Revisiting The Pandora Papers And The Famous Names Named; Has ED Been Successful In Its Findings And What Stage Are The Investigations?

The Enforcement Directorate (ED) has emerged as a central figure in the unfolding story surrounding India's digital payments giant, Paytm, in a backdrop of regulatory scrutiny and corporate upheaval. As one of India's premier agencies tasked with investigating economic offenses, we are reminded of the Pandora Papers, where the spotlight was cast on the clandestine offshore activities of influential figures, raising questions about accountability and transparency in our financial ecosystem. As the Pandora Papers unravelled the story of offshore wealth and tax evasion, the role of the ED became as crucial as ever to unearth complex schemes and hold those involved accountable for their actions. However- what has happened to date, and where does ED stand in these investigations?

When the Enforcement Directorate (ED) strikes in our country, it indicates sleepless nights for many, signalling the onset of meticulous scrutiny and potential legal repercussions.

The mere mention of an ED investigation can send shivers down the spines of individuals and entities, as it signifies deep scrutiny of financial dealings and the possibility of facing charges related to economic offences.

But does it?

The Pandora Papers, leaked in the fall of 2021, revealed a staggering array of offshore wealth and tax evasion schemes, prompting a global reckoning with the pervasive nature of financial secrecy and its impact on societal trust and integrity.

As the Pandora Papers revealed a maze of offshore interests and financial transactions involving prominent Indian figures, including politicians, celebrities, and business magnates, the ED swiftly initiated probes into suspected cases of money laundering, tax evasion, and other economic offenses.

Revisiting The Pandora Papers

The Pandora Papers, a monumental release of nearly 12 million leaked documents, laid bare the secret and often ethically questionable dealings of the global elite, from prominent world leaders and politicians to corporate executives, celebrities, and billionaires.

Having surpassed the scale of previous revelations such as the Panama Papers and Paradise Papers, this data dump laid bare the offshore interests and tax sheltering schemes of influential individuals, prompting parallels to the ancient myth of Pandora’s Box, symbolizing an outpouring of trouble and woe.

The Pandora Papers released by the International Consortium of Investigative Journalists (ICIJ), headquartered in Washington, D.C., collaborated with more than 140 media organizations worldwide; this investigation marks the largest-ever global effort of its kind.

The significance of this leak lies in the potential exposure of wrongdoing, with the revelation threatening to topple high-profile figures from positions of power and authority.

Politicians from 90 countries have already been implicated in concealing money offshore and evading taxes. Characterized by its breadth and global scope, the Pandora Papers investigation triggered police raids, legislative reforms, and the downfall of prime ministers in countries like Iceland and Pakistan.

Unlike its predecessor, which emanated from the files of a single offshore services provider, the Panamanian law firm Mossack Fonseca, the Pandora Papers cast a spotlight on a broader collection of lawyers and intermediaries at the nexus of the offshore industry.

Coming To India

Among the individuals mired in the Pandora Papers scandal are several prominent figures from India, including cricketing legend Sachin Tendulkar and Anil Ambani, the embattled brother of India’s wealthiest individual.

The leak has identified over 300 Indian names, marking the largest disclosure of its kind in Indian history, surpassing even the seismic impact of the Panama Papers leak in 2016.

A leading newspaper investigated the Indian names listed in the Pandora Papers, and in response to the revelations, the Centre announced the establishment of a Multi-Agency Group (MAG) tasked with spearheading the probe into the matter.

Subsequently, the Income Tax Department acknowledged having issued directives to a majority of Indian nationals implicated in the Pandora Papers.

The Financial Intelligence Unit (FIU) has been engaged until the end of 2022, and requests have been dispatched to foreign jurisdictions concerning the 482 individuals whose names appear in the reports.

In numerous instances, the Enforcement Directorate (ED) dispatched “Egmont requests” to the Egmont Group, an association comprising financial intelligence units from 167 jurisdictions, in an effort to obtain further information about the offshore entities under scrutiny.

While the investigation is ongoing, certain updates regarding the probe into key individuals named in the Pandora Papers have surfaced.

So, who are these individuals, and where has the investigation reached thus far?

)

1) Anil Ambani – the chairman of ADA Group, and his representatives are associated with at least 18 offshore companies located in Jersey, the British Virgin Islands, and Cyprus.

Said to be established between 2007 and 2010, seven of these companies reportedly borrowed and invested at least $1.3 billion.

Service providers managing these entities indicated that their bank loans were “guaranteed by Reliance/Anil Ambani to facilitate investments.”

