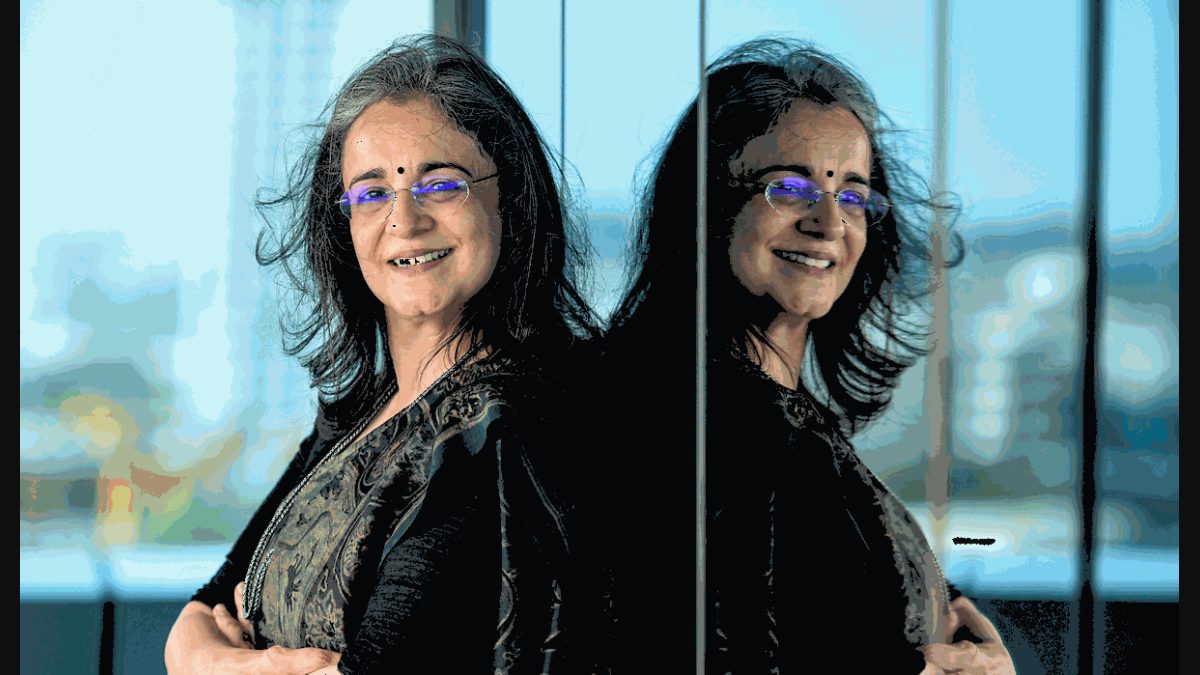

SEBI Chairperson Madhabi Puri Buch Earned Rs. 3.7 Cr From Consulting Firm In Potential Rules Violation; A Stain On India’s Corporate Integrity, She Should Resign Until Allegations Proven Baseless

India’s reputation as a growing economic powerhouse is being severely tested by the latest allegations against SEBI Chairperson Madhabi Puri Buch, her husband, Dhaval Buch and the Adani Group. According to Hindenburg Research, Buch's continued financial ties to a consultancy firm during her tenure at SEBI, coupled with her involvement in investigating the Adani Group, raises serious questions about conflicts of interest and regulatory integrity. This controversy not only casts a shadow over Buch’s role and SEBI’s credibility but also reflects a broader pattern of questionable accountability and systemic flaws within India’s corporate governance. As these allegations unfold, they challenge the nation's commitment to transparency and fairness, leaving global observers and investors questioning the true extent of India’s regulatory reliability.

India Continues To Be A Fertile Ground For Corruption, And A Safe Sanctuary For Those With “Authority”, “Influence” And “Money”. Madhabi Puri Buch, the Chairperson of India’s Securities and Exchange Board of India (SEBI), finds herself at the helm of controversy again as documents reveal that she earned approximately Rs. 3.7 crore ($442,025) from her consultancy firm during her tenure.

The revelation, which potentially indicates a breach of regulatory rules, sheds light on broader issues of corruption and the intertwining of authority and financial interests in India.

