Reliance Retail announces huge payout of Rs 1,362 per share

‘I bought at Rs 3,400 per share on grey market,’ say Twitter users as Reliance Retail announces payout of Rs 1,362 per share

Friday brought unexpected news for retail investors as Reliance Retail, the leading retailer in the country and a subsidiary of Reliance Industries Ltd, helmed by Mukesh Ambani, made an announcement that sent shockwaves through the market. They revealed a significant reduction in share capital, with a payout of Rs 1,362 per share. This development left many retail investors who had acquired the stock through the unlisted market in a state of disbelief and concern.

These retail investors now find themselves in a difficult situation, facing potential losses of approximately 60% on their investments. Having purchased the shares through the unlisted market, which operates outside the official trading channels, they are now grappling with the consequences of this unexpected turn of events.

The unlisted market, commonly known as the grey market, is a space where shares of a company are bought and sold without following the usual procedures of the formal stock exchange. In order to navigate this market, retail investors need to locate and engage with local dealers who specialize in facilitating transactions between buyers and sellers.

The reliance of these retail investors on the grey market has placed them in a vulnerable position, as they now must seek assistance from these dealers to mitigate their losses. The sudden reduction in share capital has had a profound impact on the value of their investments, leaving them with significant financial setbacks and a sense of uncertainty about the future.

Overall, the announcement made by Reliance Retail has had far-reaching consequences, impacting the financial well-being of retail investors who had put their trust in the company’s prospects. The situation serves as a reminder of the risks associated with trading in the grey market and highlights the importance of conducting thorough research and due diligence before making investment decisions.

According to certain Twitter users, they claimed to have purchased the shares at Rs 3,400 per share, while others cautioned that the grey market primarily caters to High Net Worth Individuals (HNIs), and suggested that retail investors should moderate their ambitions and limit their trading activities to the regulated equity markets.

A Twitter user expressed their perspective by stating that if individuals hold unlisted shares in the grey market, such consequences are likely to occur. They emphasized that there is no protective framework in place to safeguard the interests of investors in this particular market.

“A costly lesson for people who paid higher amounts, to be careful,” quipped another Twitter user.

“Buying from Unlisted Market is always a worrisome affair. Most of the times the shares are available at huge premium. There is lack of liquidity & open market to sell at the intended timeframe,” said another person on the microblogging platform.

“Wow. Always found Reliance Retail way too overvalued.

“Though I made money in Reliance Retail 2 years back but was wise enough to sell when valuations reached astronomical,” said another Twitter user.

A variety of opinions emerged on Twitter regarding the potential for legal action in response to the unexpected developments. Meanwhile, other users noted that a reduction in share capital is a customary occurrence within the context of unlisted companies.

Among the Twitter users, some individuals raised the query of whether pursuing legal avenues was a viable option to address the unexpected turn of events. On the contrary, other users argued that a decrease in share capital is a typical practice for unlisted companies. They emphasized that such adjustments are not unusual and may be part of the company’s overall strategy or restructuring efforts.

The divergent views expressed on Twitter reflect a broader discussion regarding the feasibility of taking legal action in light of the specific circumstances, as well as differing perspectives on the norms and practices within the unlisted market sector.

“Reduction of Capital is not uncommon for an unlisted company. Procedurally it’s subject to a special resolution passed by shareholders of the unlisted company + sanction by NCLT. Even some listed companies in past have undertaken reduction of capital,” said a Twitter user.

