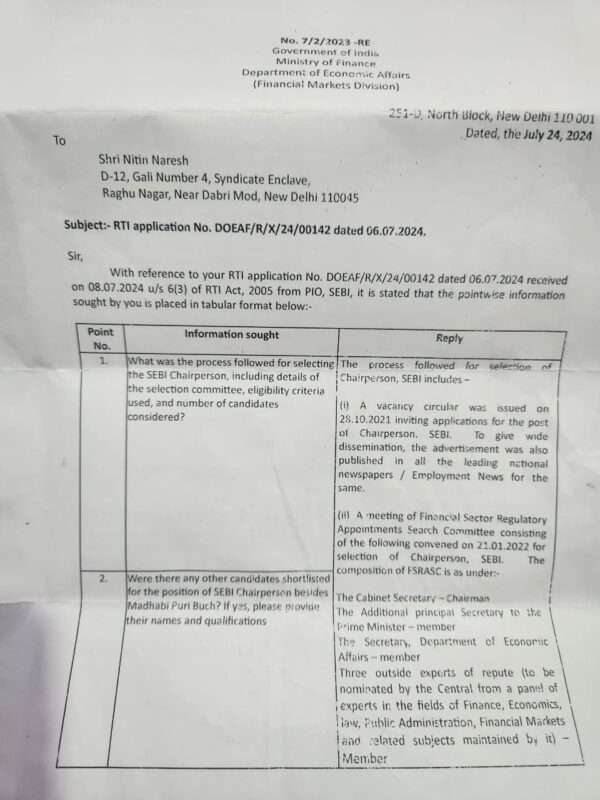

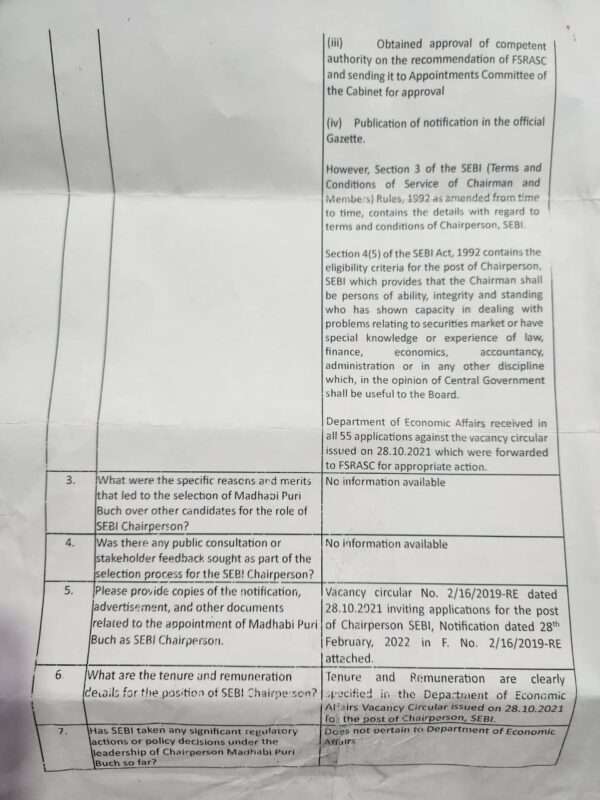

Even Inventiva has filed an RTI sometime back on the selection of madhabi puri buch and government and SEBI had no information about any merits based on which the Madhabi Puri Buch Was made the chairman of SEBI.

If we go by assumptions, it seems that the madhabi puri buch was planted by adani in SEBI so that the market regulator takes no action on any adani group companies.

Inventiva has been raising its voice against all the wrong doings of madhabi puri buch since a long time and has demanded her arrest from a very long time.