In the latest information, public documents reviewed (allegations and proof not by Hindenburg alone) disclose that Buch, who has been at the helm of SEBI since March 2022, continued to receive revenue from Agora Advisory Pvt Ltd—a consultancy firm in which she holds a 99% stake—during her seven-year tenure at SEBI.

This is reportedly in violation of a 2008 SEBI policy that forbids officials from holding an office of profit or receiving professional fees from other activities.

The controversy is compounded by allegations from Hindenburg Research, which has raised concerns about a conflict of interest. These allegations are also tied to Buch’s role in investigating the Adani Group, conglomerate led by Gautam Adani.

The scrutiny surrounding Adani began in January last year when Hindenburg’s report triggered a significant decline in Adani Enterprises’ share prices, though they have since recovered.

Hindenburg Research also pointed out the role of two consultancy firms, Singapore-based Agora Partners and India-based Agora Advisory, operated by Buch and her husband, Dhaval Buch.

While Buch claims to have disclosed her consultancy activities to SEBI, questions remain about the propriety of retaining such interests while holding a top regulatory position.

The revelation of Buch’s continued shareholding in Agora Advisory, despite transferring her shares in Agora Partners to her husband in March 2022, has drawn criticism from former bureaucrats.

Subhash Chandra Garg, a former Indian government official and SEBI board member, described Buch’s actions as a “very serious” breach of conduct, arguing that there was no justification for her to retain ownership of the consultancy firm after joining SEBI.

Buch’s handling of this matter and her lack of clarification on whether she was granted a waiver for her shareholding further fuel the debate.

SEBI’s internal processes regarding disclosures have also come under scrutiny, with some board members alleging that disclosures were not properly reviewed or discussed.

Thus, the ongoing controversy points to a broader issue within India, where the confluence of authority, influence, and money continues to create fertile ground for allegations of corruption.

As the investigation into Buch’s actions unfolds, the spotlight remains on India’s regulatory frameworks and the integrity of its financial oversight institutions.

Despite Buch’s denial of any conflict of interest, as the information is revealed, why is it important that Madhabhi Puri Buch step down from her current role as SEBI’s Chairperson?

A Stain on India’s Corporate Integrity

India, with its growing economy and aspirations to be a global financial powerhouse, is facing a glaring blemish that calls into question its commitment to corporate integrity and regulatory fairness.

The recent allegations levelled by Hindenburg Research against SEBI Chairperson Madhabi Puri Buch, her husband, and the Adani Group indicate the systemic flaws that pervade the Indian corporate governance framework.

Hindenburg Research’s accusations—that Buch continued to earn from a consultancy firm while investigating the Adani Group—are nothing short of shocking.

- Is it conceivable that an individual entrusted with overseeing financial markets could remain involved with a consultancy firm that potentially creates conflicts of interest?

- If Buch’s consultancy activities and financial stakes indeed contravene SEBI’s policies, then how can we expect any semblance of fairness and transparency in the regulatory processes she oversees?

The timing of these revelations is particularly damning.

Buch’s tenure coincides with the controversy surrounding the Adani Group, conglomerate already under intense scrutiny for alleged financial irregularities.

If there is even a semblance of truth in Hindenburg’s claims, it not only undermines the integrity of Buch’s investigations but also casts a long shadow over the credibility of SEBI’s regulatory framework.

How can investors and citizens of this country have confidence in a regulatory body if its top official is embroiled in potential conflicts of interest?

Moreover, the role of Buch’s husband, with his involvement in consultancy firms that continue to operate under Buch’s watch, only aggravates the issue.

Does this not reveal a troubling entanglement of personal and professional interests?

The fact that Buch’s husband transferred shares in a Singapore-based firm yet retained interests in an Indian firm suggests a troubling disregard for the principle of separation between personal financial activities and public responsibilities.

Why has this continued without substantial repercussions?

This scenario is not an isolated incident but part of a broader pattern where powerful individuals and corporations seem to navigate through allegations of misconduct with impunity.

Consider the protracted legal battles of figures like Vijay Mallya and Nirav Modi, whose high-profile cases have been marred by delays and perceived leniency.

The lack of swift, decisive action in these cases, coupled with the ongoing controversy surrounding the Adani Group, paints a disheartening picture of India’s regulatory environment.

The global corporate community watches with increasing skepticism as India’s regulatory actions unfold.

