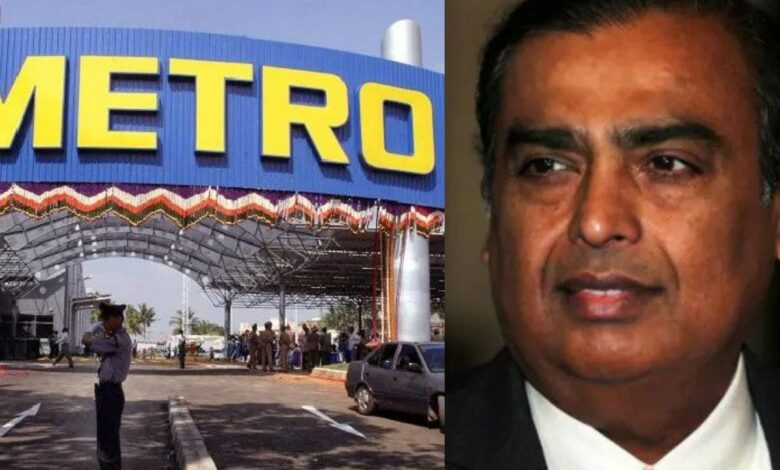

Reliance is planning to pay Rs 4,060 crore to purchase METRO Cash & Carry India.

According to industry insiders, Reliance Industries is planning to buy the Cash & Carry division of German retailer METRO AG in India for about 500 million euros (Rs 4,060 crore). According to them, the acquisition comprises 31 wholesale distribution centers, land banks, and other METRO Cash & Carry properties.

Reliance Retail, the biggest retailer in the nation, would be able to increase its market share in the B2B sector thanks to this. The billionaire Mukesh Ambani-led Reliance Industries and METRO had been in talks for a few months before the German parent company last week accepted the offer from Reliance Retail, they continued.

METRO and Reliance Industries declined to comment on the development when approached. “Our organization considers numerous alternatives continuously,” a Reliance official said. “We do not comment on market rumors or speculations,” the spokeswoman for METRO AG stated. Retailers and Kirana shops, hotels, restaurants, caterers (HoReCa), corporates, SMEs, businesses, and institutions make up METRO Cash & Carry’s clientele. Retailers and Kirana shops, hotels, restaurants, caterers (HoReCa), corporates, SMEs, businesses, and institutions make up METRO Cash & Carry’s clientele.

The largest e-commerce company Flipkart Group bought a 100% share in Walmart India Pvt Ltd, which runs the Best Price cash-and-carry operation, in July 2020. Other merchants, such as Siam Makro, which runs Lots Wholesale cash-and-carry trade business under the brand name LOTS Wholesale Solutions, were also competing to purchase METRO Cash & Carry. Siam Makro, a member of the Thai Charoen Pokphand Group, declared last month that it was withdrawing from the bidding process for METRO Cash & Carry India. In 2003, METRO AG, a company with operations in 34 nations, joined the Indian market.

Six locations are run by the company in Bengaluru, four in Hyderabad, two each in Mumbai and Delhi, and one in each of the following cities: Kolkata, Jaipur, Jalandhar, Zirakpur, Amritsar, Ahmedabad, Surat, Indore, Lucknow, Meerut, Nasik, Ghaziabad, Tumakuru, Vijayawada, Visakhapatnam, Guntur, and Hubballi. Reliance Retail Ventures Ltd (RRVL), a division of Reliance Industries, serves as the holding company for all of the group’s retail businesses. For the fiscal year that ended March 31, 2022, RRVL recorded a consolidated turnover of almost Rs 2 lakh crore.

After experiencing losses, Germany-based Metro AG’s Indian affiliate, Metro Cash & Carry, is being sought after by food delivery behemoth Swiggy. According to a report from ET Now, Metro Cash & Carry, which has 31 outlets in India, has contacted close to 10 businesses about buying its operations there for a price ranging from $1.5 billion to $1.7 billion. According to RoC filings, Metro Cash & Carry reported a net loss of INR 23.33 in FY20, despite having a sales volume of INR 6,915.3 Cr.

Indian startups Swiggy and Udaan, among others, were defeated by Reliance Industries in the competition to buy the Indian division of German wholesaler Metro, according to PTI. A deal of €500 million to €550 million (INR 4,000 crore to INR 4,500 crore) would see the loss-making wholesale division of Metro Cash & Carry leave India after 19 years of existence.

According to sources, Metro Cash & Carry has 31 locations in India and has reportedly approached close to ten businesses to buy its Metro agreed for less than half of its asking price after originally aiming to sell its wholesale division for €1.5 billion to €1.7 billion. Due to its over the years dismal financial performance, Metro was searching for a buyer. The wholesaler with headquarters in Germany reported a loss of INR 67.37 Cr despite having revenue of INR 6,503.25 Cr.

After the takeover, Reliance could keep Metro India’s senior management, according to a report.

A report in Mint stated that the German retailer believes Reliance Industries will keep the company’s current management after the deal is formally signed by the end of this month. This belief came days after it was made public that Reliance Industries was planning to purchase Metro AG’s wholesale business in India. According to the article, which relied on sources familiar with the Rs 4,060 crore agreements, Metro AG also took into account Reliance Retail’s capacity to protect the interests of its employees and quickly obtain regulatory clearances. Reliance Retail is the largest retailer in the nation.

The India-based division of the corporation employs roughly 5,000 people. According to a source who asked to remain anonymous, “The agreement is on and it will be officially inked probably before the end of the month.” According to our conversations with Reliance, we think they want the present management to stay. In addition to Metro India’s strong business strategy, this was a major draw, he continued.

According to a report from sources on Monday, the conglomerate run by billionaire Mukesh Ambani was planning to acquire the German company in exchange for 31 Metro-owned wholesale distribution centers, land, and other assets. Reliance Industries and Metro have both been silent over the development thus far. Reliance informed the news agency that it “evaluates different options continuously.”

Edited by Prakriti Arora