RBI Stopped Kotak Mahindra Bank From Onboarding New Customers. Surprising Why RBI Took So Long For This Action. Kotak Bank Has Long History Of Violations & Penalties

Kotak Mahindra loses $5.7 billion in market value after RBI curbs. Uday Kotak, the billionaire founder who holds a 25.71 per cent stake in Kotak Mahindra Bank, lost around ₹10,225 crore of his wealth in a day as Kotak Mahindra Bank share price tanks

Kotak Mahindra- Innovation or Incompetence? What took RBI so long to take action? Is Customer Data at risk of being Stolen? Shares Drops 52 week Low

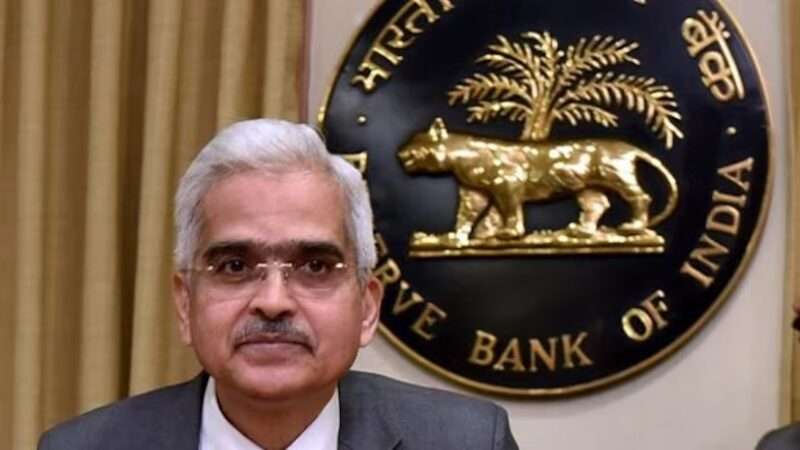

The Central Bank of India’s (RBI) recent regulatory sanctions on Kotak Mahindra Bank (KMBL) drew broad concern amongst the Indian banking sector. On April 24 2024, the RBI saw enough “serious shortcomings” in the Bank’s information technology (IT), so restrictions were imposed on KMBL operations. This followed a series of issues raised by the RBI over the last two years regarding vital deficiencies in the IT systems.

According to RBI’s press release, the Bank has been charged multiple times for data security issues, patch and change management, user access management, and disaster recovery protocols. These failures became the most disruptive events, leading to a massive service failure on April 15, 2024, creating uncountable customer frustration.

The RBI has forbidden Kotak Mahindra Bank from onboarding both new customers of online and mobile banking and issuing new credit cards. This step was taken under Sec. 35A of the Banking Regulation Act, 1949, which confers the RBI authority to issue relevant directions to banks in the public interest.

The RBI’s scrutiny and audit reports are in the public domain which points out significant deficiencies in the Bank’s IT inventory management, patch and change management, user access management, vendor risk management, data security and disaster recovery, all of which are very serious and need immediate actions. Since the RBI did not accept the corrective plan for such issues, the Bank was considered significantly non-compliant.

How RBI Actions Led To Kotak Mahindra Customers Suffer?

The RBI (Reserve Bank of India) has punished Kotak Mahindra Bank (KMBL), and it’s not just a minor criticism; it’s a severe test for both the Bank and its clients. To be precise, this decision has affected the situation of Kotak Mahindra Bank, challenging them to cope and leaving its customers feeling abandoned. Here’s why this is happening:

- Forget about the option of online account opening. If Kotak Mahindra Bank is one of your choices, take a back step. The Bank is prohibited from accepting new clients online, which translates into waiting lines at a local branch and a time-consuming paperwork process for anyone seeking to open an account. If you’re a young professional and you are in the market for a new bank? All of them are now in a risky position because of the IT problem at Kotak Mahindra.

- If you are thinking of getting a new credit card with a cool rewards type of deal, It’s not going to happen with Kotak Mahindra. RBI has restricted them from issuing new credit cards. If you already have a card with them, you’re in the safe zone for the moment. However, if you plan to get a new card with special offers or to enjoy the different choices, it won’t be possible now.

- For those who rely on online and mobile banking to handle their financial transactions, the situation with Kotak Mahindra might make you reconsider your choice. The Central Bank of India’s (RBI) action instead creates uncertainties regarding digital security and system reliability issues. Perhaps you will be concerned with whether your online transactions are actually safe. Now, what worries the customers is a matter of concern.

- With the latest decision of the RBI, it seems as if Kotak Mahindra Bank did not take enough steps to ensure customer data and privacy security. Consequently, this would likely cause many of the existing customers to leave and find another bank with which they can build a relationship of trust. Therefore, the public may no longer entrust their money to the banks if the RBI lacks confidence in them.

