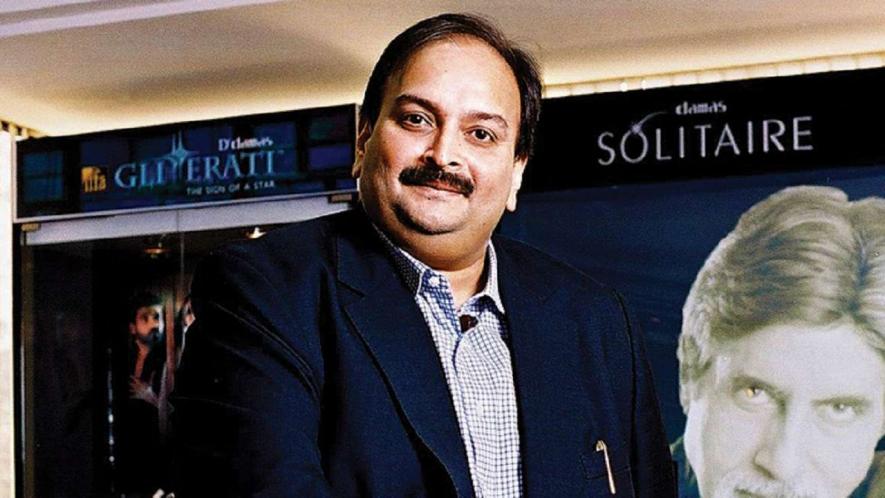

NCLT Mandates Liquidation Of Gitanjali Gems, Backed By Mehul Choksi; The Evasive Diamond Merchant And The Indian Government’s Failure At Extraditing Him

NCLT has ordered the liquidation of Gitanjali Gems, linked to Mehul Choksi, the fugitive diamond merchant, citing provisions within the Insolvency and Bankruptcy Code of 2016. The decision follows a series of legal proceedings and investigations surrounding alleged fraudulent activities within the company, ultimately leading to its admission under the Corporate Insolvency Resolution Process (CIRP) in October 2018. Mehul Choksi, once a prominent figure in the Indian business community and owner of the Gitanjali Group, has become embroiled in controversy surrounding allegations of financial impropriety. He was accused alongside his nephew Nirav Modi in the Punjab National Bank (PNB) scam, after which both are on the run. Despite ongoing legal proceedings and extradition efforts by Indian authorities, Choksi's whereabouts remain a subject of interest, mirroring the intricacies of international legal cooperation in cases of financial fraud.

The NCLT, in a lengthy legal battle, has issued a directive for liquidating Gitanjali Gems, the jewellery retailer backed by fugitive diamond merchant Mehul Choksi, citing Section 33 of the Insolvency and Bankruptcy Code, 2016.

According to a filing on the BSE, Santanu T Ray has been appointed as the liquidator by the bench and is tasked with carrying out the liquidation proceedings in accordance with the stipulations outlined in the IBC, 2016.

The resolution professional representing the jewellery retailer, Vijay Kumar Garg, lodged the petition for liquidation with the NCLT.

Garg informed the tribunal that due to purported fraudulent activities involving Gitanjali Gems and its officials, investigations were underway by various law enforcement agencies such as the Enforcement Directorate (ED) and the Central Bureau of Investigation (CBI), noting that the ED had issued directives for seizing the properties linked to Choksi.

In his submission, Garg revealed that upon assuming the role, he reached out to several investigative bodies, including the Directorate of Enforcement and the CBI, seeking access to the properties, assets, inventory, and records of Gitanjali Gems to advance the Corporate Insolvency Resolution Process (CIRP).

However, his requests were turned down, and the attachment on Gitanjali Gems’ properties during the CIRP remained in place.

Garg also pointed out that since the CIRP’s 180-day period had lapsed in April 2019 and considering the absence of ongoing business activities by the company, prospects for its revival appeared dim. As a result, he filed a plea to initiate the liquidation process and opted out of serving as the liquidator.

The NCLT, in its ruling, noted the ongoing investigations, asset attachment, and the slim chance of resolving insolvency, deeming it appropriate to proceed with Gitanjali Gems’ liquidation.

Moreover, the order highlighted that the Committee of Creditors (CoC), with the necessary voting, had sanctioned the liquidation due to the remote likelihood of receiving any resolution plan.

It emphasized the tribunal’s limited authority in matters of commercial judgment and consequently mandated the liquidation of Gitanjali Gems.

Gitanjali Gems, burdened with liabilities exceeding Rs 12,558 crore, entered the Corporate Insolvency Resolution Process (CIRP) in October 2018.

The Infamous Diamond Mogul

Mehul Choksi, the proprietor of Gitanjali Group, a conglomerate with 4,000 outlets across India, is currently residing in Antigua and Barbuda, where he holds citizenship.

Choksi and his nephew Nirav Modi face allegations from Indian authorities regarding their involvement in the Punjab National Bank (PNB) scam, purportedly defrauding the bank of more than Rs 14,000 crore.

