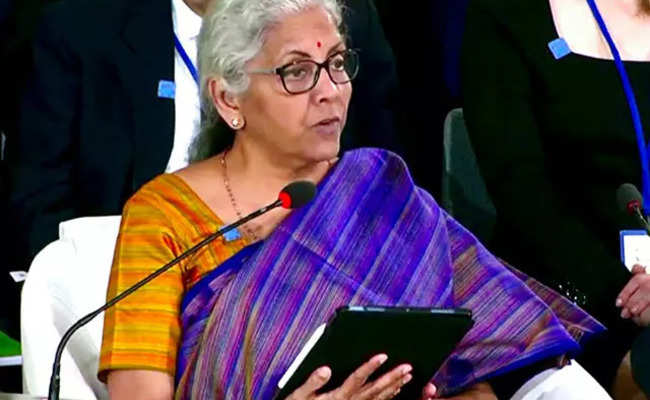

Nirmala Sitharaman stated that the dollar is rising rather than the rupee falling.

In an effort to justify the rupee’s value relative to the dollar this year, Finance Minister Nirmala Sitharaman claimed that the dollar had raised, not the rupee. He said the fundamentals of the Indian economy were strong and inflation was low compared to other parts of India. The world at a press conference after attending the annual meetings of the International Monetary Fund (IMF) and the World Bank. In response to a query on the rupee’s decline, she remarked, “First of all, I would look at it as not rupee sliding, I would look at it as dollar gaining, dollar strengthening incessantly.

According to her, the dollar is functioning well relative to all other currencies in the globe. “And I’m not talking about technicalities, but it is a reality that the Indian rupee has probably weathered this dollar rate going up, the exchange rate in favor of the dollar strengthening is there, and I think the Indian rupee has behaved much better than the many other emerging market currencies.

The rupee hit a new all-time low of 82.68 against the US dollar on Monday, following which the Reserve Bank of India (RBI) reportedly intervened. On Friday, the rupiah broke down to 82.35. According to some commentators, the central bank spent nearly $100 billion the previous year to prop up the rupee.

India’s foreign exchange reserves fell significantly from USD 642.45 billion observed a year ago at 532 USD.87 billion in the week ending October 7. Both Sitharaman and the RBI have previously blamed changes in value brought on by the strengthening US currency for the drop in foreign exchange reserves. On Saturday evening, Sitharaman said the RBI’s measures were limited to reducing excessive volatility and that the purpose of its intervention in the market was not to fix the value of the rupee.

“I believe that the RBI is working more to maintain a certain level of… more to ensure that there isn’t too much volatility,” she remarked. “To set the value of the rupee does not involve market intervention. Therefore, the only activity in which RBI is engaged is limiting the volatility. I’ve said it before, but the rupee will level out on its own. According to the finance minister, Indian inflation is at a controllable level.

“The macroeconomic fundamentals and the economic fundamentals in India are both strong. The foreign currency reserve is enough. I keep saying that the inflation rate is also at a tolerable level “She said. Consumer Price Index (CPI) inflation in India hit a five-month high of 7.41% in September compared to 7% the previous month, keeping reading for the ninth straight month far over the upper tolerance threshold of the RBI’s inflation targeting framework.

In response to inquiries, Sitharaman said she would dearly want to lower the inflation further below 6% and the government is working toward it. She also attended 24 bilateral and around a dozen multilateral talks on the sidelines of the IMF and World Bank meetings.

She noted that external causes are badly affecting countries and that several throughout the world, including Turkey, are experiencing double-digit inflation. “Additionally, external circumstances are having an impact on us. We are affected as well. But because we take a variety of timely actions each time, we are able to at least maintain this level.

At this point, bringing it to four would be ideal, but we’re trying, “She spoke.”We must thus be aware of where we are in relation to the rest of the globe. Although I don’t want to celebrate, it is true that we are sticking together. And I’m especially aware of the fiscal deficit. She said that the administration was monitoring the widening trade imbalance to see if it was increasing disproportionately towards any one nation. She was replying to a query on the trade gap versus China increasing to about USD 87 billion.

India’s trade deficit increased to USD 25.$71 billion in September as imports exceeded exports by $61.51 billion. “The same is true if you examine the imported goods; they tend to be more intermediaries than final consumer goods. Additionally, there is potential for value addition and exports when I say that we should use more raw materials and intermediate goods “said Sitharaman.

Therefore, I wouldn’t want to immediately become concerned about this net deficit, which means that imports are significantly outpacing exports, because, if you carefully consider it, the type of imports that are occurring are also very important for our industrial activity and for our value addition for exports purposes.

What if the rupee gains value?

What if the rupee traded at 60 to the dollar, as it did about ten years ago, rather than at 80+? This speculative query merits investigation. Several advantages will follow: The expense of importing oil will decrease. If the price benefit is passed on, the consumer might receive a gasoline price reduction of 20% or more, translating into an automatic yearly stimulus of more than 2 lakh crore, money that would be spent on other commodities.

The subsidy on fertilizers this year would be over 200,000 crore, and India is battling with a rise in the cost of imported fertilizers. This can be retracted. The cascading inflationary impact of the high cost of gasoline on the entire economy can be curbed. Foreign equipment providers get a significant portion of India’s capital expenditures, which can be more productive. In terms of dollars, India’s GDP will increase by at least 25%. India will quickly overtake Germany. The effect on perception will be significant.

But what will happen to exports at that point? Even though some special interests will object, we must keep in mind that exporters were still successful even when the rupee was trading at about 60 to the dollar; they were not grumbling at the time. A proverb states, “Do not grab a falling dagger. It’ll cause you harm. That is not implied in this. It is suggested to implement a coordinated plan of action based on predictions or hopes for the rupee-dollar exchange rates.

If analysts and pundits believe that the rupee will fall, then the flow of dollars into India will naturally slow down because people would be holding back in expectation of a depreciation of the rupee. If the rupee is expected to appreciate, dollars start to flood into the nation swiftly since no one wants to miss out on potential future exchange rate reductions.

Let’s start with the objective. Strong evidence that a plan to quickly strengthen the rupee is in place should be present. In response to such a statement, coordinated action should be taken, including but not limited to the following: Develop and implement a plan to reduce waste production, oil imports, and use.

The predicted annual growth in oil usage is 3%. By encouraging the use of alternative fuels and oil conservation, aim for zero growth in the future. Aggressively seek out non-dollar oil sources. The increase in imports from Russia has started this. Change the classification used to record exports. Combine all of the exports, including labor exports, to show a more wholesome state of the country’s foreign exchange inflow. Step up all of the activities that draw foreign exchange and dollars into the nation, such as exports, FDI inflows, tourism earnings (which are rebounding globally), etc.

As a demonstration of your commitment, launch “PM Build-India-Bonds” with decent returns. In order to swiftly raise $25 billion or more from the Indian diaspora—more than 30 million people with more than $1 trillion in assets—the money must be structured in a way that prevents the government’s foreign debt from rising. Stop spending money on imports that are unnecessary and may be made locally. Due to the economic woes that are plaguing much of the Western world, India has a great chance to progress (as a result of the conflict in Ukraine and other issues). A strong rupee will speed up this process. This triumph will have a big political effect.

Edited by Prakriti Arora