Neobanking: India’s Next Banking Revolution

Neobanking: India’s Next Banking Revolution

Despite its recent introduction into the larger FinTech market, the concept of a neobank has evolved in India. A neobank was initially a bank with no physical presence that operates entirely online and interacts directly with customers. A neobank aspires to be more than just another bank, offering a superior digital banking experience. This concept has developed as neobanks have sought to distinguish themselves from incumbents’ online banking services, shifting from an emphasis on digital banking to a focus on providing a superior customer experience. The neobank subsegment is not alone in experiencing this transition.

Digital technologies and client happiness have long been the two cornerstone policies of the wider FinTech sector. Neobanking policies, on the other hand, have undergone a gradual adjustment. Alternative lenders, for example, are increasingly focusing on embedded finance and use-case-centred lending rather than solely on pure-play lending platforms and marketplaces. Other FinTech segments have adopted the same strategy, with players attempting to integrate financial services into larger customer needs to develop more sustainable demand and product innovation.

The overall development and implementation of embedded finance are being driven by the digitisation of the entire banking and transaction experience, the upgrade of old systems and ways of serving consumers, and the ability to enable transactions at the source. As part of embedded finance, banking is fast developing to focus on customer delight.

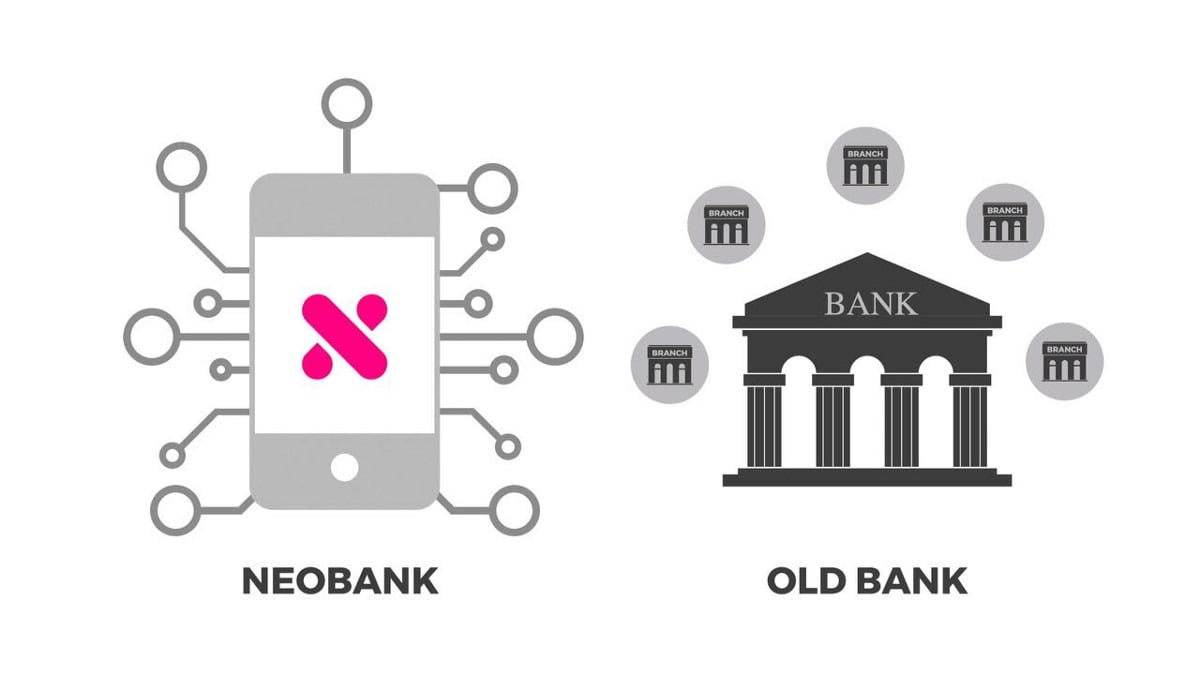

Neo banking is a type of virtual bank that operates entirely online rather than through physical locations. Neo banking provides a complete digital banking experience via smartphone applications.