Ambani’s legal representative previously stated that all disclosures had been made in accordance with Indian law.

The ED has requested details on all reported entities, issued directives to three Indian companies, and dispatched Egmont requests to FIU-BVI, Cyprus, and Jersey.

Summons were issued to Anil Ambani and his wife Tina Ambani under provisions of FEMA, and their statements have been recorded at the ED’s Mumbai office.

2) Gautam Singhania – the Chairman and Managing Director of Raymond Limited, made acquisitions of two companies in the British Virgin Islands (BVI) back in 2008.

One of these acquisitions includes Deras Worldwide Corporation, where Singhania holds the status of Beneficial Owner, with the stated purpose of acquisition being “to hold an account with UBS, Zurich.”

The other company is Lyndonville Holdings Limited, in which Singhania and his father Vijaypat Singhania are listed as shareholders. However, Lyndonville Holdings Limited was liquidated in 2016.

Following the initiation of a probe under the Foreign Exchange Management Act (FEMA), an Egmont request was forwarded to the British Virgin Islands, with responses received.

Queries were also dispatched to the Reserve Bank of India (RBI), while the Income Tax Department was tasked with identifying any pending cases under the Black Money Act involving any member of the Singhania family.

Notably, at least three summons were issued to Gautam Singhania and his father, Vijaypat Singhania. While, Vijaypat Singhania provided his statement on April 27, 2023, denying any association with Deras.

Gautam Singhania’s statement was recorded on June 1, 2023, in response to a subsequent summons. Additionally, the Bureau of Immigration was requested to furnish travel details of the scion of Raymond.

3) John Shaw/ Kiran Mazumdar – a UK citizen and the husband of Biocon chief Kiran Mazumdar Shaw, possessed 99% ownership of Glentec International, a company based in Mauritius. Acting as the Settlor, Glentec established the Deanstone Trust in New Zealand in 2015.

Kiran Shaw disclosed that details of Glentec were provided to both the Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI).

Following John Shaw’s passing in 2022, the Enforcement Directorate (ED) initiated action under FEMA provisions and issued inquiry letters to SEBI, Income Tax authorities, and RBI, with partial responses received.

Subsequently, in September 2022, the ED sought additional information from the Income Tax authorities.

With ongoing investigations underway, egmont requests were dispatched to New Zealand and Mauritius.

![]()

4) Sachin Tendulkar – along with his family members, held the status of Beneficial Owners of a British Virgin Islands (BVI) company named Saas International Limited.

The company’s history dates back to 2007, with Saas International being wound up in 2016 shortly after the release of the Panama Papers. However, upon liquidation, the shares of the company were repurchased by the shareholders, namely Tendulkar, his wife Anjali Tendulkar, and her father.

According to Pandora records, the family was classified as Politically Exposed Persons (PEPs), given Tendulkar’s former role as a Member of Parliament.

Officials from Tendulkar’s office defended the BVI investments as “legitimate.” Under the Foreign Exchange Management Act (FEMA), the Enforcement Directorate (ED) communicated with the Income Tax Department to obtain details of the cricket star’s Income Tax Returns (ITR).

Directives were issued to the CEO of Tendulkar’s company and his Chartered Accountant to furnish information on Saas.

Additionally, an Egmont request was forwarded to the Financial Intelligence Unit (FIU) of the British Virgin Islands, with further investigations ongoing.

5) Badnguthu Raghumal Shetty – Authorities detained Shetty in Bengaluru in 2020 due to non-payment of substantial loans owed to several Indian banks.

He allegedly established a complex offshore network of companies in Jersey and the British Virgin Islands, primarily in 2013. These companies reportedly hold shares of branches of his flagship company, Travelex Holdings Limited. Shetty’s wife and other family members are listed as directors of some of these companies.

Summons were sent to him and his top executives in September 2022, and his statement was recorded in December 2022.

The ED has alleged FEMA violations amounting to Rs 1,122.49 crore in the complaint filed, including a prayer for the confiscation of agricultural properties valued at Rs 53.25 crore.

6) Om Prakash Bartia – family, operators of the Sitaram Bhartia Institute of Science and Research in Delhi, established a trust in the Cayman Islands in 2006, which acquired a company named Carmichael Inc.

At one juncture, Carmichael Inc. held two Swiss Bank accounts and assets valued at $35.39 million.

Om Prakash Bhartia was identified as the Beneficial Owner of Carmichael Inc., with claims made that these investments were all “tax compliant.”

Subsequently, inquiries were made to the Reserve Bank of India (RBI) and the Financial Intelligence Unit (FIU), leading to summons being issued to members of the Bhartia family.

