Lab-Grown Diamond Lustre Increases Due to Policy Impetus 2023

Lab-Grown Diamond Lustre Increases Due to Policy Impetus 2023

The Union Budget for FY24 has extended Customs duty reduction to LGD seeds due to the great employment potential of the technology-driven industry.

During his recent State visit to the oldest democracy in the world, Prime Minister Narendra Modi gave a piece of lab-grown diamond (LGD) from Surat to Jill Biden, the first lady of the United States. That marked the beginning of a home business that has just started producing on a large basis.

The Union Budget for Fiscal Year 24 has extended Customs duty reduction to LGD seeds in recognition of the great employment potential of the technology-driven economy. Additionally, a five-year R&D funding to one of the IITs was announced to support local manufacture of LGD seeds and equipment.

However, India’s LGD industry is still in its infancy and must make enormous gains if it is to begin to compete with China on the global markets. India must obviously seize this fantastic chance since the stakes are high.

The global LGD or man-made diamond market is predicted to reach $55.6 billion by 2031, given a CAGR of 9.8%, according to a recent study by Allied Research. China manufactured 56% of the LGDs that were marketed internationally as of 2019, with contributions from India and the US of 15% and 13%, respectively.

The fact that China employs both the High Pressure High Temperature (HPHT) and Chemical Vapour Deposition (CVD) technologies for LGDs, whereas India has not yet embraced the HPHT technique, is a significant advantage for China.

Undoubtedly, the LGD sector in India has grown quickly. According to Shashikant Shah, Chair of the Council for the Promotion of Lab-Grown Diamonds and Jewellery, “In 2018, the export of LGDs from India was just Rs 300 crore, and the shipments rose to Rs 9,000 crore by 2022.” Exports of LGD exceeded Rs 13,000 crore in FY23.

There are up to 22 businesses operating in the industry at the moment, with a total capacity of 4,800–5,200 reactors/machines. In Surat, more than half of the businesses that cut and polish diamonds now also offer same services for lab-created diamonds. Additionally, of the 1.4 million people working in the diamond sector, almost 0.8 million are also involved with LGD.

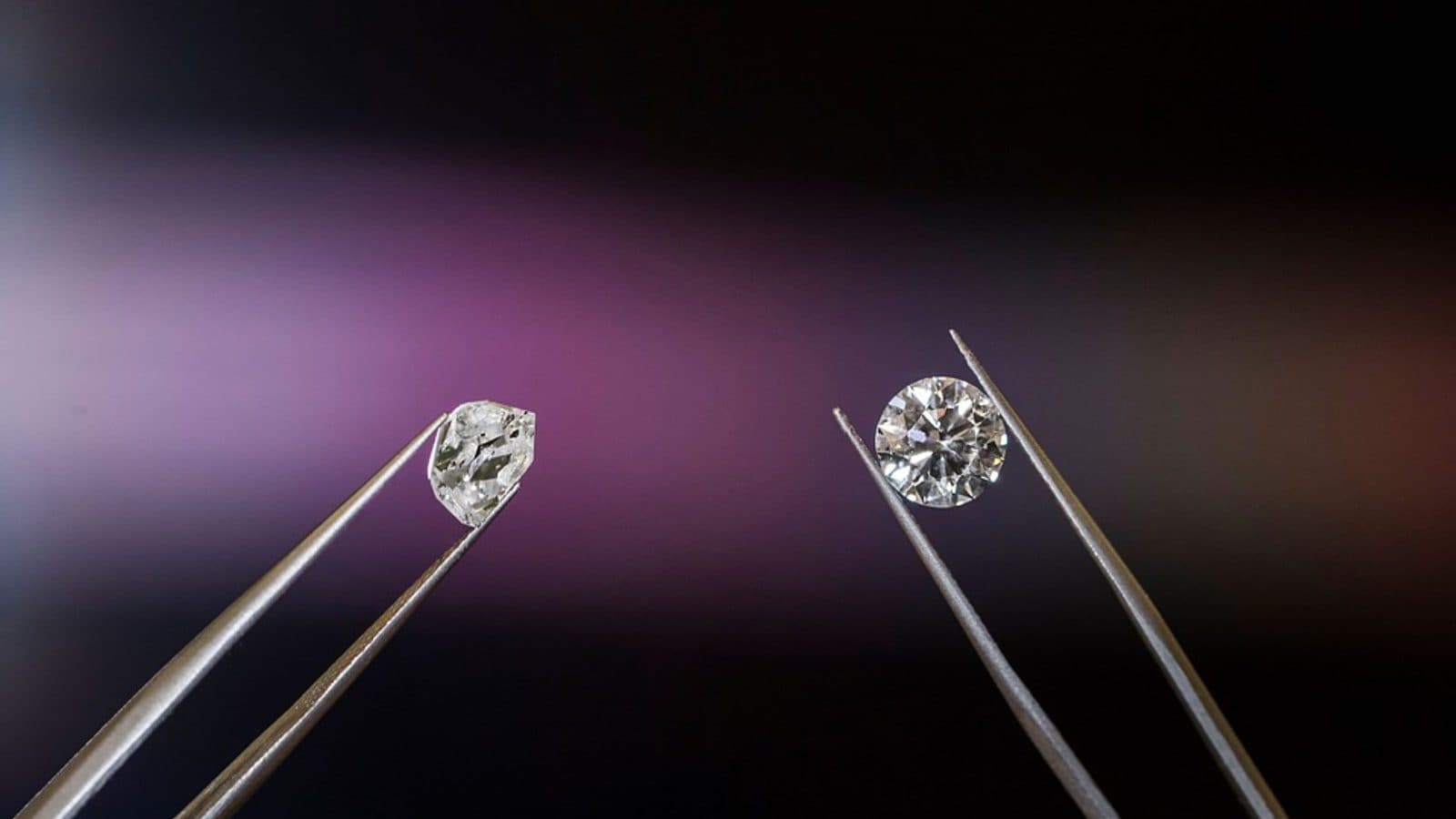

In addition to being less costly, LGDs are beneficial to the environment and have optical and chemical characteristics similar to those of natural diamonds. Since the public’s understanding of LGDs has increased in recent years, the market’s expansion has quickened.

