Revving Down Inflation: Government Considers Slashing Gasoline And Grain Levies In 2023

Experts weigh in on the potential impact of the proposed move on consumers and the economy.

According to rumours, the administration is considering decreasing taxes on gasoline and corn to combat inflation. This is not a good time for this to occur, as rising inflation is a major concern for governments and individuals alike. In this post, I will take a closer look at the scenario and make some educated estimates about what may occur next.

Understanding Inflation

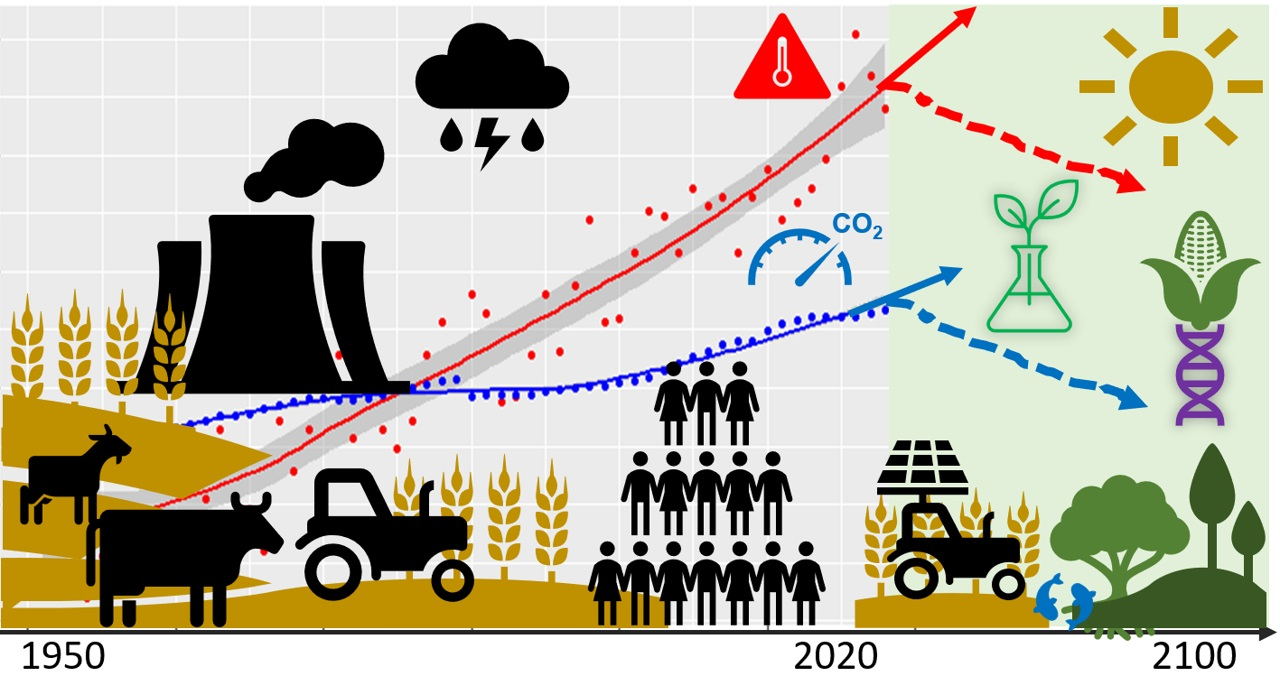

It is necessary to have a solid understanding of what inflation is and how it works before moving on to consider potential reductions in gas taxes or subsidies for corn farmers. The overall upward trend in prices of goods and services over a period of time is referred to as “inflation.” Consumers suffer harm if there is an increase in the cost of living since this lowers the amount of disposable income they have available for savings. It’s possible that people who work for the government and people who buy goods are both concerned about the recent increase in inflation.

There are a lot of different things that can have an effect on inflation. An increase in demand, a drop in supply, a change in production costs, or a change in the value of a currency can all be considered examples of typical economic shocks. Inflation can also be affected by acts taken by the government, such as the establishment of tax rates and the distribution of financial resources.

The Role of Fuel and Maize in Inflation

Oil and grain are two examples of commodities that have a huge influence on the economy of the entire world. Fuel is valuable to many businesses because it allows their vehicles to continue running. So, a shift in the cost of gasoline could have an impact not only on the ultimate price of the product but also on the expenses incurred by the company. Changes in the price of maize, which is a basic item in many countries, can have a substantial impact on the cost of living for a huge number of people. Maize is a grain that is grown and harvested worldwide.