Their responses revealed a declaration made under Section 59 of the Black Money Act regarding undisclosed foreign assets amounting to Rs 245 crore, along with the payment of a penalty of Rs 147 crore. Further investigations are currently underway.

7) Niira Radia – established approximately a dozen offshore entities, with five of these listing her as the master client with her address in Delhi.

Financial records disclosed numerous substantial transactions, including the acquisition of a $251,500 watch in Dubai through one of the BVI companies. The correspondence indicated that Radia was designated as a “do not contact” client.

Radia, however, disclaimed recognition of these companies and denied any shareholding in them.

Utilizing provisions of FEMA, the Enforcement Directorate (ED) requested Radia to furnish details of the offshore companies and recorded her statement.

Searches were conducted at her residence under the Prevention of Money Laundering Act (PMLA), with data seized sent for analysis.

Subsequently, fresh summons were issued to Radia, and the statement of her sister, Karuna Menon, was also recorded by the ED.

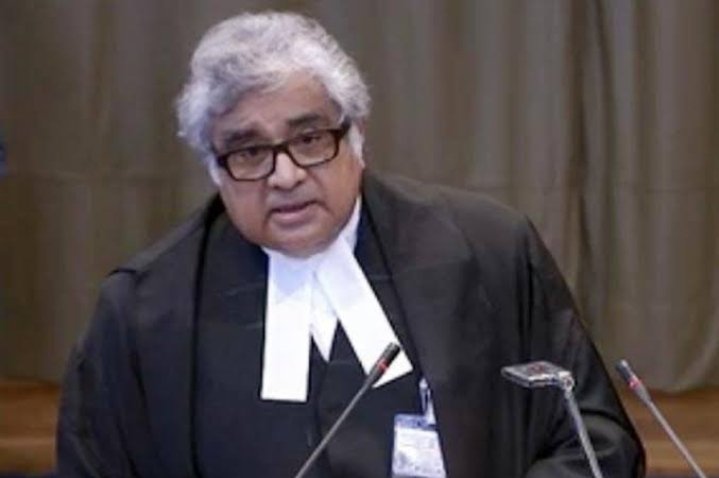

8) Harish Salve – acquired The Marsul Company in the British Virgin Islands (BVI) back in 2015 for the purpose of owning a property in London.

He was identified as the Beneficial Owner (BO) and Secretary of the company and was flagged as a Politically Exposed Person (PEP).

At the time, Salve stated that he purchased shares in Marsul solely for holding the property and asserted that as a Non-Resident Indian (NRI), he was not required to obtain permission from the Reserve Bank of India (RBI) for acquiring shares in an offshore company.

The Enforcement Directorate (ED) noted that an ongoing investigation was already in progress concerning Salve, as his name had surfaced in the Panama Papers, with inputs from the Pandora Papers now incorporated into the probe.

An Egmont request has been submitted to the Financial Intelligence Unit (FIU) of the British Virgin Islands regarding Marsul, and requests have been lodged with income tax authorities to obtain details of his tax returns. Further investigation into the matter is currently underway.

9) Gaj Singh – the former Maharaja of Jodhpur and Member of Parliament, was associated with a BVI entity named Atalante Perennity Inc.

This entity was liquidated in 2018, with emails revealing that staff at the offshore service provider were uncertain about how Singh, identified as the Beneficial Owner, had listed his address as the Umaid Bhawan Palace in Jodhpur. Representatives of Gaj Singh expressed ignorance about the offshore company.

Reportedly, FEMA investigations are ongoing, with the ED issuing summons to him and recording the statement of his representative in May 2023.

Enquiries have been made with income tax authorities, as well as the RBI and relevant banks. Additionally, an Egmont request pertaining to Warre Limited, UK— the company associated with him—has been dispatched, with responses received.

10) Gaurav Burman‘s – involvement in the Pandora Papers revealed that he lent $2 million to Bantree International Ltd, a BVI company, for its Mauritian subsidiary, Colway Investments Ltd. Colway, in turn, held shares in KPH Dream Cricket, the owners of the IPL team Kings XI Punjab.

In the course of the investigation, the ED sent Egmont requests to Mauritius and the BVI. Summons were issued to KPH Dream Cricket Private Ltd.

Bank records obtained indicated payments amounting to Rs 4.67 crore made to a third party without a tripartite agreement. The statement of Mohit Burman, one of the directors of KPH, was recorded.

Voluminous forex transactions are under scrutiny for possible contraventions of FEMA regulations.