- Customers are also angry with the absence of transparent information. How long will these measures last? What is Kotak Mahindra doing to overcome the problems? There is no clear stand from the Bank, which leaves customers confused and afraid that their money will eventually end up in nothing.

While RBI might be in pursuit of disciplining Kotak Mahindra Bank, indeed, it is the bank clients who bear all the pain. At this moment, the customers are faced with limited access to their accounts, fewer services that are available, and an overall feeling of being unsettled. This is hard for Kotak Mahindra to digest, but it’s irritating and more trouble for the customers, who expect everything to go fast and smoothly.

The outcome of RBI’s intervention on Kotak Mahindra Bank

The lack of gaining new customers online and through credit cards is the main problem standing in front of the Bank’s expansion plans.This directly undermines banks’ profits and market shares which on the long run could bring down the financial health of the Bank.

The impact of the RBI’s action on Kotak Mahindra Bank’s market value is evident in the immediate drop in stock price on the day the action was announced.

| Date | Closing Price (Rs.) | Change |

| Thursday, April 24, 2024 (Pre-RBI Action) | 1,843.00 | – |

| Friday, April 25, 2024 (RBI Action Announced) | 1,608.50 | -234.50 (12.75%) |

Kotak Mahindra Bank will now be prohibited from giving new credit cards, a significant growth region for the Bank. Credit Cards, which are about 4% of the Bank’s total loan portfolio, are one of the sources of loans for the Bank.

RBI’s action is sending warning signals to investors. The Bank’s stock can suffer a decline due to public apprehensions about data security and the lack of robust IT infrastructure. Investor trust starts collapsing, and it becomes difficult to raise fresh funds in the future.

The worst result for Kotak Mahindra would be the loss of trust. The RBI’s act reveals the Bank’s weakness in data security. This comes up with serious doubt about the safety of customer’s information, making them abandon the Bank, which endangers the security of banking practices.

The RBI’s actions will restrict the credit development and profitability of Kotak Mahindra Bank, and they might need more branches to replace the growth in their operations, which will lead to increased operational costs.

Kotak Mahindra was a pioneer in terms of digital banking. Now, the Bank is being condemned for having poor IT infrastructure. This compromises the Bank’s reputation for innovation and questions its capacity to constantly evolve with a digitalizing world.

The biggest question is centered on what lies ahead?

Uncertain Timeline

How long the restrictions will be in force is undecided. This results in confusion for both customers and investors, which prevents financial planning and investment decision-making.

Unclear Communication from Kotak Mahindra

The restrictions will remain until Kotak Mahindra Bank, an external audit is carried out, and all deficiencies are addressed to the RBI’s satisfaction, a process that is expected to take 6 to 12 months.

The absence of any statement from Kotak Mahindra is a clear indication of how deliberate their approach is. Customers deserve to be informed of the corrective action and a clear path for restoring the RBI’s confidence.

Why did it take so long for the RBI to make a move?

The Reserve Bank of India’s (RBI) recent action on Kotak Mahindra Bank (KMBL) is perhaps overdue. The RBI’s steps were definitely needed, but it’s hard to ignore a key question: why was the RBI so slow? This could be seen as a sign that the RBI was slow to take action and that people were exposed to risks for too long.

The RBI mentioned that “serious gaps” in KMBL’s IT infrastructure were identified in the past two years. According to the press release, all this resulted in a varied series of outages, the most prominent of which happened on April 15 2024.

In 2022 and 2023, KMB came under RBI’s IT spotlight after showing significant deficiencies in information technology and risk management framework. Among these issues were problems associated with the absence of IT inventory management, weak patch and change management, loosely defined user access control systems, and poor vendor risk control.

On the one hand, the Reserve Bank of India (RBI) has found these problems problematic, but on the other hand, it seems very insensitive towards Kotak Mahindra Bank in rectifying the critical vulnerabilities with due time. It was discovered that the Bank did not follow the Corrective Action Plans assigned by the RBI by the central Bank while not acting promptly enough to stop the situation from worsening.

The RBI’s response time is a cause for worry due to the growing trend of digitalization of financial services in India. The core banking of Kotak Mahindra Bank, as well as its digital channels, have experienced severe service disruptions in the past two years, which has caused significant hassle for customers. This raises grave questions about the Bank’s ability to secure customer data and also provide stability for its critical IT infrastructure.

RBI may have weakened the stability and credibility of the Indian financial system by not addressing these shortcomings for a prolonged time. The core activity of the central Bank is to maintain stability in the financial sector as well as the interests of depositors. Still, its late reaction to Kotak Mahindra Bank poses a risk to both.

