PM to launch SGX Nifty trade at GIFT

The Singapore Exchange (SGX) will launch a nifty trade of India’s GIFT Technologies finite via the SEBI Global Markets Ltd. The SGX Nifty trade will be found, the better offer price being 1.00, and is priced in US dollar terms. The indicative value for the SGX Nifty Trade is 0.0007 per share.

The SGX-Nifty Futures complex was launched on 29 June 2005 at an interest rate of S$0.50. The facility permit hedge funds and institutional investors like mutual funds to manage futures positions and leverage up to 100 times the allocated capital on a single stock, bond, or index.

Advantages of SGX-Nifty Futures:

It is a useful and simple way to hedge dedication, increase risk management in portfolios, and limit exposure to significant market swings by selling off at the right time. Futures trading is a valuable addition to the impressive range of hedging instruments. GIFT will list on SGX Nifty on Wednesday, the last trading day of the current bull market. The company is also noticing to raise around US$500 million for operations in Malaysia, Thailand, and Indonesia.

GIFT made its initial offering on September 15, 2007. The firm’s IPO raised US$345 million compared to the estimated US$222 million valuation on its prospectus with a pre-money value of US $1 billion. The firm’s IPO was the largest for India since May 2007 when Wipro was listed on the New York Stock Exchange.

The GIFT potential is joint progress between the Indian government and the private sector as part of India’s efforts to modernize its airports. The facility focus to reduce air traffic congestion in Delhi and Mumbai, which are surrounded by the world’s top ten busiest airports, with about 55 million passengers annually.

SGX Nifty Index:

The SGX Nifty Index is a market-capitalization-weighted index that tracks the top 50 non-promoted stocks in SGX Nifty. The index parts are reviewed every quarter to ensure that they assure the criteria for continued inclusion in the index. The index is calculated by SGX based on the average closing share prices of the stocks over 15 trading days.

SGX Nifty is reviewed quarterly by an Index Committee appointed by the Singapore Exchange. The committee makes formally recommends to the SGX Board to revise any of the basic structure or procedures of SGX Nifty. The Index assembly comprises one representative from each sponsor and three independent market participants who meet the minimum requirements established by the SGX Board.

What is SGX Nifty?

SGX Nifty is a market-capitalization-weighted index of the 50 top companies listed on the Primary Board of the SGX. It is reviewed quarterly to ensure that it continues to reflect the leading companies and emerging trends in Singapore’s main board market. Market capitalization demonstrates the size of each company, while weighting is proportional to the market capitalization and represents its relative importance in determining SGX Nifty performance.

SGX Nifty provides a transparent and liquid benchmark for companies to size their performance against the broader market. It also issues investors with a clear funding objective and criteria for portfolio construction. SGX Nifty is the only index in Singapore that tracks the 50 largest companies listed on SGX. A minimum of 10 companies are selected for inclusion in the index every quarter.

SGX Nifty is calculated every quarter using the average closing share prices of all eligible companies over a 15-day trading period. Stock prices from SGX’s American depositary receipts (ADRs) and its Securities Regulatory Commission (SRC) approved ADR programs are excluded from the three-month average for annual index calculation purposes.

Indian Depository Receipt:

An Indian Depository Receipt (IDR) is a type of derivative security that contains an underlying basket of co-ownership or units of an ETF representing an ownership interest in an Indian company. It is a security issued in India that represents ownership of foreign securities or debt securities. An Indian Depository Receipt is the only type of security that can be held in dematerialized form.

The Indian Securities and Exchange Board (SEBI) introduced the Indian Depository Receipt on May 2, 2003, with the purpose to attract foreign capital into India by providing Indian investors with an opportunity to charge in distant equity markets. The Depository Receipts are denominated in different currencies, including but not limited to the United States dollar (USD) and the Japanese yen (JPY.

Singapore’s SGX Nifty futures opens in Gandhinagar.

