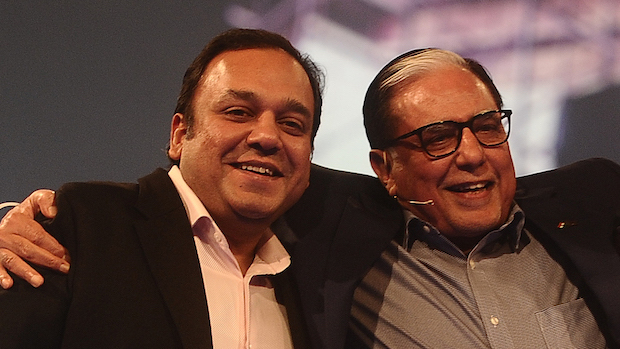

Sebi Set To Further Investigate Alleged Fund Diversion At ZEE, Top Management Including Subhash Chandra And Punit Goenka Under Scrutiny

The Securities and Exchange Board of India (Sebi) is looking into allegations of fund diversion within Zee Entertainment Enterprises (ZEE), with a focus on the company's top leadership, including founder Subhash Chandra and CEO Punit Goenka. Amidst concerns raised by regulatory findings and market volatility, the investigation highlights potential financial irregularities and their implications for one of India's prominent media conglomerates. Meanwhile, as per reports yesterday, the management at Zee refuted all such claims, stating that the following reports are 'falsified' and 'misleading'.

Sebi is prepared to interrogate the upper echelons of Zee Entertainment Enterprises (ZEE) regarding the alleged misdirection of funds within the media conglomerate, including its founder Subhash Chandra, CEO Punit Goenka, CFO, as well as present and former board members.

The regulatory body aims to conclude its inquiry by mid-April and subsequently pursue legal actions based on its findings.

Initial findings by Sebi in June last year indicated that ₹200 crore from the company had been diverted through transactions involving related parties.

However, this assertion was challenged by the father-son duo before the Securities Appellate Tribunal (SAT). Nevertheless, Sebi later informed the tribunal of a broader investigation due to the intricate nature of these transactions.

Sebi informed the tribunal that Chandra had issued a letter of comfort for ₹4,210 crore as the chairman of Essel Group, prompting the need for an extended investigation period of eight months to scrutinize transactions totalling around Rs 2,000 crore involving companies affiliated with the promoter.

According to sources, Sebi is meticulously analyzing thousands of transaction records, bank statements, agreements, partnership documents, and board meeting minutes.

R Gopalan, the former secretary of the Department of Economic Affairs (DEA), currently chairs ZEE.

Following a report disclosing Sebi’s findings that approximately $241 million (Rs 2,000 crore) might have been diverted by the company’s promoters, ZEE shares plummeted by 14.8% on the BSE, closing at Rs 164.50 per share on Wednesday.

The decline compounded the previous steep fall in ZEE’s share price subsequent to the termination of a $10-billion merger plan with Sony Group’s India business, primarily attributed to Sebi’s discoveries.

Investigation Progress

Sebi’s investigation originated from the resignation of three independent directors from ZEE in November 2019, who cited concerns regarding various issues, including the appropriation of a Rs 200 crore fixed deposit by Yes Bank to settle loans of Essel Group’s related parties, promoted by Chandra and his family. Goenka, Chandra’s son, is also implicated.

The probe uncovered that Chandra had issued a letter of comfort to Yes Bank on September 4, 2018, regarding credit facilities availed by Essel Green Mobility.

This letter ensured that ZEE would maintain a fixed deposit of at least Rs 200 crore with the bank at all times while the loan was outstanding, permitting the bank to utilize the fixed deposit for repayment in case of default.

The Denial

Meanwhile, Zee Entertainment, has rebutted recent media assertions suggesting a significant accounting discrepancy of $240 million, equivalent to Rs 2,000 crore, dismissing them as inaccurate and unfounded.

In a statement, the company clarified, “Reports alleging accounting irregularities within the company are baseless. We are actively collaborating with SEBI and are in the process of providing comprehensive responses to all inquiries.”

The Context

Zee’s denial emerges amidst disclosures by the Securities and Exchange Board of India (SEBI) regarding a substantial financial irregularity at Zee Entertainment Enterprises Ltd. The disclosure intensifies pressure on the media conglomerate following the collapse of its merger with Sony Group Corp’s local unit mere weeks ago.

SEBI’s scrutiny into Zee’s founders has unearthed a potential fund diversion totalling approximately 20 billion rupees ($241 million), as mentioned above; the amount surpasses initial estimates made by Sebi investigators by a significant margin.

These recent developments aggravate the challenges confronting Goenka, Zee’s CEO, as he endeavours to reassure investors following the collapse of the $10 billion merger with Sony.

The termination of the merger, which had been in progress for two years, transpired in January amidst prolonged negotiations regarding the leadership structure of the combined entity.

The Fallout

Amidst ongoing regulatory scrutiny into alleged financial misconduct involving a father-and-son duo, tensions between Sony and Zee have escalated since mid-2023.

Sony became apprehensive about entrusting Goenka with leadership of the merged company, while Goenka, citing a prior merger agreement, stood firm in demanding the CEO position. This impasse ultimately resulted in Sony terminating the deal in January.

In August, SEBI issued an order prohibiting Zee founders, Chandra and Goenka, from holding executive or directorial roles in any listed company, citing their misuse of authority and diversion of funds for personal gain.

However, Zee challenged SEBI‘s ruling, securing a partial reprieve in October allowing Goenka to retain an executive role pending the ongoing investigation.

The proposed merger aimed to benefit Sony by granting access to Zee’s extensive content library in regional Indian languages, while also bolstering Zee’s financial stability.

However, Zee’s full-year profits plummeted by 95% in the twelve months leading to March 31; although it reported a 585.4 million rupees for the quarter ending December 31, Zee fell short of analyst expectations.