RBI likely to hold repo rate, focus on falling inflation trajectory over the rate of inflation: Economists

RBI likely to hold repo rate, focus on falling inflation trajectory over the rate of inflation: Economists

India’s retail inflation rate experienced a notable decline in August, following a 15-month high reached in the preceding month. According to data released by the Ministry of Statistics and Programme Implementation on September 12, the Consumer Price Index (CPI) inflation for August decreased by 61 basis points (bps), bringing it down to 6.83% from 7.44% in July.

This drop in the CPI inflation rate is attributed to a cooling in vegetable prices, which played a significant role in moderating overall inflation. Vegetable prices are often a key driver of inflation fluctuations in India due to their impact on food costs, a major component of the CPI basket.

The decrease in inflation is a welcome development as it can help ease the cost of living for consumers and provide relief from elevated price levels. It is also a positive indicator for the central bank’s inflation targeting framework and monetary policy decisions.

Monitoring inflation is crucial for policymakers, as it directly affects the purchasing power of consumers and can influence economic stability. The moderation of inflation can create an environment conducive to economic growth and investment.

In August, food inflation, which holds significant weight in the overall inflation basket, increased by 9.94%. This represented a notable deceleration from the previous month when food inflation stood at 11.51% in July. Food inflation is a critical component of the Consumer Price Index (CPI) and has a substantial impact on overall inflation levels in India.

The decrease in food inflation from July to August is a positive development, as it reflects a moderation in the rate at which food prices are rising. Factors such as changes in agricultural output, supply chain disruptions, and government policies can influence food inflation.

Lower food inflation is typically seen as beneficial for consumers, as it contributes to reduced overall inflation and eases the cost of living. It allows households to allocate their budgets more efficiently and can lead to improved purchasing power.

For policymakers, understanding food inflation trends is crucial, as it informs decisions related to monetary policy and economic stability. While lower food inflation can be favorable, maintaining a balance between moderate inflation and supporting agricultural producers is a challenge for policymakers.

In August, the Core Consumer Price Index (CPI), which excludes volatile food and energy components, registered a rate of 4.86%. This marked the second consecutive month where core CPI was below the 5% mark. Although it remained below the one-year average of 5.62%, the continued moderation in core inflation suggests relatively stable underlying price pressures in the economy.

However, it’s worth noting that while core CPI showed signs of stability, the headline retail inflation, which includes all goods and services, remained elevated. Headline inflation exceeded the upper end of the Reserve Bank of India’s (RBI) tolerance limit, which ranges from 2% to 6%, for the second consecutive month. This suggests that certain factors, such as food prices or supply disruptions, may be driving overall inflation, even as core inflation remains relatively subdued.

The RBI closely monitors inflation trends to make informed decisions regarding monetary policy. A persistent deviation from the target range can influence interest rates and other policy measures aimed at managing inflation and supporting economic growth.

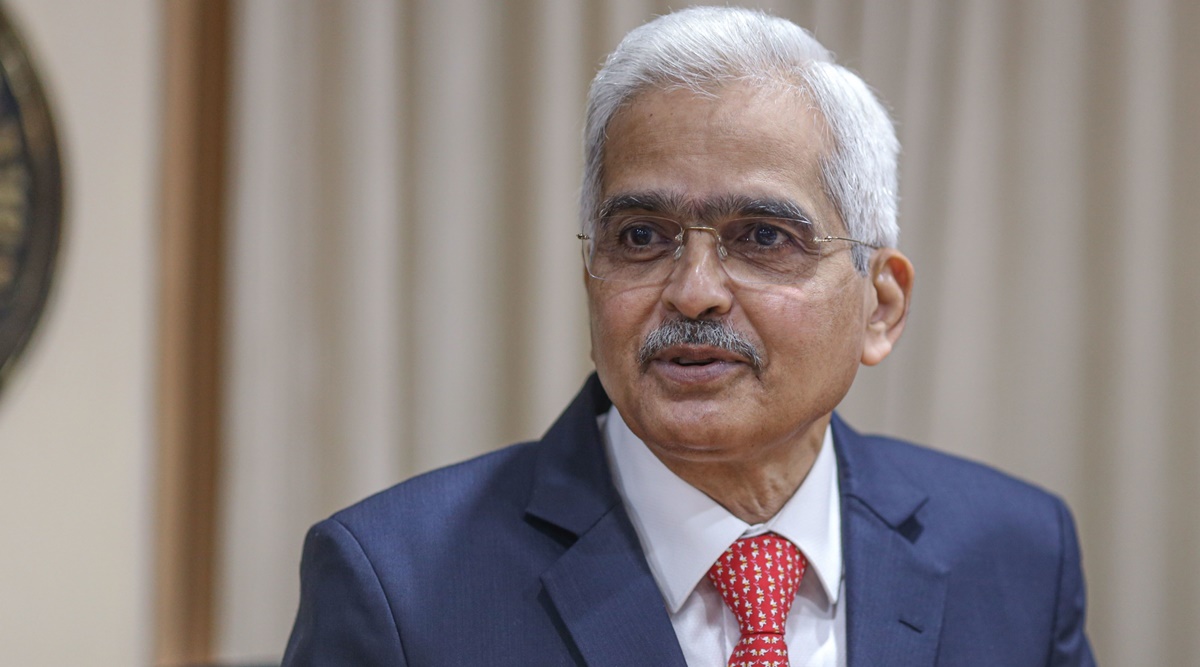

In its August monetary policy, the Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI), led by RBI Governor Shaktikanta Das, opted to maintain the repo rate at its current level. However, the MPC revised its forecast for Consumer Price Index (CPI) inflation for the July-September quarter of FY24, raising it to 6.2% from the previous estimate of 5.2%.