Neobanks provide possibilities that traditional banks do not, with the primary goal of providing excellent customer service. These banks are more efficient, less expensive, and deal with the complete financial portfolio on a single platform.

Neo banks provide a variety of financial services, including:

- Accounts creation

- Payment and money transfer

- Loans

- Additional services like budgeting, etc.

Neobanks are frequently confused with digital banks. It may appear identical to how they provide online banking services, but there is one key difference.

Neobanks exist online only, without any physical branches, and operate independently or in conjunction with established banks. In contrast, digital banks are the internet-only subsidiary of an existing and controlled participant in the banking market.

Neobanks provide the following services:

- Advanced security

Security is a major worry for customers who use digital financial services. Banks and financial institutions can use data security legislation to prevent unauthorised access to client information.

Fintech applications have many redundancies built in to ensure that customers may manage their accounts in complete anonymity. Aside from that, neobanks have implemented robust role-based access control and two-factor authentication to protect their applications against ransomware assaults.

- It’s simple, quick, and convenient

Neobanks can finish the procedure on the go, unlike traditional banks, which require customers to visit the office multiple times to open an account or obtain other financial services. There is no difference between the two in terms of the amount of time you should expect to spend at a branch.

According to a Reserve Bank of India study, customers spend an average of nearly 7.5 hours in a bank branch completing account opening processes. This entails spending time filing paperwork, acquiring documents, and having it examined by the bank’s secretarial staff.

- Seamless payments gateway

There is still a difference between doing business locally and globally with traditional banks. We’ll need to upgrade our current debit/credit card or get a new foreign transaction card.

Neo banks get around this barrier, allowing for national and international transactions at current exchange rates.

- Lower charges

Low fees are crucial needs that customers are looking for today. Conventional banks have substantial operational costs regarding manpower and rent spent for managing ATMs and branches. These costs are passed on to consumers as fees for services like chequebooks, transaction notifications, debit/credit cards, etc.

While security features like transaction alerts and data are crucial, the average client pays fees regularly.

- Offering and experience

Neobanks offer a restricted variety of product offerings compared to traditional banks, including big-ticket vehicle loans, home mortgages, and business services. The neo banking service model is more efficient and delivers seamless client service, allowing them to expand their domain knowledge.

- Round the clock assistance

Chatbots and Robo advisors provide automated support to customers based on their transaction history, allowing Neobanks to offer round-the-clock customer service.

Neobanks can satisfy all of their customers’ needs with Artificial Intelligence-based software, allowing them to give personalised solutions tailored to their specific needs.

Traditional banks offer comprehensive customer service and follow a “one-size-fits-all” philosophy. Relationship managers at brick-and-mortar banks rarely build enough relationships with customers to understand their financial needs better to provide personalised solutions.

- Value-based services

Neobanks employ AI to analyse account information, customer information, trends, and other data to offer alternative financial services to customers based on their needs. Client earnings are leveraged by neobanks, who provide demographic-based programmes and make it simple for customers to make their own investment decisions.

How are they different from other types of banks?

Neo-bank vs Traditional bank: Traditional banks use an omnichannel approach that includes physical (branches and ATMs) and digital banking presence. In contrast, neo-banks use technology and artificial intelligence (AI) to provide a range of customised services to customers.

Neo-banks cater to retail customers and small and medium businesses, generally underserved by traditional banks.

Investors in venture capital and private equity have been keeping a close eye on the market prospects for such banks, preferring them over traditional banks.

Neo-bank vs Digital bank: A digital bank and a neo-bank aren’t the same.

Digital banks are the internet-only subsidiary of an established and regulated player in the banking sector. In contrast, neo-banks operate exclusively online without any physical branches, either independently or in conjunction with traditional banks.

