How Quasi-Equity Can Help Drive Value Creation Instead of Chasing Valuations 2023

How Quasi-Equity Can Help Drive Value Creation Instead of Chasing Valuations 2023

With a 15,400% rise in companies from 2016 to 2022 and the birth of 100 unicorns, India’s startup ecosystem has experienced an incredible upswing. Nevertheless, obtaining finance for startups continues to be difficult despite these outstanding results. The Indian startup ecosystem saw a 35% decline in investment in 2022, and the upcoming year will also have its fair share of financial challenges.

Investors are becoming cautious with their investments for good reason. They are rigorously scrutinising governance and reporting requirements and advising entrepreneurs to put profits and sales ahead of growth.

A significant amount of dry powder is also building up on the sidelines and ready to be used. While India will remain a hub for new ventures and investment, founders and business owners must recognise that a variety of finance sources will always play a significant role in the current capital stack for any company.

The current funding environment is unpredictably structured, mostly as a result of equity investors’ increased caution when allocating their cash. It is imperative that we remove the myth that equities investors include the whole investing environment in the nation.

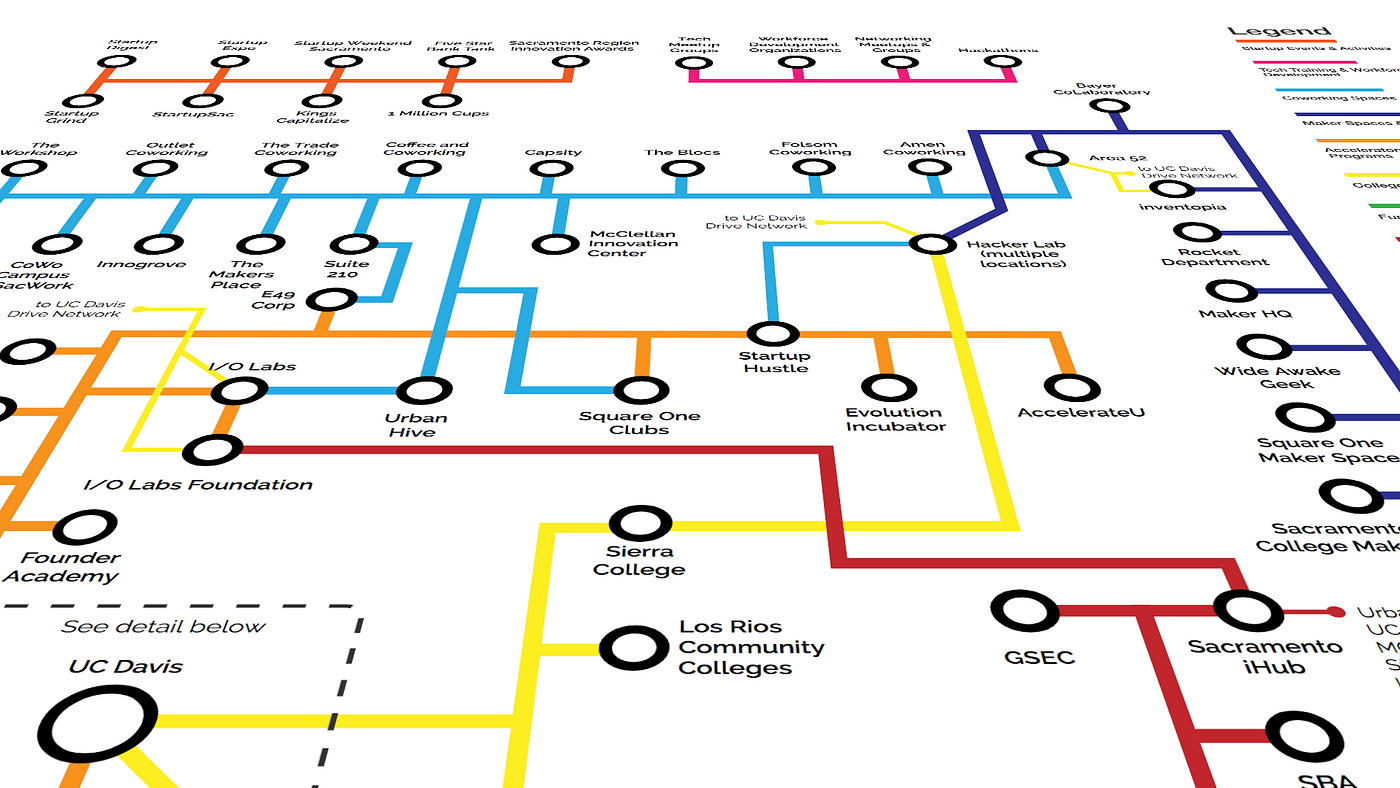

We must aggressively raise people’s knowledge of the many financing options. Bank loans and other conventional financing methods continue to be good choices for most firms. But as the startup ecosystem develops, it makes room for a more complex finance stack that can accommodate different stages of company development.

Here comes quasi-equity, a type of finance that resembles equity investment but differs in important ways. I’m primarily referring to modern lending platforms that operate similarly to equity investors but have several advantages, including no stock dilution, no requirements, no interest or collateral, and most significantly, no prejudice.

In today’s small and medium-sized firms, quasi-equity is swiftly growing in importance as a component of the capital stack. With a $219 billion credit deficit in the nation, the need for alternate capital-raising strategies is only increasing. To prolong their runway without diluting ownership, thousands of new economy enterprises use equity-free finance options including performance-credit and cash flow-based financing. Moreover, access to operating cash has become crucial due to the booming entrepreneurship in India.