The way the RBI handled the Kotak Mahindra Bank case also made the ability, consistency, and transparency of its regulatory approach questionable. The central Bank moved quickly against other financial institutions, such as HDFC Bank, over similar IT-related issues. However, in the Kotak Mahindra Bank case, the Central Bank applied a gentler approach.

This absence of the uniform regulatory impedes the Bank’s credibility and diminishes its competence to efficiently supervise the banking sector. This, in turn, raises the issue of the accountability elements in place to ensure that the central Bank’s actions are in tune with its objectives of financial stability and consumer protection.

What’s Next for RBI?

The RBI must utilise this experience to strengthen its supervisory oversight of all banks, irrespective of their size and reputation, to guarantee that robust IT governance and operational resilience are maintained at the same high level for all banks. Constantly monitoring the non-compliance and showing reaction should be the norm, not the exception.

Along with this, the central Bank should increase monitoring and evaluation of banks’ IT infrastructure and risk management practices. The RBI will thus be able to identify the weakness before it poses systemic risks that can overturn the financial system’s stability.

Due to the delay of RBI in the case of the Kotak Mahindra Bank, the public has lost trust in the competence of RBI to regulate the banking sector. To rebuild trust, the RBI must commit to proactive and consistent oversight, with its goal to protect the interests of the customers and the financial system.

Why RBI Must Also Investigate Kotak Mahindra’s 811 App?

The RBI’s recent regulatory action against Kotak Mahindra Bank for significant IT deficiencies is a good move, but it does not go to the roots of the matter. The attention of the Central Bank has now turned to the Bank’s flagship digital offering, the 811 app, which demands a complete assessment of its faults and shortages.

The case of Paytm Payments Bank involved data leaks due to fraudulent account creation through poor KYC procedures. It was allegedly discovered that scammers have figured out how to get around the bank’s online registering processes thereby making customers’ data vulnerable and enabling the fraudsters to carry out illegal activities. The particular incident brought the main importance of the comprehensive KYC requirements into the light to ensure the account holders are properly assessed.

However, if the RBI’s action against Kotak Mahindra Bank, though it is focused on IT infrastructure, could also indicate the bank’s weak and ineffective digital onboarding process in terms of information, security, and privacy. The incident brings up the issues of the bank failing to guarantee the protection of customer information during the process of creating an account.

Just like, Paytm users had been worried about fake KYC (Know Your Customer) processes that scammers might have used to trick them out of sharing personal information. This is huge for banks because this process helps them identify you and your bank account to ensure the proper safety measures are in place to prevent fraud.

The RBI should intervene following the “Paytm incident”. They would like the bank to be assured that there are strong KYC procedures in place, especially for the Kotak Mahindra 811 app to protect customer information.

Any financial app must have a reliable security system in place. The KYC scams can happen virtually anywhere and the RBI needs assurance that Kotak 811 and other apps use precautions to protect your information.

As per the KMBL’s annual report, 811 is said to be the leading source of over 72% of online savings accounts opened in the past year, and therefore, any attack on the app could potentially result in affecting thousands of customers. Is 811 a reliable application secure enough to manage such a large amount of confidential information? If the Bank’s single point of failure can eventually withstand failure, it can impact a substantial portion of the customer population.

By making account opening easier, the app may lose security to the point of not performing enough customer identity verification. The RBI should conduct a thorough examination of the onboarding procedures within 811. Are there enough controls to forbid identity theft or the creation of any fraudulent account? Is the app KYC-compliant? If so, how well is it regulated in this regard?

During the onboarding process, 811 collects a large proportion of personal data. Is the app privacy policy concise, transparent and explicit on how the collected data is stored, accessed, and used? Is there any customer consent to data use, and has a firm enough mechanism been installed to prevent unauthorised access or data leaks?

811 has suffered countless outages and downtimes that have denied customers access to their accounts and the ability to perform essential financial operations. This contradicts the very idea that banking should be exclusively online.

Most customers of the 811 app have left reviews on various platforms, citing the program’s poor performance with interface problems, navigation issues, and ease of use. This is not permissible for a platform that is supposed to be the Bank’s primary customer service channel.

Inadequate Security Measures

Considering the high responsibility for financial data, the 811 app should provide robust security tools to guard users’ data. On the other hand, some reports indicate that the app lacks the necessary security protocols, and customers are vulnerable to fraud and data breaches.

Lack of Transparency

Kotak Mahindra Bank has yet to reveal the performance metrics of the 811 app, customer feedback and the measures it has taken to improve the platform. Such opacity not only betrays the public trust but also raises questions about the Bank’s caring about customers.