What is the purpose of a neo bank?

The first difference is that neo banking is not confused with digital banking. They are similar in banking services that operate through mobiles and other devices and use technology solutions to reduce fixed overhead costs. But that’s where the parallels end. The way neo banks are set up and what they offer are noticeably different: a more simple, intelligent, and delightful user experience.

In terms of business models, neo banks can go one of three paths:

Fintechs that work with traditional banks and provide a mobile/web interface and wrapper around their partners’ products are not licensed.

Traditional banks with their digital initiatives

Licensed neo banks operate independently, without the need to partner with a regular bank. In nations that allow it, this is frequently the case with digital banking licences. Freestanding licenced neo banks have yet to be permitted in India.

In India, neo banking primarily fits towards the first type. While some neo banks have banking licences, most work with traditional banks rather than gaining their own. The banking partner offers the overall platform for handling customer accounts, keeping customer funds, and providing the rails for interbank payments and settlements in this operational model. The neo bank is in charge of product distribution and handling the entire customer journey from acquisition to servicing.

Many neo banks, including Monzo in the United Kingdom, Xinja in Australia, and N26 in Europe, provide traditional banking products and services. Other neobanks, like Starling in the United Kingdom, offer both cheap and no-fee accounts and services. Some banks also provide tools for creating both branded and white-labelled banking products and services, allowing them to participate in the “Banking as a Service” idea.

What are the features of a neo bank?

There is some pushback to neo banking, just as there is to other new tech-driven projects. However, this is a lack of awareness of the details involved. As you can see here, Neo banking is more than just a digital banking service with a nice UI.

1. Banking as a service

Neo banks want to make financial management easier for their customers, and collaborating with existing banking products is the key to doing so in the digital banking experience. They build the products and services application layer on top of banking partners’ core banking products and payment infrastructure. Third-party tie-ups allow neo banks to cross-sell value-added goods. This will help them to concentrate on improving the user experience of their goods.

2. New age, flexible and scalable tech platforms

Neo banks, which commonly refer to themselves as “tech businesses first, banks second,” are far more technologically advanced than traditional banks. A look under the hood of a neo bank’s system reveals that both the front and back ends are entirely digital, with no clunky old IT platforms in the way.

They’re primarily app-based, which means you’ll be able to complete most typical tasks like account opening, fund transfers, and customer service with just a few taps of your fingers. Using neo banks to open a virtual bank account and manage your funds is simple, paperless, and can be done from the comfort of your own home.

3. Marketing as a strategic differentiator

The marketing approach is a primary focus of neo banking. Neo banks make up for their lack of intrinsic consumer trust and legacy through many client engagement activities. This is the point at which neo banking separates itself from digital banking.

Neo banks mostly use digital and social media to promote their campaigns, focusing on community building, influencer marketing, and releasing positive testimonies. Customer referrals are a valuable asset for any neobank, and they are frequently modelled after successful platform economy giants like Uber and Netflix.

India has the second-largest number of internet customers and smartphone users, indicating a bright future for neo banks in the country. Neo banks have been raising enormous sums of money from prominent investors around the world in recent years, recognising the potential of a massive underbanked section in India.

Can neo banks replace traditional banks?

Neo banks are unlikely to replace the old banking system entirely in India. Given that neo banks are a newer idea with a restricted variety of products and services, they have a long way to go before matching the breadth of services provided by traditional banks. Because neo banks are fully digital, they may struggle to connect with the country’s non-tech aware population, which still prefers face-to-face encounters with their financial representative. Furthermore, neo banks are still reliant on their ties with regular banks because they lack a full banking licence.

In India, the future of neo banks is predicted to shift dramatically. In November 2021, the Niti Aayog recommended establishing full-stack “digital banks” in India, which would offer their services through the internet rather than through physical locations.

