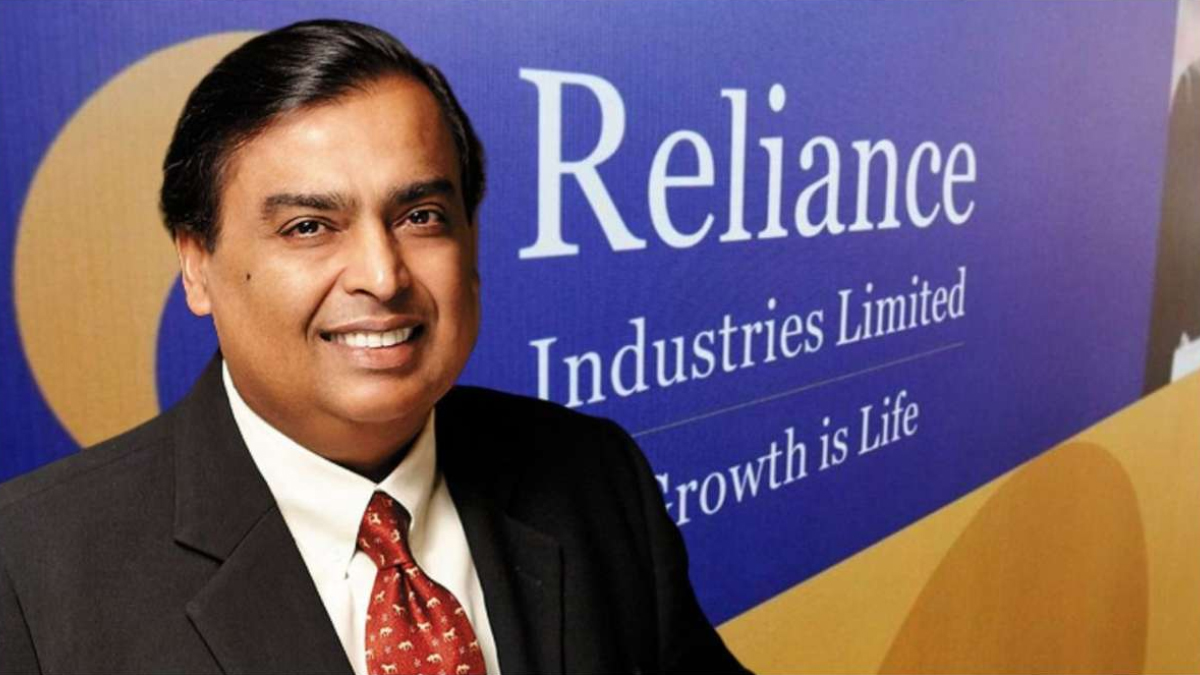

Reliance Industries shares tumble over 4 pc; mcap erodes by Rs 69,364 cr

Reliance Industries shares tumble over 4 pc; mcap erodes by Rs 69,364 cr

Shares of Reliance Industries Ltd on Monday tumbled over 4 per cent after it shelved a proposed deal to sell a 20 per cent stake in its oil refinery and petrochemical business to Saudi Aramco for USD 15 billion.

The market heavyweight’s stock tanked 4.42 per cent to close at Rs 2,363.40 on the BSE. During the day, it declined 4.92 per cent to Rs 2,351.

On the NSE, it tumbled 4.42 per cent to close at Rs 2,363.75.

In traded volume, 4.17 lakh shares were traded on the BSE and over 1.11 crore shares on the NSE during the day.

The market valuation of Reliance Industries tumbled Rs 69,364.46 crore to reach Rs 14,99,185.71 crore on the BSE.

After missing two self-imposed deadlines, billionaire Mukesh Ambani’s Reliance Industries Ltd has shelved a proposed deal to sell a 20 per cent stake in its oil refinery and petrochemical business to Saudi Aramco for an asking of USD 15 billion, as the Indian firm focuses on the new energy business.

“Due to evolving nature of Reliance’s business portfolio, Reliance and Saudi Aramco have mutually determined that it would be beneficial for both parties to re-evaluate the proposed investment in O2C business in light of the changed context,” the Indian firm said late Friday, adding that it will continue to be Saudi Aramco’s “preferred partner” for investments in India’s private sector.

Ambani had in company’s annual general meeting of shareholders in August 2019 announced talks to sell a 20 per cent in the oil-to-chemicals (O2C) business, which comprises its twin oil refineries at Jamnagar in Gujarat, petrochemical assets and 51 per cent stake in fuel retailing joint venture with BP, to the world’s largest oil exporter.

At that time, he had announced the deal would close by March 2020. The deadline was missed and the company blamed pandemic controlling restrictions, imposed towards the end of March 2020, for hampering due diligence.

This year too, at the AGM, Ambani stated that the deal would close by the end of the year. At the same event, he also announced new energy forays, including a plan for developing one of the largest integrated renewable energy manufacturing facilities in the world.