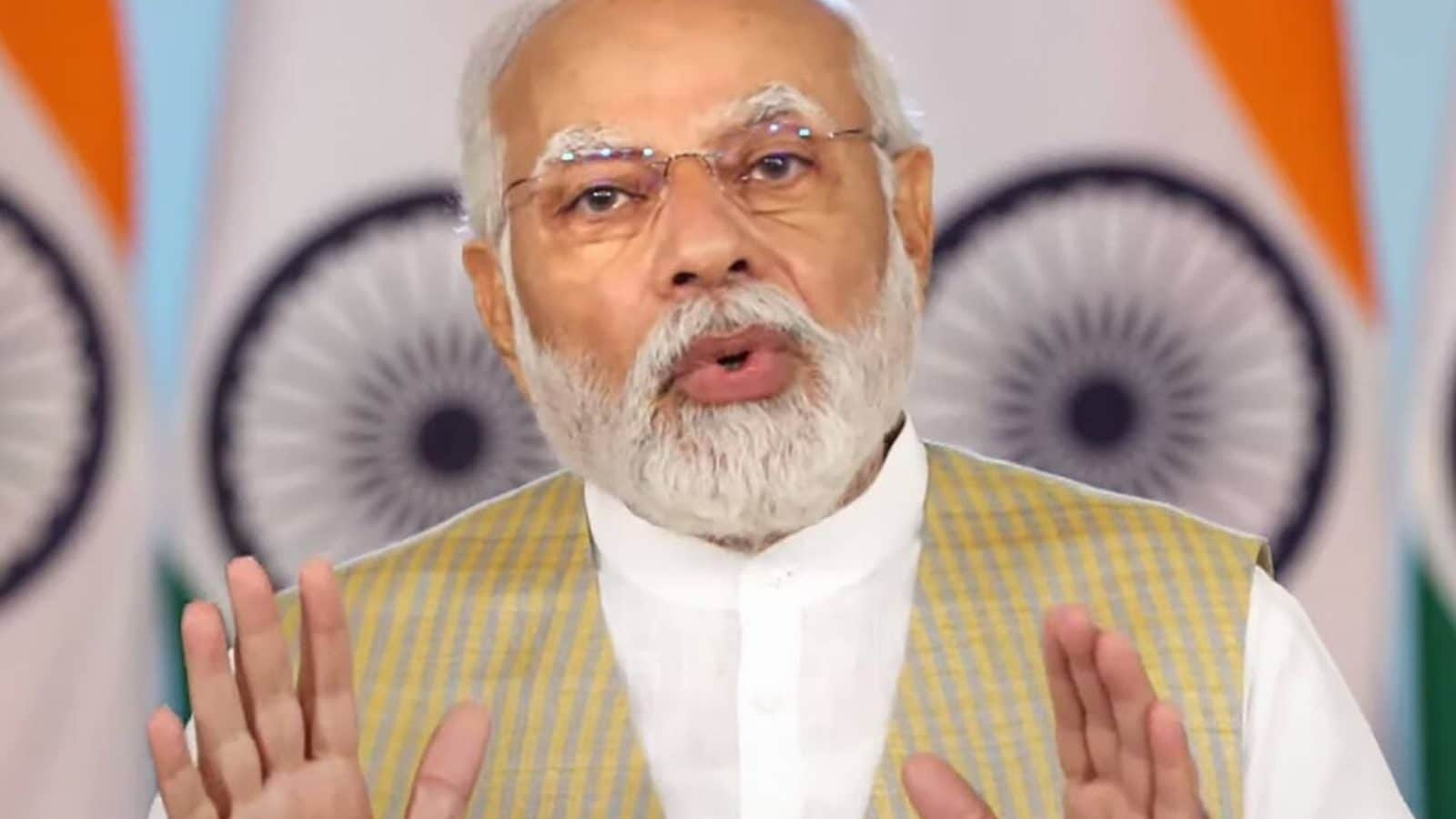

“GIFT City, a mega-IT and SEZ project is being developed in the Gujarat International Finance Tech-City (GIFT) SEZ in Gandhinagar. Two other IT and SEZ projects have been proposed for the zone around GIFT City. Before Prime Minister Narendra Modi’s visit to Singapore, several Singapore companies have shown interest in investing in Gujarat. Chief Minister Anandiben Patel and Gujarat Finance Minister Saurabh Patel visited Singapore a few months ago to woo IT companies from South-East Asian countries.

In 2005, Singapore’s securities regulator fined SGX $1 million for failing to reveal its proprietary “Nifty”, a technical indicator created by a former senior SGX executive and later used to evaluate the condition of the local stock market. The transformer also secures Mr. Wong from leaving Singapore between midnight and 7 am for five years.

In July 2015, the Singapore Stock Exchange stopped giving quotes in the Indian stock market guide as it came under pressure from regulators in India to stop trading. As per media reports, the Securities and Exchange Board of India (SEBI) has started cracking down on brokers involved in illegal cross-border trading activities.

