Paytm Laysoff 1000 Employees Amid Restructuring Efforts Including AI-Powered Automation, A Sad Beginning To The New Year

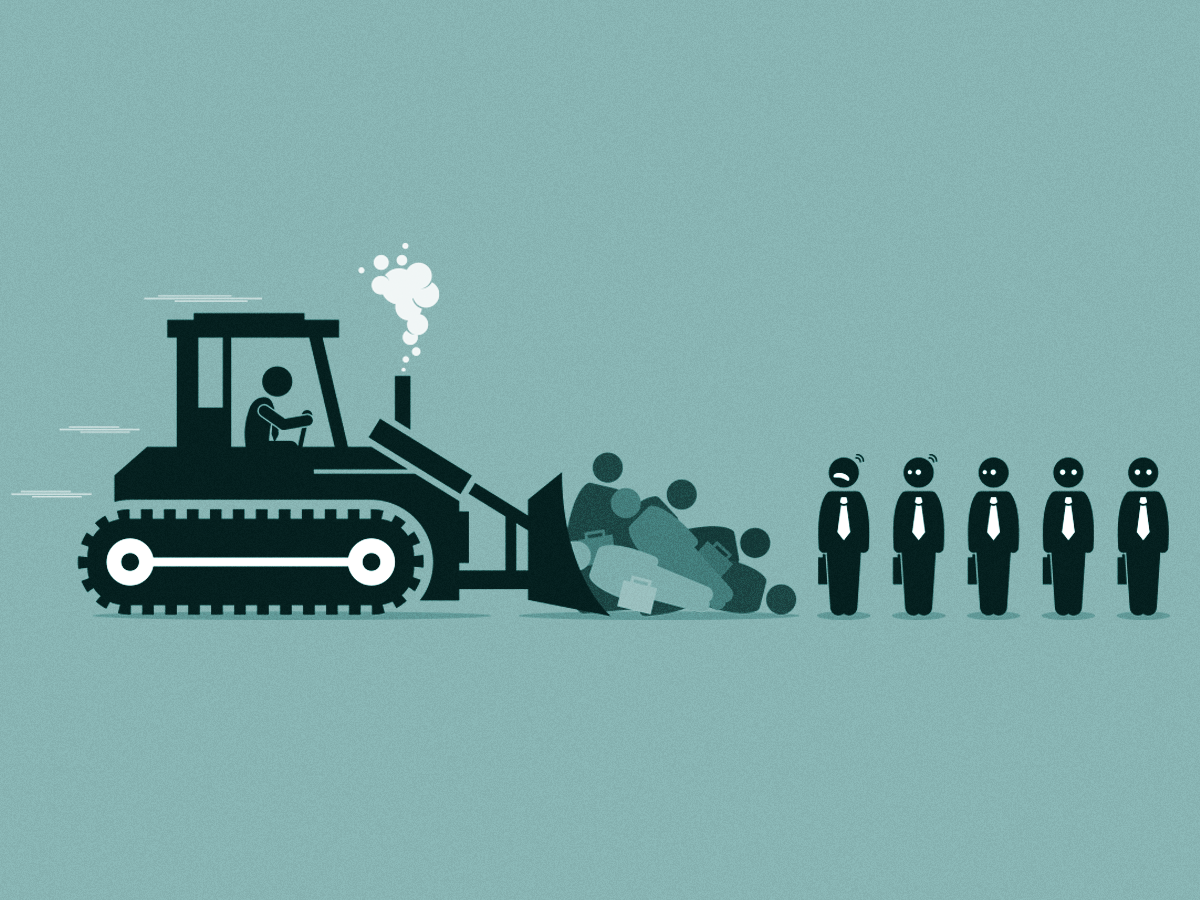

In the current scenario marked by regulatory shifts and funding uncertainties, Paytm has initiated a significant restructuring initiative, laying off over 1,000 employees across multiple units, constituting around 10% of its overall workforce. The company's decision to streamline operations comes in the wake of its withdrawal from certain lending segments and reflects broader trends in the Indian tech industry.

Paytm, in a bid to streamline its various businesses and reduce costs, has reportedly laid off over 1,000 employees across multiple units in the past few months, constituting approximately 10% of its overall headcount.

This move follows Paytm’s decision to withdraw from small-ticket consumer lending and the ‘buy now pay later’ segment due to regulatory constraints imposed by the RBI.

The round of job cuts marks one of the most significant workforce reductions by an Indian new-age tech firm in the current year.

The tech industry in India has witnessed a trend of substantial layoffs, with over 28,000 employees being let go by new economy companies in the first three quarters of 2023.

