RBI Governor Das Advocates for Active Disinflationary Monetary Policy 2023

RBI Governor Das Advocates for Active Disinflationary Monetary Policy 2023

Monetary policy plays a crucial role in shaping a nation’s economic trajectory. It is the means by which a central bank, such as the Reserve Bank of India (RBI), manages the money supply, interest rates, and overall financial stability.

A key objective of monetary policy is to control inflation, and the RBI has traditionally followed a policy of disinflation, aimed at bringing down inflation rates to acceptable levels.

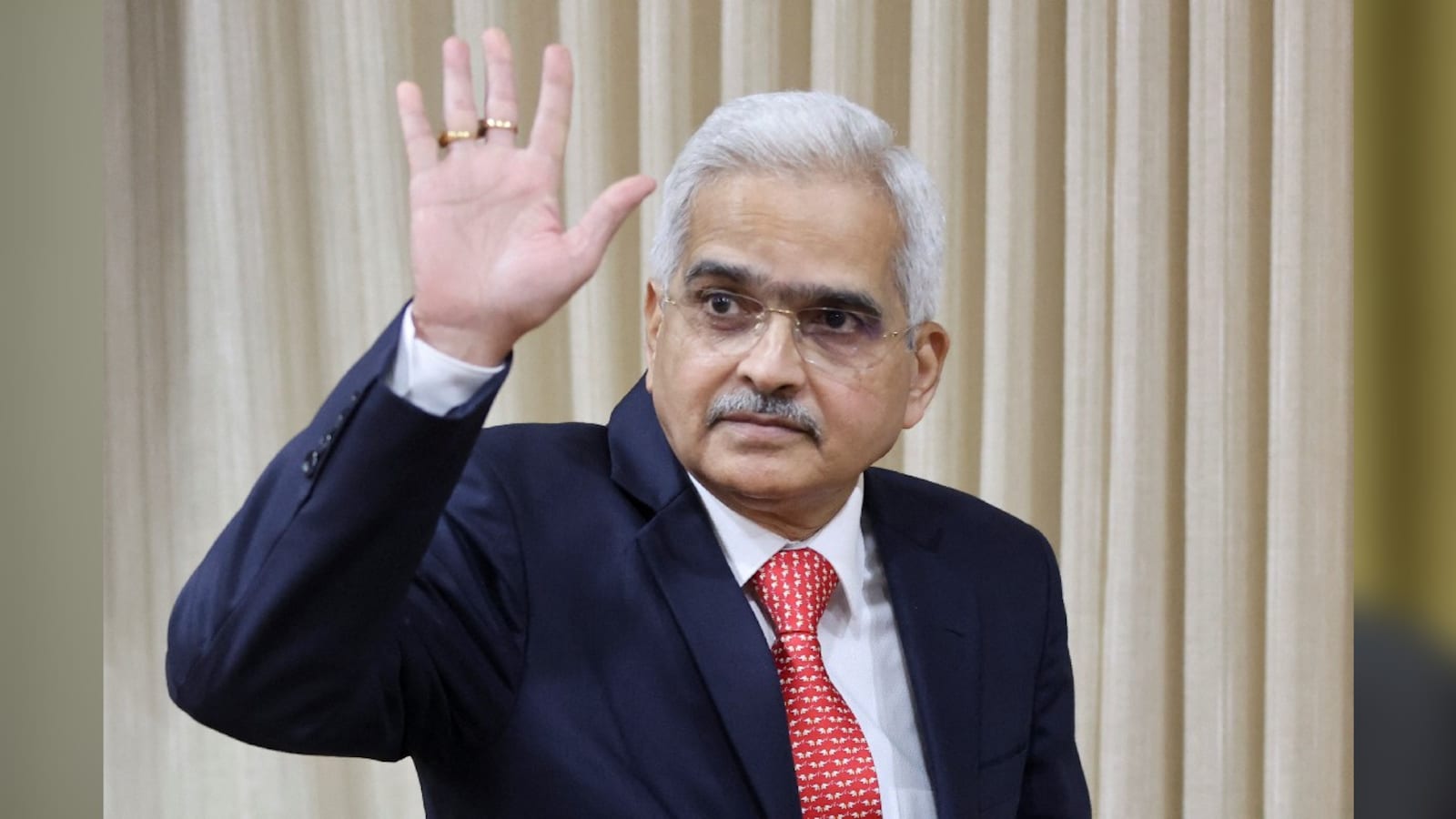

RBI Governor Shaktikanta Das has emphasized the importance of an actively disinflationary monetary policy for India’s economic growth and stability.