Businesses who are skilled at analysing the layers of today’s capital stack know when to use each funding option. Leveraging equity or risk capital for longer-term innovation and raising quasi-equity to accelerate short- and mid-term growth goals, streamline cash flows, and maintain a healthy runway are the best strategies. Entrepreneurs need to prioritise sustainable business growth while also choosing their future course with profitability and sustainability in mind.

The day when founders just sought for huge values has long since passed. It is frequently wiser for organisations in the growth stage to hold onto stock, putting valuation concerns on the back burner while concentrating on sustainable expansion to generate value creation. However, without financial resources, this progress is impossible.

Quasi-equity provides business owners with the exceptional benefit of receiving equity-free capital to accelerate expansion without giving up control of their company. This strategy gives businesses the freedom to maintain a growth-oriented focus without interference from investors, board seat losses, or equity dilution.

It is crucial to understand that there is no universal financing formula. What is effective for one business within a certain industry might not be appropriate for another. Depending on where a firm is in its development, different types and amounts of capital may be necessary. While mature firms may look for investment to grow into new industries, pre-seed startups may need cash to create a product prototype or hire key team members.

Today’s founders can choose from a variety of funding choices, such as recurring revenue advances, private loans, venture debt, working capital, and cash flow-based financing. It’s important to keep in mind, though, that each choice is very different from the rest. Thus, it is crucial to combine the finest components from various financing sources, depending on the unique circumstances, financial needs, long- and short-term goals, and return on investment (ROI).

Sustainable finance alternatives are essential for long-term success as firms traverse the unpredictable global economy. It has never been more important to strategically combine various levels within the contemporary capital stack. While interim advantages may be obtained via short-term cost-cutting measures, intelligent founders understand the need of sustainable capital alternatives to resist unforeseen shocks and guarantee firm survival.

The present environment will reverse the recent trend of overvaluation and overinvestment in start-ups, encouraging companies to adopt a more sustainable strategy. For their businesses to develop, entrepreneurs must carefully determine the best mix of stock and alternative finance.

Businesses must extend their perspectives and investigate the various funding possibilities accessible to them in this constantly changing financial environment. With its non-dilutive and founder-friendly approach, quasi-equity is a crucial component of the current capital stack for any organisation. Founders are better equipped to handle the difficulties of fundraising by carefully combining funding sources and keeping a long-term perspective.

In the modern entrepreneurial landscape, discussions around fundraising usually oscillate between debt and equity. However, the burgeoning concept of quasi-equity offers a middle ground that could potentially change the dynamics of startup investment. This innovative financial instrument has proven to be more than just an alternative, instead fostering real value creation as opposed to merely inflating company valuations.

Quasi-equity financing involves financial instruments that are a hybrid of debt and equity, incorporating elements of both. These could be convertible notes, revenue-sharing agreements, or mezzanine financing, among others. Quasi-equity attempts to combine the best of both worlds: the flexibility of equity and the fixed return schedule of debt. Importantly, it aligns the interests of investors and business owners far more effectively than traditional funding methods, primarily focusing on the long-term health and value creation within a business.

Chasing valuations often leads to inflated market caps without a corresponding growth in real value. This Fear Of Missing Out (FOMO) can encourage investors to pour money into companies at unsustainably high valuations, which then puts pressure on startups to deliver immediate, exponential growth. Such pressure could result in poor decision-making, including rushed market entries, compromised product quality, and operational inefficiencies.

Taking on substantial debt at the early stages of a business can be crippling, particularly because repayments start almost immediately. Debt servicing can divert precious resources from crucial business operations, thereby inhibiting value creation and genuine growth.

One of the most compelling features of quasi-equity is its flexibility. Payments can often be tied to revenue, profits, or other performance metrics, rather than fixed monthly payments. This allows a startup to focus on growth and value creation, knowing that capital repayment will be commensurate with their success.

Because the repayment structure is often tied to the company’s performance metrics, quasi-equity inherently aligns the interests of investors and business owners. Both parties become invested in the long-term success and value creation within the company, rather than fixating on short-term gains or exits.

As quasi-equity does not necessarily involve surrendering ownership stake at the onset, founders retain greater control over the company, allowing them to make decisions focused on long-term value rather than short-term appeasement of shareholders.

On the flip side, the debt-like features of quasi-equity, such as convertible notes, can provide a downside protection for investors. If the business fails to perform as expected, investors can convert their holdings into equity, thereby partially mitigating their financial risk.

Many SaaS companies have benefited from revenue-based financing, a form of quasi-equity. This model allows companies to pay back their investors out of their recurring revenue streams, thus providing the businesses with the cash they need for expansion without diluting ownership.

In sectors like GreenTech, where the gestation period for profitability can be long, quasi-equity can offer a more sustainable pathway for growth. Here, convertible notes often play a crucial role, allowing companies to scale their technologies without the burden of immediate debt repayments.

While quasi-equity financing is still in its nascent stage, its potential for driving real value in startups is immense. It offers a more flexible, sustainable, and equitable model of financing that aligns closely with long-term business health and value creation. As the startup ecosystem continues to evolve, quasi-equity is likely to play an increasingly pivotal role, steering the focus from mere valuation to the much-needed realm of genuine value creation.