In 2022, more than 20,000 employees were laid off, and the number was 4,080 in 2021, reflecting the challenges faced by startups amidst a drying-up of funding for loss-making enterprises.

Under its Paytm Postpaid initiative, the company had initially provided loans of less than Rs 50,000. However, with regulatory changes, Paytm is now shifting its focus towards wealth management and insurance broking.

The decision to withdraw from Paytm Postpaid led to a 20% drop in Paytm’s stock on December 7.

While a Paytm spokesperson contested the reported number of job cuts, they confirmed layoffs as part of an effort to achieve a 10-15% reduction in staff costs during the current fiscal year.

The spokesperson emphasised the company’s commitment to transforming operations through AI-powered automation, replacing many roles with artificial intelligence to enhance efficiency.

Paytm’s strategic shift includes a concentration on developing new products for its wealth management vertical and establishing a robust insurance distribution business.

The company aims to hire fresh talent for specific new business developments in broking (Paytm Money) and create an insurance distribution marketplace.

Despite the layoffs, Paytm plans to achieve its targeted reduction in employee costs by the end of the fiscal year.

The impact of these workforce reductions is evident across various departments, including payments, lending, and executive roles in operations and sales.

Performance-related issues have been cited as the primary reason for layoffs, aligning with the company’s focus on achieving profitability.

While Paytm is actively reducing expenses, a company spokesperson highlighted that as of the end of September, the fintech firm maintains a substantial cash balance of around Rs 8,754 crore.

The recent appointment of Bhavesh Gupta as the president of the company indicates Paytm’s strategic efforts to diversify its revenue sources, with a particular emphasis on Paytm Money as a strong revenue-generating business in the wealth management sector.

Presently, around 83% of Paytm’s overall revenue is generated from payments and financial services, primarily credit-related activities.

The Viewpoint

Paytm’s recent layoffs are among the most substantial in the Indian tech sector this year, echoing a broader trend of startups facing funding challenges and making tough decisions to ensure sustainability.

However, one cannot deny the negative role of investment banks in taking these companies public and the potential consequences of their actions.

At the same time, it stresses a concern regarding the valuations assigned to companies during initial public offerings (IPOs) and calls for regulatory intervention by the Securities and Exchange Board of India (SEBI).

1. Valuations and Due Diligence

The critique on the perceived lack of proper due diligence by investment banks when bringing companies to the market needs to be addressed– calling for accountability and the fact that these banks might be responsible for overvaluing companies, leading to inflated IPO prices.

This aspect raises pertinent questions about the thoroughness of the valuation process and the need for a more stringent evaluation mechanism to ensure accurate assessments.

2. SEBI’s Regulatory Role

The suggestion by SEBI to pull up investment banks speaks of the need for regulatory oversight and enforcement.

However, isn’t it SEBI’s responsibility to address this in the first place itself?

SEBI is now looking to scrutinise the practices of investment banks, ensuring that they adhere to rigorous due diligence processes and act responsibly in the interest of investors.

However, why was this not addressed, and why now, after substantial losses have been incurred at the hands of retail investors?

3. Beyond IPO Distribution

Also, there are questions about the broader role of investment banks beyond the distribution of IPOs.

While they play a crucial role in bringing companies to the public market, their responsibilities should extend beyond this initial phase.

They must include ongoing monitoring and support to ensure that the company’s performance aligns with the expectations set during the IPO.

4. Founders’ Profits vs. Investor Interests

If we look into the broader picture, it seems that only founders are profiting from IPOs, and hence, there is an absolute misalignment of incentives.

It raises concerns about whether the interests of founders and early investors are prioritised over those of public shareholders.

This misalignment should lead to questionable business practices, such as constant changes in business models to cater to the preferences of private equity (PE) investors rather than focusing on sustainable, long-term growth.

5. Changing Business Models

Companies constantly changing business models to appease PE investors emphasise potential instability in the companies’ strategic direction – it may be a consequence of pressures to deliver quick returns, possibly at the expense of long-term viability.

It indicates the need for a more sustainable and principled approach to business strategies that prioritise the interests of all stakeholders, including public shareholders.

The Last Bit, As Paytm reinvents itself through company’s strategic restructuring; the layoffs, while impactful, are part of a larger plan to optimise operations, reduce costs, and focus on areas with substantial growth potential.

Paytm’s emphasis on AI-led automation for future success also indicates that many roles and layoffs might be in order in FY24.

However, hopefully, in the new year, there will be greater accountability, transparency, and responsibility in the entire process of taking companies public.

The responsibilities of investment banks should extend beyond the IPO phase, emphasising the importance of maintaining ethical business practices and ensuring that the interests of all stakeholders, including public investors, are safeguarded throughout a company’s lifecycle as a publicly traded entity.