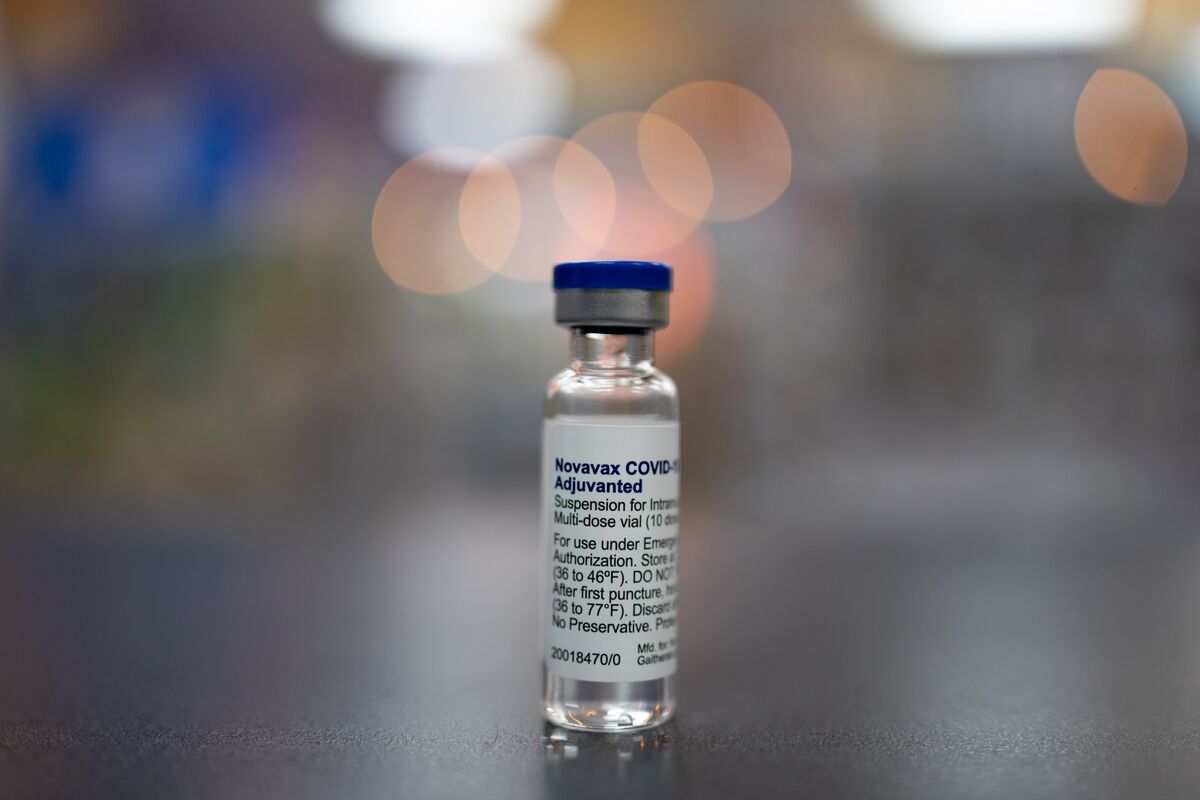

Novavax Loses $294 Million In Q1, 25% Of Staff Will Be Laid Off

As Novavax announced plans to reduce a quarter of its workforce and unveiled promising data for its COVID-flu vaccine, the cash-strapped biotech's shares surged by more than 50%.

Novavax Loses $294 Million In Q1, 25% Of Staff Will Be Laid Off

In addition, the company announced $800 million in conditional ex-US purchase contracts for its COVID shot for 2023, months after raising doubts about its viability. It is expected that commitments will be shipped in the rest of the year, according to John Trizzino, Chief Commercial Officer of Pfizer.

According to five analysts polled, the company expects revenue between $1.4 billion and $1.6 billion in 2023 versus $831.6 million. In its 35th year of business, Novavax can rely on its cost-control measures and a successful trial for its COVID combination vaccine candidate to stay afloat.

A mid-stage trial of the combination shot in adults aged 50 to 80 showed similar immune responses to COVID’s protein-based vaccine and already approved influenza shots. Global regulators expect to conduct annual COVID vaccination campaigns similar to influenza vaccinations. About 392 jobs will be cut in addition to the layoffs.

These are part of its ongoing efforts to reduce costs. Employees on the contract would constitute the remaining 5%. The biotech expects to save 20% to 25% on research and commercial expenses over the past year by cutting costs.

By the third quarter, its cash and equivalents had fallen from $1.3 billion to $637 million. Novavax reported a $3.41 per share loss for its first quarter, which was lower than the $3.46 estimated loss.

Company’s Stock Price

A dismal earnings report from Novavax for the fourth quarter and a warning from the vaccine maker that uncertainty about future funding for Coronavirus shots have led to substantial doubt about the company’s survival and prompted Novavax shares to drop more than 25% in after-hours trading.

Following the company’s after-hours earnings report, the stock plunged 25.7% to $6.88. Sales were $357 million, below expectations of $383 million. Novavax reported losses of $182 million. Its statement on its future financial framework stated that significant doubt is present about its ability to continue.

The company believes it has enough capital to last for another year. Still, it’s not confident about the forecast this year since the Biden Administration is expected to stop buying vaccines from Covid and give them away free to Americans. Novavax is likely to reduce some jobs to reduce its spending rate, CEO John Jacobs said.

Over 1,500 people are employed by the company. Aside from partnerships and licensing deals, Novavax is looking at contracts that could be much more significant, according to the CEO. It took Novavax 26 years to develop the Covid-19 vaccine, which has been commercially available since 1986.

A sluggish uptake and manufacturing challenges plagued Novavax’s shot’s release. While developing the shot, the company’s shares traded as high as $330, valued at over $20 billion. Their share price was around $9.30 during the crash, losing over 97% of its value. He added that Novavax has two billion dollars of signed contracts with government entities outside the U.S. that the company plans to collect.

A collection agreement is being negotiated with these governments through 2024, according to the CEO. Jacobs explained that the company is evaluating its global footprint, rationalizing its supply chain, portfolio, structure and infrastructure.

In 1996, Novavax brought its first product to market, the Covid-19 vaccine. A $1.6 billion contract to develop a vaccine as part of Warp Speed was awarded to the company in 2020 when it was reportedly on the brink of collapse. A protein-based vaccine, rather than mRNA-based vaccines, is a more traditional method than the mRNA approach used by Pfizer and Moderna.

Novavax traded at over $300 in 2021 as investors invested in its development. Novavax’s shot was released in July 2022, but Americans had already begun to see its benefits the previous year due to manufacturing problems. Several years after Pfizer, Moderna, and Johnson & Johnson, Novavax’s vaccine reached the U.S. market.

Novavax has reportedly been administered only 80,000 times in the United States, while Pfizer and Moderna have issued hundreds of millions. A slow uptake in the U.S. has also hurt Novavax’s international marketing campaign, which was approved in the European Union several months before its U.S. rollout.

Proofread & Published By Naveenika Chauhan