In recent years, inflation has been caused by a variety of factors, including the rising cost of oil and grains, amongst others. There are a lot of things that can influence how much gas costs. A number of factors, such as market supply and demand, as well as governmental regulations, affect corn prices.

Possible Tax Cuts to Tame Inflation

Since the price of fuel and maize has increased, many people have requested that the government consider cutting taxes as a means of fighting inflation. It has been suggested that taxes on fuel and maize might be eliminated in order to lower overall production costs and prices for consumers. This is good news because it suggests that inflation will go down. If inflation goes down, people will be able to buy more goods and services.

The idea has merit, but first, we must investigate a number of concerns that have been raised about it. For example, lowering the taxes on gasoline and grain could lead to a reduction in overall tax revenue. This might put at risk important economic projects and services provided by the government. There is a possibility that a reduction in taxes will not lead to a reduction in the prices of goods and services because businesses can decide to keep the money they save rather than give it to their customers.

Alternative Approaches to Tackling Inflation

The administration may investigate more options in addition to lowering the levies on gasoline and grains. One example of monetary policy would be for the government to either raise interest rates or limit the amount of new money that may be issued. These strategies have the potential to assist in lowering costs and inflation by lowering consumer demand. Each of these factors has the potential to stunt economic growth; as a result, policymakers need to find a happy medium between them.

Altering the organizational framework of the economy could be another strategy that the government employs in an effort to tackle the root causes of inflation. For instance, the government ought to make efforts to improve existing infrastructure, cut back on unnecessary bureaucracy, and encourage healthy competition as well as creative ideation. If certain changes are made, the economy may become more productive, save money on the costs of manufacturing, and operate more effectively as a result.

Even if lowering the taxes on petrol and maize results in unintended repercussions, those are not the only considerations that should be taken into account. In the near term, swings in the price of oil and other global events, such as the COVID-19 epidemic, can have a considerable impact on price inflation. As a result, the government needs to take action against inflation in a way that is both broad and flexible, taking into account both short-term and long-term concerns.

It is also very important to keep in mind that different demographics will be affected by inflation in a variety of unique ways. For households with low incomes, for example, the effects of inflation may be felt more severely because of their inability to readily adjust to rising costs of living. In order to protect those who are more vulnerable and to reduce inequality, the government needs to study programmes like these.

When designing its policies, the government must keep in mind the impact such policies will have in the long run on issues of sustainability and the environment. A decrease in the price of gasoline, for instance, would result in a rise in carbon emissions, which would be harmful to the environment. As a result, the government must consider taking steps to encourage sustainable growth and the transition to a lower-carbon economy.

In order for the government to determine what causes inflation and how to combat it, they will need to hold discussions with members of the business sector as well as other interested parties. Possible solutions include removing bottlenecks in supply chains, making markets more creative and competitive, and enhancing the overall functioning of the economy. If the government works with both the public and private sectors, it can keep inflation in check and make sure the economy stays stable in the long run.

Conclusion

As a result, the anticipated reduction in taxes on gasoline and grain constitutes an issue that is both significant and timely and calls for an in-depth investigation. There may be some positive impacts, such as a fall in tax revenue, but there may also be some bad effects, such as decreased production costs and cheaper prices for goods and services. Moreover, there is a possibility that businesses will not pass savings on to customers.

So, the government needs to carefully assess the advantages and drawbacks of such a decision and think about other alternatives, such as reforms to the monetary system and structural improvements that are aimed at addressing the underlying causes of inflation.

In addition to this, the government is required to function in an open and honest manner while also keeping the people informed of its policies and actions. This would increase the government’s ability to regulate the economy and make sure that everyone’s needs are met by ensuring that everyone’s wants are met.

In conclusion, the fight against inflation is a difficult endeavour that calls for a comprehensive and well-coordinated plan. Even while lowering tariffs on fuel and grains is one possibility, it is vital to take additional steps and carefully assess the benefits and drawbacks associated with each solution. The government needs to work together with all of the relevant stakeholders in order to both determine the primary factors contributing to inflation and keep the economy in good condition.

Edited by Prakriti Arora