Some Insiders In SEBI also claims that he also takes a hefty money from the startups launching their IPO

Lets Read The Hindenberg Report

Background: 18 Months Since Our Adani Report, SEBI Has Shown A Surprising Lack Of Interest In Adani’s Alleged Undisclosed Web Of Mauritius And Offshore Shell Entities

It has been nearly 18 months since our original report on the Adani Group presented overwhelming evidence that the Indian conglomerate was operating “the largest con in corporate history”. Our report exposed a web of offshore, primarily Mauritius-based shell entities used for suspected billions of dollars of undisclosed related party transactions, undisclosed investment and stock manipulation.

Since then, despite the evidence, along with over 40 independent media investigations corroborating and expanding on our original work, Indian securities regulator SEBI has taken no public action against the Adani Group.[1] Media has reported that SEBI is likely to impose mere token, technical violations on the Adani Group despite the breadth and magnitude of the issues.

Instead, on June 27th, 2024, SEBI sent us an apparent ‘show cause’ notice. SEBI did not allege any factual errors in our 106-page analysis, but instead claimed the disclosure around our short position– which we disclosed repeatedly– was deficient, arguing that we should have provided even more robust disclosure. [1,2]

The SEBI notice also claimed our report was “reckless” for quoting a banned broker with specific experience dealing with SEBI who detailed how the regulator was fully aware that firms like Adani used complex offshore entities to flout rules, and that the regulator participated in the schemes.

In our July 2024 response to the ‘show cause’ notice, we wrote that we found it odd how SEBI—a regulator specifically set up to prevent fraudulent practices – showed little interest in meaningfully pursuing the parties that ran a secret offshore shell empire engaging in billions of dollars of undisclosed related party transactions through public companies while propping up its stocks through a network of sham investment entities.

The Indian Supreme Court said that SEBI had drawn a blank in its investigation of these shareholders, as detailed in the court records. In late June 2024, Adani CFO Jugeshinder Singh described some regulator notices aimed towards Adani Group as “trivial”, apparently writing off the prospect of their severity even before the process was concluded.

Background: “IPE Plus Fund” Is A Small Offshore Mauritius Fund Set Up By An Adani Director Through India Infoline (IIFL), A Wealth Management Firm With Ties To The Wirecard Scandal

Vinod Adani – Brother Of Gautam Adani – Used This Structure To Invest In Indian Markets With Funds Allegedly Siphoned From Over Invoicing Of Power Equipment To The Adani Group

As detailed in our original Adani report, documents from the Directorate of Revenue Intelligence (DRI) alleged that Adani “grossly” overvalued the import valuation of key power equipment, using offshore shell entities to siphon and launder money from the Indian public. [1]

A subsequent investigation by non-profit project Adani Watch in December 2023 showed how a web of offshore entities, controlled by Gautam Adani’s brother, Vinod Adani, were recipients of funds from the alleged over-invoicing of power equipment.

In one complex structure, a Vinod Adani controlled company had invested in “Global Dynamic Opportunities Fund” (“GDOF”) in Bermuda, a British overseas territory and tax haven, which then invested in IPE Plus Fund 1, a fund registered in Mauritius, another tax haven.

Whistleblower Documents Show That Madhabi Buch, The Current Chairperson Of SEBI, And Her Husband Had Stakes In Both Obscure Offshore Funds Used In The Adani Money Siphoning Scandal

We had previously noted Adani’s total confidence in continuing to operate without the risk of serious regulatory intervention, suggesting that this may be explained through Adani’s relationship with SEBI Chairperson, Madhabi Buch.

What we hadn’t realized: the current SEBI Chairperson and her husband, Dhaval Buch, had hidden stakes in the exact same obscure offshore Bermuda and Mauritius funds, found in the same complex nested structure, used by Vinod Adani.[3]

Madhabi Buch and her husband Dhaval Buch first appear to have opened their account with IPE Plus Fund 1 on June 5th, 2015 in Singapore, per whistleblower documents.

A declaration of funds, signed by a principal at IIFL states that the source of the investment is “salary” and the couple´s net worth is estimated at $10 million.

Read Full Hindenberg Report Here https://hindenburgresearch.com/sebi-chairperson/