Russia’s Central Bank Takes Decisive Action, Raising Interest Rates to 12% as Ruble Plunges

Russia’s Central Bank Takes Decisive Action, Raising Interest Rates to 12% as Ruble Plunges

In a bold move aimed at stabilizing its economy, the Central Bank of Russia has announced a significant hike in interest rates, raising them to 12%. This decision comes in response to the recent sharp decline in the value of the Russian ruble, a situation that has raised concerns both domestically and internationally. The central bank’s swift response is intended to stem the tide of economic uncertainty and protect the purchasing power of Russian citizens. This unexpected decision has sparked discussions about its potential impacts on the country’s financial landscape and its citizens’ daily lives.

The Ruble’s Plunge: A Precarious Situation

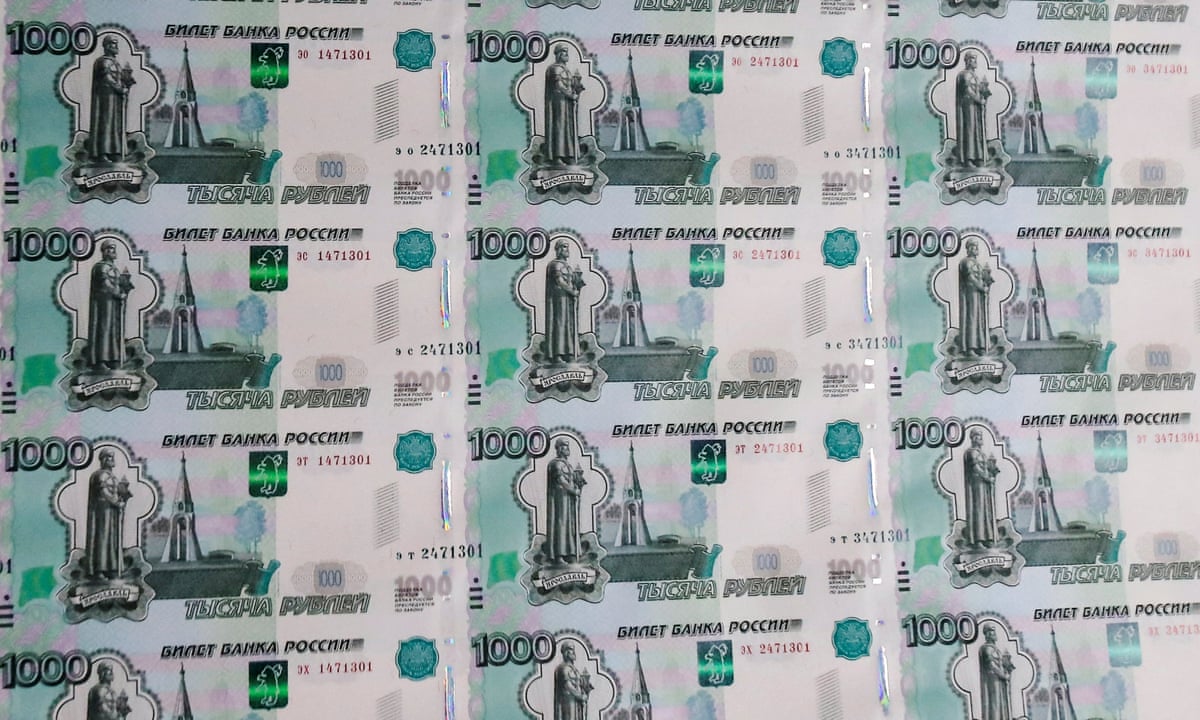

The ruble, Russia’s national currency, has experienced a rapid and steep decline in value over the past weeks. This downward spiral has been attributed to a combination of factors, including geopolitical tensions, global market fluctuations, and domestic economic challenges. As the ruble loses value, the cost of imported goods rises, which can lead to higher inflation rates and a decreased standard of living for ordinary Russians.

The Central Bank’s Response: Raising Interest Rates

Recognizing the urgency of the situation, the Central Bank of Russia has executed a substantial increase in interest rates, aiming to restore investor confidence and stabilize the ruble. Interest rates represent the cost of borrowing money, and by raising them, the central bank intends to make borrowing more expensive. This strategy can help curb inflation by reducing consumer spending and cooling down the economy. However, the decision also carries potential drawbacks, including the possibility of slowing down economic growth and making it more challenging for businesses to invest and expand.

Potential Impacts on the Economy

The central bank’s decision to raise interest rates is a double-edged sword, carrying both benefits and risks for the Russian economy. On one hand, it can help attract foreign investors seeking higher returns on their investments due to the increased interest rates. This influx of foreign funds can provide a much-needed boost to the ruble’s value and stabilize the currency exchange rates. Moreover, it can help combat inflation by limiting consumer spending, thereby preventing runaway price increases.

On the other hand, the decision to raise interest rates can also have some adverse effects. Higher interest rates can lead to reduced consumer spending, as borrowing becomes more expensive. This can slow down economic activity and potentially lead to job losses, hitting ordinary citizens and small businesses hardest. Additionally, if interest rates remain high for an extended period, it might discourage businesses from taking loans to expand or invest in new projects, hampering economic growth in the long run.

Impact on Everyday Life

The central bank’s move to raise interest rates will have a direct impact on the daily lives of Russian citizens. As borrowing becomes more expensive, individuals with mortgages, car loans, or other types of credit will face higher monthly payments. This can strain household budgets and force families to reconsider their spending habits. Additionally, those with fixed-rate savings accounts may benefit from the higher interest rates, as they will receive better returns on their savings. However, the overall increase in the cost of borrowing may offset these gains for many families.

International Implications

The decision by the Central Bank of Russia to raise interest rates and stabilize the ruble will not only affect domestic stakeholders but also reverberate on the global stage. As Russia’s economy is closely linked to international markets, fluctuations in its currency can impact trade relationships and investor sentiment around the world. A successful stabilization of the ruble could restore confidence in Russia as a reliable economic partner, while a prolonged crisis might deter foreign investors and weaken its global standing.

Looking Ahead: Uncertainties and Hopes

The Russian economy now stands at a critical juncture, with the central bank’s decision to raise interest rates holding the potential to either alleviate or exacerbate the ongoing crisis. As the country strives to navigate these challenges, the hopes are high that the ruble will regain its lost value and stabilize the economy. However, uncertainties remain, and the effectiveness of the central bank’s strategy will depend on various factors, including global economic conditions, geopolitical developments, and the resilience of the Russian financial system.

In conclusion, the Central Bank of Russia’s recent decision to raise interest rates to 12% in response to the ruble’s sharp decline reflects the urgency of the economic situation. While this move holds the promise of stabilizing the currency and mitigating inflation, it also carries potential risks for economic growth and ordinary citizens. As the country and its citizens brace for the impacts of this decision, the world watches closely, hoping for a positive turn of events in Russia’s economic landscape.