According to industry observers, the LGD sector may dominate the market and perhaps surpass natural diamonds. As the mining of natural diamonds declines, LGDs are expected to be referred to simply as “diamond” by 2035 or so. Unlike American Diamonds, Zirconia, and Physical Carbides, which are not alternatives to genuine diamonds, LGDs have a bright future, according to Shah.

“Four years ago, we had 40 workers, and now there are over 2000,” said Smit Patel, Director of Green Lab Diamonds, one of the leading makers of LGDs and the company that, coincidentally, also produced the diamond given to the US First Lady. Customers have started asking about LGDs while purchasing diamonds, which is comparable to the scenario in the US four years ago in India.

Industry insiders further point out that the LGD sector has the additional benefit of entirely local value generation, unlike in the case of natural diamonds. It should be emphasised that while being a significant gem and jewellery exporter, India only adds a little amount of local value to most imported goods.

“Considering that 30–35% of the population falls into the middle or upper middle income category, there is a great potential for lab grown diamonds in domestic and global markets,” stated a market observer.

LGDs are sometimes referred to as synthetic diamonds, man-made diamonds, or cultivated diamonds. The CVD process, as opposed to HPHT, is thought to generate higher-quality diamonds. Yellow or brown diamonds with lesser economic value are frequently created using the HPHT process. The lab-grown diamonds are certified by organisations like the Gemological Institute of America (GIA), International Gemological Institute (IGI), and Gemological Institute of India (GII), which also offer certification for natural/mined diamonds.

The lustre of lab-grown diamonds has brightened in 2023, not only because of their clear and brilliant nature but also due to the noteworthy policy shifts that have lent these synthetic gemstones a strong support. An amalgamation of eco-consciousness, social responsibility, innovation, and policy reforms have made lab-grown diamonds an increasingly attractive option for consumers, industries, and policy-makers alike.

Lab-grown diamonds are essentially identical to mined diamonds, both visually and on the molecular level. Their primary differentiation lies in their origin. While the traditional diamond industry has a troubled history riddled with concerns about environmental harm, conflict financing, and labor exploitation, lab-grown diamonds promise an ethically cleaner and environmentally friendlier alternative. These manufactured diamonds are grown in labs under controlled environments, thereby sidestepping the need for destructive mining.

In 2023, policy impetus worldwide began to align with the sustainable and ethical objectives of lab-grown diamonds. Governments and international institutions, recognizing the potential environmental benefits and social implications of lab-grown diamonds, began rolling out supportive legislation and favorable regulations. These policy incentives were largely aimed at reducing the environmental footprint of the diamond industry and ensuring more ethical practices in the gemstone supply chain.

Emerging markets, particularly India and China, have shown substantial legislative support for lab-grown diamonds. These two countries host a large portion of the global diamond processing market, with India alone handling about 90% of the world’s diamond cutting and polishing.

In 2023, the Indian government, in a bid to promote sustainable practices and boost its domestic gemstone industry, introduced a series of tax incentives for companies involved in the production of lab-grown diamonds. These included reductions in Goods and Services Tax (GST), and relaxation of import-export laws on machinery and raw materials.

Similarly, China has reformed its industrial policies, providing generous subsidies for companies involved in the manufacturing of lab-grown diamonds. China’s five-year plan emphasizes green and sustainable growth, which perfectly aligns with the ethos of lab-grown diamonds.

In the Western world, the shift towards sustainable consumption, corporate responsibility, and ethical sourcing has accelerated in recent years. In 2023, both the United States and European Union passed legislation favoring lab-grown diamonds.

The United States introduced regulations that mandate clearer disclosures regarding the origin of diamonds, boosting consumer confidence in lab-grown variants. The EU, as part of its Green Deal and sustainable finance strategy, has provided financial support and research grants for companies pioneering lab-grown diamonds, particularly those developing techniques to reduce the carbon footprint of their manufacturing processes.

These policy changes have added considerable momentum to the already burgeoning lab-grown diamond industry. Companies operating in this domain are experiencing growth as the demand for ethical and environmentally friendly diamonds is increasing.

Traditional mining companies are also acknowledging this shift. Many have begun exploring lab-grown diamonds as a supplementary business, a clear indication of a broader industry shift. These changes hint at a future where lab-grown diamonds may coexist with mined diamonds or perhaps even supersede them.

Lab-grown diamonds, once a curiosity of science, have transformed into a viable, attractive alternative to traditionally mined diamonds. This metamorphosis is not just a result of technological advancements and changing consumer preferences, but also a response to significant policy impetus from around the globe.

In 2023, as governments enact legislation supporting these synthetic diamonds, they shine brighter than ever. The collaboration of technology, policy, and ethics heralds a future of the diamond industry that’s not only glittering with potential but is also greener and more sustainable.