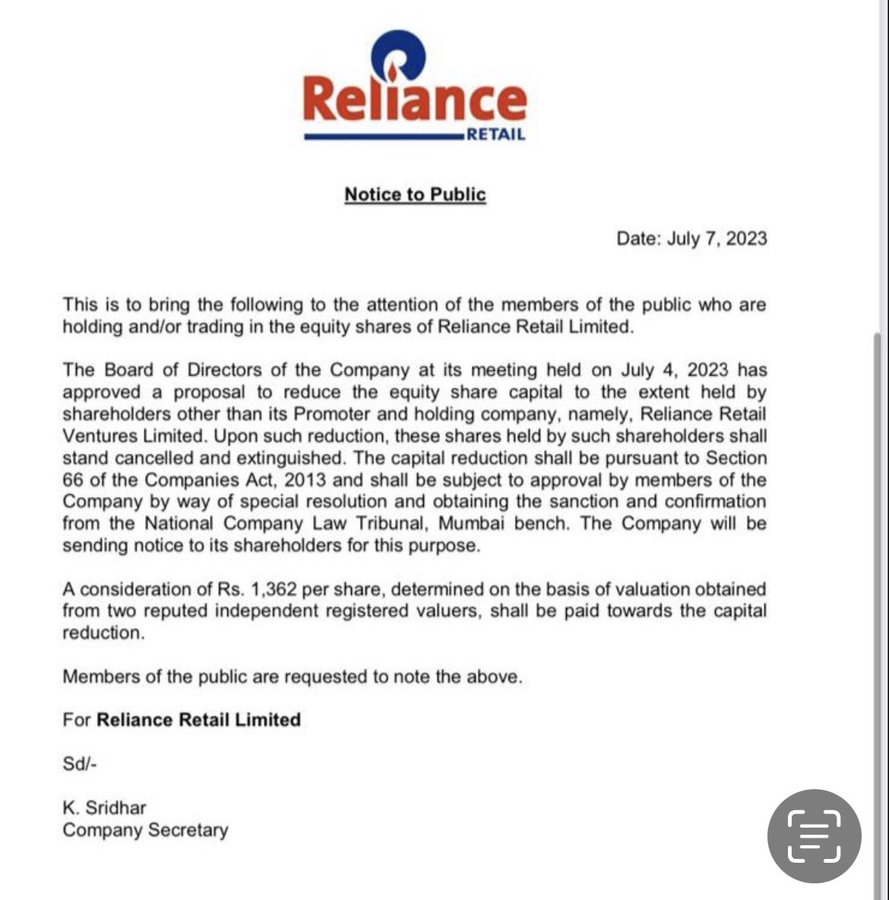

On July 4, 2023, the board of Reliance Retail approved a proposal to reduce the equity share capital. As part of this plan, shares held by shareholders other than the promoter and holding company will be cancelled and extinguished.

”A consideration of Rs 1,362 per share, determined on the basis of valuation obtained from two reputed independent registered valuers, shall be paid towards the capital reduction,” said an exchange filing by its parent firm Reliance Industries.

Reliance Retail has announced plans to reduce its equity share capital, effectively making it a wholly-owned subsidiary of Reliance Retail Ventures Limited (RRVL). This move aims to streamline and optimize the company’s business structure.

Currently, RRVL, as the promoter and holding company of Reliance Retail, holds 99.91% of the share capital, while the remaining 0.09% (approximately 78.65 lakh equity shares) is held by identified shareholders. Reliance Retail will notify its shareholders about this capital reduction process.

However, it is important to note that the capital reduction is subject to regulatory approvals and requires the consent of the company’s members through a special resolution, as well as obtaining sanction from the National Company Law Tribunal, Mumbai bench.

Two global consulting firms, EY and BDO, have independently valued Reliance Retail at around $92-96 billion. Ernst & Young assessed the value per share at Rs 884.03, while BDO Valuation Advisory LLP estimated it at Rs 849.08 per share. These valuations underscore the rapid growth of Ambani’s businesses.

Reliance Retail Ventures, which wholly owns Reliance Retail, encompasses various retail operations, including international partnerships and Ambani’s consumer goods business.

Over the years, Reliance Retail has entered into partnerships with numerous global brands, expanding their presence in the Indian market. These partnerships span diverse sectors such as fashion, food, and luxury, featuring brands like Burberry, Pret A Manger, and Tiffany.

It’s worth mentioning that in 2020, Reliance Retail Ventures raised Rs 47,265 crore by selling a 10.09% stake, valuing the company at approximately $57 billion. Notable investors in this round included KKR, the Saudi Public Investment Fund, General Atlantic, and the UAE’s Mubadala.