)

11) Arvind Singh Mewar – established the Far East Trust in the British Virgin Islands (BVI), designating his Udaipur palace as his residence and assuming the role of Settlor.

A complex offshore structure was constructed around the trust, primarily intended to hold a property in London. In 2015, the property was sold for 1.94 million pounds.

The Enforcement Directorate (ED) initiated inquiries with the Reserve Bank of India (RBI) and the Income Tax Department, in addition to dispatching letters to several Indian banks associated with Mewar’s accounts.

Summons were issued to the former Maharaja, with investigations ongoing regarding alleged direct payments from his UK bank to his UK-based company, Lake Palace Hotels and Models UK Limited.

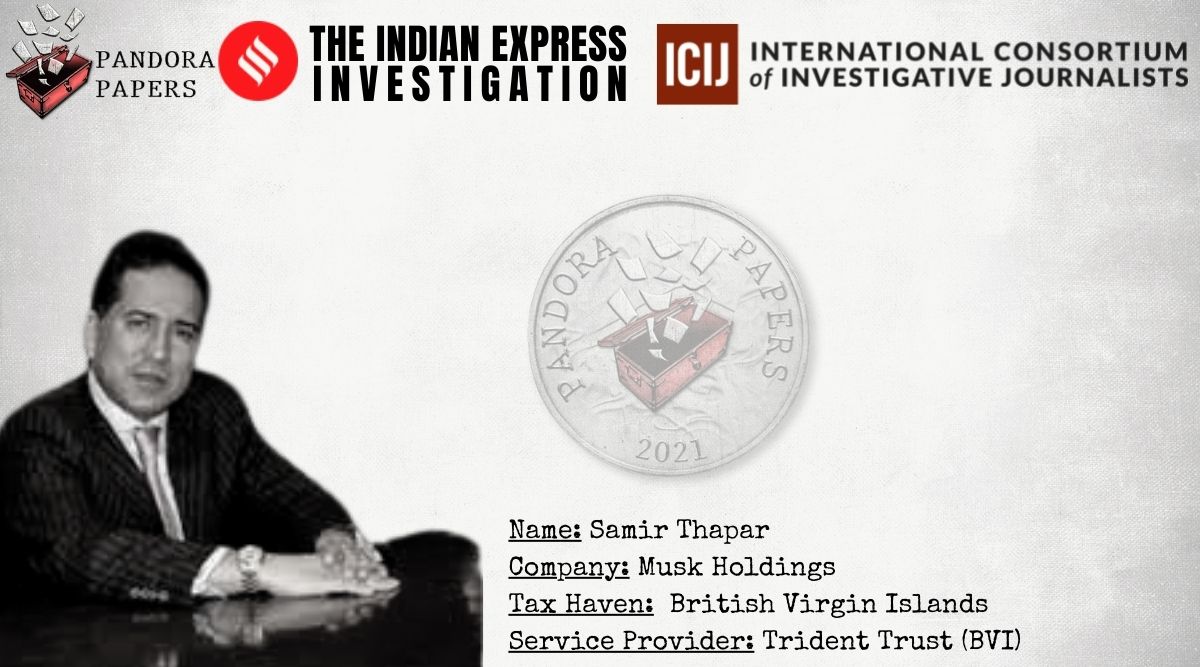

12) Samir Thapar – an offshore stakeholder of JCT Ltd, linked to its chairman and managing director, held interests in Musk Holdings Ltd and Zanha International Ltd, both registered in the BVI.

While records in the Pandora Papers identify Thapar as the sole shareholder of Musk Holdings, official documents of JCT designate “non-promoter” Francatina Development Inc as its ultimate beneficial owner.

The ED conducted a Foreign Exchange Management Act (FEMA) probe, with reports from income tax authorities indicating that Thapar had not disclosed any foreign assets in his tax returns.

Inquiries were made to banks, and in April 2023, a fresh directive was issued to Thapar requesting investment details.

13) Lalit Goyal – co-founder of the Ireo real estate group, transferred assets, investments, and shareholdings worth an estimated $77 million to an offshore structure comprising four entities registered in the BVI, established as “investment vehicles.”

Before the group incurred significant losses and faced allegations of illegally siphoning off investors’ money by two New York-based investment companies, this offshore maneuvering took place.

Goyal was arrested in November 2021, with searches conducted under the Prevention of Money Laundering Act (PMLA).

Egmont requests were sent to aid in identifying his foreign assets, particularly in the UK and UAE. In October 2022, assets worth Rs 1,317 crore belonging to Ireo and Goyal were attached by the ED.

