RBI retains inflation projection for FY23 at 6.7 pc

The RBI on Friday retained inflation forecast for FY23 at 6.7 per cent amid uncertain price trajectory on “geopolitical shocks” and on hope that inflationary pressures would ease with pick-up in kharif sowing and supply chain improvements.

In its previous monetary policy review in June, it had projected retail inflation for 2022-23 at 6.7 per cent, higher from 5.7 per cent forecast in April.

The six-member Monetary Policy Committee (MPC) unanimously decided to raise the benchmark repo rate by a steep 50 basis points to 5.40 per cent with immediate effect to tame inflation while supporting growth.

Repo is the key rate at which the RBI lends short-term money to banks. One basis points is equivalent to one-hundredth of a percentage point.

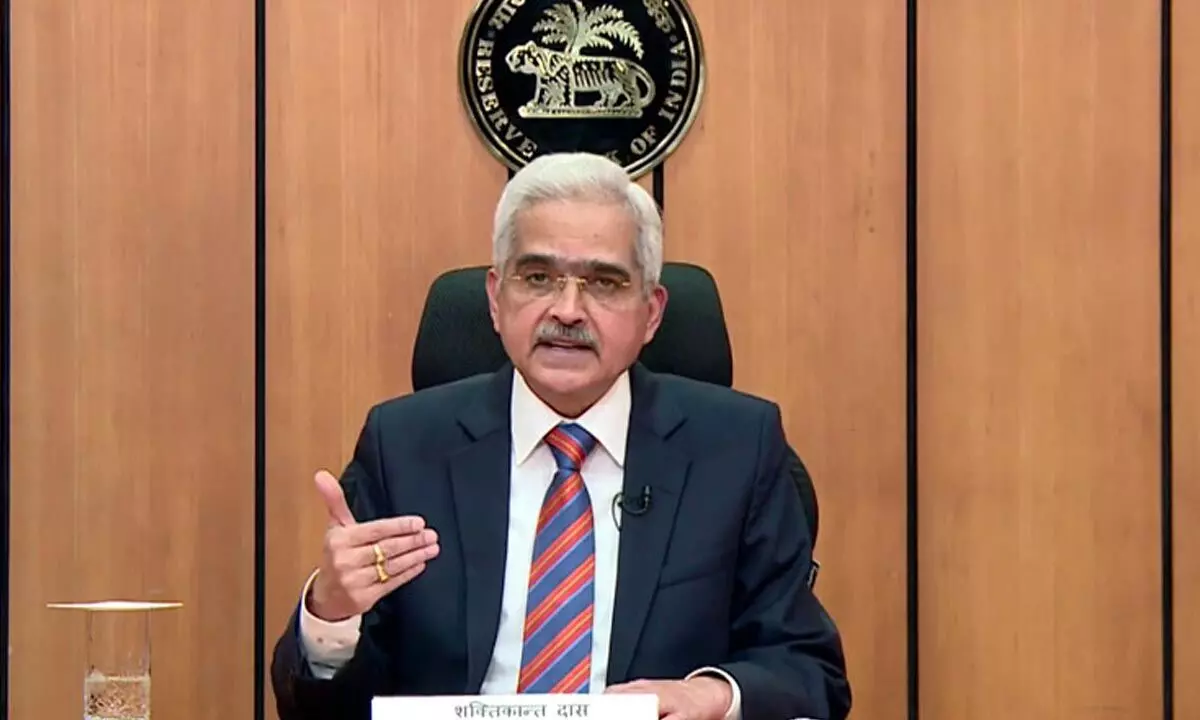

RBI Governor Shaktikanta Das said inflation in second and third quarter of current fiscal year is expected to remain above the upper tolerance level of 6 per cent.

The central bank has been mandated to keep retail inflation at 4 per cent with a bias of 2 per cent on the either side.

Spillovers from geopolitical shocks are imparting considerable uncertainty to the inflation trajectory, even as food and metal prices have come off their peaks recently, Das said while announcing the MPC meeting outcome.

He said global crude oil prices have eased in the recent weeks, however, they remain elevated and volatile. There are supply-related concerns amid weakening of global demand outlook.

“Taking into account these factors and on the assumption of a normal monsoon in 2022 and average crude oil price (Indian basket) of USD 105 per barrel, the inflation projection is retained at 6.7 per cent in 2022-23,” Das said.

For second quarter of 2022-23, the RBI has projected inflation at 7.1 per cent; Q3 at 6.4 per cent. It is, however, expected to come under control at 5.8 per cent in Q4.

Das said risks are evenly balanced with respect to inflationary outlook. The RBI expects the Consumer Price Index (CPI)-based retail inflation to come down to 5 per cent in first quarter of 2023-24.

Sowing of kharif crop has picked up in the ongoing monsoon, which augurs well for the domestic price outlook, RBI said. It will also boost rural consumption.

“The shortfall in paddy sowing, however, needs to be watched closely, although stocks of rice are well above the buffer norms,” Das said.

He also expects prices of edible oil to soften further on the back of government intervention as well as ease in supply from international producers.

In June, retail inflation stood at 7.01 per cent.

Noting that inflation has remained above 7 per cent since the beginning of current fiscal year, Das said food inflation has registered some moderation, especially with the softening of edible oil prices, and deepening deflation in pulses and eggs.

“Cost pressures are, however, expected to get increasingly transmitted to output prices across manufacturing and services sectors,” he said.