Finance Minister Arun Jaitley has made it clear that the watch-list for potential countries for investments would be revised according to the progress of reforms in these countries. Earlier in April 2017, a new regulation called Foreign Exchange Management (Foreign Investment Promotion Board) Regulations, 2016 was passed, which provides guidelines for individuals and entities wanting to invest in India.

What is the Taxation Aspect for this?

The Nifty50 is a market capitalization-weighted index that tracks the top 50 non-promoted stocks in SGX Nifty. The index components are reviewed every quarter to ensure that they satisfy the criteria for continued inclusion in the index. The index is calculated by SGX based on the average closing share prices of the stocks over 15 trading days.

SGX Nifty is reviewed quarterly by an Index Committee appointed by the Singapore Exchange. The committee makes formally recommends to the SGX Board to amend any of the fundamental structure or methodology of SGX Nifty. The Index Committee comprises one representative from each sponsor and three independent market participants who meet the minimum requirements established by the SGX Board.

SGX has a board of directors that includes the chief executive officer of the exchange, who is also the Chairman; two members elected by shareholders in the same ratio they meet to elect eleven directors in total, and two independent non-executive directors. The Board meets every quarter to review key policies and projects.

Move to Benefit Foreign Investors

SGX’s move will give foreign investors greater access to the equity market in mutual funds and exchange-traded funds. Investors in Singapore could also trade sources of alternative capital on the exchange. On June 2, 2008, SGX launched a platform for overseas investors called the Global Investment Platform (GIP), which allows them to buy foreign currencies and bonds with the nominal value from SGX.

SGX Nifty Futures is a futures index and trading platform for international trading in securities in Singapore. The exchange started trading in N.Y.SEF (United States Dollar) futures on April 20, 2012 and has since added other currency futures, including the Japanese Yen, British Pound, Euro, Australian dollar, and Canadian dollar.

The Nifty50 Index is an index for the SGX Nifty. The index is calculated by SGX based on share price change over 15 trading days. The index is reviewed quarterly to ensure that it continues to reflect the leading companies and emerging trends in Singapore’s main board market.

The Singapore Exchange (SGX) was established in 1934 by a group of local investors headed by Dato Onn Jaafar, who operated the Kuala Lumpur Stock Exchange (KLSE). As the KLSE listed the first Asian company—the Straits Steamship Company (SSC)—SGX went public on January 1, 1935, at a valuation of about S$5 million. The SGX Index began trading on November 25, 1935. At that time, there were only six companies listed on any exchange in Asia.

The SGX rules for corporate governance were amended with effect from July 1, 2007, to reflect better the changes in corporate practices and the development worldwide in corporate governance. The rules were amended to allow the directors of the Company to ensure that sufficient shareholdings are maintained by the Company for future capital needs and to authorize the Company to raise new capital as it happened that it needs more funds.

The Singapore Exchange (SGX) announced a new scheme—SGX ListCo—to make it easier for investors to put money in companies listed on SGX and at the same time, support SGX’s growth strategy. SGX announced the scheme on July 11, 2014, as it seeks to expand its corporate listings. SGX will raise S$40 million under the project, which is expected to raise total listing capital to S$3 billion by 2020.

The Securities and Futures Commission (SFC) is the independent regulatory company that monitors and enforces securities laws in Singapore. On September 19, 2013, SGX announced that it had signed a memorandum of understanding with the SFC on regulatory matters. This was the first time that SGX had entered into a formal agreement with an organization outside the exchange itself.

On June 2, 2008, SGX launched a platform for overseas investors called the Global Investment Platform (GIP), which allows them to buy foreign currencies and bonds with the nominal value from SGX. This capability is part of Singapore’s efforts to intensify its place as a global financial hub.

As per a Reuters report dated January 27, 2009, SGX has agreed to obtain a 5 per cent stake in the LSE. The deal will help the exchanges extend their businesses in Asia and diversify their revenue sources. Singapore Exchange and London Stock Exchange (LSE) are planning to launch a trading platform for companies listed on both exchanges in 2010.

SGX and Beijing-based China Foreign Exchange Trade System (CFETS) signed a divide up to set up a yuan (renminbi) clearing center in Singapore. The clearing center, which has been approved by the People’s Bank of China, the country’s central bank, will initially easy to understand yuan securities denominated in Singapore dollar. It was reported that this is the first step toward full cross-border clearance of Chinese currency trades into Hong Kong.

