The 50/30/20 budgeting formula- The idea of saving more

What is the 50-30-20 budgeting formula?

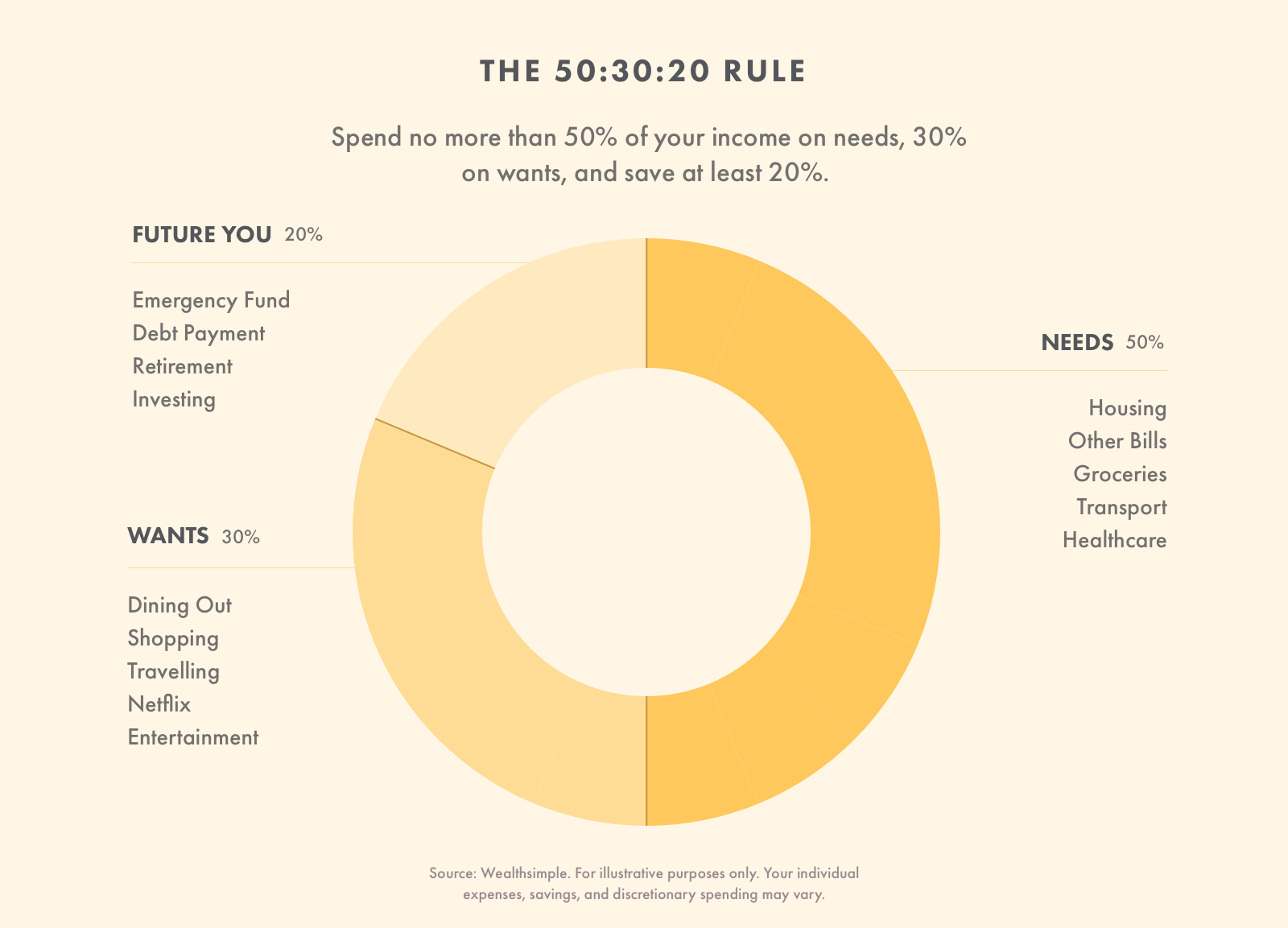

The 5030-20 budgeting formula is proposed by Elizabeth Warren and Amelia Warren Tyagiis, which is the easiest way to calculate and establish money and budget.

The basic function of the formula is

- 50 percent the income will raise for accommodation and living that includes rent, groceries, utility bills, and travels.

- 30 percent for lifestyle and entertainment be it movies, dining, or attractions. These can be considered as optional.

- 20 percent of the income spent on debt and saving.

How to calculate the 50-30-20 budgeting formula?

The 50/30/20 budgeting formula- 50 percent

The half of your income for the absolute importance of your life that is food and shelter. These are the amount that you have to pay anyway despite where you live and work. Letting a high percentage will help you to adjust the amount in the end. These expenses are housing: that includes your rent and mortgages, food: the groceries and other essentials, transportation: the fuel bills to car maintenance comes falls in this category, Utility bills: the gas bills, electricity bills, and water bills sum up utility bills.

The 50/30/20 budgeting formula- 30 Percent

30 percent is the wants that include shopping, dining, and vacations. According to financial experts considered this as an unrestricted, open choice, but in this era, it is the luxuries that people do not want to miss. This generally has a lot of items such as restaurants, clothing, mobile plans, gym, etc. 30 percent of your income should be spent on personal spending. The more you save here, the more progress you can make.

The 50/30/20 Budgeting formula- 20 percent

This includes your savings plans like retirements, credit cards, and emergency savings. These are future savings that you may break in case of an emergency. These savings are taken at last after the essentials and personal spending are paid. These extra savings are for future investments or student loans that might put you in pressure in years to come.

Why the 50-30-20 method is good for you?

Keeping track of your income and savings help to focus on your financial progress. That can be further broken down into individual expenses. Without budget planning and framework t is hard to improve the spending efficiently and savings for the future.

Apart from the 50-30-20 method, there is another budget planner like Zero Sum and Envelope Budgeting that also help you to plan your expenses accordingly. It is better to choose a budgeting style based on the factors. Yet, the 50-30-20 method is one of the easiest methods to do so.

Final Thoughts

The 50-30-20 budgeting formula is a decent method to achieve your financial goals. It takes a little bit of time and strategies to make the expenses categories, after that you can keep track of the progress.

A caution, do not take the rule seriously, this might end up putting you in a lot of trouble. Framework and review your income and determine the essentials. Don’t be afraid to think outside of the box.