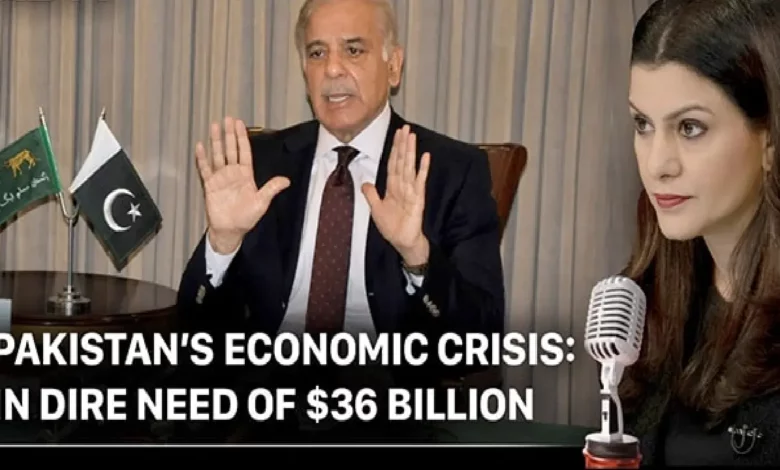

Pakistani’s Economic Crisis: In dire need of $36 Billion – Hot Mic with Nidhi Razdan.

Pakistani’s Economic Crisis: In dire need of $36 Billion – Hot Mic with Nidhi Razdan.

Nidhi Razdan on the Hot Mic: Pakistan is in the midst of a severe economic crisis. Prime Minister Shehbaz Sharif’s new government is trying to meet bailout criteria set by the International Monetary Fund by repaying $6.4 billion in debt over the next three years.Pakistan is teetering on the brink of a major calamity. There was the protracted political crisis in which Imran Khan refused to step down.

The International Monetary Fund and the World Bank roll out debt relief plans to push green investments in low-income countriesas prime minister until he had no alternative and Shehbaz Sharif was ushered in.

However, the country is presently in the midst of a severe economic downturn. Pakistan’s new government is attempting to meet bailout criteria established by the International Monetary Fund by repaying $6.4 billion in debt over the next three years.

Pakistan has gone to the International Monetary Fund (IMF) 22 times in the past, appealing for a bailout. However, genuine reform initiatives have been lacking, which is why they keep coming back. Pakistan’s foreign exchange reserves are rapidly diminishing. They’ve dropped by half in far less than a year. And the country will require $36 large amounts of foreign funding in the coming fiscal year, which begins in June.

Pakistan’s currency has plummeted roughly 8% in the last month, according to Bloomberg statistics compiled from 13 countries, making it Asia’s worst performer. The country is frantically negotiating a bailout arrangement with the IMF and other countries to keep its economy going and avert default. Receiving an IMF loan, on the other hand, comes with a long list of criteria, which Pakistan has traditionally struggled to meet.

Minimize the budget deficit, strengthen banking and tax legislation, expand the social safety net for reduced families, phase out electricity subsidies, and reduce the central bank’s engagement in the foreign currency market.

Pakistan’s current economic problems are mostly the result of the country’s excessive spending on non-developmental and financially unsustainable projects.

Experts have cited disastrous infrastructure projects such as the Gwadar-Kashgar Railway Line Project, which primarily relied on external borrowing rather than indigenous institutions and were financed with long-term loan instruments. Pakistan’s troubles have been compounded as a result of all of this. The development of the China-Pakistan Economic Corridor (CPEC) increased Pakistan’s debt burden, allowing for ever-increasing foreign borrowing. The CPEC project resulted in a $64 billion Chinese debt to Pakistan, up from $47 billion in 2014.

The Pakistani rupee’s continued devaluation against the US dollar has added to the country’s mounting external debt. The use of an IMF bailout has now become urgent as countries that were formerly liberal lenders to Islamabad have become more cautious.

The problem is that countries that were formerly eager to bail out Pakistan are now unwilling to do that unless Pakistan makes significant progress with the IMF. Pakistan was able to recruit the support of China, Saudi Arabia, and the United Arab Emirates when it faced a similar financial crisis in 2018, before appealing to the International Monetary Fund.

) Pakistan’s finance minister, on the other hand, disclosed on May 28th that the country has sought assistance from Saudi Arabia, the United Arab Emirates, and other nations. They were all prepared to help Pakistan with money, but they demanded that Pakistan first go to the IMF.

Pakistan’s finance minister, on the other hand, disclosed on May 28th that the country has sought assistance from Saudi Arabia, the United Arab Emirates, and other nations. They were all prepared to help Pakistan with money, but they demanded that Pakistan first go to the IMF.

Last week, Pakistan’s government made a risky and unpopular step by raising domestic fuel prices to meet an IMF demand for restarting its bailout program. However, it sparked an immediate political blowback from Pakistan’s Prime Minister, Imran Khan, who claimed that the gasoline price spike was the biggest in the country’s history and that the government had not pursued an agreement with Russia for a 30% cheaper oil.

The administration had been considering gas import agreements with a number of countries, including Russia.

Imran Khan has grown more confident in confronting the Sharif dictatorship as the economic slump intensifies. He urges that polls be held as soon as possible. Elections are not scheduled to take place until the summer of 2023. The other major fear is what will be done by the all-powerful military. It is reported that if Shehbaz Sharif continues to push the IMF’s popular conditions on Pakistan’s people, it may revoke his appointment. As a result, the economic and political situation in the country will be volatile in the next months.

)

Pakistan’s currency has plummeted roughly 8% in the last month, according to Bloomberg statistics compiled from 13 countries, making it Asia’s worst performer. To keep its economy strong and avoid default, the country is feverishly negotiating a bailout deal with the Fund and other countries. However, receiving an IMF credit comes with stringent requirements, which Pakistan has previously struggled to meet.

Reduce the budget deficit, improve bank and tax legislation, boost the social safety net for low-income people, phase out power subsidies, and reduce the Federal Reserve’s foreign exchange market activity.

Pakistan’s current economic problem is primarily due to the country’s fiscal irresponsibility on non-developmental and unprofitable projects.

In May, the Pakistani rupee fell by over 7% since March 2020, because the nation negotiated a bailout plan with the IMF and other countries to keep its economy going. Experts predict the currency to stay under pressure despite the government’s efforts to meet the IMF’s conditions.

)

Pakistan will need $36 billion to $37 billion in finance for the fiscal year beginning in June, according to Finance Minister Miftah Ismail. This year’s funding gap, according to Morgan Stanley, could be as much as $8 billion. The need for an IMF rescue has grown urgent since countries that have traditionally been liberal lenders are now treading more carefully.

“Pakistan’s finance needs for the next year will be fulfilled, but they’ll be tight, which will keep the currency under pressure,” said Saad Khan, director of research at Karachi’s IGI Securities Ltd.