13) Malvinder Singh and Shivinder Singh – former promoters of Ranbaxy, established two offshore firms in the BVI in 2009: Clonberg Holdings and Forthill International Ltd, each owning an apartment in London.

Shivinder Singh mortgaged some properties of Forthill to secure a loan of 5.1 million pounds from Barclays Bank. Spouses and children of the Singh brothers were shareholders of the offshore firms.

Following their arrests in 2019 and facing charges of money laundering and fraud, a PMLA case was underway. Subsequent to searches conducted in May 2022 at Malvinder Singh’s residence, a bank account in Singapore was discovered, frozen due to alleged proceeds.

The proceeds from the sale of a property owned by Shivinder Singh and his wife allegedly transferred to conman Sukesh Chandrashekhar, are currently being traced.

14) Preeti Chandra – the wife of Unitech promoter Sanjay Chandra, established an offshore family trust and obtained a Dominican passport.

Formed in 2015, Trikar International Inc (BVI) was intended to hold assets for the family trust, with Preeti Chandra serving as the protector.

Additionally, Bellmora Ltd (BVI) was incorporated as the designated beneficiary in the Chandra Family Trust in 2015, aimed at holding investments in the UAE and India, as well as maintaining a bank account in the UAE.

The Enforcement Directorate (ED) has an ongoing Prevention of Money Laundering Act (PMLA) case against the promoters. In 2022, properties valued at Rs 1,057 crore were provisionally attached, and a letter was dispatched to the UAE to enforce the attachment order.

An MLAT (Mutual Legal Assistance Treaty) request has been sent to the UAE to obtain information on all the Chandras’ entities under scrutiny for alleged money laundering.

15) Iqbal Mirchi – a trusted aide of underworld don Dawood Ibrahim, passed away in 2013, with members of his family first identified with 17 offshore companies in the 2016 Panama Papers and later, in the 2021 Pandora Papers.

The latter revealed investments and transfers conducted by Iqbal Mirchi’s first wife, Hajra Iqbal Memon, and their two sons, Junaid Iqbal Memon and Asif Iqbal Memon, as well as property investments by Akbar Asif, the brother of Iqbal Mirchi’s second wife, Heena Kauser.

Amid an active PMLA case, a fresh Egmont request has been forwarded to the BVI following the Pandora Papers revelations.

The total assets for attachment of assets belonging to Mirchi and his legal heirs—via four separate orders—have been estimated at over Rs 799 crore. Multiple prosecution complaints were filed against the family, and in March 2021, a Red Corner Notice was issued for Hajra Memon and her sons.

An extradition request has been sent to the UK for three members of Iqbal Mirchi’s family, asserting that they are wanted in India on charges of money laundering and acquiring assets through illegal means.

16) Kapil and Dheeraj Wadhawan – the promoters of Dewan Housing Finance Corporation Limited (DHFL), have been in jail for over three years for defrauding Indian banks of over Rs 88,000 crore.

They incorporated a series of offshore entities mostly in the BVI and the Bahamas. The flagship BVI entity, V&M Aviation, entered into an agreement with Credit Suisse to register a charge (loan) for purchasing a Bombardier Challenger aircraft for $22.65 million.

Amid an ongoing PMLA probe, Egmont requests have been dispatched to the BVI, UAE, Bahamas, and Switzerland, with responses currently under analysis.

Since the initiation of the PMLA probe, properties valued at Rs 2,013.08 crore belonging to the Wadhawan brothers have been attached. These include foreign properties as well as foreign investments of the DHFL promoters.

17) Bakul Nath – Fresh evidence emerged against individuals implicated in the AgustaWestland helicopter deal, namely Bakul Nath, the son of Congress veteran Kamal Nath, and chartered accountant Rajiv Saxena, in connection with a company named Pristine River Investment.

An offshore company, Spector Consultancy Services, was established for Bakul Nath by the same consultant linked to Pristine River. Saxena established a Trust in 2014 with a BVI company, Tanay Holdings Limited, connected to the ownership of 14 other companies or assets.

The ED initiated action against Bakul Nath, with Pristine River’s account under analysis and fund transfers being traced.

The account of Tanay Holdings has been attached, and Letters Rogatory have been dispatched to Switzerland in Bakul Nath’s case.

Additionally, a PMLA case was underway for Rajiv Saxena, with properties valued at $2.9 million attached.

Rajiv Saxena is also implicated in the Moser Baer bank fraud case, with his foreign properties valued at $49 million attached, including his personal villa.