Charges against Choksi include criminal conspiracy, breach of trust, cheating, corruption, and money laundering, prompting Indian authorities to issue an arrest warrant against him.

The Dodgy PNB Scam

In March 2018, a special PMLA court issued non-bailable arrest warrants against Choksi and his nephews Nirav Modi and Neeshal Modi, accusing them of conspiring with PNB Bank officials to orchestrate the massive fraud.

The scam, considered one of India’s largest banking scandals, involved the issuance of fraudulent Letters of Undertaking (LoUs) by PNB Bank officials in Mumbai, allowing for the misuse of funds totalling over Rs 14,000 crore.

It was found that the overseas branches of Indian banks allegedly disregarded RBI guidelines, failing to share crucial documentation with PNB, facilitating the scam.

Choksi’s Departure from India

Choksi fled India for Antigua and Barbuda in January 2018, just before the PNB scam came to light.

Since then, various investigative agencies have initiated multiple cases against him and seized numerous properties valued at thousands of crores while efforts are underway by Indian authorities to secure his extradition back to India.

Where Is Mehul Choksi And Why No Extradition

As of now, Mehul Choksi is reportedly in Dominica.

In late May 2021, he disappeared from Antigua and Barbuda and was apprehended in Dominica while allegedly attempting to flee to Cuba by boat.

A Caribbean court intervened to halt his repatriation from the Dominican Republic.

In April 2023, the High Court of Antigua and Barbuda ruled that Choksi cannot be extradited from the country. The decision came amidst a civil suit filed by Choksi, seeking an inquiry into his alleged abduction in 2021.

These developments have provided temporary relief for Choksi, for his role in the PNB banking scam worth Rs 13,000 crore.

Interpol’s Red Corner Notice Withdrawal

In March, Interpol withdrew the Red Corner Notice issued against Choksi, allowing him unrestricted movement globally; this decision was a major setback that hindered the efforts of the CBI and Indian authorities to bring Choksi back to India to face justice.

The Mysterious Kidnapping

Choksi, now a citizen of Antigua, sought refuge in the country in 2017

In May 2021, he disappeared from Antigua and later emerged in neighbouring Dominica, where he asserted that he had been forcibly taken by operatives linked to the Indian government.

In a civil lawsuit filed in the High Court of Antigua and Barbuda, Choksi presented his record of events, alleging a series of orchestrated actions, including collusion, coerced abduction, removal from Antigua and Barbuda, as well as physical assault and battery.

According to the lawsuit, on May 23, 2021, Choksi visited a villa in Jolly Harbour as directed by an individual he had encountered previously. Upon entering the premises, he found himself surrounded by six to eight men purporting to be members of the Antiguan police force, despite the absence of official attire.

Despite his request for legal representation, Choksi was denied access to his lawyers and subjected to physical restraint and torment by these individuals. Subsequently, he was gagged, blindfolded, and secured to a wheelchair before being transported to a nearby vessel.

During his time aboard, he alleges that he was interrogated by the men present, including three individuals whom Choksi asserts were affiliated with the Research and Analysis Wing (RAW).

These men purportedly disclosed intimate details from Choksi’s life, issuing threats against him and his family upon their return to India, while demanding information about undisclosed bank accounts, as per the lawsuit.

Choksi contends that he was coerced into confessing to wrongdoing related to the Punjab National Bank Case and implicating specific individuals; when he resisted, he claims to have faced further intimidation and abuse.

According to his legal filings, one of his captors threatened to gruesomely harm him and his family, stating, “I will tie you upside down and skin you alive, and your family would be next. I have done this many times before.” Additionally, Choksi alleges that another assailant brandished a knife, held it to his throat, and issued additional threats.

After approximately 15 to 17 hours at sea, the vessel halted in Dominican waters, where Choksi was transferred to a Coast Guard vessel manned by individuals clad in dark blue uniforms. According to him none of his captors from the previous vessel accompanied him aboard the coast guard vessel.

Henceforth, the court’s decision saw Choksi being repatriated to Antigua from Dominica, where he initiated a civil lawsuit urging for a prompt and comprehensive investigation into his alleged forced expulsion from Antigua and Barbuda, as well as safeguarding against any future attempts at removal.

The Last Chapter

In a ruling favouring Choksi, the court mandated that he could not be removed from the country without a High Court decree and, provided he exhausted all available legal recourses, including appeals.

The court order outlined directives demanding an independent judicial inquiry into the circumstances surrounding Choksi’s purported abduction and transfer from Antigua and Barbuda to Dominica against his will.

Additionally, the court order stipulated that Choksi must not be compelled to depart or be forcibly removed from Antigua and Barbuda without a High Court directive subsequent to an inter partes hearing and upon completion of any appeals or legal remedies as per the law.

It further instructed the second Defendant to disclose the statement obtained from Choksi by its officers on August 15, 2021.