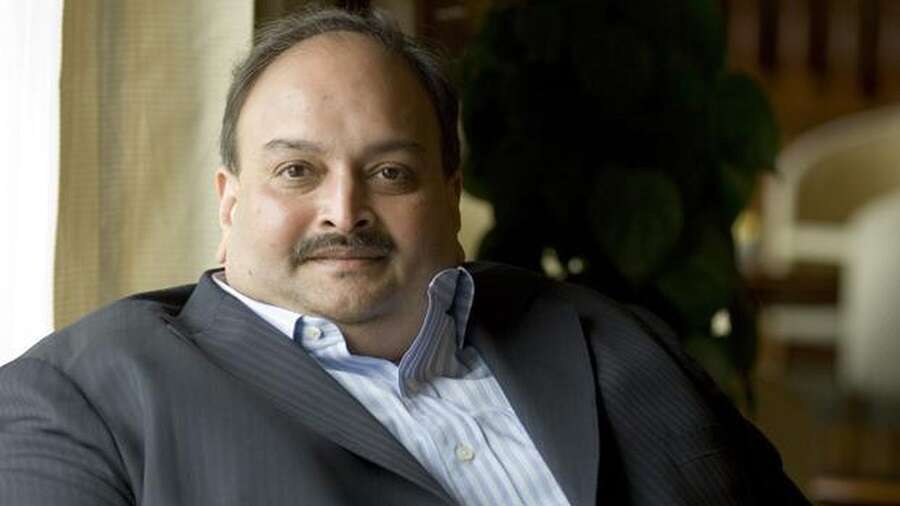

Sebi bans Mehul Choksi from Capital Market for ten years and slaps Rs 5 crore fine for manipulating trades.

Sebi bans Mehul Choksi from the capital market for ten years and fined him Rs 5 crore for market manipulation. Choksi, Nirav Modi’s maternal uncle, was the chairman and managing director of Gitanjali Gems as well as a member of the promoter group. Both are accused of defrauding the state-owned Punjab National Bank (PNB) of over Rs 14,000 crore.

New Delhi, Oct 31 (PTI): The Securities and Exchange Board of India barred and fugitive businessman Mehul Choksi from the securities markets for ten years and fined him Rs 5 crore for engaging in fraudulent trading in Gitanjali Gems Ltd shares.

According to all the Securities and the Exchange Board of India (Sebi) order, he must pay the penalty within 45 days.

Choksi, Nirav Modi’s maternal uncle, was the chairman and managing director of Gitanjali Gems as well as a member of the promoter group. Both are accused of defrauding the state-owned Punjab National Bank (PNB) of moreover Rs 14,000 crore.

Choksi and Modi both fled India after the PNB scam was exposed in early 2018. While Choksi is even believed to be in Antigua and Barbuda, Modi is imprisoned in the United Kingdom and has challenged India’s extradition request.

The current proceedings stem from a common show cause that notice issued by Sebi in May 2022 against Choksi in connection with the regulator’s investigation into alleged manipulative trading in Gitanjali Gems’ scrip. For the period of July 2011 to January 2012, the regulator investigated the trading activities of the certain entities in the company’s scrip.

In its order, Sebi stated that Choksi had funded a group of 15 entities known as ‘front entities,’ then who were directly or moreover indirectly connected with him and then with each other and then who had taken positions in Gitanjali Gems’ scrip during the investigation period, both in the cash and derivative segments. He’d used them as front companies to manipulate the company’s stock.

It was discovered that the company transferred funds to front entities worth Rs 77.44 crore, of which funds worth Rs 13.34 crore were used mainly by front entities to the trade in the scrip.

The regulator noted that, then immediately prior to the current investigation period, the shares of Gitanjali Gems available to general investors, excluding promoter holdings and holdings of banks/ financial institutions/ FPIs, were 28.96% for the quarter ended June 2011. This was also reduced to 19.71 percent in the third quarter of 2011. Following the investigation period, the number of shares the available to the general investors increased to 25.36 percent.