Can India truly be seen as a safe and transparent destination for global investment when its high-profile figures are frequently embroiled in controversies that appear to lack timely and effective resolution?

The perception of India as a fertile ground for corruption and a safe haven for the powerful is being reinforced by these ongoing issues.

In the face of such allegations, one must question the efficacy of India’s regulatory frameworks and their ability to hold powerful individuals accountable.

Until systemic changes are made, and until there is demonstrable and timely action against those who breach trust and regulations, India risks undermining its own credibility on the global stage.

The need for transparency, accountability, and integrity has never been more urgent. Will the current system rise to the occasion, or will it continue to falter in the face of such critical challenges?

History, And What Have We Learnt From It?

There have been several high-profile cases where prominent industrialists have been involved in scandals or alleged scams, and in some instances, the repercussions have been minimal or delayed.

1) Satyam Computer Services (2009)

Industrialist: Ramalinga Raju

Scandal: In what is often referred to as India’s Enron, Ramalinga Raju, the founder of Satyam Computer Services, confessed to inflating the company’s profits and falsifying accounts to the tune of $1.5 billion.

Despite the magnitude of the fraud, the legal proceedings took years to reach a resolution, with Raju and several others eventually convicted in 2015. However, the delay in action and the fallout on employees and investors was significant.

2) 2G Spectrum Scandal (2008)

Industrialists: Various, including Anil Ambani and Sunil Bharti Mittal

Scandal: The 2G spectrum scam involved the alleged underpricing of 2G spectrum licenses, leading to a loss of billions of dollars to the Indian exchequer.

Key figures included industrialists and telecom operators who were accused of benefiting from these irregularities.

Despite the high-profile nature of the case, many accused were acquitted or faced minimal consequences due to prolonged legal battles.

3) Vijay Mallya and Kingfisher Airlines (2016)

Industrialist: Vijay Mallya

Scandal: Vijay Mallya, the owner of Kingfisher Airlines, was accused of defrauding banks of over ₹9,000 crore ($1.4 billion) through unpaid loans. Despite his high-profile status and the severe financial impact on creditors, Mallya fled India and has faced extensive legal proceedings abroad.

While there has been some progress, the resolution has been protracted.

4) Nirav Modi and PNB Fraud (2018)

Industrialist: Nirav Modi

Scandal: Nirav Modi, was accused of defrauding Punjab National Bank (PNB) of over ₹13,000 crore ($2 billion) through fraudulent letters of undertaking.

Modi fled the country before the fraud was exposed. Although there have been arrests and legal proceedings, the process has been slow, with Modi’s extradition and trial ongoing.

5) Adani Group Allegations (2023)

Industrialist: Gautam Adani

Scandal: The Adani Group faced allegations of stock manipulation and accounting fraud by Hindenburg Research.

While investigations have been launched, and share prices initially dropped, the group’s response and the regulatory actions taken have been debated.

The case has shown concerns about corporate governance and regulatory oversight in India.

6) IL&FS Crisis (2018)

Industrialist: Various top executives

Scandal: Infrastructure Leasing & Financial Services (IL&FS) defaulted on its debt, leading to a major financial crisis in India. Executives, including some from top corporate backgrounds, were implicated in financial mismanagement and fraud.

While some legal actions were taken, the resolution of the crisis and its broader implications have been ongoing.

These examples illustrate the interplay between power, influence, and accountability in high-profile corporate scandals.

While legal and regulatory systems exist to address such issues, delays and inadequate enforcement can sometimes undermine the effectiveness of justice.

)

Madhabi Puri Buch Should Resign

Given the gravity of the allegations against Madhabi Puri Buch, it is important to consider whether she should remain in her position as SEBI Chairperson until these claims are thoroughly investigated and proven baseless.

The allegations of financial ties to a consultancy firm during her tenure, coupled with potential conflicts of interest in the Adani Group investigation, cast a serious shadow over her ability to lead SEBI impartially.

Therefore, until these issues are resolved and her role is cleared of any wrongdoing, it may be prudent for Buch to step down from her position to preserve the integrity of SEBI and maintain public and investor confidence in the regulatory body.

The need for transparency and accountability in such high-profile roles demands that those under scrutiny step aside while investigations are conducted.