RBI committed to bringing inflation within target, MPC minutes reveal

RBI committed to bringing inflation within target, MPC minutes reveal

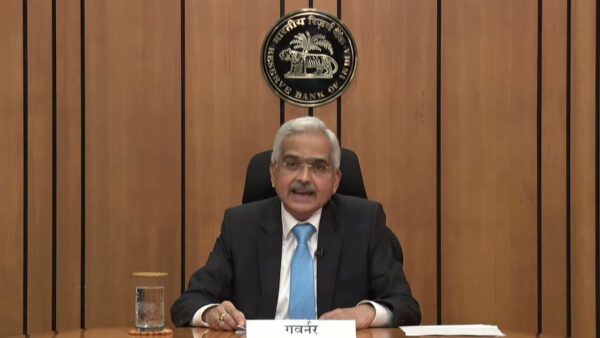

“The time is appropriate to go for a further increase in the policy rate to deal with inflation and inflation expectations effectively,” RBI governor Shakitkanta Das, who heads the six-member panel, said.

“The modification in the language of the attitude should be understood as a continuation and fine-tuning of our recent approach,” RBI governor Das said. “Our policy in recent months has been unmistakably focused on the withdrawal of accommodation, both in terms of liquidity and rates.” “In my opinion, the withdrawal of accommodation would not damage the economic process and would reinforce our ongoing initiatives to fight inflation and stabilise inflation expectations.”

Monetary Policy Committee (India)

The Monetary Policy Committee sets the benchmark interest rate in India. The Monetary Policy Committee (MPC) meets at least four times annually (more precisely, at least once every QUARTER), and it releases its decisions following each of these meetings.

Six people make up the committee: three Reserve Bank of India (RBI) employees and three outsiders chosen by the Indian government. For “utmost confidentiality,” they must observe a “quiet period” for seven days before and following the rate determination. The committee’s ex officio chair is the governor of the Reserve Bank of India (RBI). The governor has the casting vote in the event of a tie, and the majority vote makes decisions.

To counter rising pricing pressure, the MPC increased the repo rate by 50 basis points on June 8—nearly a month after it had previously increased it by 40 basis points during an off-cycle policy meeting. One-tenth of a percentage point is referred to as a basis point.

Retail inflation decreased from a nearly eight-year high of 7.79 per cent in April to 7.04 per cent in May. However, for 32 straight months, inflation has exceeded the RBI’s medium-term target of 4 per cent. More concerningly, it has now gone five months without falling below the 2–6% tolerance range’s top bound of 6%.

In its most recent meeting, the RBI increased its prediction for this fiscal year’s inflation to 6.7 per cent while keeping its growth prediction at 7.2 per cent.

The Covid-19 outbreak and ensuing lockdowns have had a slow but steady negative impact on India’s economy. By hiking the repo rate and progressively removing excess liquidity from the banking sector, the RBI, like the majority of central banks throughout the world, is attempting to reduce the pandemic-era boost.

‘Direction, not level, of inflation should be watched’

In the minutes published on June 22, Deputy Governor Michael Patra stated that overall headline inflation levels would remain high for a while. As a result, the direction of inflation should be monitored rather than its level, which will continue to be higher for a while due to the severe shocks.

Patra stated in the minutes that if headline inflation begins to decline in the second half of the year, “the objective of raising the policy rate beyond the level of future inflation will be accomplished sooner rather than later, providing an opportunity to halt and reconfigure.”

According to Patra, the RBI should make an effort to lower inflation into the acceptable range by January through March or April through June and gradually get it toward the target during FY23.

Patra also stated that given that monetary policy involves lags, the MPC’s goal should be to raise the repo rate at least above the inflation prediction for the next four quarters.

As a result of monetary tightening, Patra stated, “it is concurrently vital to condition public perceptions and expectations that growth will be closer to 6 per cent than to 7 per cent in 2023–24.”

In order to get the real policy rate to a mildly positive level that is consistent with the developing inflation and economic dynamics, according to external member Jayanth Varma, more work needs to be done in the MPC’s upcoming meetings.

“Therefore, in my opinion, the timing is right for MPC members to start taking steps toward offering estimates of the future course of the policy rate. The minutes reported Verma as suggesting that this would underpin inflation expectations while stabilising long-term bond markets.

Ashima Goyal, a different member, asserted that the one-year forward real rate should not be more negative than 1% at the current stage of recovery.

According to Goyal, “a fifty or sixty basis point hike would do this while looking through part of the spike in 2022 even while further supply-side movement and clarity on global events are needed.” Such a real interest rate will be avoided by a possible additional rise in demand and an unsustainable current account deficit, which won’t significantly slow down the recovery. Markets benefit from the recovery, enabling them to withstand rate increases that follow it.’

According to Rajiv Ranjan, an Executive Director of the RBI, sustained supply interruptions and the ensuing price pressures could become ingrained in higher inflation expectations, given that India’s inflation forecasts mainly were adaptive or backward-looking.

According to Ranjan, “this would call for front-loaded policy action to rein in inflation expectations since the short-term trade-off between inflation and output worsens under strong inflation expectations (the upward shift of the Phillips curve).”

Shashanka Bhide added that unless the foreign supply situation rapidly improved, the inflationary pressures that have gotten worse since March are projected to persist as a problem in FY23. To ensure a stable macroeconomic climate, he said it was essential to reduce inflation pressures right now.

For its bi-monthly review, the panel will now meet in August.