This suggests that Choksi, through front entities, attempted to corner the market during the investigation period in order to reduce the number of shares available to general investors, also which subsequently had increased after the front entities sold all the shares in the market. Furthermore, the front entities cornered the position limits in Gitanjali Gems’ scrip by amassing a sizable position in the derivatives segment.

“I find that the aforementioned findings, together with the main noticee’s (Mehul C Choksi) failure to rebut the aforementioned findings, clearly establish the noticee’s role in creating a false and then misleading appearance of all trading in the scrip of GGL by then using and funding front entities in executing manipulated trades.”

In his 20-page order, Sebi Whole Time Member Ashwani Bhatia stated, “I thus find that the noticee has also violated all the provisions of the PFUTP (Prohibition of the Fraudulent and Unfair Trade Practices (PFUTP) Regulations.”

As a result, the regulator has barred Choksi from “buying, selling, or then otherwise dealing in securities, then directly or indirectly, also in any manner whatsoever, for a period of ten years… and the new notice shall pay a monetary penalty of nearly Rs 5 crore.” In February of this year, Sebi barred Choksi from the securities markets for a year and fined him Rs 1.5 crore for violating the insider trading rules in the main Gitanjali Gems case.

In February 2020, the regulator fined Choksi, Gitanjali Gems, and another individual a total of Rs 5 crore for violating various regulations, then including listing norms, also in connection with the massive PNB fraud. PTI SP RAM.

Following an investigation into alleged manipulative trading in the recent scrip of Gitanjali Gems, SEBI barred Mehul C. Choksi for ten years and then also imposed a penalty of 5 crore.

It may be recalled that on January 31, SEBI barred Choksi from entering the securities market for a year.

A one-year prohibition

In the previous order, SEBI ruled Choksi and director Rakesh Girdharlal Gajera violated insider during trading rules while trading Choksi’s jewelry business Gitanjali Gems and then imposed a joint fine of 2.5 crore split between Choksi and Gajera, as well as a one-year ban from all trading.

Furthermore, Choksi and Gajera were barred from buying, selling, or dealing in Gitanjali Gems Ltd securities for a period of two years. As part of the settlement, SEBI ordered Gajera to pay a fine of Rs. 15.82 crore.

“As per publicly available information, Mehul Choksi fled the country on January 4, 2018, and also is stated to be the residing in Antigua and the Barbuda,” said Ashwani Bhatia, whole-time member of SEBI, in the latest order. In the aftermath of the current Punjab National Bank scandal, he was charged in India.

Furthermore, the Directorate of Enforcement has opened an investigation into Mehul Choksi, based on a complaint filed by PNB. I see that a charge sheet has been filed in both cases. The ED also filed an application with the PMLA Court in 2019 to also have Choksi declared a Fugitive Economic Offender,under the current Fugitive Economic Offenders Act of 2018. (The case is currently before the Bombay High Court.).”

Aside from that, the Income-Tax Department has also had initiated proceedings against Mehul Choksi. Bhatia stated that he must remit/pay the penalty within 45 days of receiving this order.

Mehul Choksi was also involved in the Canara Bank Fraud Case-

Officials confirmed on Thursday that the Central Bureau of the Investigation (CBI) has filed a new FIR against fugitive diamantaire Mehul Choksi for defrauding a Canara Bank-led consortium to the main tune of Rs 55.27 crore.

According to people also familiar with the matter, the Central Bureau of Investigation (CBI) has filed a new first information report (FIR) against fugitive diamantaire Mehul Choksi for allegedly defrauding a consortium of banks led by Canara Bank of Rs 55.27 crore.

The agency also conducted raids in three different locations in Mumbai. According to the people cited above, Bezel Jewellery India Pvt Ltd (previously known as D’damas Jewellery), a company promoted by him, and its full-time directors Chetna Jhaveri, Dinesh Bhatia, and Milind Limaye have also been booked by the agency.

Canara Bank filed a complaint on August 30, 2021, alleging that the bank, along with Bank of Maharashtra, sanctioned 30 crore and 25 crore as working capital facilities to Bezel Jewellery under a consortium agreement.

Though the loan was granted for the manufacture and sale of gold and diamond-studded jewelry, the company did not route any business transactions through the account to conceal the diversion of funds, according to the people cited above on condition of anonymity.