The RBI’s Responsibility to Investigate

The Reserve Bank of India (RBI), the prime regulator of the banking sector, is tasked with ensuring that all financial institutions, including their digital offerings, function at the highest level of security, reliability, and customer service. The Reserve Bank’s recent response to the IT lapses at Kotak Mahindra Bank is a step in the right direction, but more is needed.

RBI needs to investigate the 811 apps extensively by auditing their technical architecture, security protocols, user experience and performance. This inquiry must be an independent audit, a customer opinion questionnaire, and a well-rounded analysis of the way the Bank responds to customer complaints and feedback.

Consequences of Inaction

Not resolving the systemic issues in the Bank’s 811 app could even lead to more significant issues beyond the scope of the Bank and the banking sector in India. Besides discontented customers and security victims, the Bank’s financial stability and growth chances can decline if people leave the Bank in a mass exodus.

In addition to the RBI’s not taking any action, this will lead the banking sector to think that for digital platforms, the existence of customer complaints and concerns of regulators cannot affect their activities. This might, hence, encourage other banks to provide further weight to immediate profits compared to the long-term sustainability and customer trust to enhance the credibility of the Indian financial system even further.

RBI should act quickly and appropriately to analyse the 811 app and act against Kotak Mahindra Bank for its negligence. The investigation should end with recommendations and corrective actions, including the deadline by which the Bank is supposed to do it.

Additionally, the RBI may need to introduce more stringent rules and procedures for creating and operating digital banking platforms, thus ensuring the customers’ safety, reliability, and user experience come first.

The RBI can only successfully carry out its mission of maintaining financial stability and safeguarding the interest of Indian consumers by implementing proactive and stringent regulations of digital banking platforms. To do anything less would betray the core objective of the Central Bank to the people.

Regular complaints from customers regarding the services of Kotak Mahindra Bank

The common complaints of customers about Kotak Mahindra Bank’s services are:

- Users of the Bank’s mobile banking app have faced technical issues such as server downtime, inability to perform transactions and unreliability of the app in general.

- As a result of ATM problems, the mobile app has caused customers to face difficulties in cashing out from ATM machines and making transactions at bank branches.

- Due to the fall in various digital banking services, including mobile apps and online banking, the Bank needs help maintaining channel integrity so customers can access their accounts and services.

- Customers have expressed dissatisfaction with the Bank’s non-transparency in tackling their concerns with the digital platforms and the timeline of resolution communication.

- Customers are stuck in transit during digital service failures, causing inconvenience and hindering them in financial transactions.

- The primary customer complaints are about the reliability, availability, and accessibility of Kotak Mahindra Bank’s online banking services, including the app, and the Bank’s transparency regarding these grievances.

- Kotak Mahindra Bank is fighting against the flood of fraud, where shams and thefts affect customers, making the banks more stringent in their preventive measures.

Kotak Mahindra Bank, once regarded as a trusted and reliable bank, is now facing a series of fraud cases that threaten to shake the foundation of its reputation. The figure pointed out by the Reserve Bank of India (RBI) “5,278 fraud cases reported in the last three months of 2022-23 – depicts a disturbing picture of systemic risks and customer exposure.

The Vast Amount Of Fraud

Let’s have a look on some past frauds involving Kotak Mahindra Bank:

- Loan Processing Scheme Fraud: 10 employees of Kotak Mahindra Bank who have been accused of cheating, fraud, and forgery in a fake account loan processing scheme where they convinced customers to transfer stamp duty as well has been filed, causing a loss of 1.02 crore.

- Cyber Fraud: Three officials of bank Kotak Mahindra were suspected and found guilty of opening 2,000 accounts forged with documents for a fee of Rs 20,000 from a gang. The Bank has a cyber fraud case filed by the police.

- Phishing and Phishing Fraud: The Bank confirmed submitting a total of 5,278 cases to law enforcement agencies, with 97% of those cases involving card-related frauds during Q1 fiscal year 2023 from activities done like phishing, vishing, skimming and more.

- Unauthorized Transactions: Clients faced the problem of their money being fraudulently used for allegedly unlawful purchases and other malicious activities, and they lost money due to it. That created a sense of instability among the customers and an erosion of trust in the Bank’s security system.

- Cheating and Forgery: Workers were in charge of illicit activities like cheating on loan distribution and Stamp Duty payments, which caused cash shortages and many complaints.

- Account Opening Fraud: Upon investigating, the auditor found that the three branch managers responsible for 2,000 accounts had used fraudulent documents, suggesting a severe oversight or a flaw in the Bank’s documentation process.