Customer referrals, awards, comments, and testimonials are essential to Niyo. In the Niyo community, they regularly engage with 50K+ users in India. Building connections and focusing on the client experience are crucial focal points for any neo bank with such a robust digital presence. Niyo puts their customers first in all they do.

How are the neo-banks evolving?

In 2017, the term “neo-bank” began to acquire traction around the world.

Neobanks is also known as ‘challenger banks’ because they have emerged as a new competitor to traditional banks in terms of client involvement, connectivity, reach, and user experience.

Neo-banks are a new concept in India, but they have gained traction recently.

According to a report by a fin-tech research firm, India’s neo-bank companies raised more than $230 million in 2020.

About a dozen neo-banks in India, including Razorpay X, EpiFi, Open, NiYo, and Jupiter.

Evolution of neobanking in India

Over the last two years, the Indian neobanking environment has exploded. Although over 18 players are vying to expand their operations, factors like as unique product offerings and target consumer categories ensure that each neobank has development potential in the following years. With enhanced Indian banking infrastructure, new banks and regulatory obligations, and technologically advanced FinTechs, India’s financial services journey is transforming, with a greater focus on client needs. In addition, factors like incumbent banks seeking strategic alliances with neobanks and interest from private equity firms are contributing to India’s neobanking growth narrative.

What are the pros of neo-banks?

Low costs: Neo-banks can keep their costs low because of fewer rules and the absence of credit risk.

Most products are low-cost and do not require monthly maintenance.

Convenience: These banks provide consumers with access to the bulk of their banking services via an app.

Speed: Neo-banks allow customers to open accounts and process requests rapidly.

Those who provide loans may opt to forego the traditional time-consuming application processes favouring novel credit-evaluation strategies.

What are the challenges that they face?

Digital illiteracy: Because neo-banks are primarily focused on digital, they may not be able to meet the banking demands of non-tech-savvy customers or those living in rural India.

Mobile penetration: As of 2020, India had a smartphone penetration rate of just over 54%, thus excluding the rest of the population from the reach of neo banks.

Services offered: Compared to regular banks in India, neo-banks only provide a limited number of products and services.

Building trust: As neo-banks lack a physical presence, customers cannot rely on them in the event of a problem or obstacle.

Regulatory roadblocks: The Reserve Bank of India has yet to acknowledge neo-banks.

Due to a lack of enabling rules, neo-banks cannot accept deposits or offer lending products on their own books.

Dependence on other financial institutions: Some fintechs have a non-banking financial corporation as their parent, allowing them to engage in lending activities. In contrast, the majority of others work with banks and financial institutions.

As a result, neo-banks can complement but not replace traditional banks.

Top 5 Neobanks In India

1. Jupiter

Jupiter is an Indian neobank, or digital banking company, that provides end-users with many digital retail banking services, allowing customers to open and manage bank accounts from the comfort of their own homes.

Jupiter, based in Mumbai, India, also provides consumers with unique features like wealth tracking, real-time spend breakdowns with insights, and handy savings pots to help people save for their purchases. Furthermore, all of these can be managed on a real-time basis. Unlike many banks, the organisation does not deduct hidden fees. Moreover, Jupiter bank accounts do not need a minimum amount to be maintained.

Furthermore, the funds in your Jupiter account can be quickly withdrawn from any of the ATMs. It is one of the fastest Indian UPI-based payment apps.

2. FI Money

Working professionals’ smart bank account. Track spends, save, do more.

In about 3 minutes, you can open a Fi Savings Account online! Track your costs, organise your accounts, maximise your savings, and automate payments with Fi’s unique tools to do better with your money. You’re rewarded for saving as well!

Fi is a one-stop financial services app with a built-in savings account with no minimum balance! Some prefer to refer to it as a ‘neobank.’ They want to make things easier for you. Fi is a cutting-edge financial app that helps you understand your money, increase your money, and organise your assets. It provides everything from simple UPI payments to a stylish VISA Debit Card with no foreign exchange fees. Think of it as banking 2.0 for a generation of digital natives.