They also stated that the company did not repay the loan, resulting in a loss of 55.27 crore to the consortium. Choksi is currently residing in Antigua and Barbuda, where he fled immediately after the CBI became aware of the Punjab National Bank (PNB) fraud case worth Rs 13,578 crore in 2018.

Choksi was discovered in Dominica, a small Caribbean island, in May of last year, where the Indian government attempted to have him deported rather than go through the lengthy extradition process in Antigua, where he is a citizen. Dominica, as first reported by HT, withdrew criminal proceedings against Choksi in May of this year, effectively killing the Indian government’s hopes of having him deported.

In response to the CBI’s new FIR, Choksi’s lawyer, Vijay Aggarwal, stated, “According to the CVC’s vigilance manual and a circular issued by the finance ministry on May 13, 2015, there can only be one consolidated FIR against one group of companies.” Separate FIRs for each loan are witch hunts and are akin to filing separate FIRs for each brick in the case of an allegation of an illegal wall.”

Mehul Choksi, Nirav Modi’s uncle, was involved in the PNB fraud. He was the owner of the Gitanjali Group, a retail jewelry company. He is charged with money laundering and criminal breach of trust, in addition to corruption and criminal conspiracy.

What exactly is the Canara Bank Fraud?

Under a consortium agreement, Canara Bank and Bank of Maharashtra each sanctioned 30 crore and 25 crore as working capital facilities to Bezel Jewellery.

The loan was allegedly granted for the all manufacturing and sale of gold and diamond-studded jewelry, but the company did not also route any of the business transactions through the account to conceal the diversion of funds.

According to the agency, the company did not repay the loan, resulting in a loss of 55.27 crore to the consortium. Bezel Jewellery and its full-time directors, including Choksi, Chetna Jhaveri, Dinesh Bhatia, and Milind Limaye, have also been booked by CBI.

What exactly is the scam?

The Choksi-Modi duo is wanted by Indian authorities for defrauding Punjab National Bank (PNB) of also more than 14,000 crore through the Punjab National Bank (PNB) scam. Choksi was arrested on charges of criminal conspiracy, cheating,then breach of trust, dishonesty, corruption, money laundering, and property delivery.

The Income Tax department confiscated Choksi’s properties on April 16, this year, according to reports. Choksi’s nine acres of agricultural land in Nashik have also been seized by I-T investigators.

The Punjab National Bank scam is related to the bank’s fraudulent letter of undertaking. Nirav Modi, a jeweller and designer, is the main accused in the case. Choksi and Modi both fled India after the PNB scam was exposed in early 2018. Nirav Modi’s maternal uncle is Choksi, the promoter and managing director of Gitanjali Gems. Choksi has been barred from the capital markets for a year and fined by the stock market regulatory body.

What happened to Choksi?

He has lived in Antigua and Barbuda since 2018, where he is now a citizen. He vanished from the country in 2021, only to reappear in Dominica. He was pushed away from the country.

Who exactly is Mehul Choksi?

Mehul Chinubhai Choksi (born on 5 May 1959) is an Indian-born businessman who is wanted by Indian authorities for the criminal conspiracy, then criminal breach of trust, cheating, and also dishonesty including delivery of property, then corruption, and money laundering. Choksi stated in an interview that he is innocent and that all allegations against him are false, then baseless, and motivated by political expediency.

Choksi has been an Antiguan citizen since 2017. He is the founder of the Gitanjali Group, an Indian retail jewelry company with 4,000 stores. An arrest warrant has been issued for Choksi in connection with all the alleged Punjab National Bank fraud case. In 2013, he was accused of stock market manipulation. He went missing from Antigua and Barbuda in late May 2021. He was apprehended in Dominica while attempting to flee to Cuba in a boat. A Caribbean court has temporarily halted his repatriation from the Commonwealth of Dominica.

Mehul Choksi was born in Bombay on May 5, 1959, as the son of Chinubhai Choksi. He received his education at G. D. Modi College in the Palanpur, Gujarat. He is the father of three children: who is a son and two daughters. In December 2010, one of his daughters also married Akash Mehta, an Antwerp-based diamond merchant. Choksi is fugitive businessman Nirav Modi’s maternal uncle.