- Lack of Account Verification: The investigation by the police uncovered that out of the 10% of banking clients who made fresh openings of their accounts, the Bank needed to have verified them, which provided an opportunity for fraudsters to exploit the system and conduct their illicit businesses.

- Customer Deception: Employee inauthenticity caused a loss of trust, as customers were promised that the company would settle stamp duty payments without the customers measuring up and, consequently, moving to fraudulent loan processing.

- Forgery and Falsification: Positions were filled by employees who were caught engaging in forgery, falsification of documents, and breach of confidence, for which the Bank was made to face financial discrepancies and court actions against them.

- Systemic Vulnerabilities: The widespread fraud cases reported demonstrate the systemic weakness of the Kotak Mahindra Bank and urge for better security features and regulatory supervision.

The recent frauds emphasise Kotak Mahindra Bank’s difficulty in preserving its operations’ integrity and the critical role of strict anti-fraud activity measures and customer interest protection.

Defection or systematic failure?

Kotak Mahindra Bank’s explanation of these fraud cases as “customer lapses” raises doubt; therefore, there is a need to dig deeper. Whether these occurrences can be categorised as customer carelessness or a more profound failure of the Bank’s security systems and risk management procedures. The Bank’s argument that 97% of cases resulted from card-related fraud only increases the need for a thorough investigation of the Bank’s internal control and protection systems.

Suspicious activities that Kotak Mahindra Bank has staged in connection with these fraud cases bring about a lot of questions. The Bank hasn’t been transparent regarding the type of fraud or how much money gets stolen. They still have not explained how they are addressing this issue. Such a lack of clarity would stimulate people’s disbelief towards the truthfulness or readiness of the Bank to take responsibility and ensure customers’ security. Fundamentally, in situations when money is at stake, people must be provided with clear answers and not with uncertainty.

The rapid rise in fraud activities at the Kotak Mahindra Bank calls upon the Bank to immediately counter this surge by implementing a robust and active response. The RBI is responsible for acting immediately, investigating the fraud, penalising the bank, and taking decisive actions to protect clients from future threats.

The unprecedented number of frauds reported at Kotak Mahindra Bank is far more than just an issue of numbers; it is an issue of trust, responsibility, and the entire banking system. Something must be done urgently as this problem, if not resolved, can cause the Bank and its customers to be at risk, as well as the whole financial world.

This Is Not The First Action Of RBI On Kotak Bank. Lets Dig In Past To See RBI Action On Kotak Mahindra Bank

- The Reserve Bank of India (RBI) has, by an order dated October 17, 2023, imposed a monetary penalty of ₹3.95 crore (Rupees Three crore Ninety Five lakhs only) on Kotak Mahindra Bank Limited (the bank) for non-compliance with RBI Directions on “Managing Risks and Code of Conduct in Outsourcing of Financial Services by banks”, “Recovery Agents engaged by Banks”, “Customer Service in Banks”, and “‘Loans and Advances – Statutory and Other Restrictions’”. This penalty has been imposed in exercise of powers vested in RBI conferred under the provisions of Section 47A(1)(c) read with Sections 46 (4)(i) of the Banking Regulation Act, 1949.

- SEBI slaps ₹1.6 cr penalty on Kotak AMC chief Nilesh Shah, 6 others for flouting Mutual Fund rules. These penalties were incurred for the defaults and breach of the investment rules in respect to the six Fixed Maturity Plan (FMP) schemes that had matured in April and May 2019. The scam was backed by debt securities from Edisons Utility Works and corporates of the Essel Group, including Konti Infrapower & Multiventures. Debt instruments were used here and their security was agreed upon by pledging equity shares of Zee Entertainment Enterprises by its promoter Cyquator Media.

- Reserve Bank of India (RBI) by an order dated June 06, 2019, imposed a fine of ₹ 20 million on Kotak Mahindra Bank Limited (the bank) for not following the directions RBI issued in exercise of its powers under section 27(2) and section 35A of the Banking Regulation Act, 1949.

Viewpoint

The recent RBI action against Kotak Mahindra Bank (KMBL) for critical IT infrastructure shortcomings, coupled with the past SEBI fine for alleged non-disclosure during its IPO, raise a concerning question: does Kotak Mahindra Bank show habitual tendency towards delivering regulatory compliance?

These past incidents highlight a pattern of regulatory concerns for Kotak Mahindra Bank and its entities. The confirmed SEBI fine and recent significant RBI actions raise questions about potential recurring issues.

Moving forward, strong commitment to regulatory compliance is crucial for Kotak Mahindra Bank and its entities to rebuild trust with investors and customers.