Nifty (formerly NIfty50) is a family of 50 Index Futures and Options contracts traded on the Singapore Exchange Derivatives Trading Platform (DTP). The Nifty 50 Index exposes the largest and most liquid stocks in India. Nifty has been styled as a broad-based estimate of market view and is issued by the National Stock Exchange of India Limited.

SGX Asia Clear Limited is a wholly-owned subsidiary of the Singapore Exchange. Founded in October 2002, SGX Asia Clear was established to manage post-trade and settlement services for bonds and structured products listed on SGX, also other regional exchanges.

SGX has also tied up with BNP Paribas, ICICI Securities, and South Africa’s N.Y.S.E and Johannesburg Stock Exchanges to develop a platform for trading India-focused securities in the United States. The U.S.

In December 2010, the Monetary Authority of Singapore (MAS) proposed that SGX and the Securities and Futures Commission (SFC) review regulations in anticipation of a potential influx of foreign exchange lender who was previously obligated by strict domestic laws to control the capital outflow. To that end, MAS encouraged Singaporean banks that could assist such investors in investing in Singapore to align their foreign currency regulations with those of the Democracy of Singapore.

For January 2012 – September 2012, the total revenue of SGX was S$1.11 billion. The total revenue for October 2011 – December 2011 was S$1.16 billion. The exchange set down a 10% drop in revenue from the last quarter of 2011, affected by a volatile trading environment, highlighted by Europe’s sovereign debt crisis and concerns over the potential slowdown in China’s rapid economic growth.

SGX’s electronic market architecture allows bids and provide to be repeatedly executed. Even as the SGX platform continues to grow, it attempts to keep pace with emerging technology and is currently testing a new cloud-based trading platform. The test was launched on December 19, 2012, to bring more financial institutions and investors to the trading platform. It is expected that the test site will be made available for public use after the conclusion of this part of the tryout process in 2013.

The Singapore Exchange (SGX) announced on December 15, 2009, that it had agreed to receive a 30% stake in the International Petroleum Exchange (IPE) in London. The interchange, which trades contracts for the future delivery of oil and gas, was bought by Dubai-based Exante Limited in 2005. IPE is jointly owned by Deutsche Börse Group and Exante. The give-out is worth around £40 million (US$67 million).

SGX’s international arm, SGX International (SGXI), currently has trading hubs in London, Paris, Milan, and New York. Shanghai Stock Exchange (SSE) is used as a trading hub for the Chinese market. SGXI is also focused to establish a regional hub in the Middle East. The exchange started listing new companies on April 22, 2007, as the role of an effort to create a prominent worldwide presence and make itself more attractive to foreign investors.

SGX has been accused of not placing enough emphasis on the promotion of corporate social responsibility and transparency, issues that have plagued its peer and rival, the Singapore Exchange. In February 2004, SGX declined to disclose the pay package of chief executive officer Peter Kwan despite a campaign by Singapore’s National Council of Social Service (NCSS) and the Consumers Association for Livable Prices (CALP) for more information.

Each of the 50 companies is looked after by an investment bank and a specialist merchant. These companies are selected by SGX on an ongoing basis in consultation with all rounds of sources, including broker examiners, fund managers, corporate finance advisors, and SGX specialists.

SGX has announced plans for a new data center to do business in India. The conservatory is fully managed by SGX and will be located at the existing Mumbai office. The new provision is expected to become operational by December 2010. This is so far a step taken by SGX to further facilitate cross-border trading through technological development.

Conclusion

Around the world, stock exchanges are making efforts to comply with the new global transparency rules set forth by the Organisation for Economic Co-operation and Development (OECD). SGX and NYSE Amex work as securities exchange representatives of SGX; NYSE Euronext and NASDAQ are market operators of NYSE Amex and NASDAQ OMX, respectively.

Under the OECD Transparency Instrument, Singapore’s SGX aims to become the world leader in securities disclosure by the end of 2012. The discussion is taking steps to elevate its application of best practices in disclosure and reporting standards and introduce a new suite of opposing procedures for officials.

On 15 December 2009, Singapore Exchange (SGX) agreed to obtain a 30% stake in the International Petroleum Exchange (IPE) in London. The interchange, which trades contracts for the future delivery of oil and gas, was bought by Dubai-based Exante Limited in 2005. IPE is jointly owned by Deutsche Börse Group and Exante. The distribution is around £40 million (US$67 million).

edited and proofread by nikita sharma