Chetan Chinubhai Choksi, his younger brother, owned and operated Diminco NV in Antwerp, which had also defaulted on a nearly US$25.8 million payment to an ICICI Bank subsidiary. In 2013, the bank filed a lawsuit against Diminco NV in the commercial courts in Belgium and the United Kingdom.

Other instances of fraud-

A special PMLA court issued non-bailable arrest warrants (NBWs) against the Choksi and also his nephews Nirav Modi and Neeshal Deepak Modi, the owners of Firestar Diamonds, in March 2018. They are suspected of plotting a $1.8 billion fraud with two employees of Punjab National Bank (PNB), then the country’s second-largest state-owned lender. So far, at least six PNB employees and at least six Choksi and Modi employees have been arrested. Choksi is a wanted man by the Indian government.

In an open letter, Choksi maintained his innocence. The CBI arrested Vipul Chitalia, the Vice-President of the Gitanjali Group of Companies and a key aide to Choksi, on March 6, 2018. Chitalia was apprehended at the Mumbai airport and held in custody until March 2018.

A designated PMLA authority determined that 41 properties worth approximately Rs 1,210 crore attached by the real Enforcement Directorate (ED) in the name of Mehul Choksi and his affiliated firms are almost money laundering assets and also ordered that their attachment be maintained.

In February 2018, the central probe agency attached 15 flats and the 17 office premises in Mumbai, a mall in Kolkata,and a four-acre farm house in Alibaug, and 231 acres of land in Nashik, Nagpur, then Panvel in Maharashtra, and Villupuram in Tamil Nadu under the Prevention of the Money Laundering Act (PMLA) in connection with an alleged $2 billion fraud at a Mumbai-based branch of the main Punjab National Bank (PNB).

Choksi traveled from India to Antigua and Barbuda on January 7, 2018. The PNB scam was revealed a few days later. On January 15, he also took the oath of citizenship of Antigua and Barbuda, where he applied for citizenship under the country’s Citizenship by Investment program in November 2017.

Indian authorities, however, claim that he has not renounced his Indian citizenship. His lawyer informed the Bombay High Court on June 17 that he had left India for medical reasons and not to avoid prosecution in the case. Since then, the CBI has been attempting to extradite him back to India.

Choksi went missing in Antigua and Barbuda on May 23, 2021. He was last seen around 5:15 p.m. on May 23 before leaving his home in a car that police recovered in the Jolly Harbour area.

A search has been launched to find him. He may have fled to Cuba, according to reports. On May 26, he was apprehended by local police in Dominica, a nearby Caribbean country, while attempting to flee to Cuba by boat. This attempt to flee would strengthen the CBI’s case in Antiguan courts for extradition to India.

Choksi was kidnapped by what he thought were Indian and Antiguan police and brought to Dominica by boat, according to his lawyer. He also claimed that when he met Choksi, he had a swollen eye and several bruises. The High Court of Justice of the Commonwealth of Dominica has temporarily halted his deportation from the island.

Choksi’s photographs were leaked to Antiguan media on May 29, 2021. Choksi’s left hand is bruised and swollen in the photos, and his left eye is bruised and swollen. Several Indian agencies used diplomatic channels to contact the Dominican government, urging that he be handed over to Indian authorities because he is an Indian citizen and has an Interpol Red Corner notice.

In exchange for campaign funding, the opposition parties of United Workers’ Party of the Dominica and also United Progressive Party of Antigua and Barbuda are allegedly using this opportunity to support him against his deportation to India.

Choksi filed an affidavit in the High Court of Dominica in early June 2021, claiming there was no arrest warrant against him when he left India in January 2018 for medical treatment in the United States. He also stated that he has no intention of failing to appear in court and that he has no plans to leave Dominica. In his bail petition, he claimed medical issues and a fear for his health. Melford Nicholas, the Antiguan Information Minister, stated that they moved to revoke his Antiguan citizenship on the grounds that he provided false information when applying for citizenship. Choksi has filed a legal challenge.

edited and proofread by nikita sharma