Shaktikanta Das, governor of the Reserve Bank, emphasised on Friday that in order for inflation to gently decelerate from its peak of 7.44 percent in July, monetary policy must continue to be aggressively deflationary.

Speaking at the Kautilya Economic Conclave 2023, he added that managing price stability and financial stability effectively has been a goal of the RBI.

Due to moderate increases in vegetable and gasoline costs, retail inflation inched down to a three-month low of 5.02 percent annually in September, returning it within the Reserve Bank’s acceptable range.

In order to control inflation, the Reserve Bank has increased the main policy rate (repo) by 250 basis points since May 2022. However, in February of this year, it stopped raising interest rates.

Consumer Price Index (CPI)-based inflation was 6.83 percent in August and 7.41 percent in September of 2022. The rate of inflation peaked in July at 7.44 percent.

Disinflationary monetary policy refers to a deliberate effort by a central bank to reduce the rate of inflation. The primary tool used to achieve this goal is the management of interest rates and money supply. When inflation rises above a predetermined target, the central bank takes measures to tighten monetary conditions. This can involve raising interest rates, reducing money supply, or implementing other measures to curb excessive demand in the economy.

Governor Shaktikanta Das has consistently advocated for an actively disinflationary monetary policy in India. He argues that keeping inflation in check is essential for ensuring macroeconomic stability and sustainable economic growth. Here are some key insights from his perspective:

- Price Stability: One of the primary reasons for pursuing disinflation is to maintain price stability. High inflation erodes the purchasing power of consumers and can lead to economic uncertainty. By keeping inflation in check, the RBI ensures that prices remain stable, enabling businesses and households to plan their finances more effectively.

- Real Interest Rates: Governor Das highlights the importance of real interest rates, which are nominal interest rates adjusted for inflation. Positive real interest rates incentivize savings and investments. When inflation is high, real interest rates can turn negative, discouraging savings and undermining economic growth. An actively disinflationary policy helps maintain positive real interest rates.

- Attracting Investments: Low and stable inflation rates are attractive to foreign investors. A disinflationary policy sends a positive signal to investors, both domestic and foreign, that the country is committed to economic stability. This, in turn, can attract more investments, leading to increased economic growth.

- Fiscal Space: Lower inflation allows fiscal authorities more room to maneuver. When inflation is high, governments may need to allocate a significant portion of their budgets to inflation-adjusted expenditures, leaving less room for productive investments in infrastructure, education, and healthcare.

- Managing Expectations: Governor Das believes that an actively disinflationary policy helps anchor inflation expectations. When people expect low and stable inflation, they are less likely to engage in speculative activities, such as hoarding goods or demanding higher wages to compensate for expected price increases. This, in turn, contributes to greater economic stability.

While an actively disinflationary monetary policy offers numerous benefits, it also faces challenges and criticisms. Critics argue that too much emphasis on inflation targeting can lead to excessively tight monetary policies, which may hinder economic growth.

:max_bytes(150000):strip_icc()/GettyImages-92601377-589e3c5b3df78c475800c201.jpg)

They contend that a singular focus on inflation can ignore other important factors, such as employment and income inequality.

Additionally, the effectiveness of monetary policy in controlling inflation is subject to various external factors, such as global commodity prices, supply disruptions, and fiscal policies. The ability of the central bank to achieve its inflation target is not always guaranteed.

RBI Governor Shaktikanta Das’s emphasis on an actively disinflationary monetary policy reflects a commitment to maintaining economic stability and promoting sustainable growth in India.

While there are challenges and criticisms associated with this approach, the benefits of price stability, real interest rates, attracting investments, fiscal space, and managing expectations cannot be overlooked.

In a world characterized by economic uncertainties, the RBI’s dedication to keeping inflation in check provides a foundation for India’s economic resilience. However, it is essential to strike a balance between disinflationary policies and other economic objectives, such as employment and income distribution, to ensure that the monetary policy remains relevant and effective in addressing the nation’s evolving needs.