Why try Fi?

- It’s a fascinating alternative to traditional banking’s intricacies.

- Up to $5 lakh in insurance coverage

- Up to $5 lakh in insurance coverage

- There is no forex markup

- There are no hidden costs.

- You can withdraw money from any ATM.

- Available 24 hours a day, 7 days a friendly Customer service

FEATURES

- Make sense of your money instantly

- Get all your personal finance questions answered by Ask.Fi

- Gain daily, weekly and monthly insights into your spending; judgement-free

- Get rewarded for saving money

- Set fun rules that automatically save for you

- The world rewards you for spending money; Fi rewards you for saving

Use Fi regularly to make smart financial decisions and also earn rewards

Smart Deposit: A flexible way to save that’s tailored to you and your objectives

Set up automatic payments: As you go, make rules or set reminders

Instant money transfers: Fi Protocol determines the most cost-effective means of transfer, and Fi will generate a unique UPI ID for you! Create your own secure UPI PIN and use BHIM UPI to send and receive money right away.

3. Niyo

NIYO is a fintech firm based in Bengaluru that provides consumers with digital banking products like prepaid payroll cards, cross-border travel payment debit cards, and multi-wallet tax benefit cards. NIYO, a neo-bank or challenger bank, was founded in 2015 and offered digital banking products and services through partnerships with banks. Niyo has offices in over 30 locations across India, with more than 10,000 workers spread out across the country.

Niyo has more than 1.3 million retail customers and over 6000 enterprise customers. The Niyo Bharat card, a zero-balance account, a Niyo tax saver card, and a Niyo Global Account are the company’s offerings.

4. OcareNeo

OCareNeo, India’s first digital health and banking platform, is the brainchild of the OCare group, created in 2015 by Dr Neeraj Sheth, a renowned dental health practitioner who has worked in the UK and India. Swarup Choudhury, a top IT executive, founded the company with the goal of combining healthcare and banking technology into a single platform. The goal was to use Fintech to close the gap in healthcare funding, enhancing the global flexibility of the healthcare ecosystem.

OCareNeo combines all digital aspects of banking, healthcare, and insurance into a single platform to help consumers live healthier lives.

The pandemic of the 2020 Coronavirus made it even more critical to develop a platform that would aid individuals in medical emergencies by lowering their healthcare costs through predictive predictions and empowering them to deal with emergencies through proactive financial management solutions. OCareNeo’s objective is to help people manage their finances properly, care for family members’ medical needs, and stay healthy with OCareNeo’s digital passport, all under one roof.

5. ZikZuk

ZikZuk is an Indian neobanking platform that offers SMEs and start-ups a unified banking experience to handle their critical financial concerns. It enables them to manage their finances properly and provides practical recommendations to help them make better business decisions and develop their company.

Raj N, a serial entrepreneur, promotes ZikZuk. His own experiences, combined with what he learned from his mentorship programme for aspiring entrepreneurs, let him realise the frequent issues SMEs owners face, like obtaining affordable loans, lack of visibility into the company’s cash flow, etc.

ZikZuk’s mission is to provide a financially sustainable and scalable ecosystem for SMEs to run and grow their businesses in India. The Neobanking platform from ZikZuk delivers excellent customer service and assists founders in making data-driven business decisions.

The bottom line

Neobanks are on the rise in India, upsetting established banking arrangements. Their popularity has skyrocketed in a relatively short period, and they have emerged as the banking industry’s future.

Everything is becoming digitalised, and the world is undergoing a revolutionary upheaval. It wouldn’t be an exaggeration to suggest that the electronics we carry in our pockets dominate the entire planet.

With every service now available digitally, the tech-savvy youth embrace it wholeheartedly, and the older generation is embracing it.

Banking, which is one of the most crucial aspects of our lives, is now available without physical branches, making life much easier.