Despite this upward revision, economists anticipate that inflationary pressures will continue to ease in the coming months and are likely to eventually fall within the RBI’s tolerance band in September. Several factors contribute to this expectation:

- Monsoon Impact: The spatial distribution and performance of the monsoon can significantly influence agricultural production, which, in turn, affects food prices. A favorable monsoon can lead to improved crop yields and contribute to lower food inflation.

- Kharif Sowing: The Kharif season is critical for Indian agriculture, and a successful sowing season can boost crop production and help stabilize food prices.

- LPG Price Decline: A substantial decrease in LPG (liquefied petroleum gas) prices can offset inflationary pressures, contributing to lower overall CPI.

Economists at the State Bank of India (SBI) see a favorable outlook for retail inflation, suggesting that it may gradually move closer to the RBI’s tolerance band. This expectation is based on a combination of factors, including improved monsoon conditions, robust agricultural output, and declining LPG prices.

The RBI closely monitors inflation developments and uses monetary policy tools to manage inflation within its target range while supporting economic growth. A return to inflation levels within the tolerance band would provide greater flexibility for monetary policy decisions, potentially allowing for adjustments in interest rates to support broader economic objectives.

Fiscal policy interventions have played a crucial role in stabilizing prices of essential food items like cereals, pulses, and vegetables. This has contributed to a reduction in overall retail inflation in August. As a result of these developments, monetary policymakers may find some room to continue the pause in rate hikes during the October meeting. This assumes that food prices will further cool down as more precise estimates of the Kharif crop harvest become available.

Debopam Chaudhuri, the Chief Economist at Piramal Group, suggests that despite the recent moderation in food prices, fluctuations in food prices may still occur throughout the remainder of the year. One factor contributing to this volatility is the potential impact of El-Nino on the Rabi crop, which could lead to price increases for commodities like wheat, sugarcane, and pulses in early 2024.

It’s important to note that managing food price volatility is a significant challenge for policymakers, as it directly affects the cost of living for the population. The government and central bank often implement various measures to mitigate the impact of price swings, including interventions in agricultural markets, buffer stock management, and monetary policy adjustments.

The outlook for food prices, particularly in an agricultural country like India, remains closely tied to factors such as weather conditions, crop yields, and global commodity prices. Policymakers will continue to monitor these factors and make informed decisions to balance the need for price stability with broader economic objectives.

Debopam Chaudhuri highlights the importance of Indian monetary policy considering higher food price volatility as climate change intensifies over the years. Climate change can have profound effects on agriculture, potentially leading to more erratic crop yields and greater fluctuations in food prices. This suggests that monetary policymakers need to take into account the evolving dynamics of food inflation as they make policy decisions.

Madhavi Arora, Lead Economist at Emkay Global, anticipates that the material easing observed in August’s Consumer Price Index (CPI) inflation, which stood at 6.83%, driven by a sharp reversal in perishable food prices, is likely to continue into September. This may result in an inflation rate of less than 6% for that month.

However, Arora also expects overall food inflation to reverse significantly in the second half of FY24. While non-perishable food items may exhibit some persistence in price increases, the overall trajectory of food inflation is expected to reverse. Core inflation, which excludes food and energy components, is expected to remain relatively sticky before eventually easing by the fourth quarter of FY24. Arora predicts that core inflation will undershoot headline inflation by 30-40 basis points (bps) in FY24, with an overall inflation rate of 5.2% for that fiscal year.

Given this outlook, Emkay Global expects the Reserve Bank of India (RBI) to maintain its policy rates in the near term and not precede the Federal Reserve in any policy reversal in calendar year 2024.

These insights reflect the complex interplay of factors that influence inflation in India, including the impact of climate change on agriculture, the behavior of perishable and non-perishable food prices, and the role of core inflation in shaping overall price dynamics. Policymakers will need to carefully navigate these dynamics to ensure price stability and support economic growth.

Hitesh Suvarna of JM Financial suggests that the Reserve Bank of India (RBI) would likely be more concerned with the trajectory of inflation, which is trending lower, rather than the elevated inflation rate itself. Consequently, he does not anticipate a rate hike in the next Monetary Policy Committee (MPC) meeting scheduled for October 6.

However, Suvarna expresses caution regarding deficient rainfall and depleting reservoir levels, which have the potential to fuel inflationary pressures. Such conditions could necessitate tighter monetary policy measures in the future, depending on their impact on food prices and overall inflation.

In terms of expectations, assuming a Consumer Price Index (CPI) inflation rate of 5.6% in September 2023, Suvarna anticipates that the RBI may revise its inflation projection for the second quarter of FY24 upward by around 40 basis points (bps) in the upcoming MPC meeting. This reflects the central bank’s commitment to maintaining price stability and aligning its monetary policy with evolving inflation trends.

It’s noteworthy that central banks worldwide are monitoring inflation trends closely and making policy decisions based on their respective economic conditions. While some central banks, such as the European Central Bank (ECB) and the Bank of England (BoE), are considering rate hikes, the U.S. Federal Reserve, according to Suvarna, is expected to hold interest rates steady in its upcoming policy meeting. These divergent approaches reflect the varying economic dynamics and inflation outlooks across different regions.